|

Markets continue to defy gravity. What is real value and what is desperate money chasing a home is the vital matter. With interest rates at an all time low - zero in most western economies - and the world flush with funds it is hard to find a home to park your funds. So equities are the focus.

Where and when will this rush to equities end?

There are no clear signs and whilst I have been cynical about this run up I am reluctant to change my call, as this is the stuff that creates bubbles. And when bubbles burst rationality goes out the window and everything gets smashed.

But lets look at what the charts say:

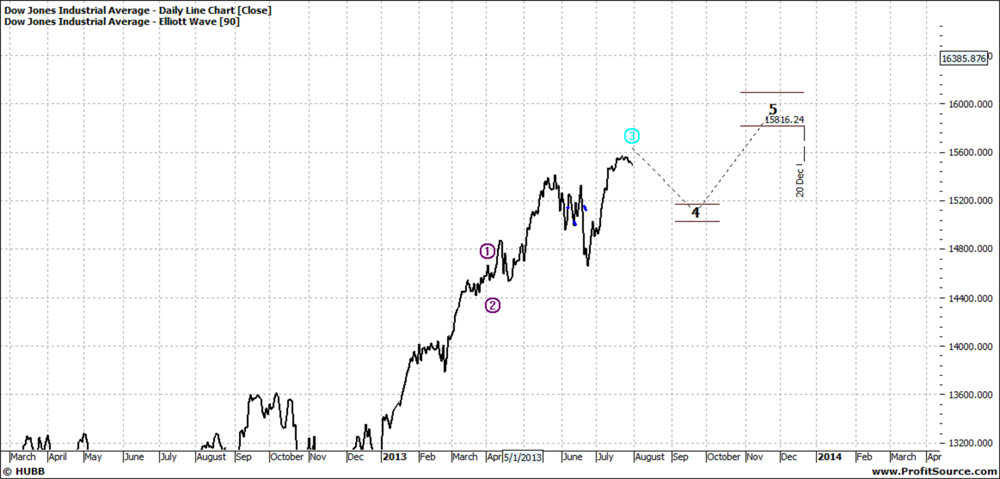

INDU:

Click to Enlarge

The Dow is due for a correction and has been for some time - but who knows when?

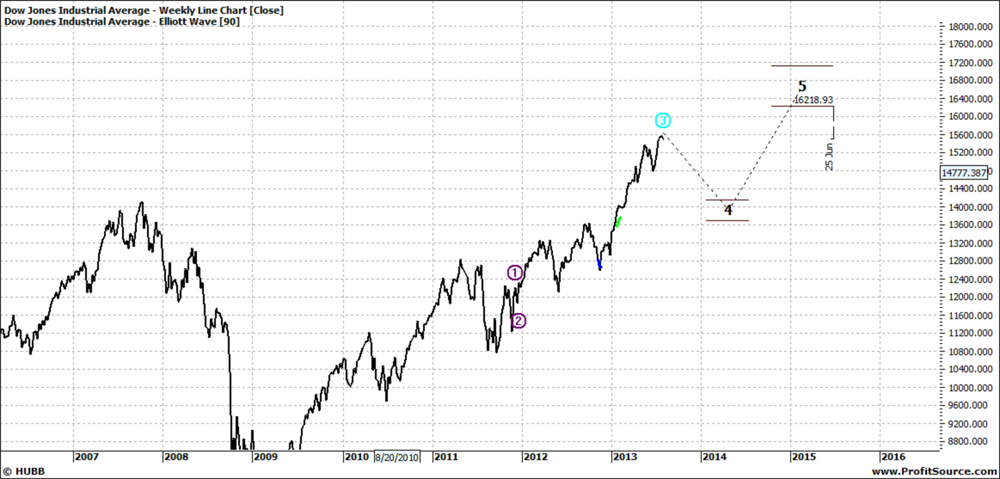

On a weekly basis it is due for a bigger correction:

Click to Enlarge

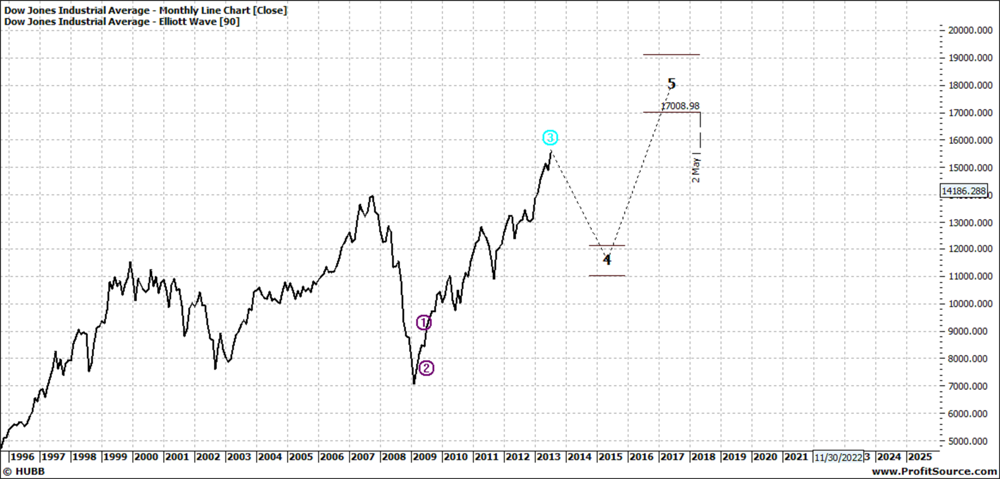

And an even greater one on a monthly chart:

Click to Enlarge

But two years away!

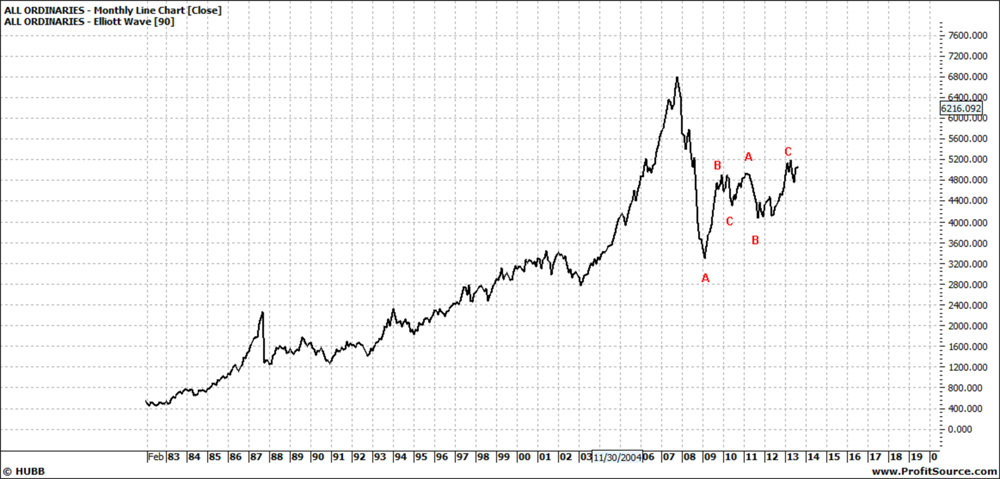

Closer to home, the weekly All Ords looks like this:

Click to Enlarge

And the monthly:

Click to Enlarge

So it appears that the bias is to the upside - but on a long-term basis it is not a strong trend.

Lets look at some sector indices - on a weekly chart, which in balance is the more useful:

Financial:

Click to Enlarge

Still more upside!

Resources:

Click to Enlarge

Maybe downside.

Industrials - more of the same - range trading:

Click to Enlarge

Consumer staples - more upside:

Click to Enlarge

And maybe also for Discretionary:

Click to Enlarge

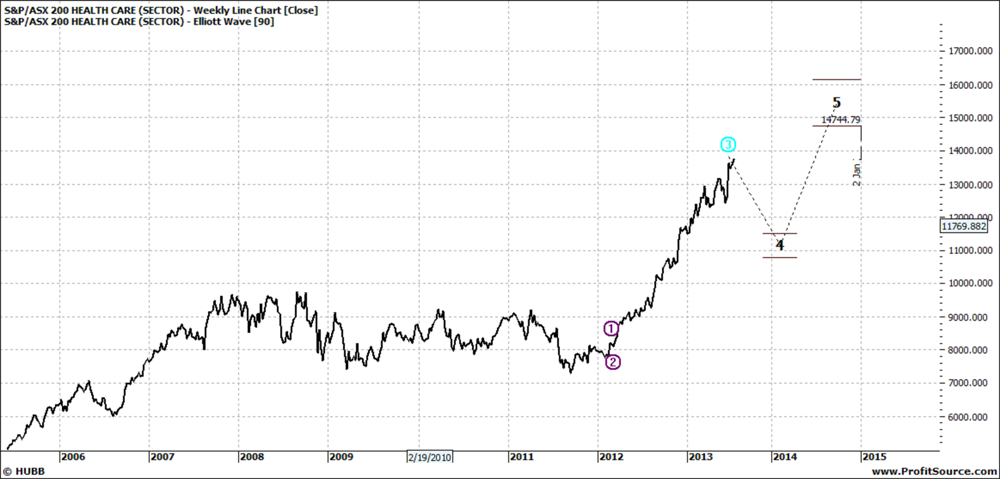

And likewise Health Care:

Click to Enlarge

So the charts say that over the next couple of years generally upside.

We accept that for the minute

Enjoy the ride

Tom Scollon |