|

Well what an incredible run the DOW has had! What are the odds it can continue even higher?

I still find it astounding that it has run so hard – and one might say it is priced to perfection. That is, only good news is priced in. Of course with interest rates at 1% some risk aversity has gone out the window as investors chase better returns elsewhere and in particular equities. But this is conjecture so I should hasten to the charts:

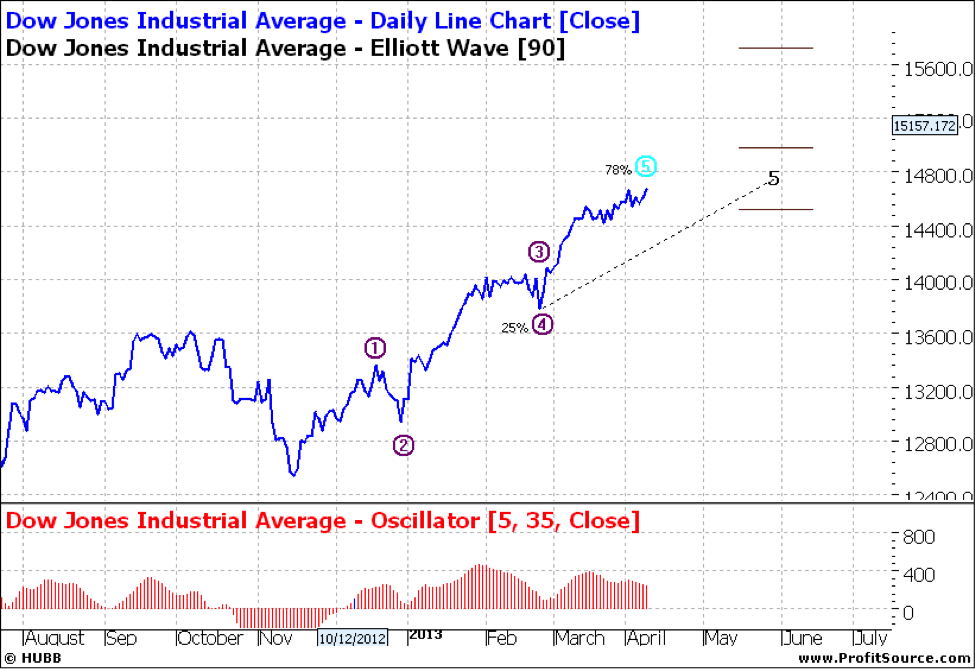

Click to Enlarge

So we can see on my default chart that the first wave five has been reached and the second wave five is not that far away. The probability of a third wave five is not high – maybe a few percent. But it can happen.

