|

Well I still scan the top 300 stocks regularly but there is no stock I can say I could really get excited about. Yet the market just keeps heading north.

At best all I can do is look at what sectors are driving the market.

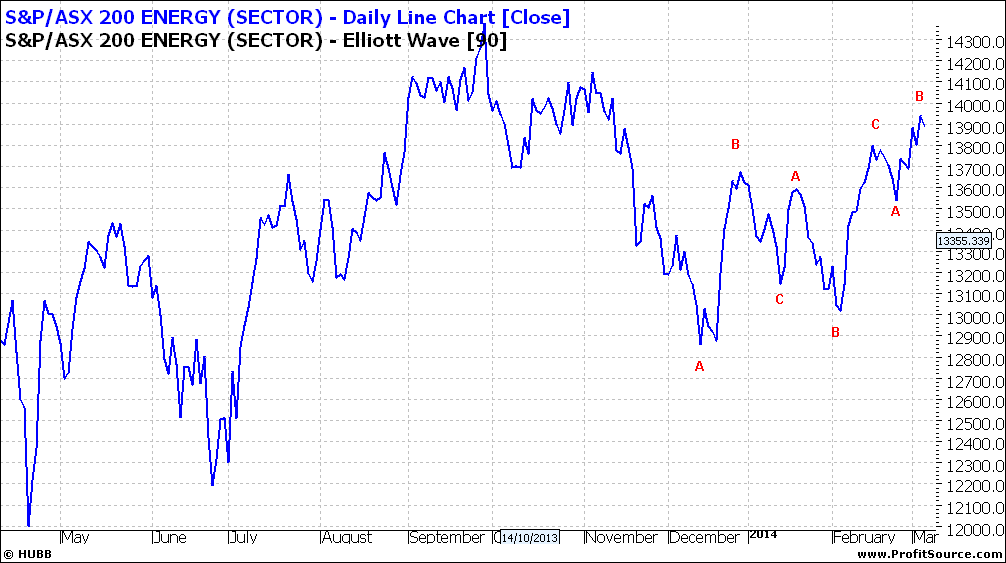

Energy has firmed over the last few days with various global tensions:

Click to Enlarge

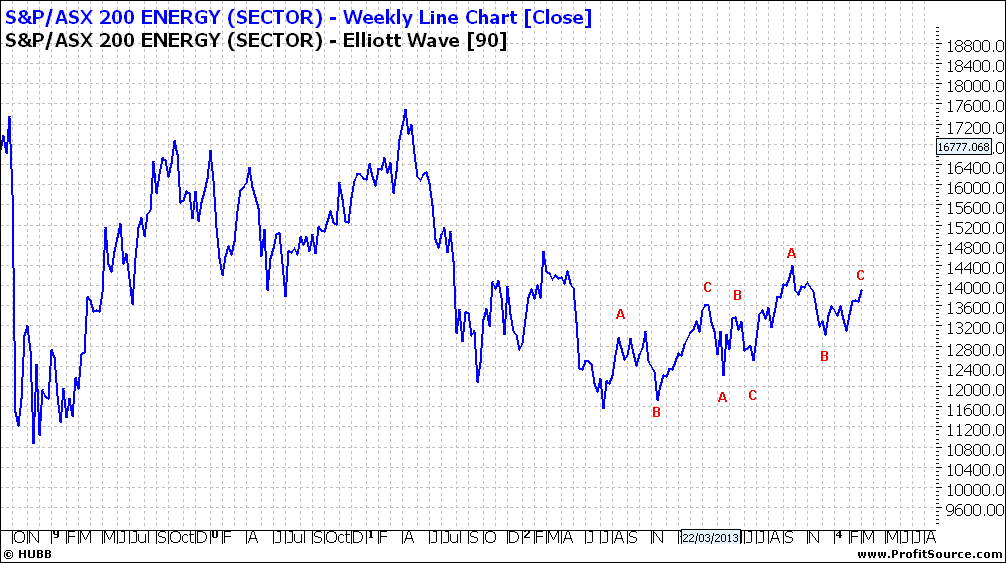

But other factors at play when we look at a weekly:

Click to Enlarge

Perhaps an uncertain world economic outlook?

