|

I have done the work all you have to do is take a quick spin with me!

For each market we will look at a daily and a weekly.,

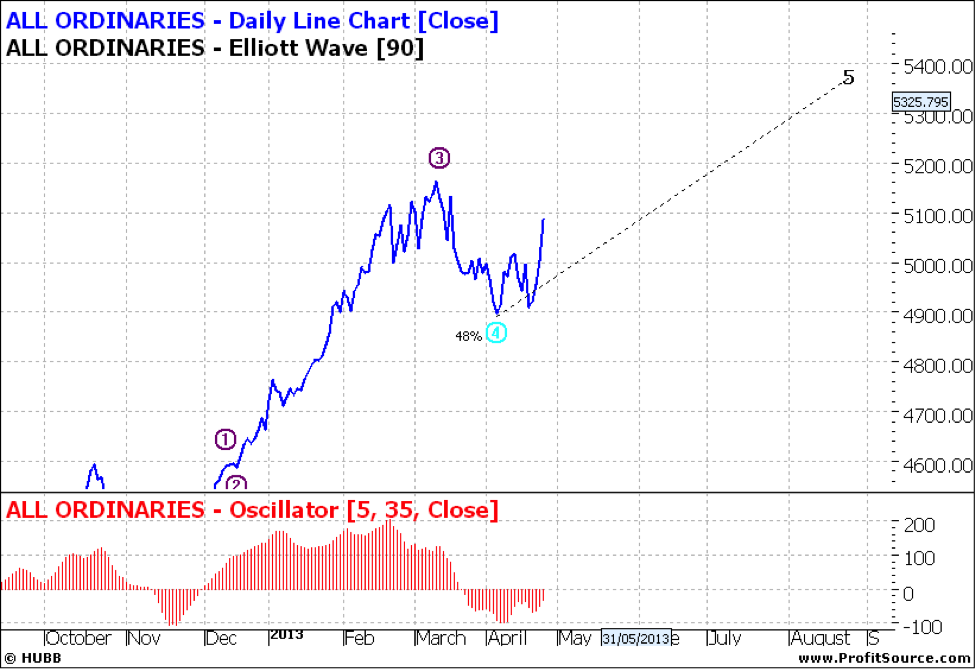

Let’s start with the Australian market:

Click to enlarge

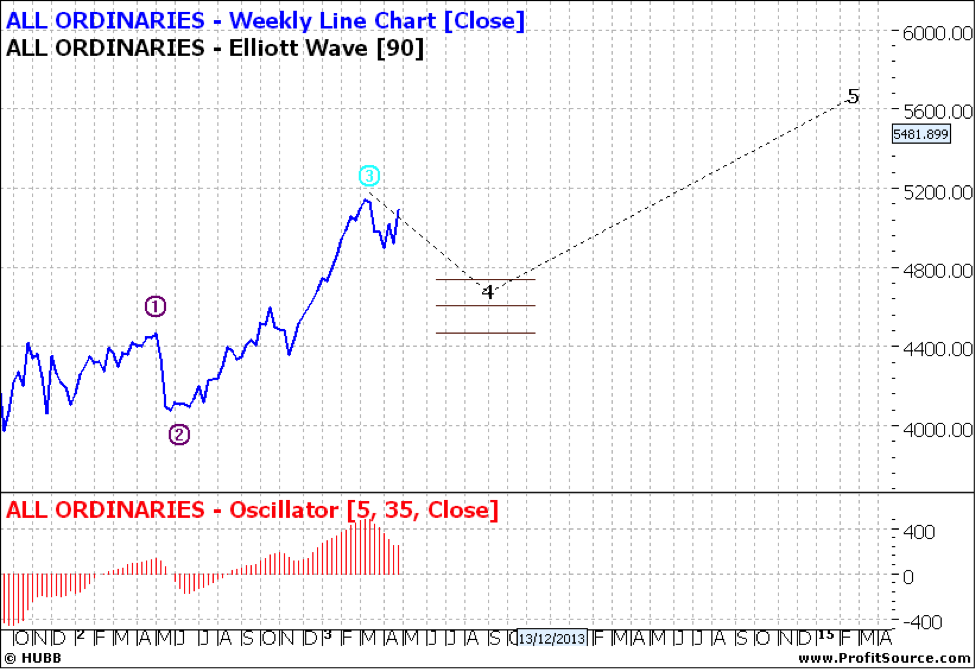

The Australian market is looking good with some more upside ahead – but the weekly says beware of possible easing at some time in the coming months.

