|

Is it time to dump them?

Let’s look at a few charts:

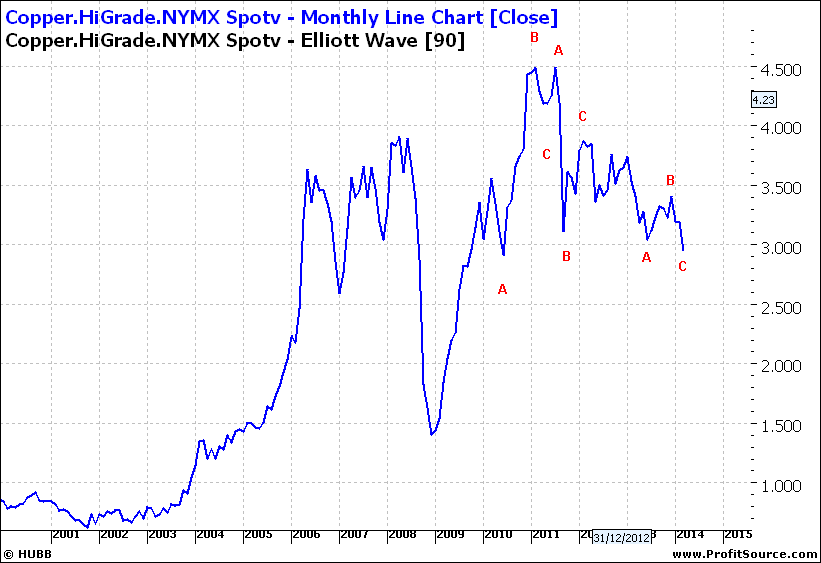

Copper:

The big picture – monthly - the most widely used of all base metals – is still highly priced in relative terms – and you could question is this sustainable:

Click to Enlarge

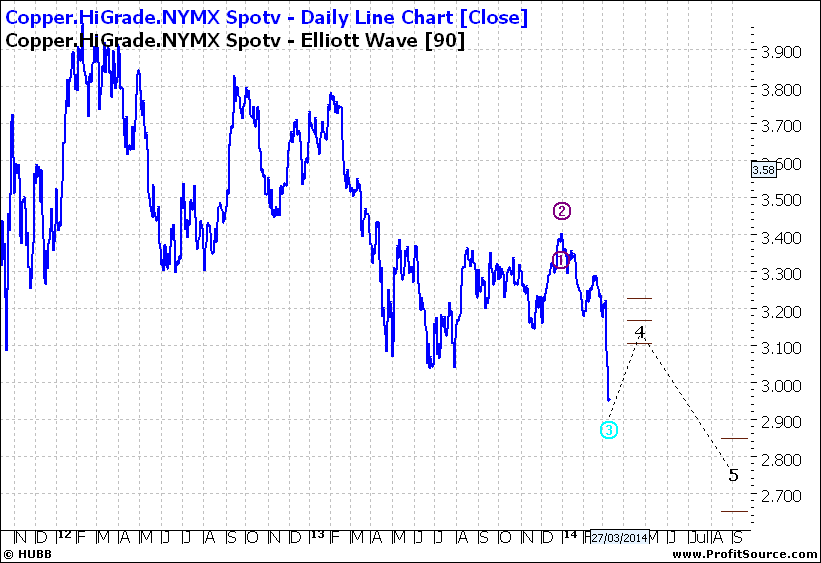

On a short term basis there is still further softness ahead:

Click to Enlarge

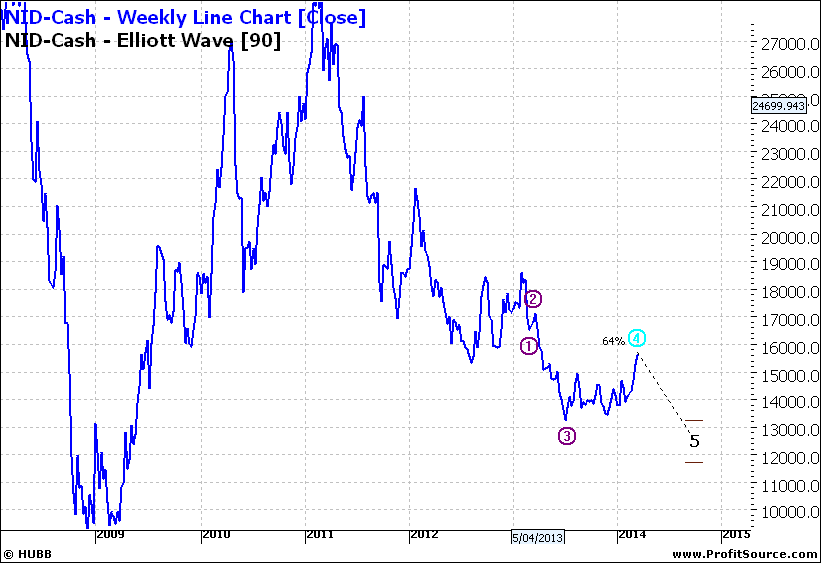

Nickel is another litmus test for global growth:

Click to Enlarge

And again softness – but it is not going to collapse in a heap – well not on current indications. Make no assumptions though.