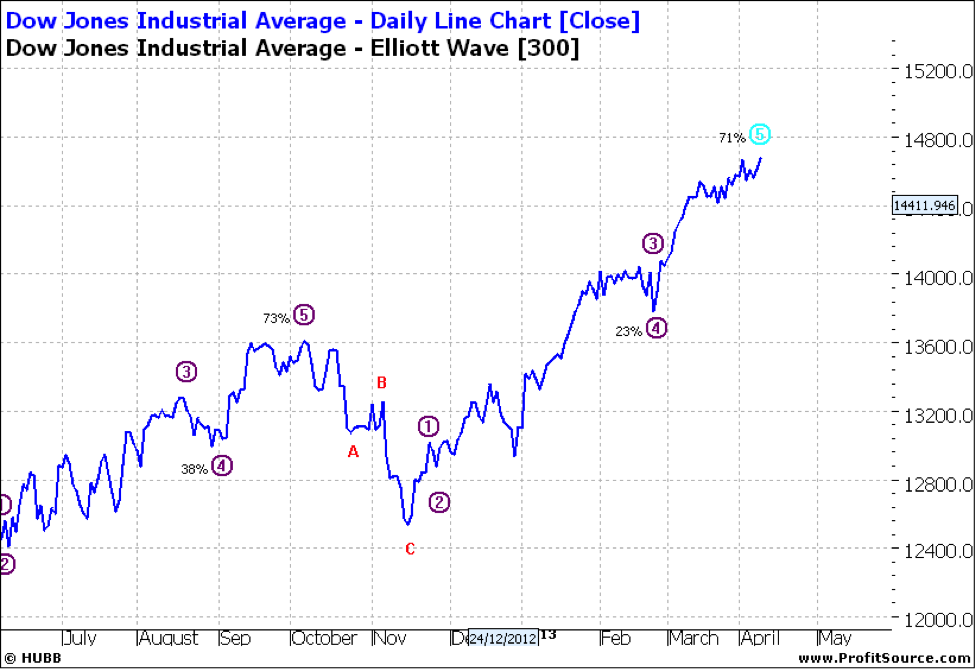

At such times I look beyond my default 90 day Elliott – the ProfitSource default of 300 days:

Click to Enlarge

And this suggests that wave five criteria has pretty much been met. So the big question is to where from here? Many will be asking such a question and there will be some temptation to take profits. Although there is no sign that investors are rushing to do so. This is a statement of the confidence that Americans have in not just their positions but in the US economy. A level of confidence we have not seen for many years.

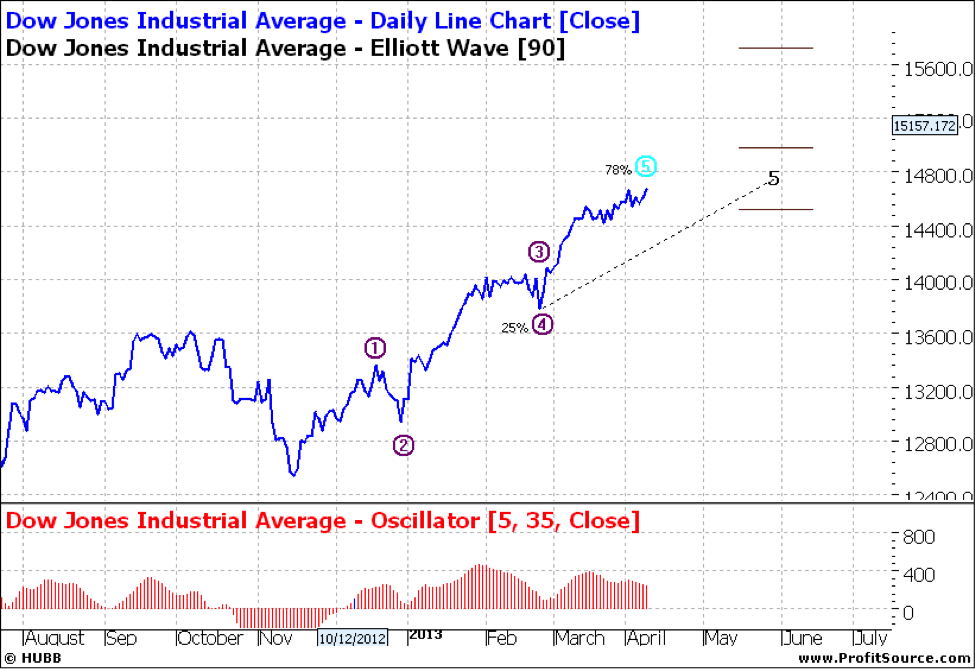

I next look at a weekly chart – I look at both 90 week and 300 week but show only the former below as they both project the same picture:

Click to Enlarge

You will agree this shows pretty much the same picture so we are none the wiser from it.