Click to enlarge

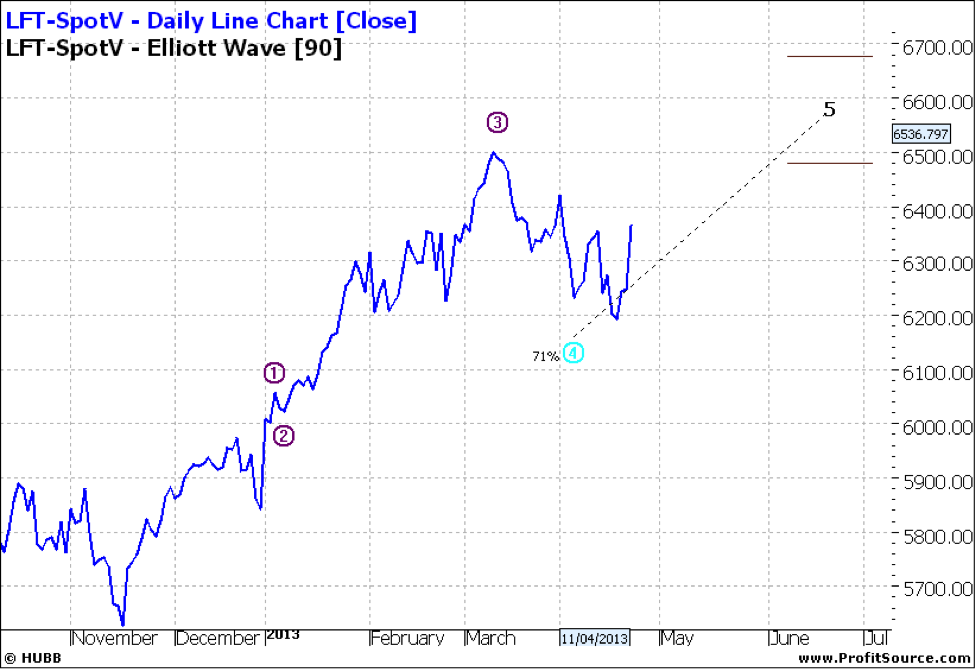

FTSE:

Click to enlarge

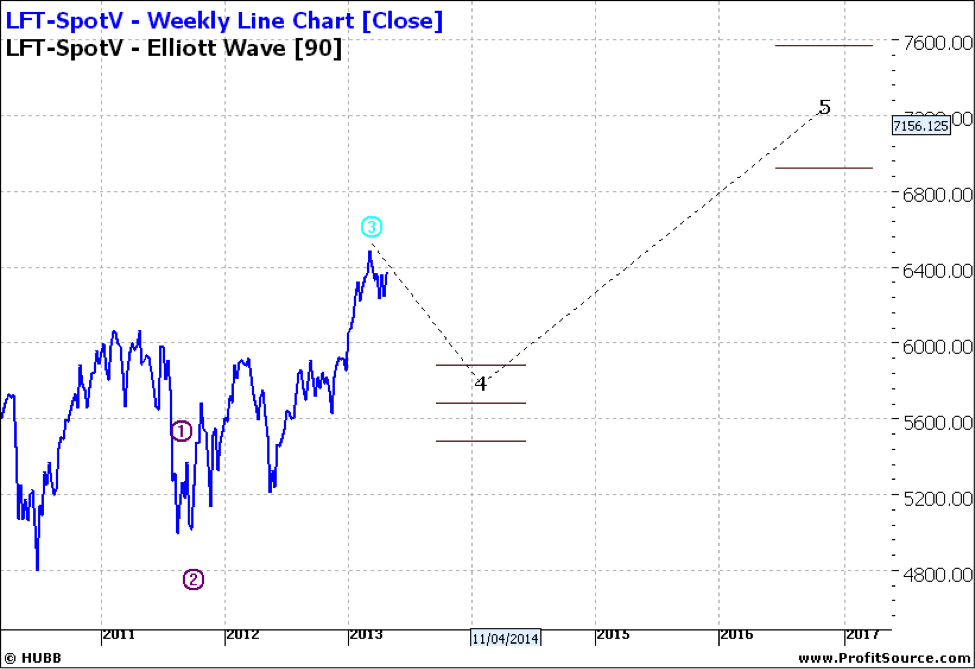

Likewise still upside but some correction likely in the coming months.