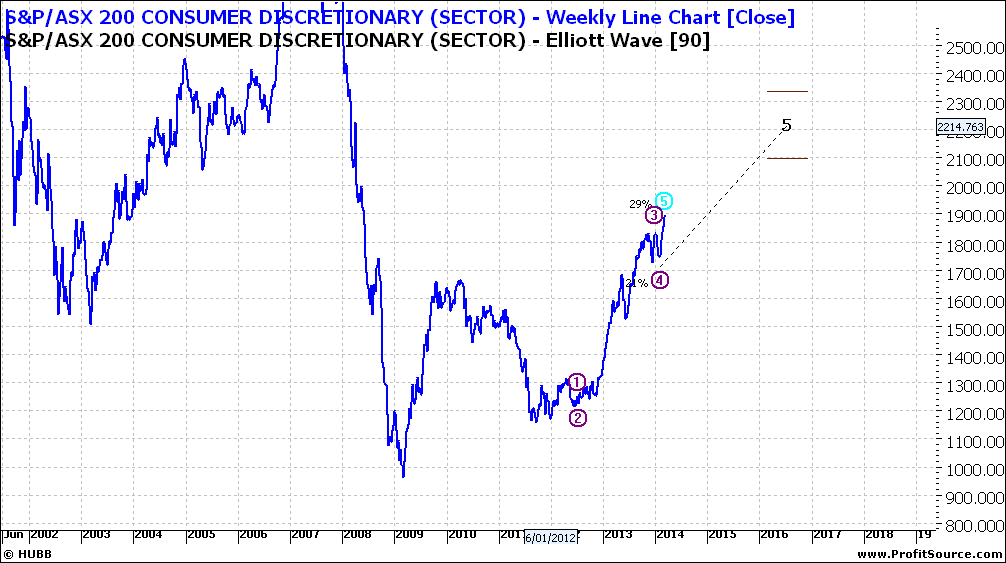

Discretionary Goods:

Click to Enlarge

Click to Enlarge

Short term there is not a lot of upward pressure but on a weekly chart we can see that there is some steady upside – you are feeling at ease and now spending more – maybe more than you can afford. But we worry about that later.

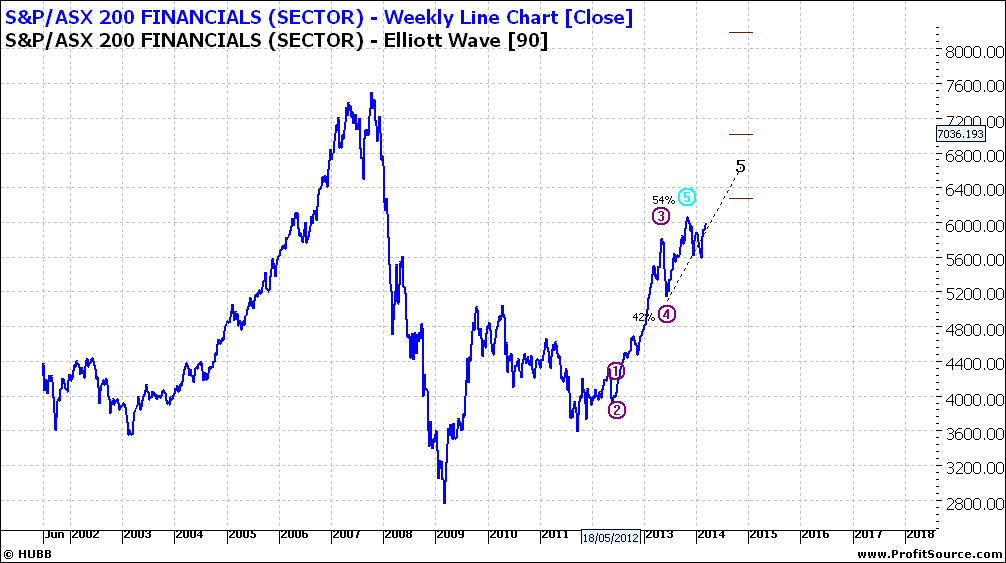

Banks:

Click to Enlarge

So banks also have some longer term upside.

