|

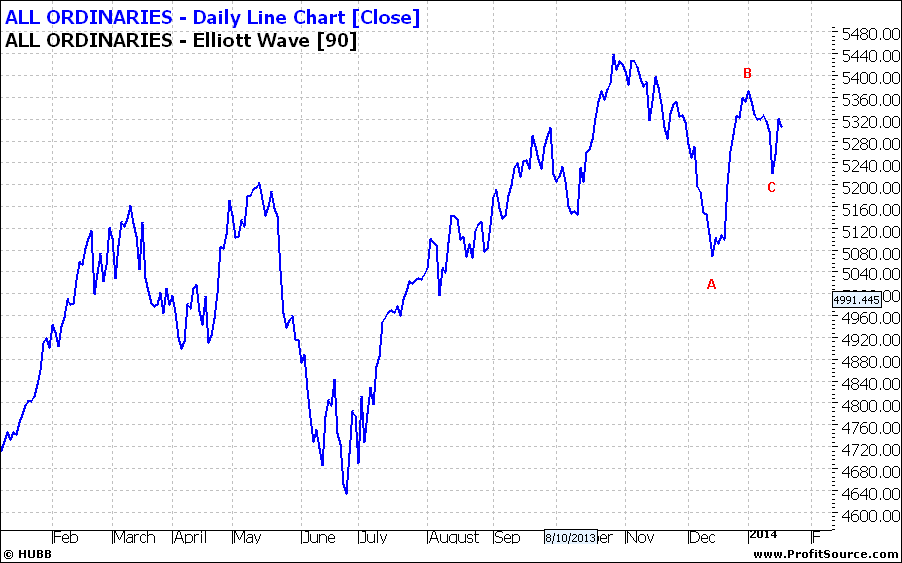

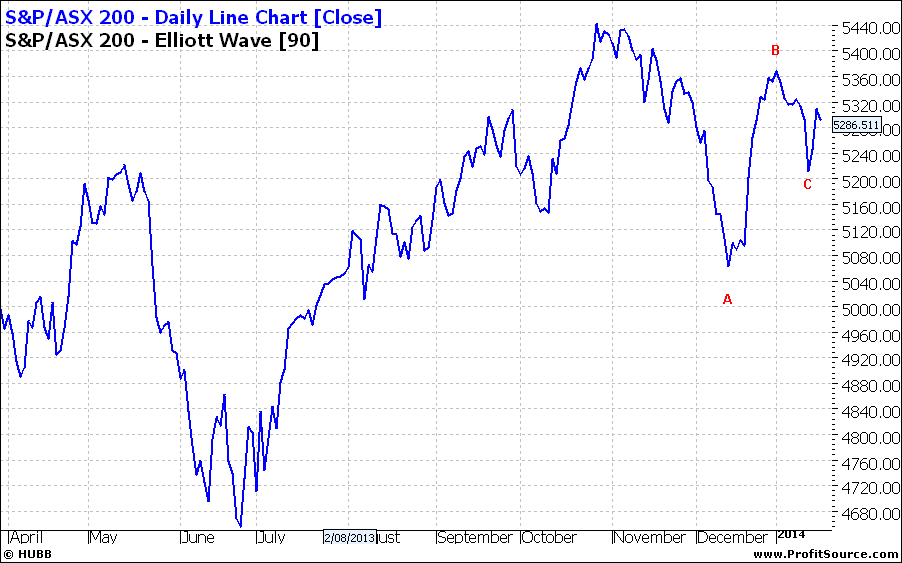

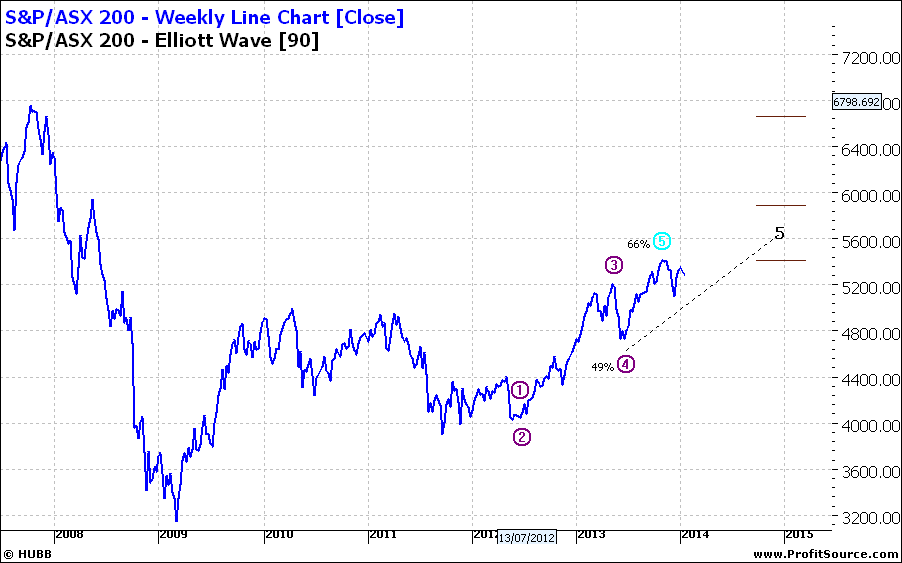

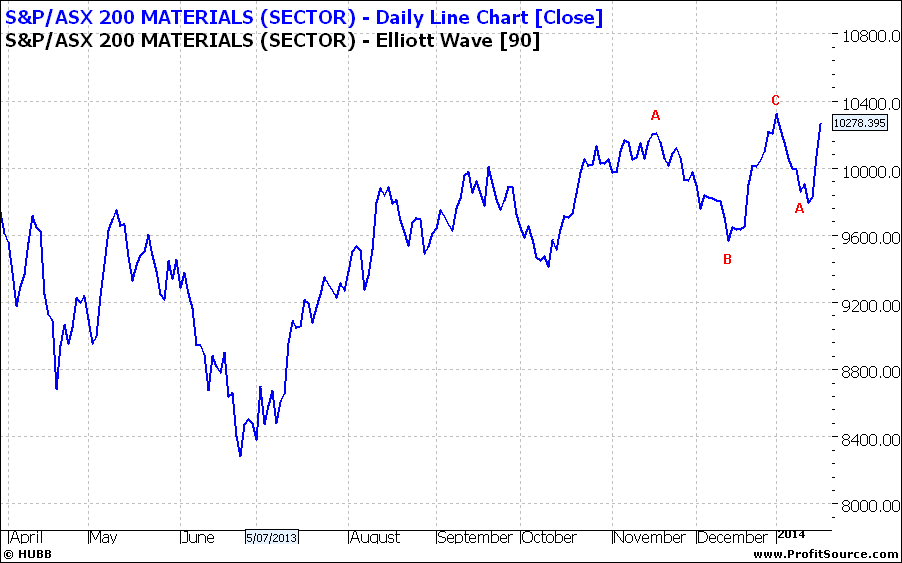

It appears that the main action is not far from complete. That is in terms of trend. Let me explain but first a look at charts. I am looking at both daily and weekly for XAO but also XJO to reconfirm and the two mostly watched indices – Materials and Banks.

So here we go:

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

So firstly, the XAO suggests the trend is pretty much over – but that is not to say we may not see ups and downs – but this will be more range trading rather than any clearly definable trend up or down.

The XJO – a slightly narrower index but one that represents the real companies of any size – suggests similarly. Except for the weekly. And that does not mean it is at a divergence to the XAO as we could tweak the XAO just a teeny bit to show similarly. So the possibility of the ultimate overall direction for the coming year is up could be an ok idea.