Click to enlarge

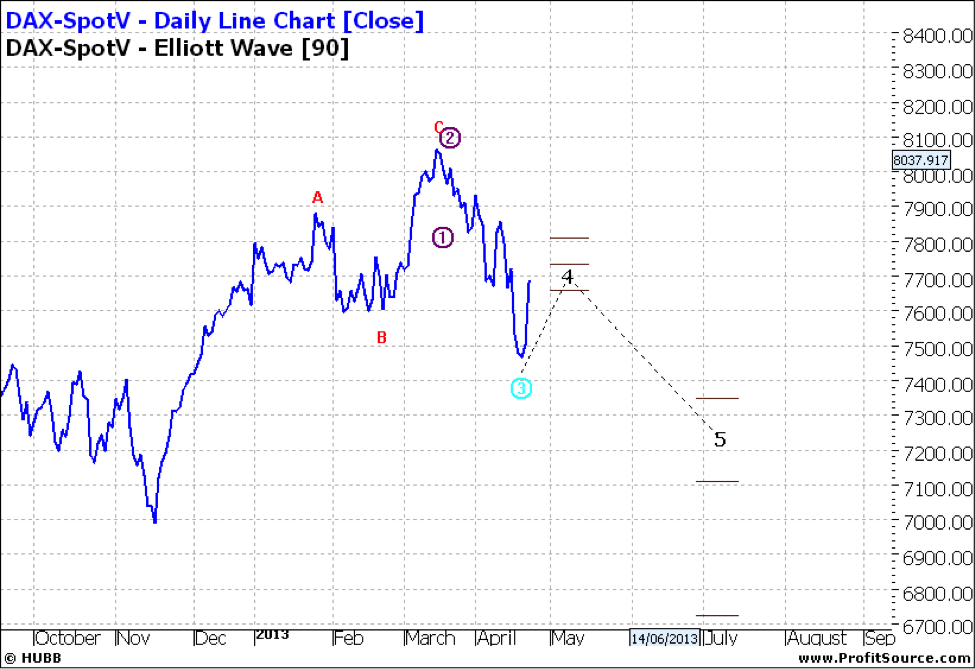

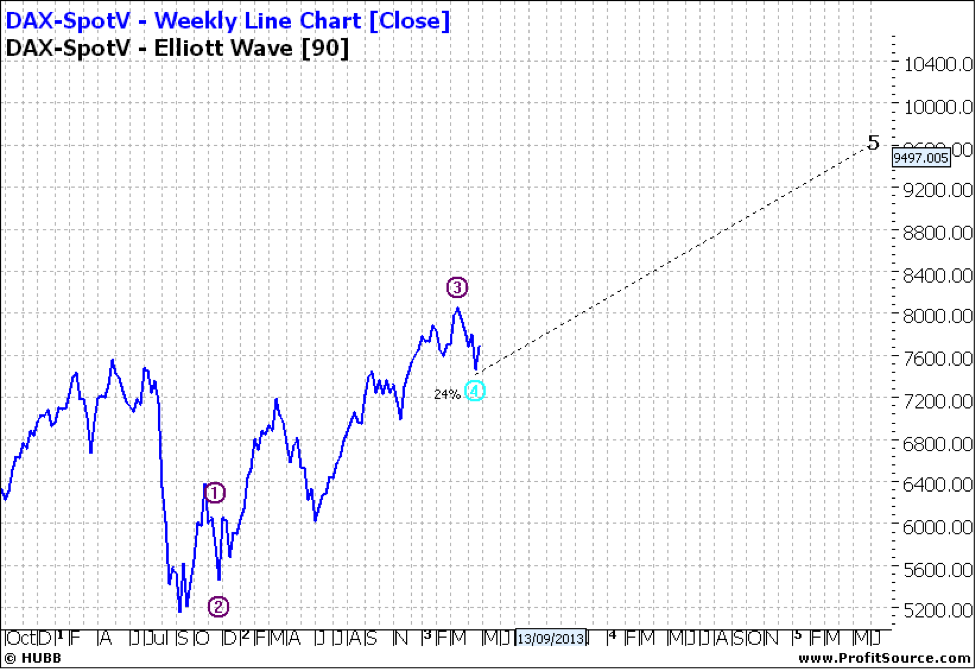

DAX:

Click to enlarge

Prudent Germany – ahead of the game is already into retreat and will eventually complete wave four and go into wave five ahead of other bourses.

