|

Well it could be for a few years even though the gold stake holders would like to think otherwise. And no matter how they much talk it up nothing will change. And not even Indian weddings will save the precious metal in the coming years.

Let’s look at the charts:

Click to enlarge

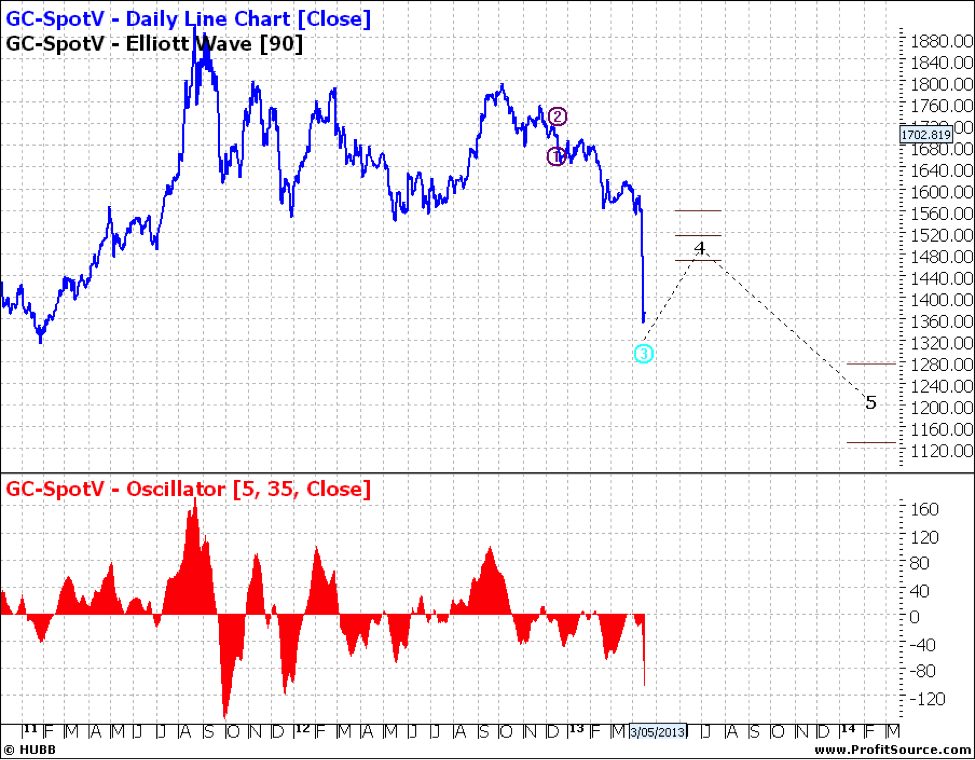

This daily suggests that we may see a short term rally in the coming months but the bears will sell hard in any rally which is thus likely to be short lived. And in fact with the very weak oscillator there could well be many false starts to the short rally. It will be very tentative as some bears will sell early in any rally.

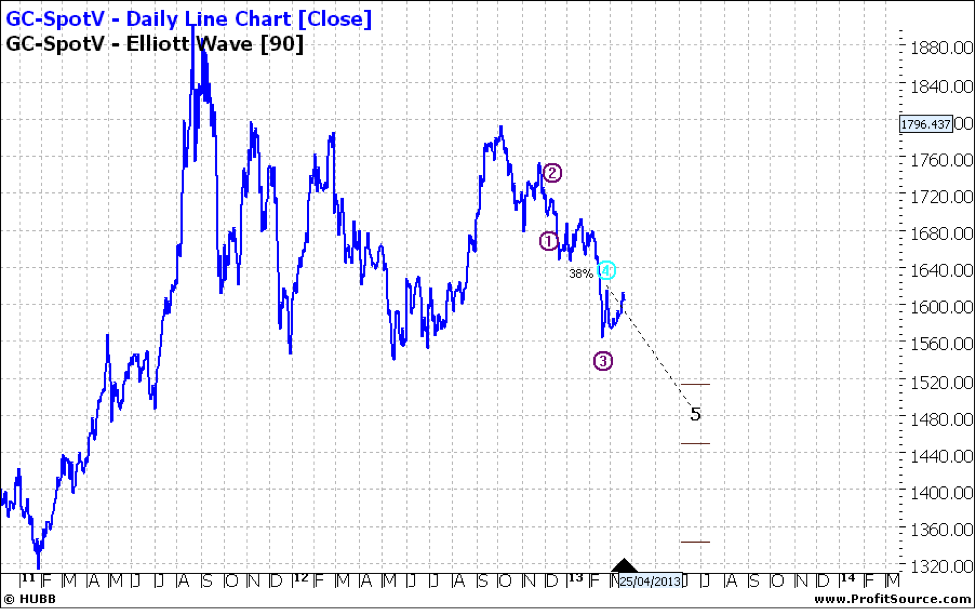

It is interesting to look back a month and there were indications that this was going to be a soft few weeks ahead:

Click to enlarge

And in fact the first sign of weakness as per ProfitSource Elliott was back in December last year – impressive!

Click to enlarge

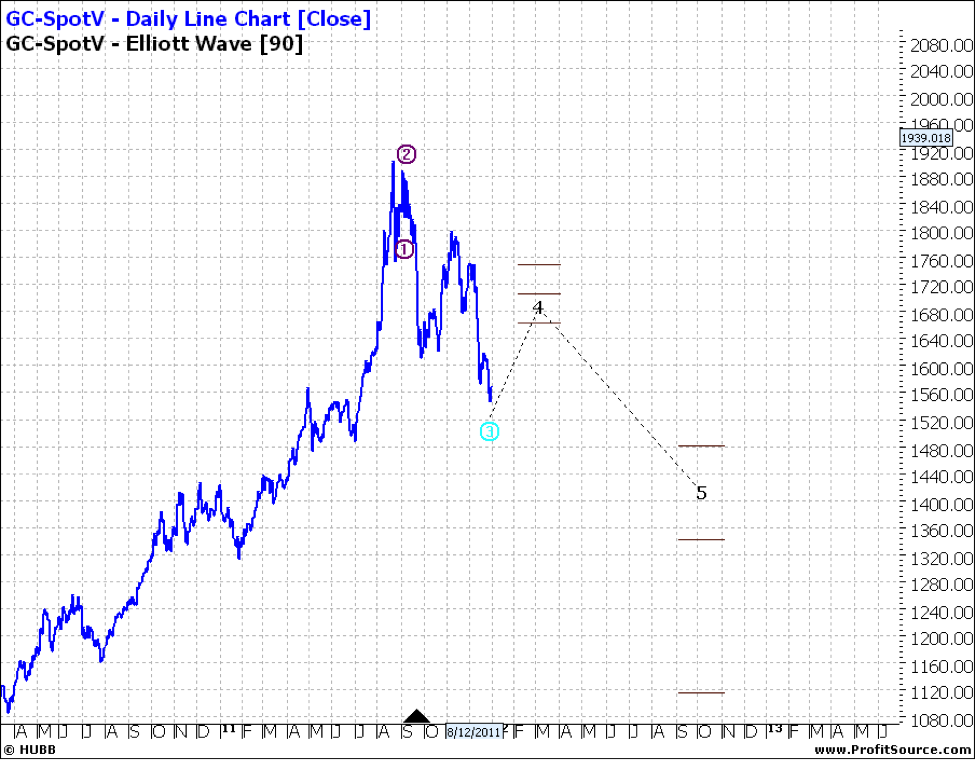

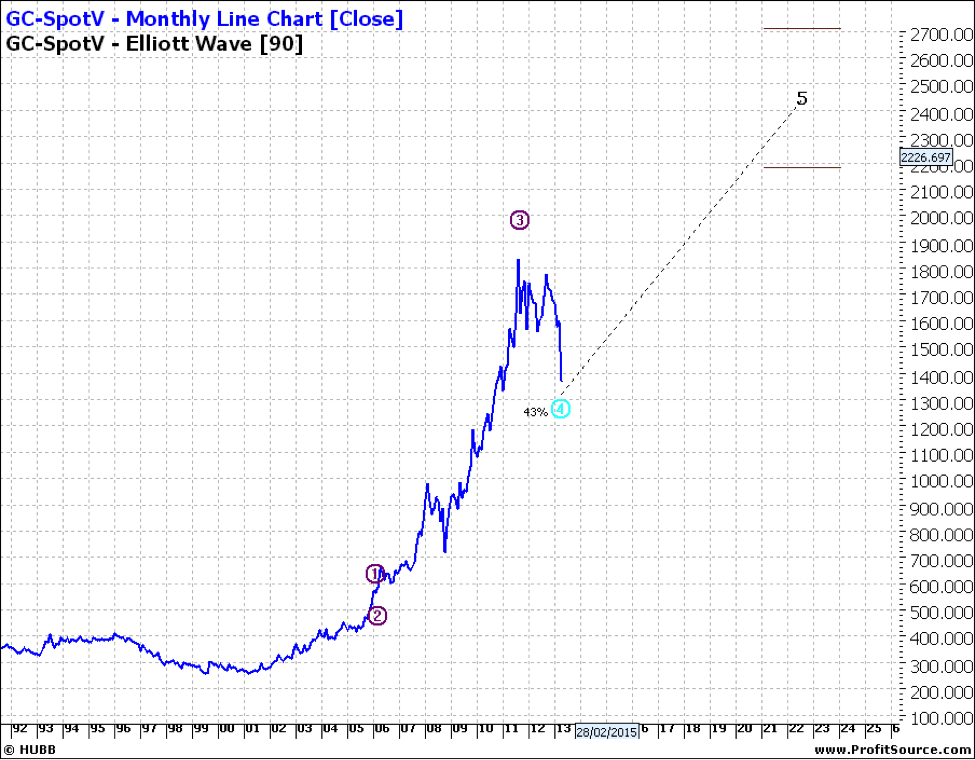

The 90 week Elliott shows a similar picture to the daily – albeit over a more extended period:

Click to enlarge

It suggests a rally sometime later in the year or even into first half of 2014. That means there could be some more to fall in the coming weeks. Note also the weak oscillator again – meaning it will be hard for gold to have a half decent rally from here.