Health:

Click to Enlarge

And also for health stocks on a weekly basis, there is some good upside is seen – and you may be able to get on board in a forthcoming pullback!

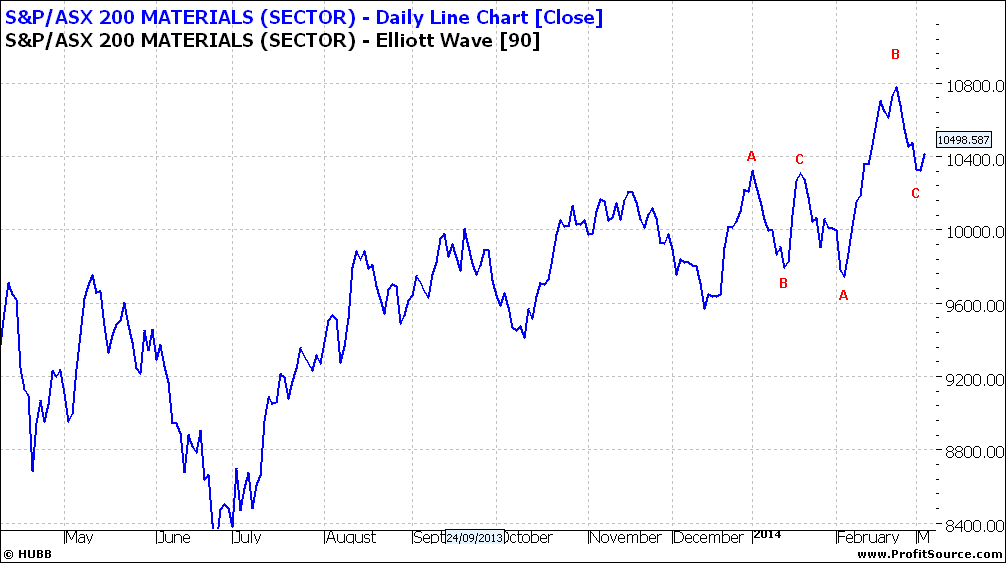

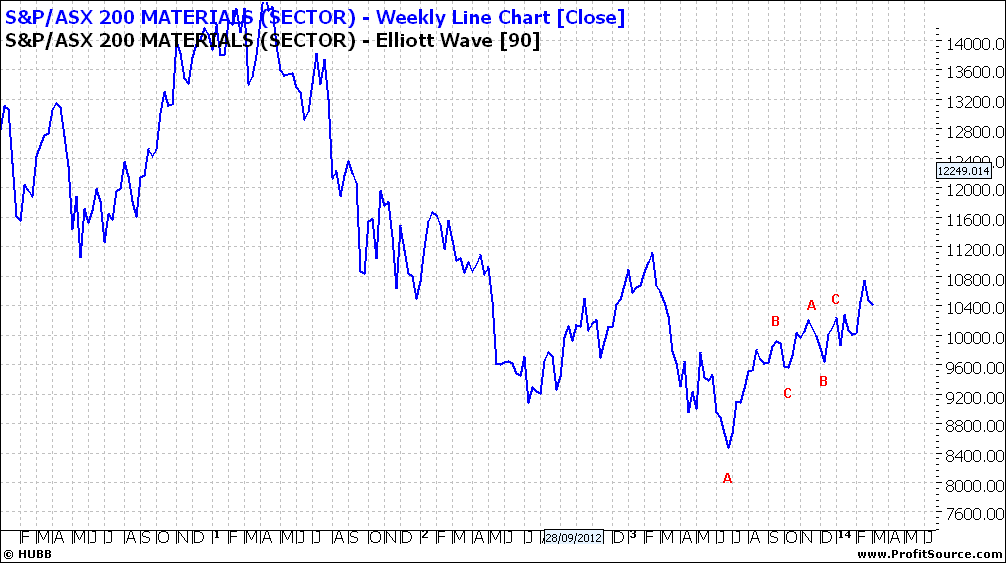

Resources:

Click to Enlarge

Click to Enlarge

On both a short term and medium term outlook there is not a lot of upward momentum.