Click to enlarge

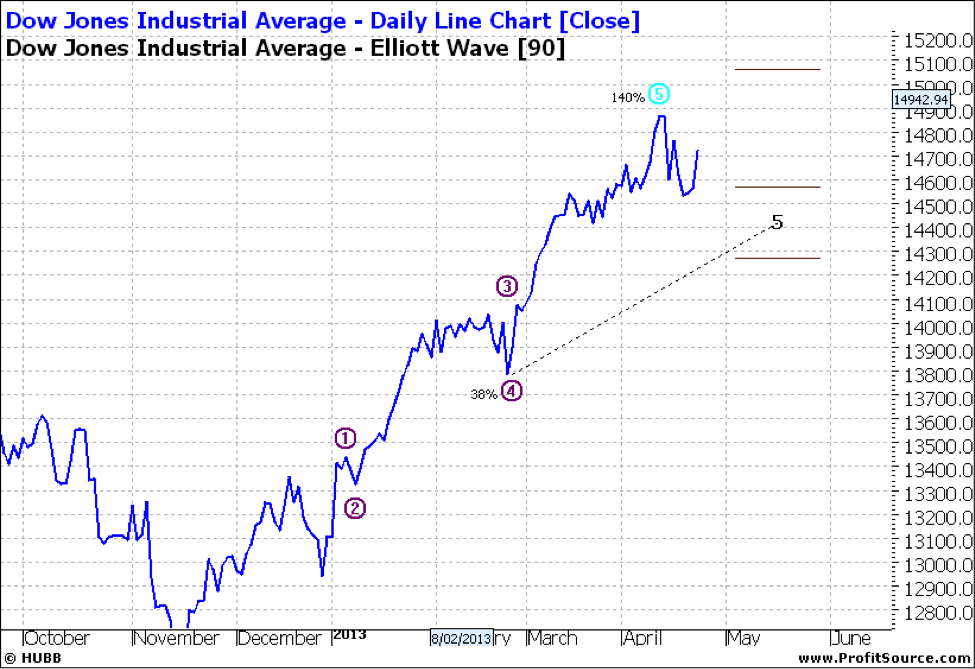

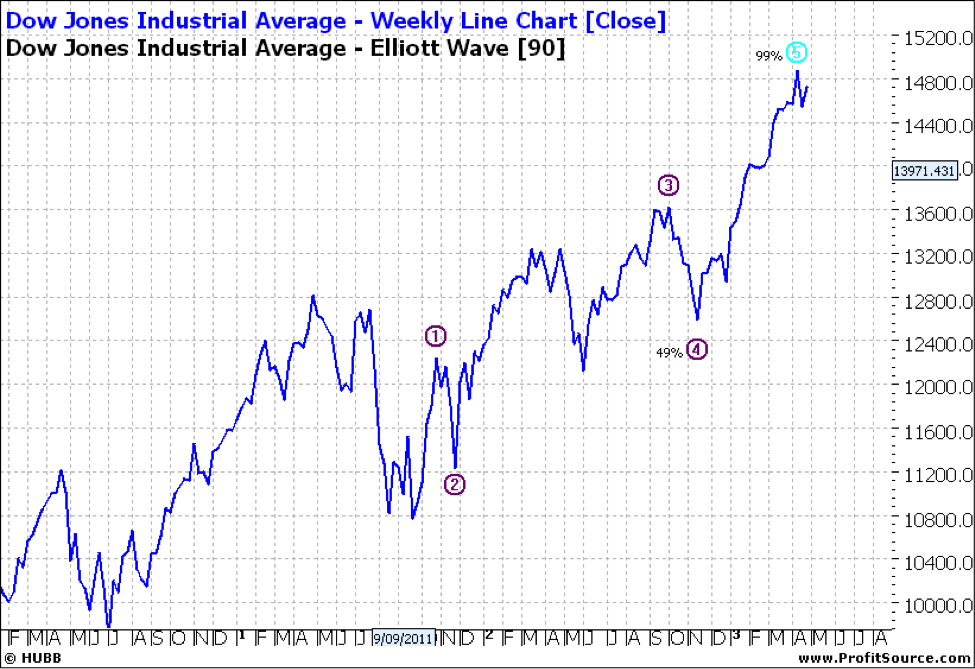

DOW:

Click to enlarge

The DOW could go higher but there is not much more upside and soon all eyes will be on what retreat might lie ahead.

