|

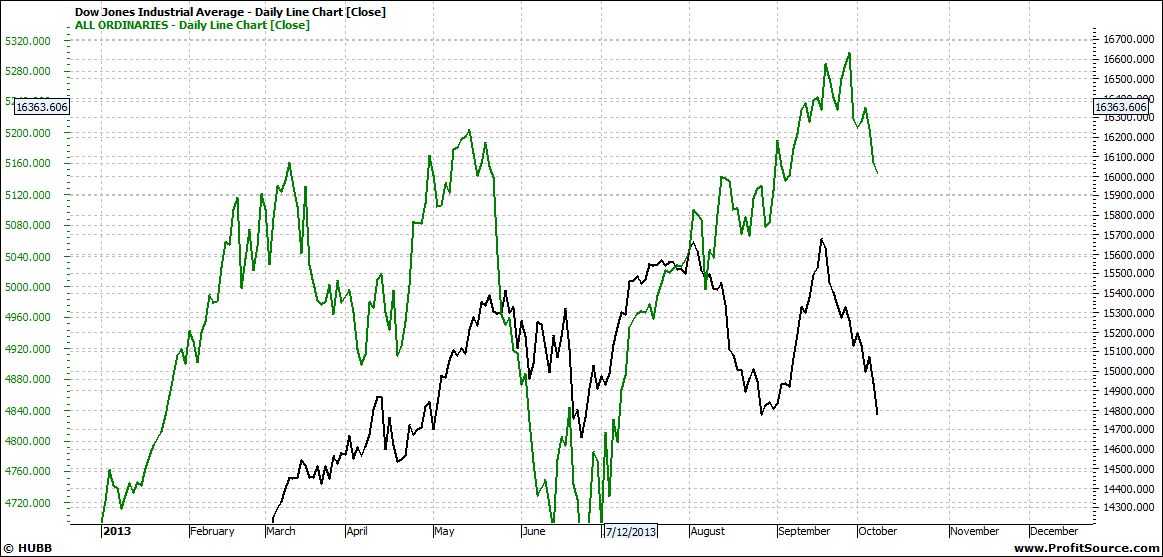

The Australasian All Ords was slow out of the block after the 2009 low and in fact lags the DOW by a long measure from the recovery of the 2009 low. But in recent times the XAO is ignoring what is happening in other parts of the world:

Click to Enlarge

In the last two months you can see in the above chart that the XAO has well and truly surpassed the INDU.

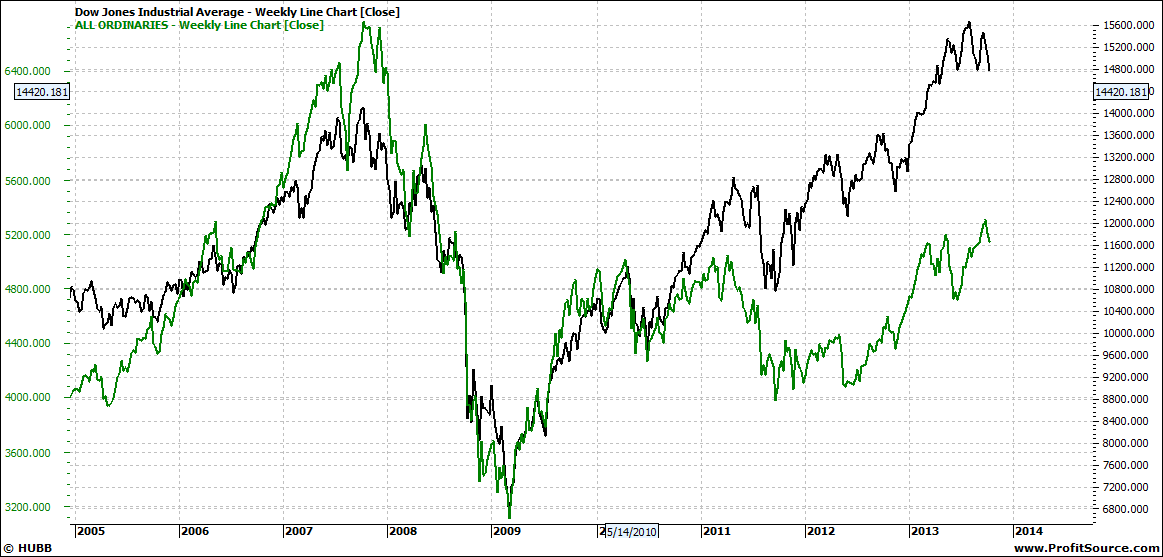

But a different picture on a weekly:

Click to Enlarge

So overall the Oz market has been cautionary over the last 3-4 years – but for some reason it is now going it alone.

