|

Markets have periods of trends and periods of rest, just like you do when you want to go for a run. Sometimes, after a big move up or down, a market will reverse and go straight back the other way. But more often it will pause to gather its strength. This can be a challenging time for the trader, as good ABC trades are harder to come by.

Let’s consider the recent market action in Soybeans.

Chart 1 – Soybeans Since the 2012 High

click to enlarge

The extreme high was made on 4 September 2012, and the first lower top trade was one of the trades of the year. From there the market went down for 73 calendar days to make its first low on 16 November. As you can see from the chart, the time since then has been spent in a more confined range.

While we can look back and say that it would be easier not to trade during this period, we didn’t know at the time that this was how it was going to turn out. We have to learn that information as we go, and ABC trades, whether or not they are traded, are a good way to do that.

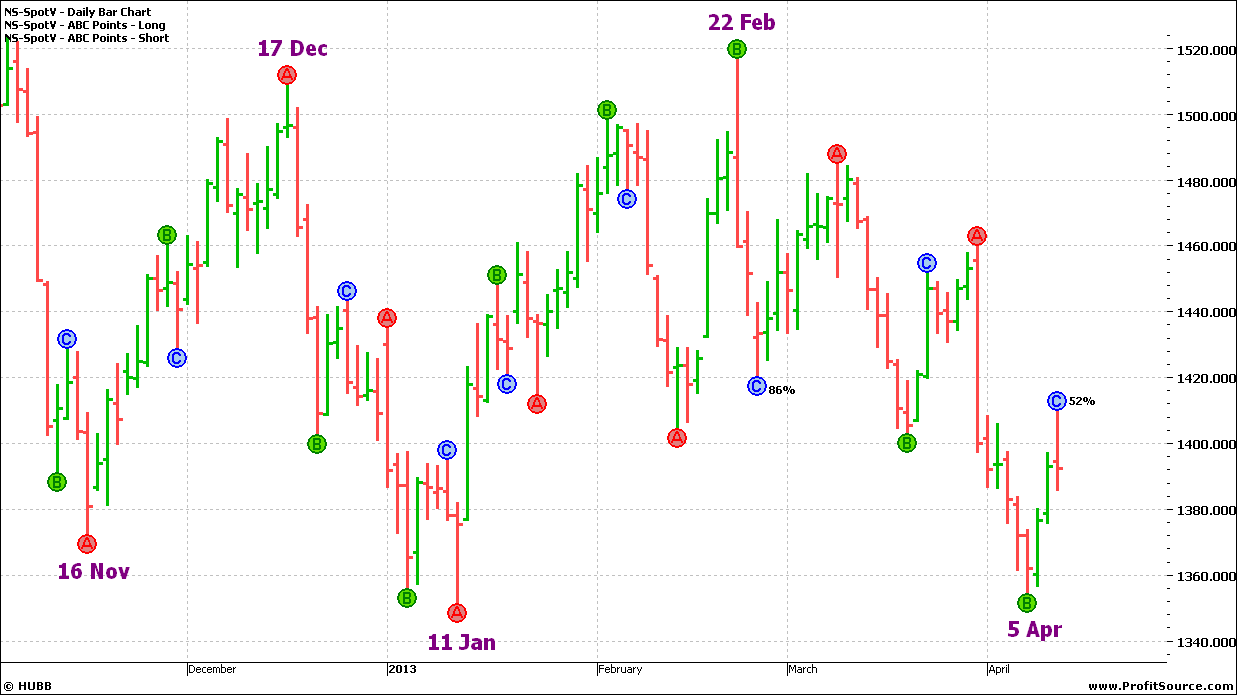

Chart 2 – ABC Long and Short Trades

click to enlarge

If you study Chart 1 carefully, you will be able to see the three sections of the down move. The first was short, lasting only for the first run down followed by the rally to the lower top. The second, and largest section, lasted until early October and was followed by a month of sideways prices. The final one ran down into the low on 16 November.

So, while there was no compelling evidence for a low being in place, you could see the reason why it was there as prices rallied. When an ABC long trade appeared on 30 November, it was the first long trade since the top on 4 September. This in itself is a sign that the trend might be changing. This trade made 75% but failed to reach the 100% milestone.

From the top on 17 December another downward leg commenced, and the next ABC trade was a short. Again it reached 75% but couldn’t make 100%. It’s worth noting that in non-trending periods ABCs will get to 75% much more readily than 100%. Also it is not generally helpful to trail stops behind swings in these markets, since the trends do not last long enough to make good profits.

In early January a low formed, which was lower than the November low and which then offered an ABC short trade. This trade failed at 50% on 11 January, but this means that you would have at least broken even on the trade had you taken it. 11 January was a reversal bar and closed above the low of 16 November, and you could have gone long the following day.

This was followed by an ABC long trade on 18 January. This trade was stopped out for a loss, but note the key reversal day where this occurred – you should get back in after this. Again the trade made it to 75%.

This brings up a money management question. The Starter Pack rules only allow exit at 75% when entry is possible by 25%, so as to preserve the minimum 2:1 reward:risk ratio. But if the trade is unlikely to make it to 100%, should you exit at 75% anyway and accept a lower ratio? You can only answer this question by doing some testing. It may be better to simply avoid the trade.

The next ABC long trade failed, and there is great surprise because prices halted for 4 days slightly below the level of the 17 December top.

You can see that as the sideways period progresses the signals become less clear and it becomes more advisable to sit and watch the market rather than trying to trade it. Nevertheless, eventually the direction has to resolve, so if you get a good signal, act on it.

A good signal came on 22 February, when the market pushed up above the December high and immediately reversed. While this was a short signal, the market didn’t travel very far. The next ABC long trade, with Point B at the February top, was hardly very attractive, and there is no surprise that prices reversed again at the 50% milestone of that trade.

After another failed short trade the market came on 5 April to test the level of the 11 January low, although it didn’t go below it. This low is 140 calendar days from the 16 November low, making 213 days from the September 2012 high. But the market is still in its sideways configuration. April is not a seasonal month for lows in Soybeans; it is more likely to produce a top. So you would want to keep a close eye on the market action and bear in mind that a sideways period can break either up or down.

After a good rest it should be ready for another run.

Knowledge is Power!

Tim Walker

|