Click to enlarge

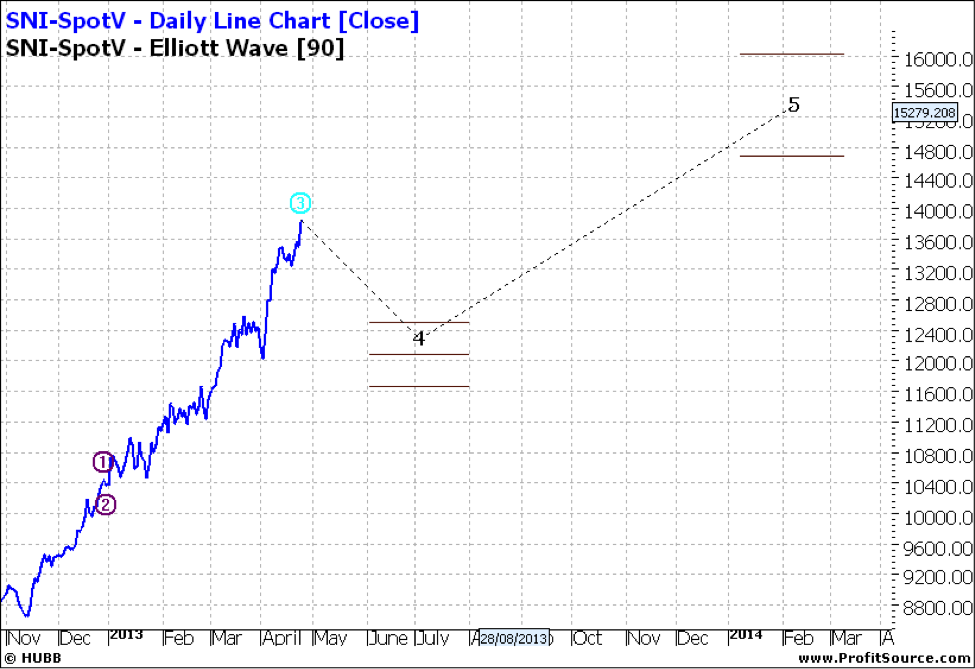

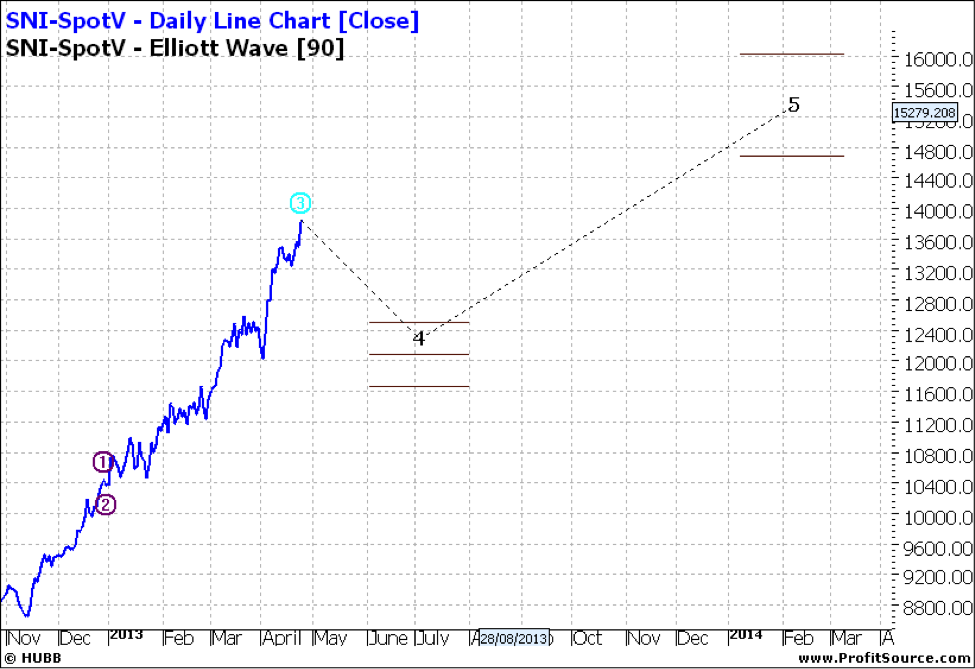

Hang Seng:

Click to enlarge

The Hang Seng is showing a similar pattern of retreat as the DAX but on a weekly basis it looks just about cooked.