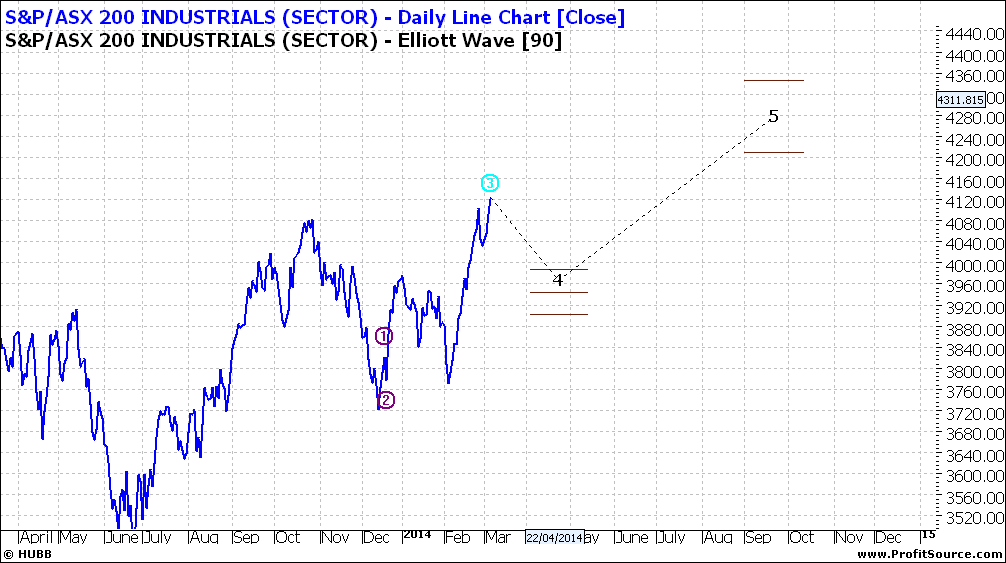

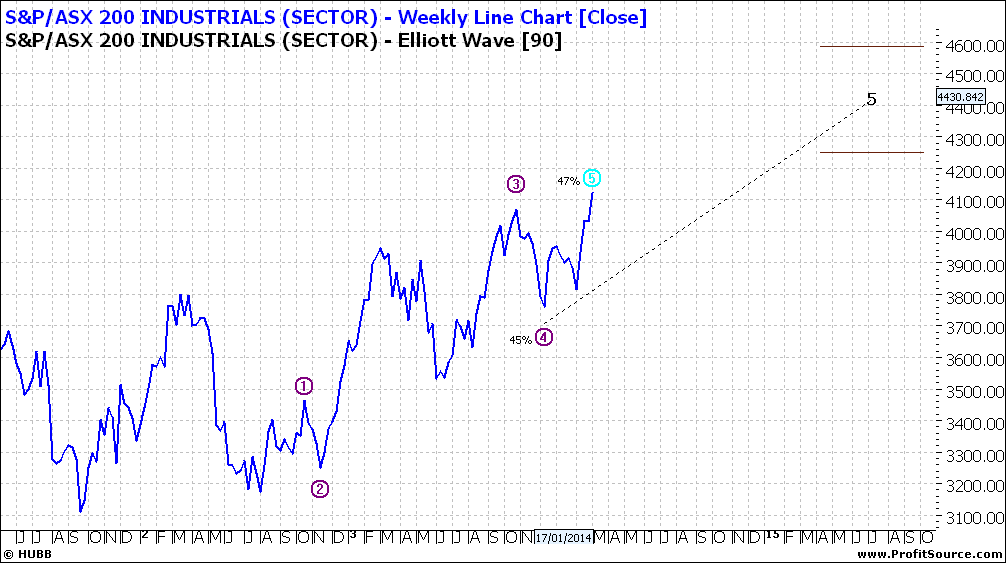

Industrials:

Click to Enlarge

Click to Enlarge

So it appears this is the sector where the action is. But this is quite a motley collection of stocks thus it is hard to say clearly that any particular market segment has the upside. One needs to trawl the majors in the sector.