The next leg down could be as far out as 2016. This is because gold believers will take a while to sell down to any large extent. But then we will see a final capitulation to a low possibly around US$1200/oz – a retracement of about one third.

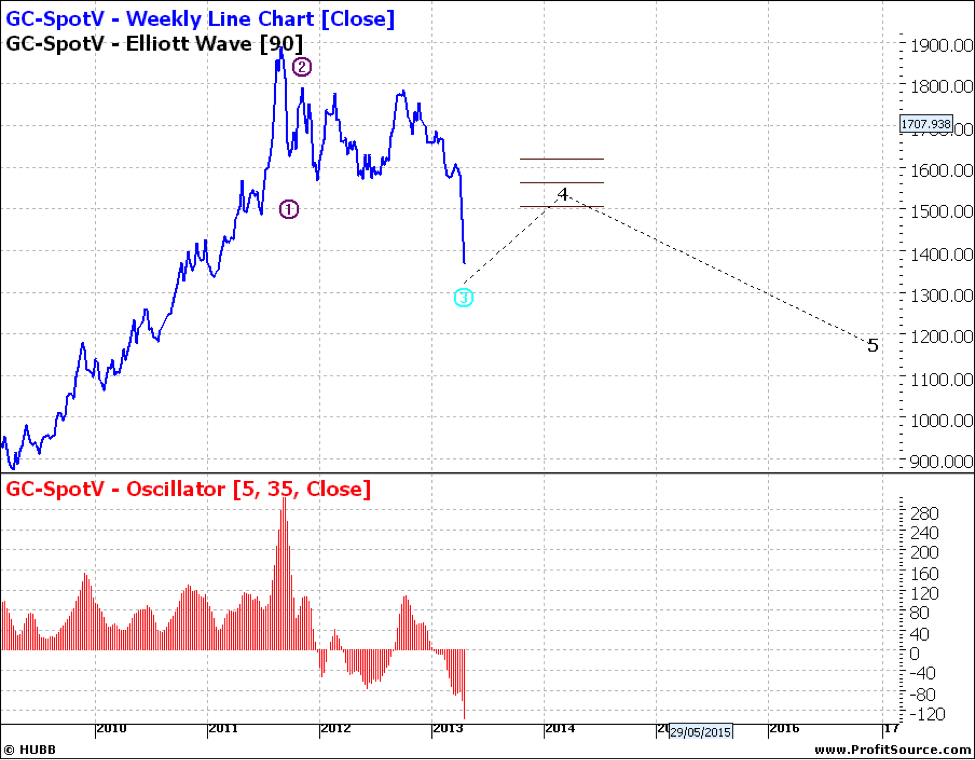

The monthly points to good news:

Click to enlarge

A doubling from the projected low – $US1200 to US$2400. But don’t get too excited as it could be ten years away.

Enjoy the ride

Tom Scollon

|