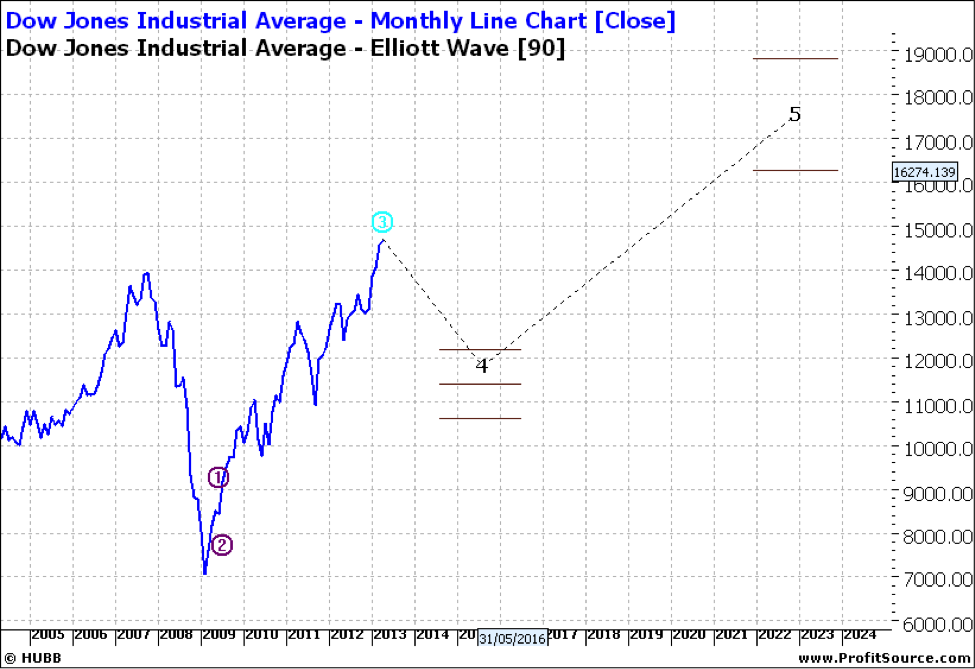

I then go to a monthly:

Click to Enlarge

And this suggests a pullback – but 2014-2016 – so who cares now I ask.

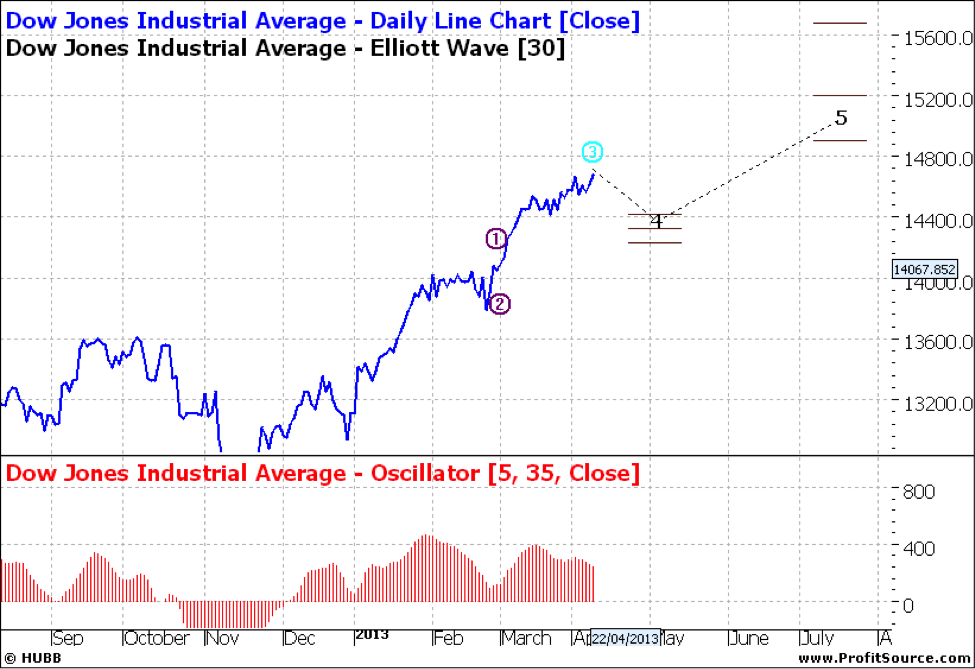

I scratch around and in desperation look at a 30 day chart – a very short term perspective and see:

Click to Enlarge

This says we could see some easing ahead. I choose this word carefully and refrain from the word ‘weakness’ as we cannot read weakness into the chart. But we will wait and see.

The next question is what does this mean for global markets? What is amazing at the moment is that so many global markets are currently dancing to their own tune. We might have a look at world markets next week if that still appears to be a hot topic.

The Australian market still looks a little tentative and CBA is still soft so I await another few days of data before commentating further.

Enjoy the Ride

Tom Scollon

|