|

A soft week has many feeling that the market is at a high. So those who bought months ago or more probably are easing back on the throttle. But there are always the usual suspects that buy at market highs. This is history repeating itself. It happens over and over again. Amusing but also sad. But market forces and freedom to make decisions will have people do all sorts of strange things. I am not saying this is the top but it is not far off.

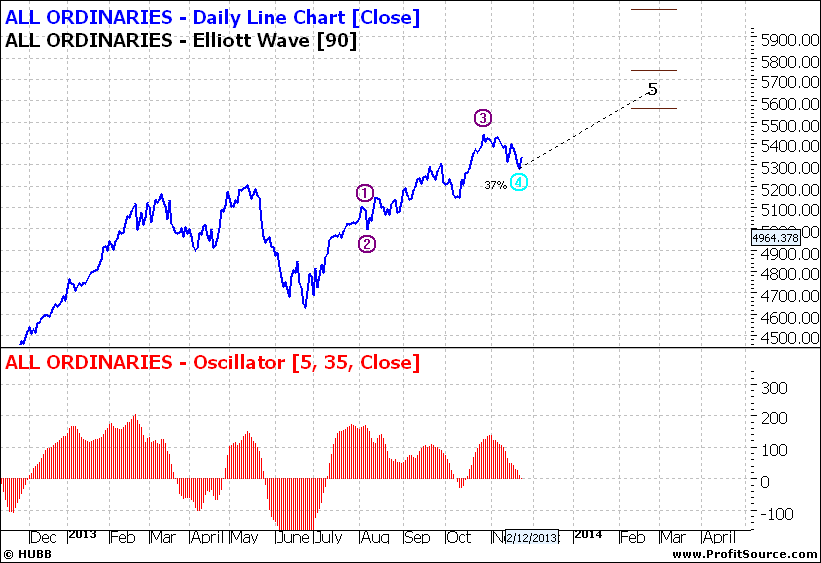

Let’s look at Friday’s chart for the Australian market:

Click to Enlarge

So what we have here is a 90 day Elliott with an oscillator. This at the moment a textbook Elliott wave four recovery. The oscillator is at zero and there are all indications that wave four could be complete.

Would you buy if wave four is complete and heading to wave five? Yes but bear in mind the move for the All Ords is probably only about 6%. And moves for some stocks would be less and some may still continue their path south. Others maybe well increase by more than 6%. So it is a matter of sorting through the charts.

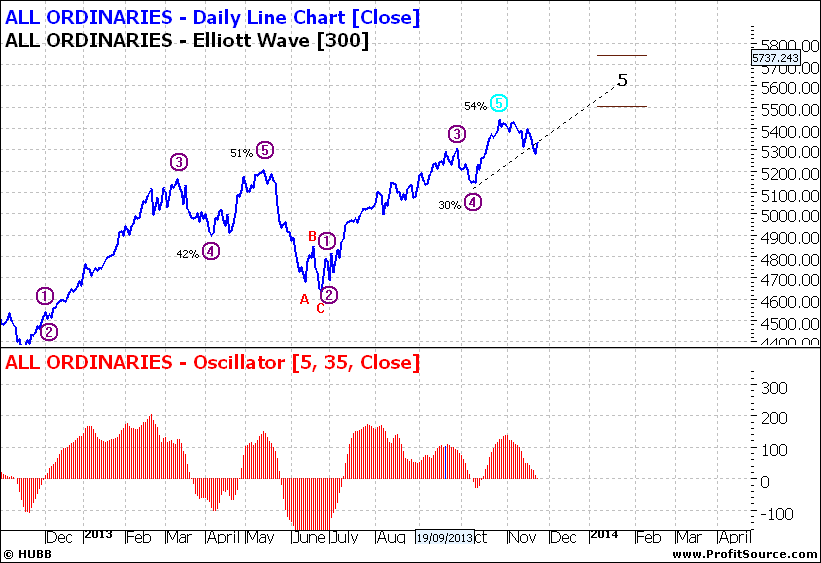

Note the 6% is based on the first wave five. The likelihood of a second and third wave five is not high – but it could happen. The 300 day Elliott takes a more conservative view:

Click to Enlarge

Suggesting about 5500 could see it out.

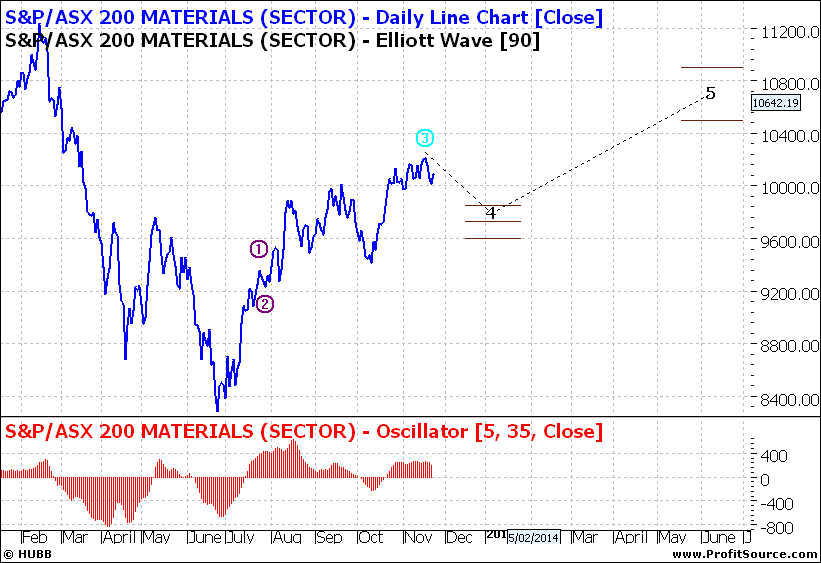

Now not all sectors are in synch at the moment – take a look at the Materials:

Click to Enlarge

So before you focus on stocks it is important to focus on sectors and once you have identified those sectors that look promising then focus on stocks.

For example if FMG follows a classic wave four path then it will offer much better prospects of gains.

Overall I would be thinking about any trade in the coming days as being a short term trade. My perspective.

Enjoy the ride

Tom Scollon |