|

The Australian market looks very much in sideways mode:

Click to Enlarge

It is struggling to break through at the moment – halting at a triple top perhaps?

But further out it shows some promise after this initial stalling is overcome:

Click to Enlarge

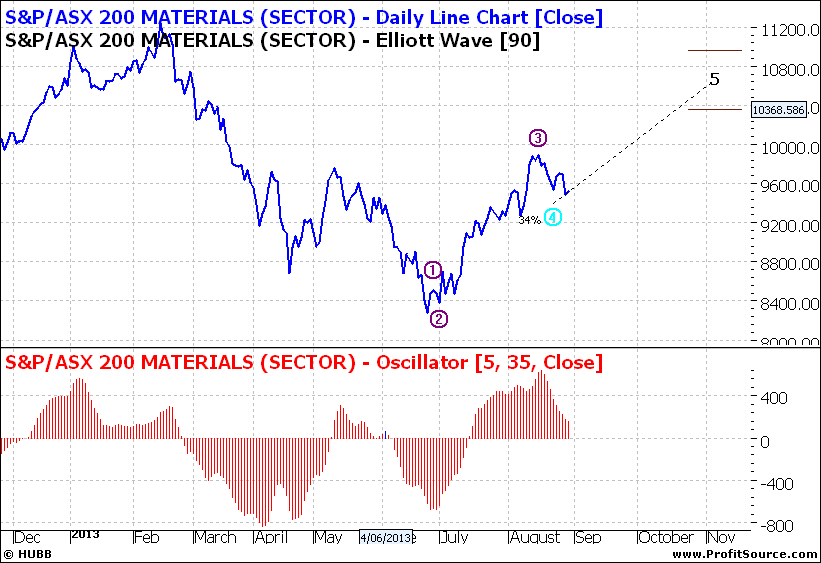

The Materials sector in contrast however, appears to have some short term upside:

Click to Enlarge

But possibly it needs to consolidate at a wave four retreat – note the oscillator above – not quite yet at zero. In the coming days we could see some buying come back in.

But when we look at a weekly of the XMJ it suggests this short term resurgence could be a rally before a new low is reached. So buying is maybe only for the short term.

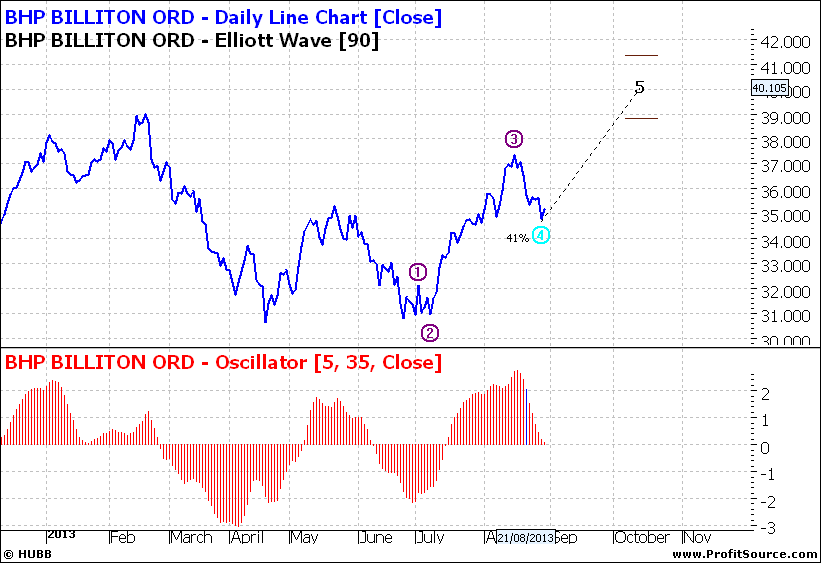

I like BHP as a short term play:

Click to Enlarge

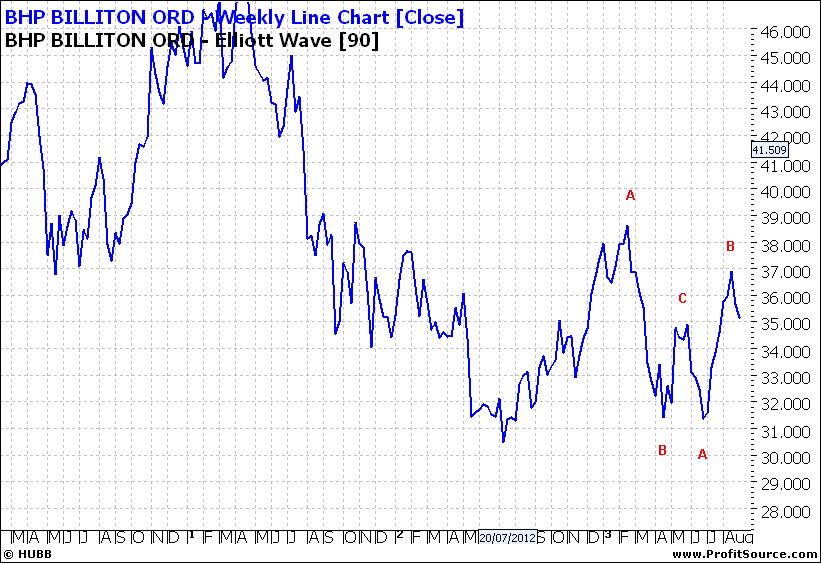

But the weekly for BHP suggests the upside

might only be short lived:

Click to Enlarge

So my medium term expectations are not that high.

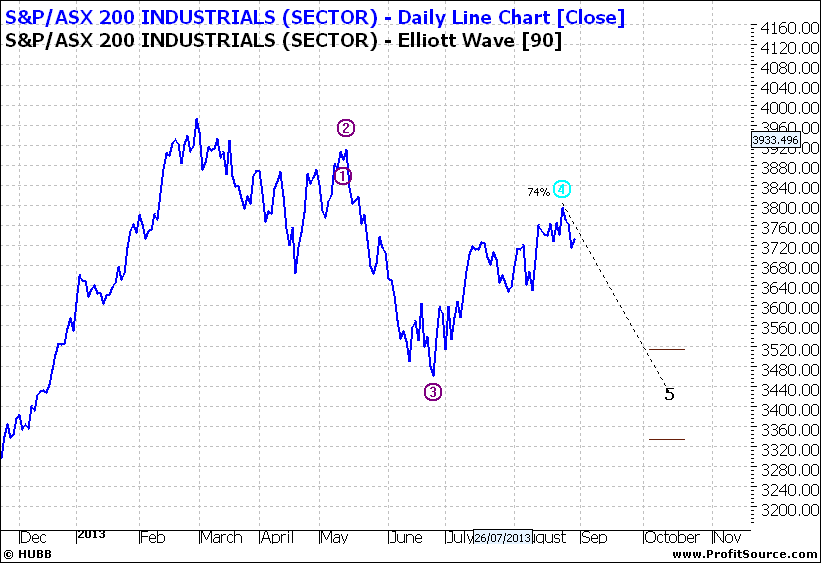

Two other important sectors in the Australian market are Industrials:

Click to Enlarge

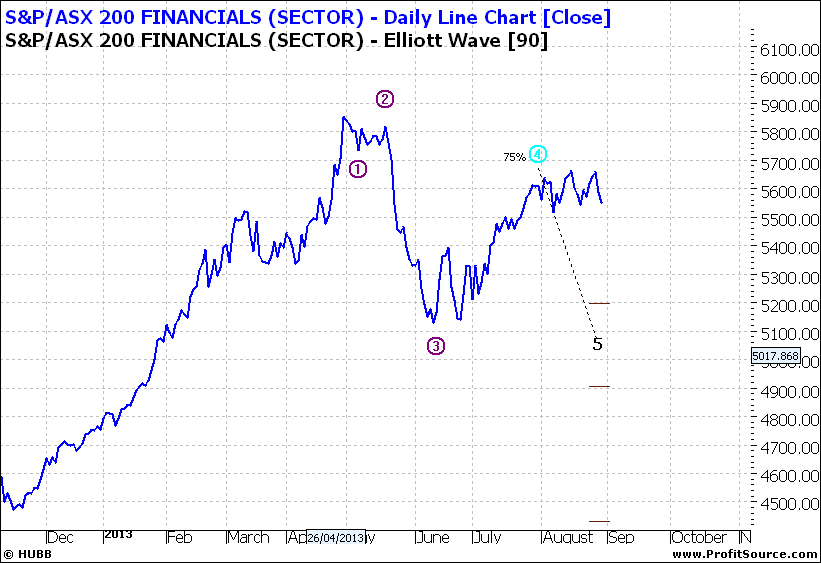

And this looks a little wobbly. As does the XFJ:

Click to Enlarge

In general the charts tell me that this market still remains one for careful selection of stocks - perhaps a truism. But those of you who have invested have made money in the last few months. Well done.

The key question is what will the next few months bring?

Enjoy the ride

Tom Scollon

|