|

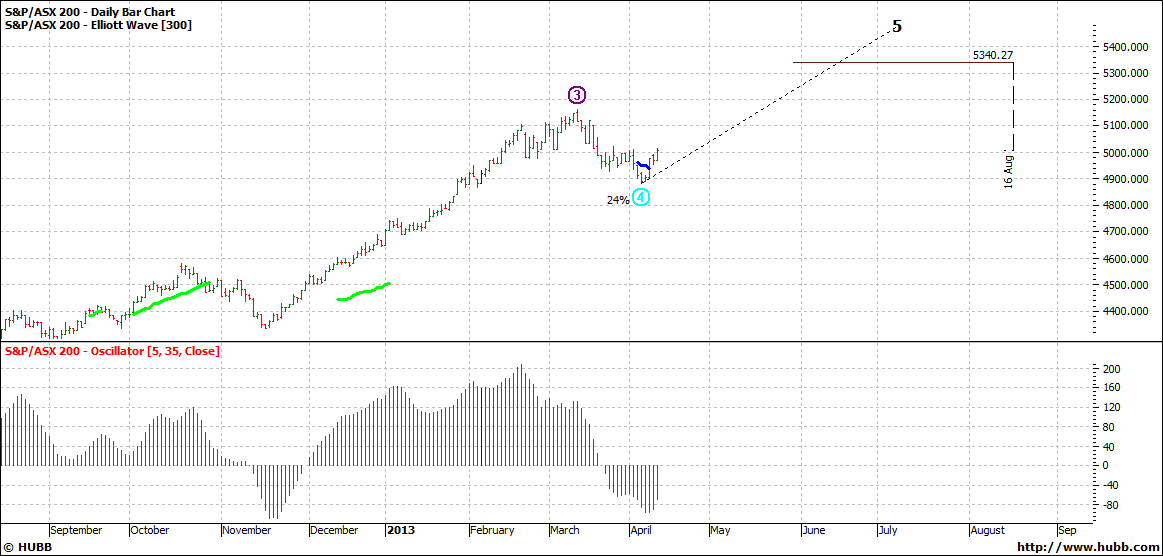

Australian investors are looking for the next leg up after the recent 2012/13 rally appears to have run out of steam, stalling some 200 points below the ASX 200 peak of March this year. In fact, markets appear to have consolidated rather nicely, resting on strong support at current levels and a faint whiff of confidence still remaining from the excellent run we saw of previous months.

Click to enlarge

ASX 200 Looking For Direction

But there remains one problem: The Australian economy is faced with a lose-lose situation in the face of its two biggest influences –the dollar and commodities. Mining stocks in particular are poised to face revenue pressures regardless of the situation in a unique set of consequences ultimately out of their control.

Cost Pressures Rising as Commodities Prices Fall: The fact that the Australian economic climate is dominated by currency movements and quantitative easing is not a new concept to most readers and investors with an understanding of major economic drivers. But the fact the Australian dollar remains expensive thanks to the fed’s constant drive to devalue the US dollar has meant that in the face of softening commodities prices, not only are Australian miners getting less per tonne of resources, their products are also more expensive in the eyes of their largest consumers. To top it all off, Australia remains by far the most expensive country in the world for any mining company to do business.

Such a situation paints a rather difficult future for the medium term outlook. With the Australian economy heavily leveraged to mining performance, the likelihood of a sustained rally higher is going to be difficult when other global economies are better positioned to benefit from lower interest rates and a comparatively more ‘affordable’ dollar.

