|

Well potentially.

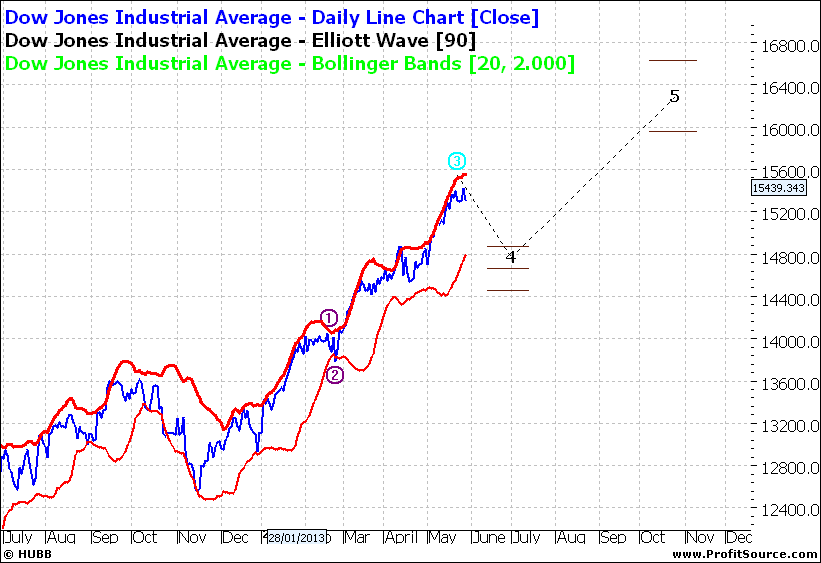

But let’s start with a chart:

Click to Enlarge

The above is now and the next is 2007:

Click to Enlarge

What interests me is the Bollinger Band or more particularly the way the market has tracked the high bands – both of course are self fulfilling.

We see in both, a market that is heading into a stratosphere without any abating. Without breathing. Without a pause. And without a cause. More investors are piling in and adviser taking them there but at some point there will be tears - ‘weeping and gnashing of teeth’

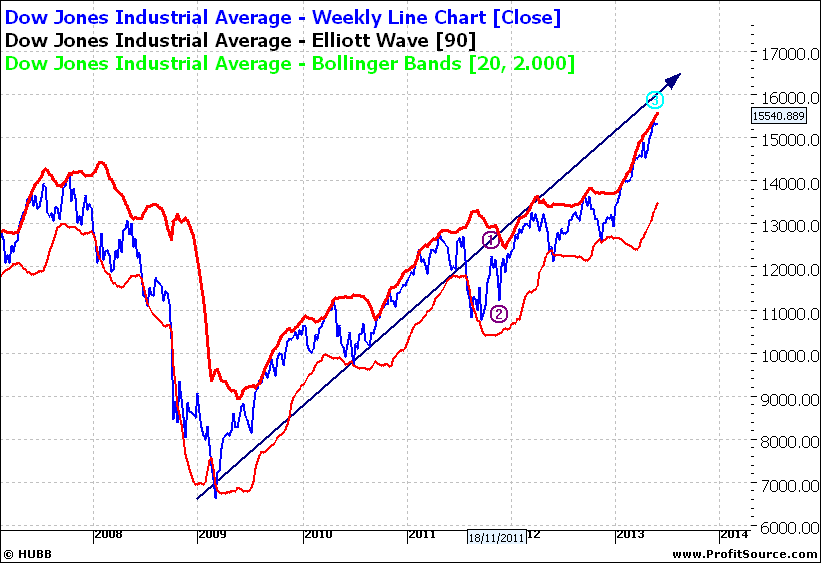

When we look at a weekly of the DOW we see a similar picture almost non –stop from 2009 to now:

Click to Enlarge

Of course your question is when it will end. That is all you want to know. You are not interested in where it will end. This is not a question investors ask at the top of bull runs. Investors dive in as everyone else is in the swimming pool enjoying the sun.

When looking for the answer to the question we should remind ourselves that markets over extend themselves – in both directions. There is fact no indication even in today’s Bollinger that the market has over extended higher yet. But when we think we are approaching the top of a mountain we need to become just a little more aware of where and how we tread. We ease up and move cautiously.

But what I still see is frenzy and markets like the FTSE doing really stupid things – big moves up and big moves down. I worked for UK companies for 15 years straight and the caution of ‘The City’ was drilled in to me. Yet I wonder where that prudence is now. Migrated to Australia – but we will look at the cautious XAO another time.

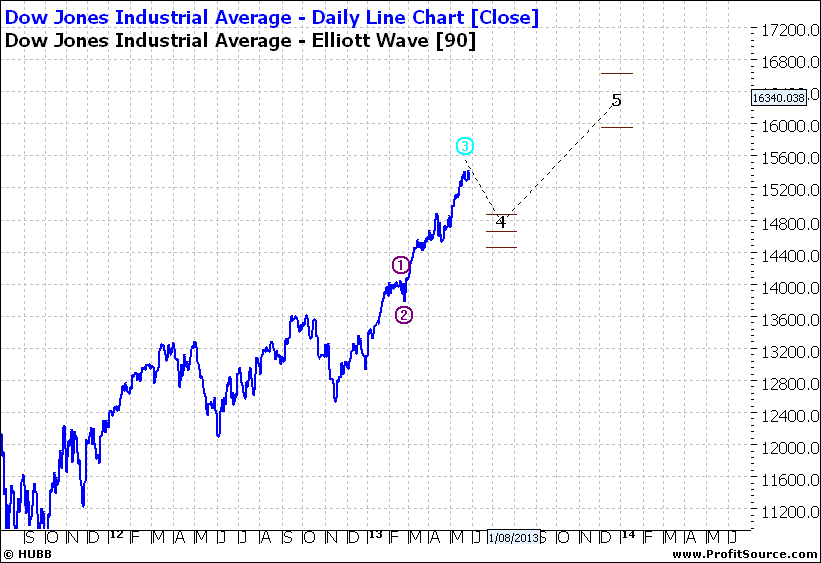

Let’s look at the Elliott projection for the DOW:

Click to Enlarge

When we see such a movement – that is when we see a wave four pullback that does not mean the market is going to start a retreat. Anecdotally I know that a market is likely to continue the wave three higher – in the direction of wave five. The higher that wave three goes, the deeper the wave four pullbacks becomes. So it is possible that we could see the DOW at 16,000 before we see an easing – and a deeper pullback.

Generally markets move to ridiculous heights before they ease and in this time the smart investors start to sell down as the innocent lambs come to the slaughter.

As I have said many times before start moving to the exit – or at least know where the exit doors are. Don’t get caught in the crush

Enjoy the ride.

Tom Scollon

|