Other metals are following a similar pattern. So let’s branch out and look at other ‘health’ indicators – oil and gold and finally the Aussie dollar.

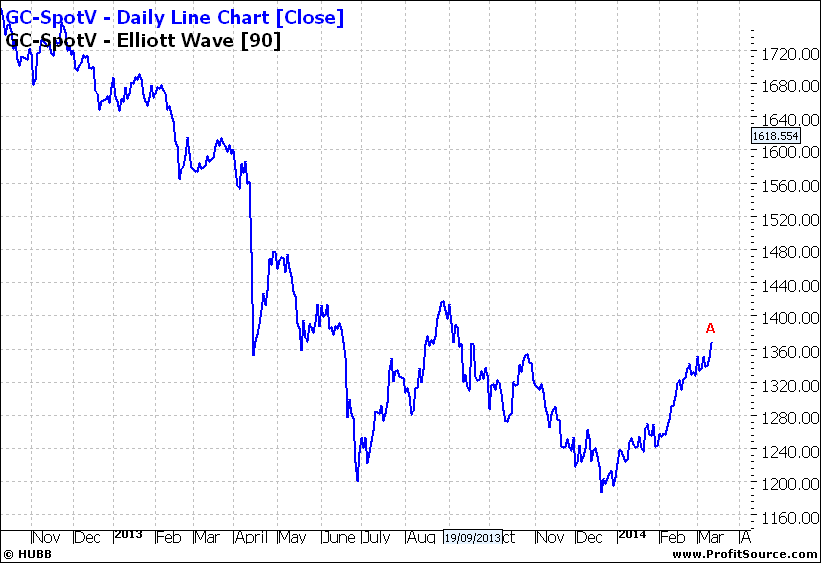

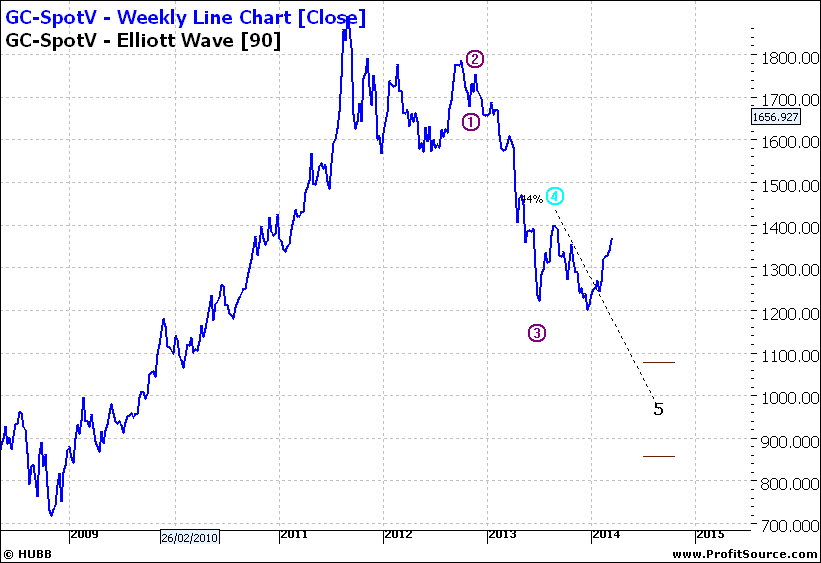

Gold has been rallying with recent Ukraine tensions:

Click to Enlarge

But is looking weak medium term:

Click to Enlarge

Back to five year lows! So maybe a good time to spring clean gold stocks if you haven’t already. But the decline is 70% complete. Too late?