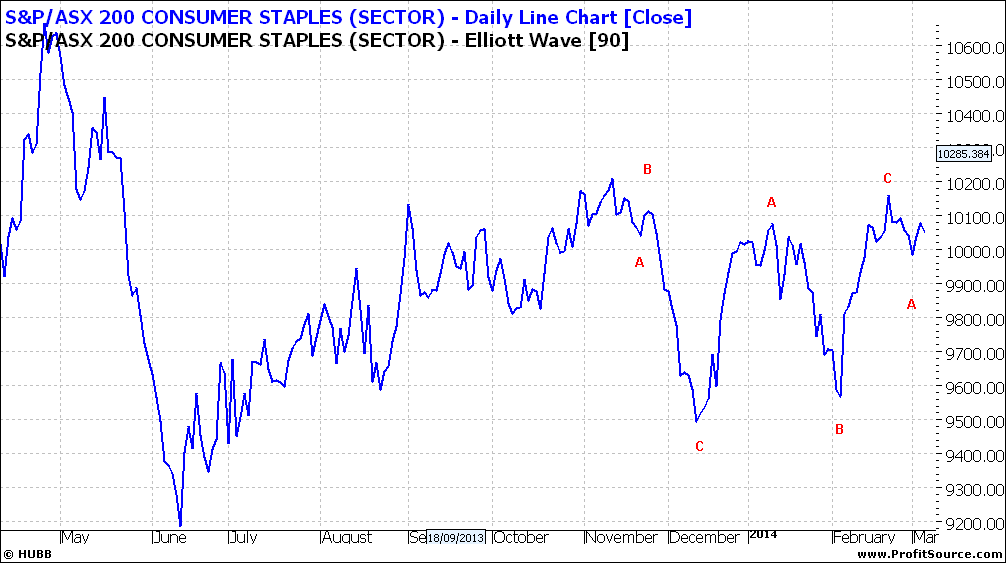

Staples:

Click to Enlarge

Click to Enlarge

Short term benign – but further out still looking good!