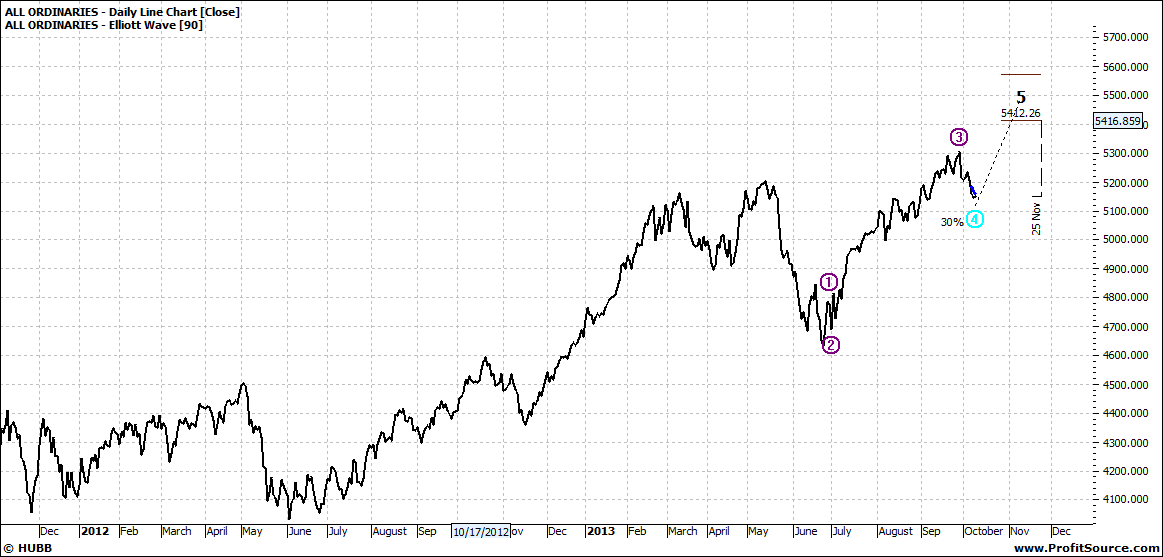

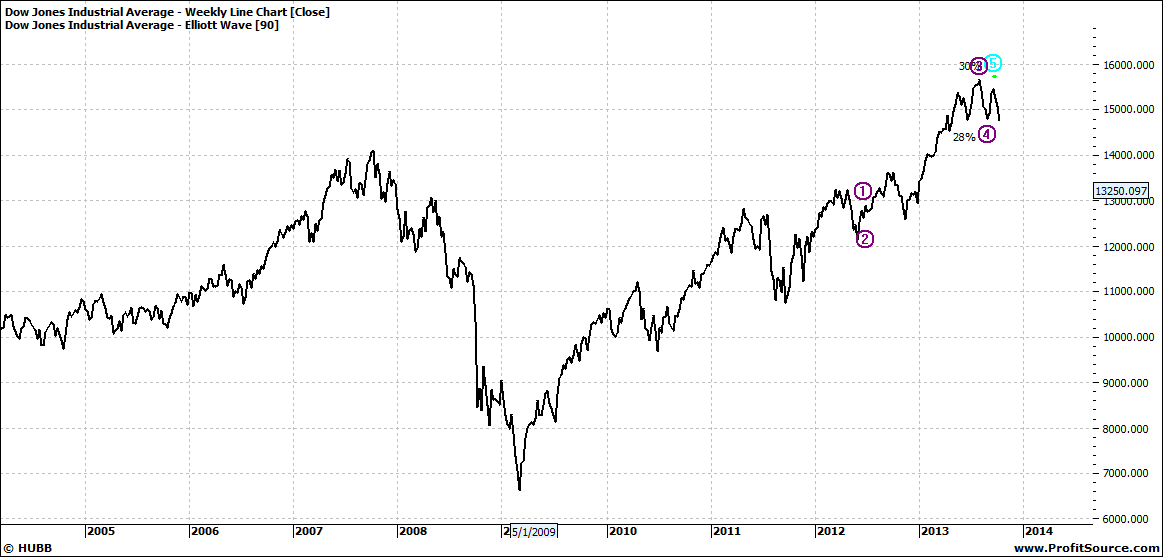

Maybe many Australians think there is one more kick in the market:

Click to Enlarge

That this, is just a mere wave four pullback, and a new wave five lies ahead – as above.