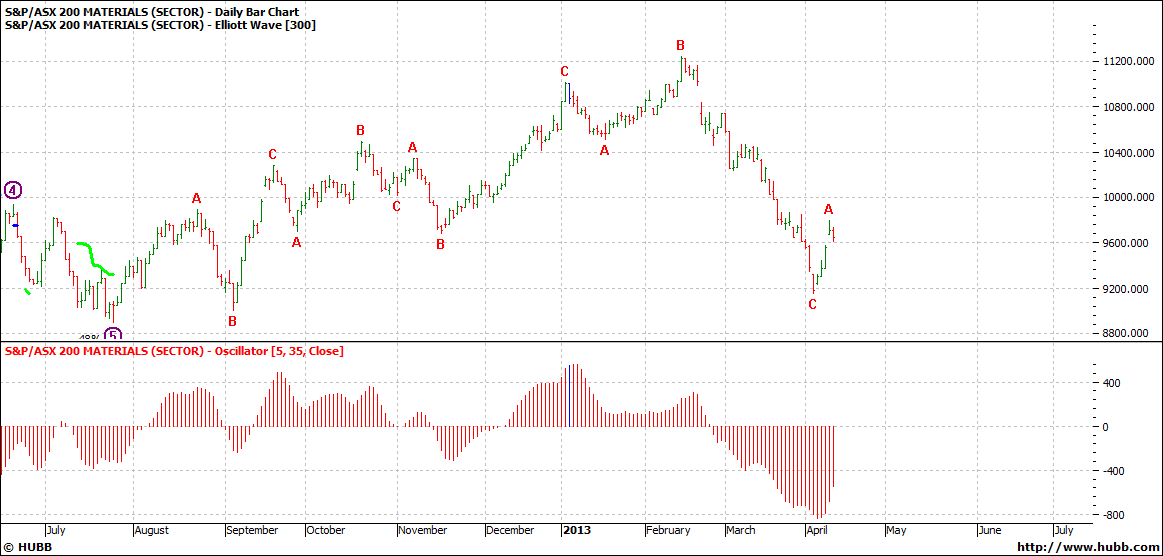

Click to enlarge

Note: Momentum represented by the Oscillator is still severely lacking for the Australian materials sector, indicating no such rally due for the Australian mining sector and clearly reflecting the volatility and cost pressures facing major miners.

Here’s an unlikely comparison: Imagine renting a home in Western Australia’s Pilbara region, some 1600km, or 17 hours from the nearest major city, being Perth. Such a home in this baron town, hosting only mining companies and a minimal tourist industry experiences rents at approximately $8000 per month. Compare that with a house on the Upper West Side in Manhattan, sporting a gym, pool and amenities which comes in at a similar $8000 per month price point. This is Manhattan! The epicentre of New York and buzzing metropolis considered the centre for global finance and banking! New York is full to the brim, with limited housing supply and an ever growing demand for inner-city living. Yet, comparing these two locations, Port Headland, is in fact by most accounts a more expensive place to live! Dictated solely by a booming mining industry and rising commodity prices of recent years, the area remains highly leveraged to any adjustment of global demand for Australian resources and a sustained lack in ‘value’ caused by an inflated Aussie dollar. Such a gross over-value in home prices points directly to the rising price and cost pressures of the Australian mining industry and paints a very risky outlook of mining companies searching elsewhere for a cheaper cost of doing business.

The point of the matter is, where do you want to leverage your future investment earnings? Australia is in a unique position, held hostage to factors largely out of its control, whilst the US, in particular, is at the bottom of its economic cycle, gaining momentum thanks to actions placed by the federal reserve in which it retains near complete control. As unfair as it may seem, currency manipulation plays a major part in overall economic performance. It just so happens that mining, in particular, faces a lose-lose situation via a combination of the overly resilient Aussie dollar and anemic commodities prices.

Other factors which would, under most circumstances be seen as a positive for the Australian economy are also wreaking havoc in the value of the nation’s dollar. Low levels of sovereign debt are attracting increased offshore investment, also strengthening the dollar’s position as a benchmark or ‘reserve’ global currency. Traditionally, commodities prices would drop in tandem with the dollar, seeing a net ‘minimal’ impact on returns for Aussie miners. Unique circumstances of the post GFC era, however, make such traditional synergies a thing of the past as the correlation of the Aussie dollar falls purely with the decisions of Mr. Bernanke and his comrades.

Not to worry! Life goes on for Aussie markets and the dollar will once again fall below parity. But life isn’t expected to get any easier in the near future. AUD leveraged investments will continue to struggle and investors MUST maintain an international focus to what is very much a globalized world in 2013. Whether you like it or not, we are dictated by the actions of dominant economies. Until interest rates begin to rise in America and the US dollar again builds value, Australia, and everything leveraged to the dollar and our export industry will face a major handicap to our offshore counterparts. Don’t sail against the wind, seek offshore investment opportunities to bolster your portfolio performance today! US Options are of course a great place to start: www.optionsxpress.com

Stay Ahead Of The Game,

Lachlan McPherson

|