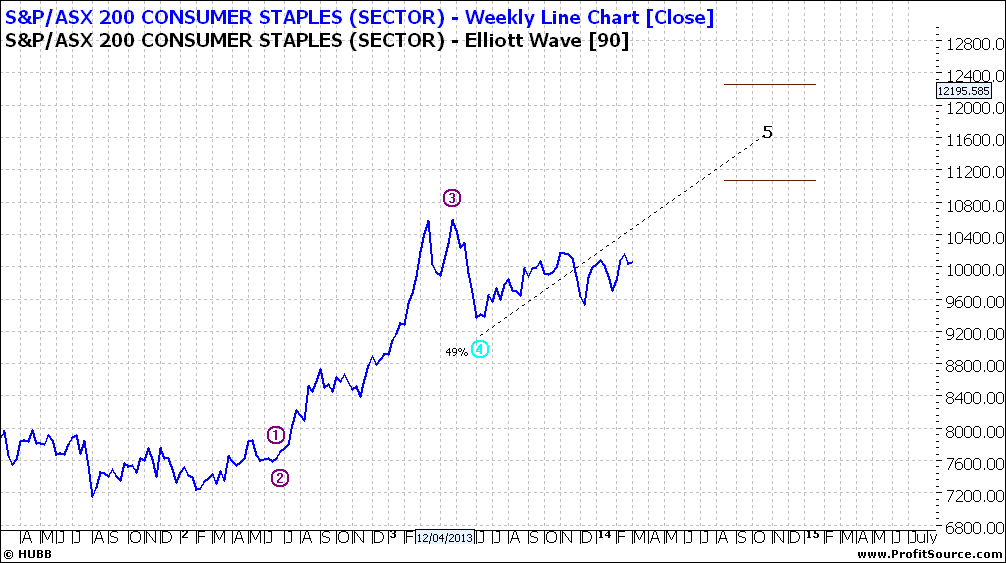

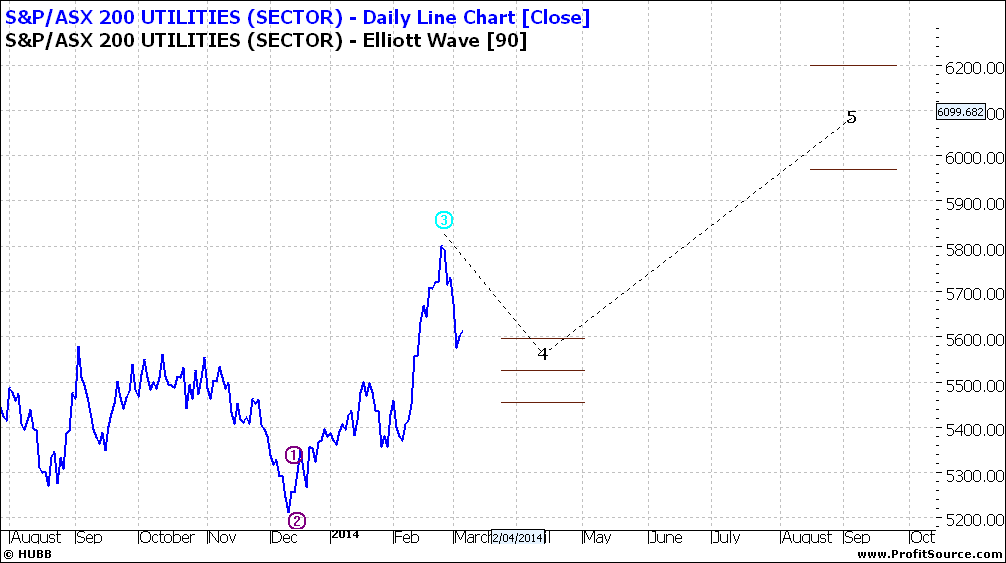

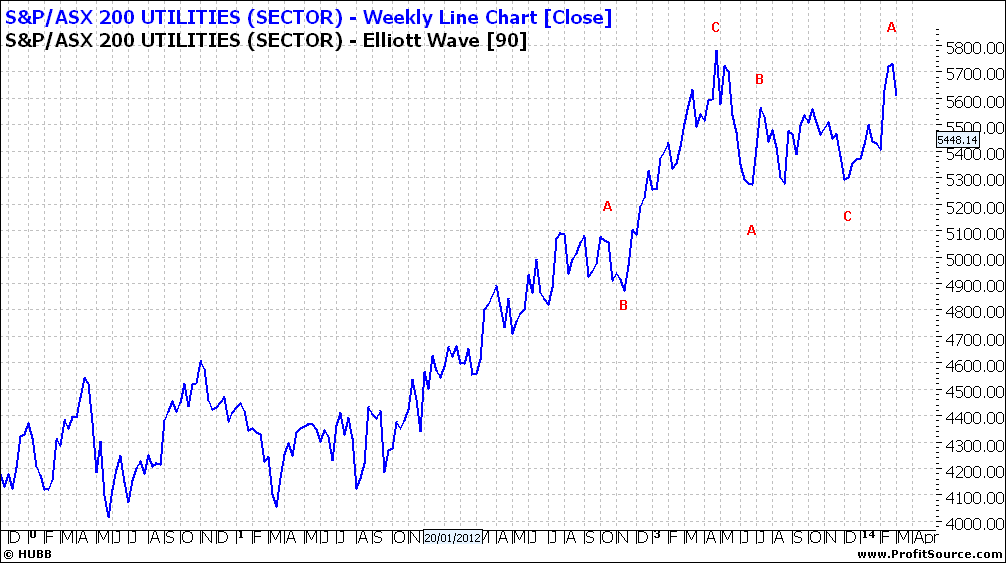

Utilities:

Click to Enlarge

Click to Enlarge

Short term still active but medium to long term there does not appear to be a lot of upside.

So though there are no screaming bargains there is still some value if you have the discipline to patiently scan the interesting sectors.

Enjoy the ride

Tom Scollon

|