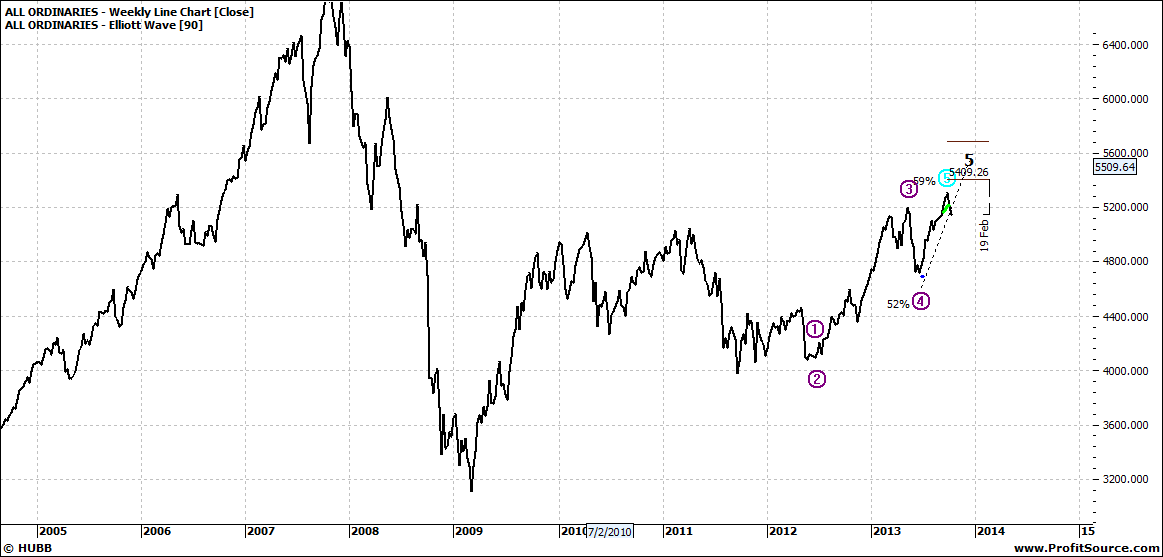

This could well be true – but there is limited upside:

Click to Enlarge

Although an index is just a conglomeration – average is too descriptive and lavish a term – it is really just a mix of stocks – so there may be value in some individual stocks for those who know how.

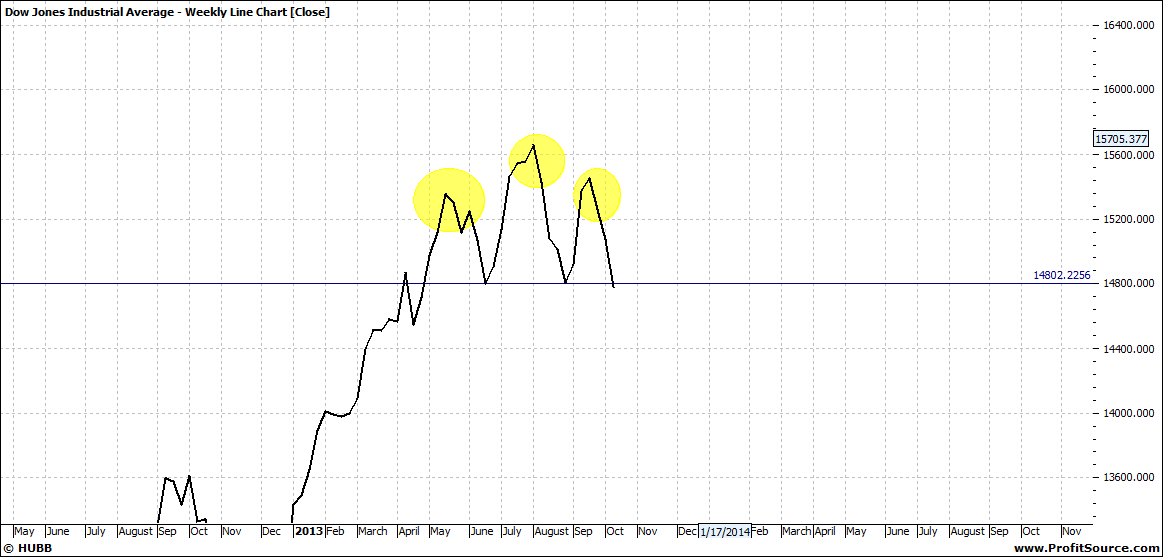

The INDU I would say is topping:

Click to Enlarge

The above is a daily and we can see a head and shoulder pattern in more detail below:

Click to Enlarge

So merely confirming a top. There is strong support at 14,000 and so there will be a lot of people watching this level.

So this is a time for caution – to start thinking about spreads – to cover you positions and to make money on the downside.

Not a time where you turn your back and head to the beach.

Enjoy the ride

Tom Scollon |