Click to enlarge

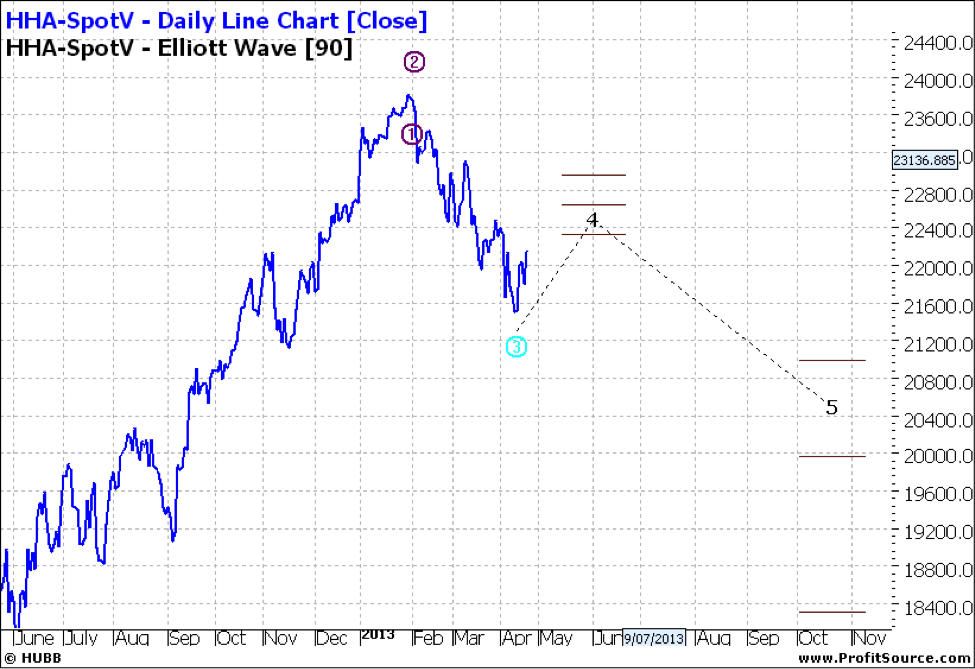

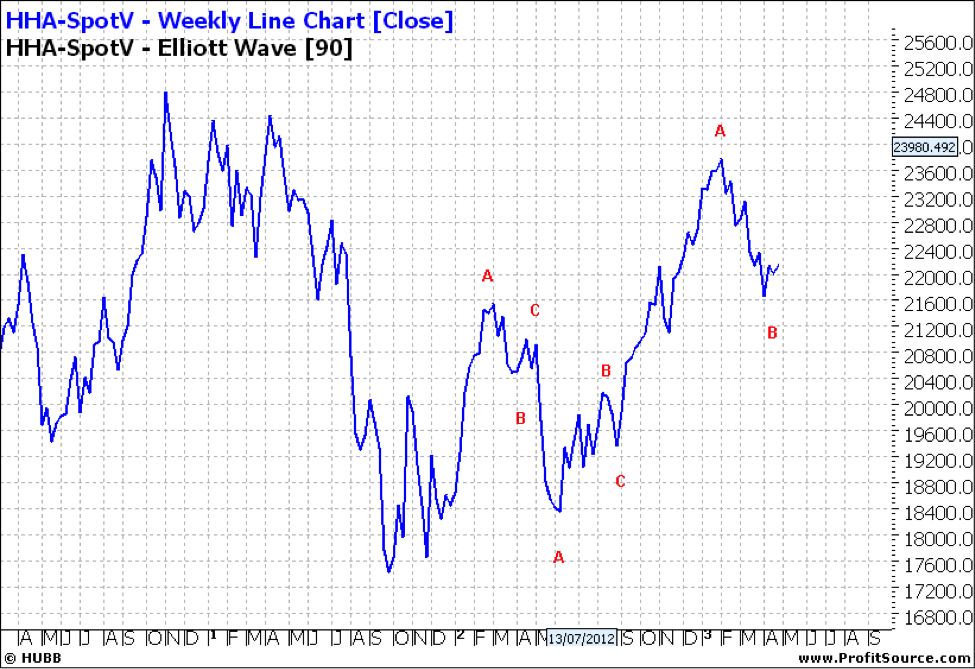

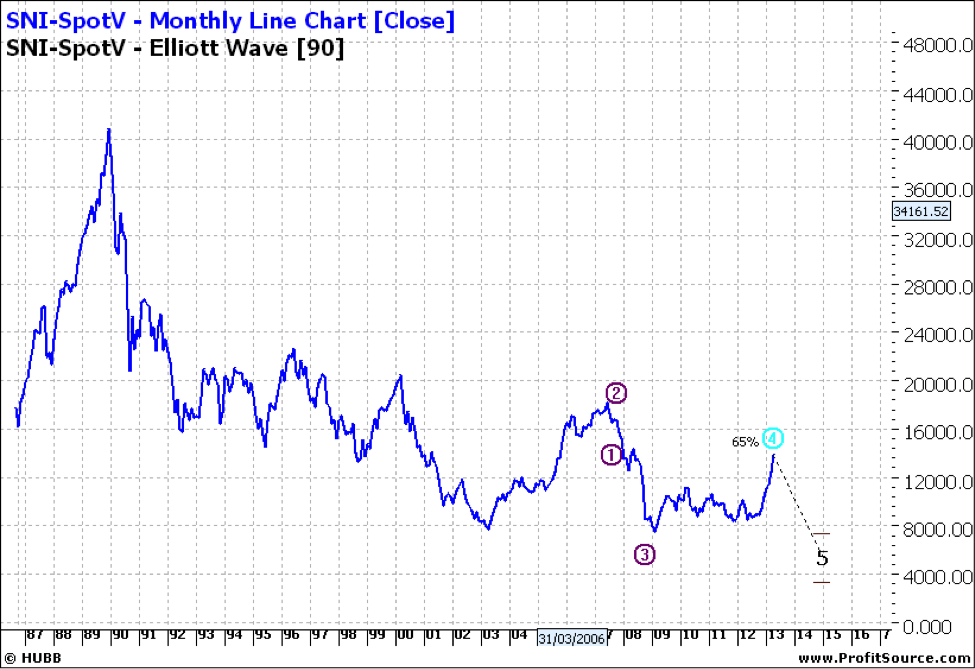

Nikkei:

Click to enlarge

The Nikkei is one of the biog stories of the year – well at least six months – up over 50% since November last year.

Click to enlarge

It has more to go – but instead of looking at a weekly here we look at a monthly:

Click to enlarge

The Nikkei has more to go and will have many Japanese investors excited – but in a relative sense it is very much a short to medium term story. Japan is doomed. I was very much a fan of the Japanese story in the 1980’s when I thought Japan could one day out strip the USA as the number one economy. Alas it will never happen. Long term forecasters even say Japan may just disappear into oblivion. As a long term student of Japanese business and social change, I have to agree. It simple does not have the culture that can survive the 21st Century. A long story but not for here.

Enjoy the ride

Tom Scollon |