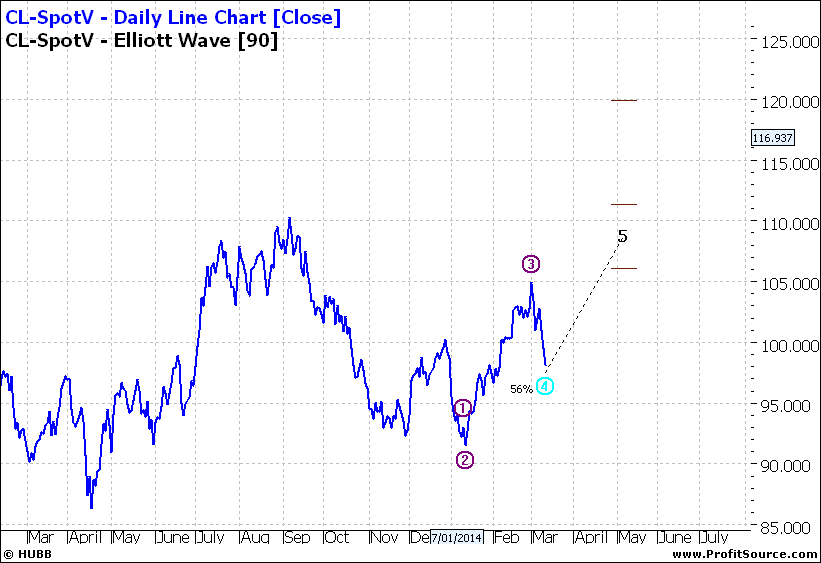

Oil also has risen with recent tensions:

Click to Enlarge

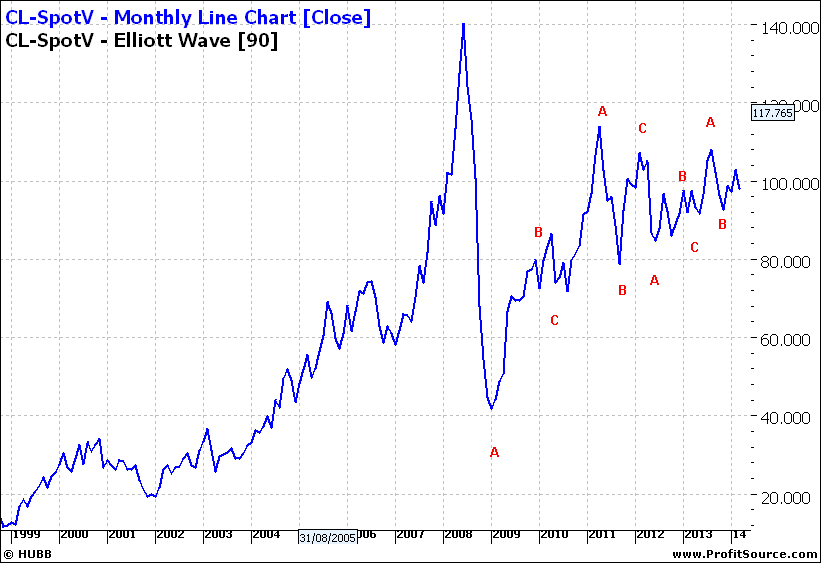

But is otherwise benign with some longer term range trading with an upward bias:

Click to Enlarge

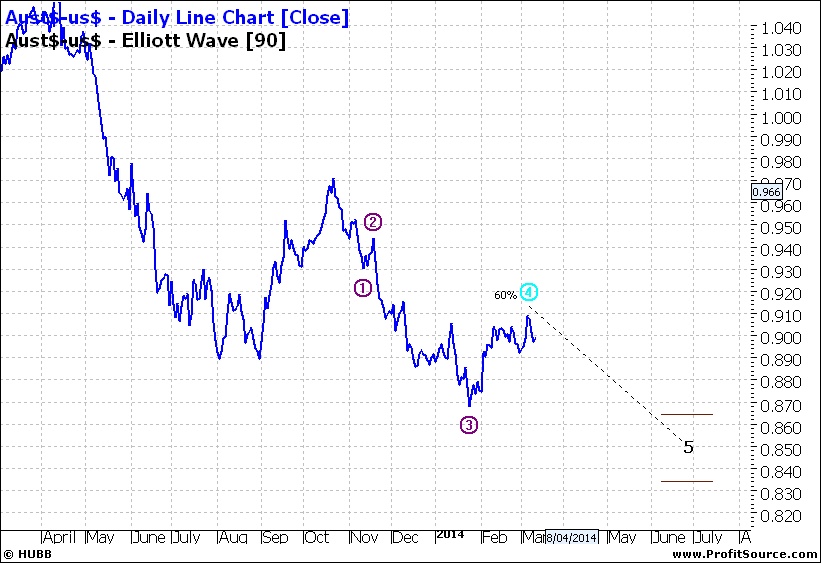

And the Aussie is easing in sympathy with metals:

Click to Enlarge

What is more surprising is that resources have held up so well. But we are at something of a cross road and I sense some change afoot that we cannot see yet on the charts.

Enjoy the ride

Tom Scollon

|