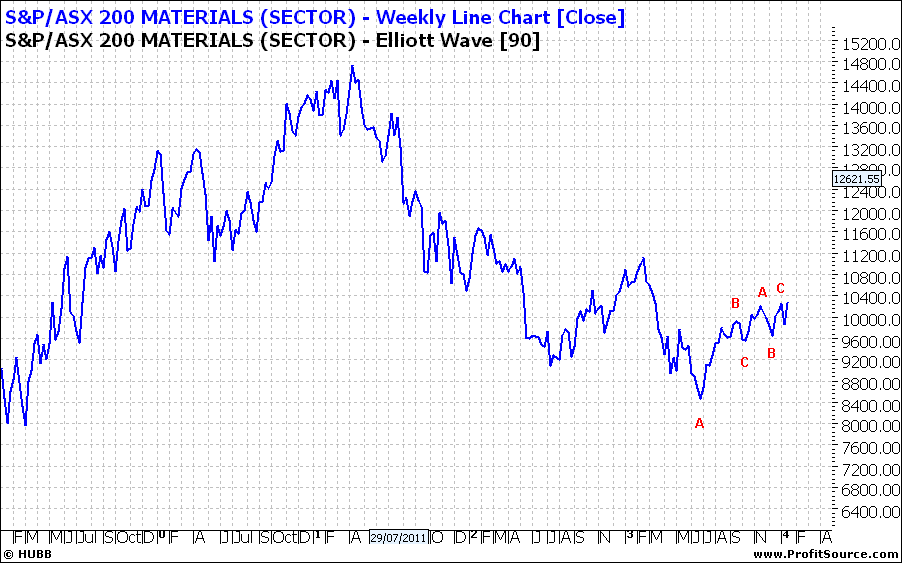

The Materials shows little action in both daily and weekly charts. This is because even though the DOW still moves higher overall the world economy is in no way over all GFC fallout.

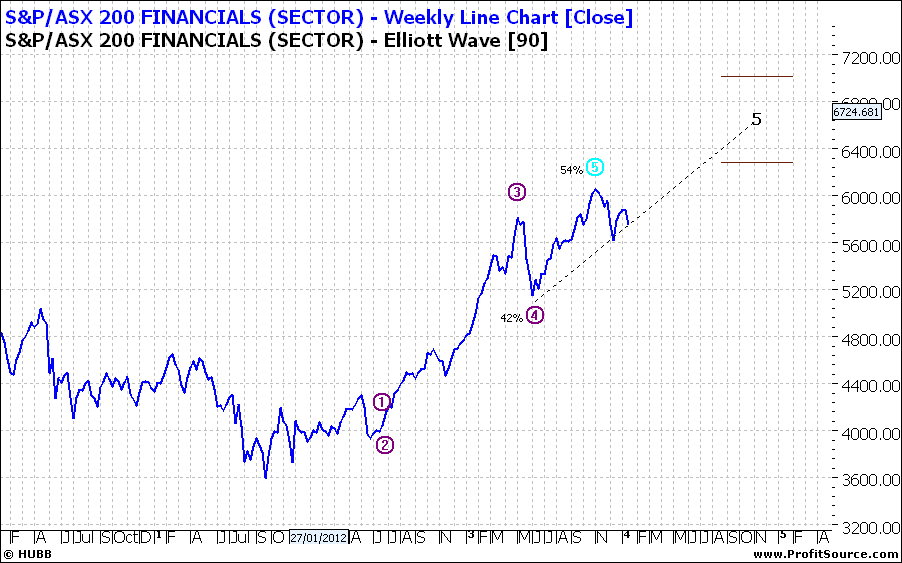

The Finance sector shows short term downside but overall trend up – maybe.

This sector is a major determinant of overall action for our markets so we cannot ignore what it is saying. And that is why I say we could see ups and downs over the coming months. The world bourses will be very reactive to sometimes small benign news – because many markets are fully priced.

So maybe a year when, most portfolios will not repeat last year’s gains – but also a year to ‘hang on to your britches’

But either way I hope the year is above all a happy and healthy one for you and yours.

Enjoy the ride

Tom Scollon

|