|

Had I offered BHP to you at $30 anytime over the last couple of years you would probably have grabbed as much as you could. Especially at the peak in April 2011 at around $50. But today you just don’t want it at all.

Well there are a probably a number of reasons why our appetite for BHP has sort of gone away. It is interesting though that the appetite for the stock was strong at its peak two years ago. I am not sure what buyers were thinking at that time but something we do know is that probably, most of the buying was based on perception – perception that this party will not end. And perhaps soon the context might be that the heavens will open and there will be dark clouds and thunder and a feeling of Armageddon as the stock sinks to a new low. But again this is perception.

All of this just reminds me that markets overstretch to both the upside and the downside – and that is why they correct – back to a ‘line of best fit’

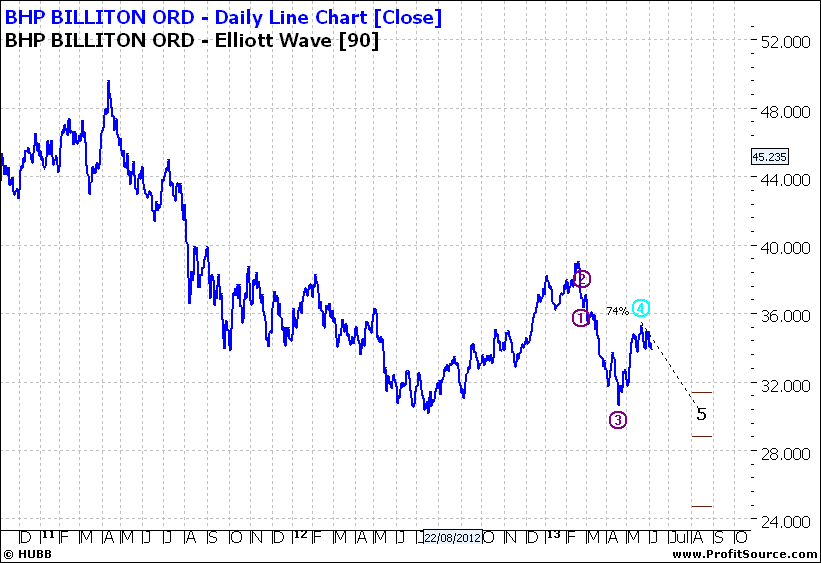

Anyway let’s look at the chart and see what is happening:

Click to Enlarge

BHP has technically been range trading for the last two years is our first observation. Our second observation is that BHP is a five wave impulse downward move and the first wave four low is about $31 with the second wave five at $29.

What we know is that when an impulse pattern is in train we can only use the projections as a guide. And for mine I am happy just to know which direction a stock is moving and wait for the low or high to be reached.

So the projected $30 sort of level is only a starting guide – it could be lower – much lower in fact.

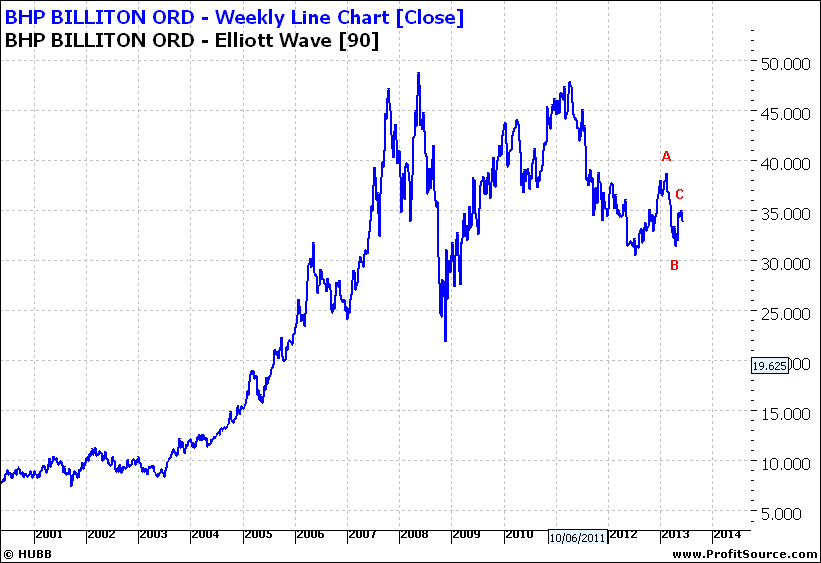

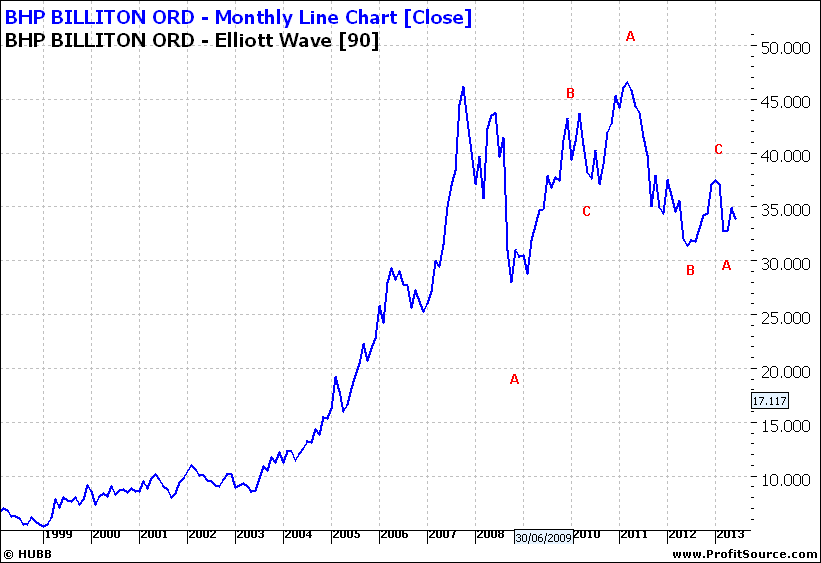

So we then turn to a weekly and monthly:

Click to Enlarge

Click to Enlarge

Both are the same and what they really confirm is the long term view that BHP is ready for pasture for a while. There does not seem to be any new big trend developing. Now that does not mean we could not see significant moves within the trading range over the coming years but for now we cannot see a new trend emerging. Now the picture will change but with weekly and monthly charts it takes a long time to change the charts opinion.

So maybe there is short to medium term money to be made – on both sides of the market.

But for now we need to look elsewhere for long term opportunities.

Enjoy the ride

Tom Scollon |