|

I had the last month in Europe and whilst economies are showing a little firmness, to me, there is an uneasy calm. Still massive unemployment in many southern European economies – but those that have money still don’t really care about tomorrow so the long lunch is still the norm. And even the unemployed have money as social security is generous – more generous than those nations can afford.

These economies underwent major agricultural reform decades ago and have been undergoing secondary industry reform for the last decade or so, but still industries are going into liquidation. Countries and business owners have hung until the last breath. It is usual. For secondary industry much more reform is needed – and even greater reform in tertiary and government sectors. The longer it is deferred the greater the ultimate pain. But this has been said a million times but still manyana.

Beautiful to visit Europe – but when I return to Asia I hear the tigers munching away at the old aunt’s breakfast.

So markets specifically?

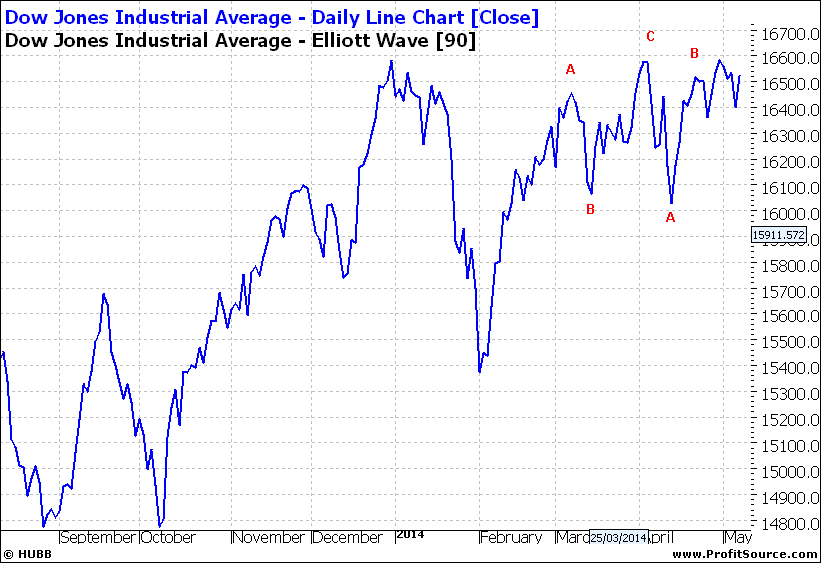

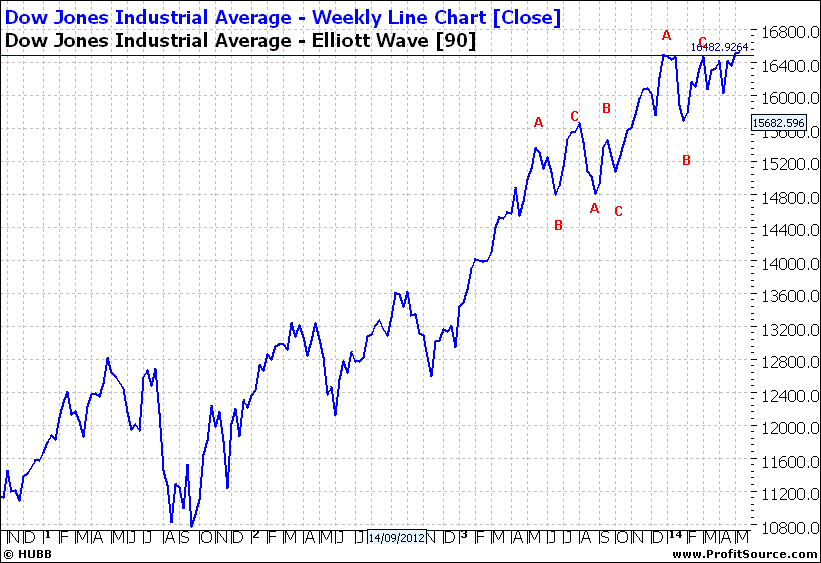

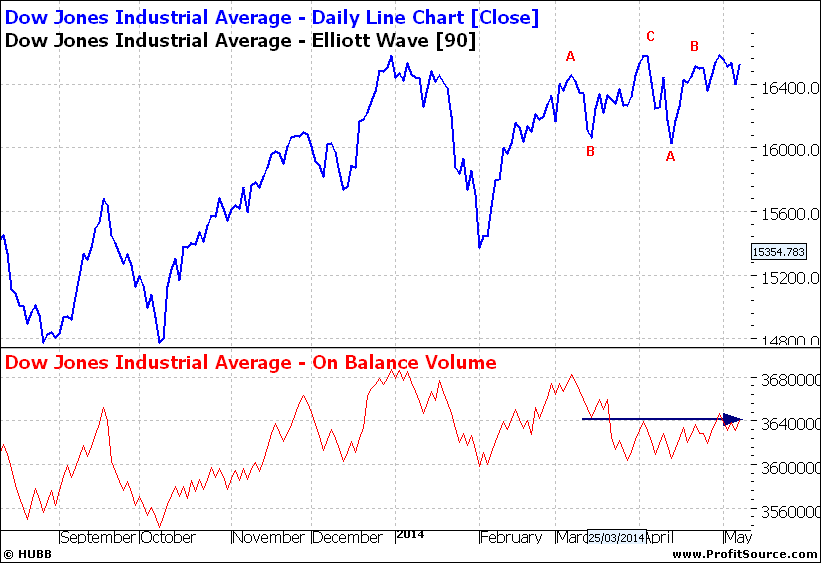

Most markets are in the pause phase. Today let’s look at the DOW – firstly daily, then weekly, then monthly:

Click to Enlarge

Click to Enlarge

Click to Enlarge

In the daily chart we can see the DOW is range trading. When we look at a weekly we can see it has hit a ceiling – albeit temporary. There is a lot of resistance around 16,400 and this has been happening for almost six months.

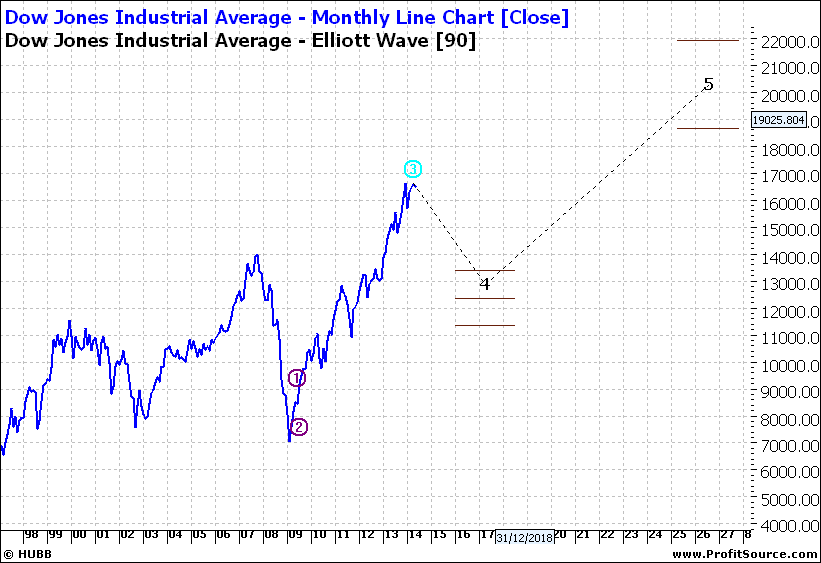

The monthly chart signals a pullback in the next couple of years and then a new high. But weekly is very much the big picture and a lot can happen in the next three years or so. It just says caution at this stage.

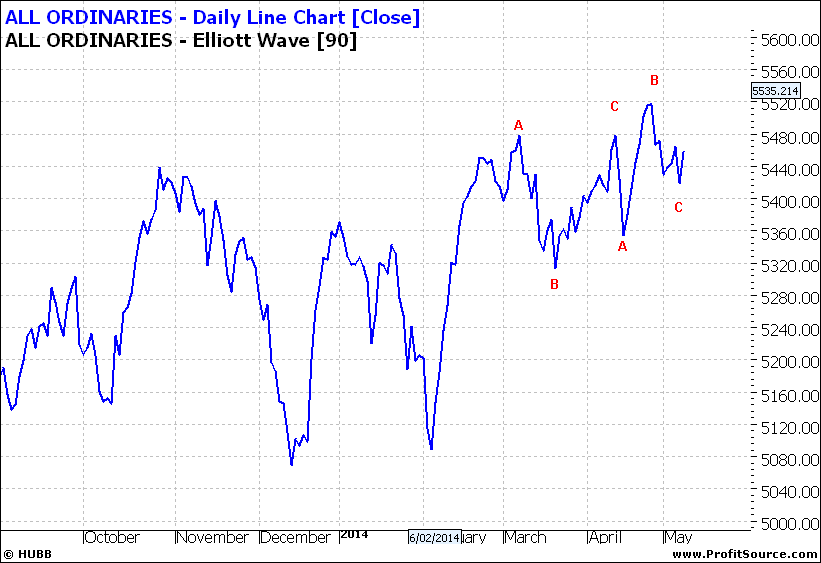

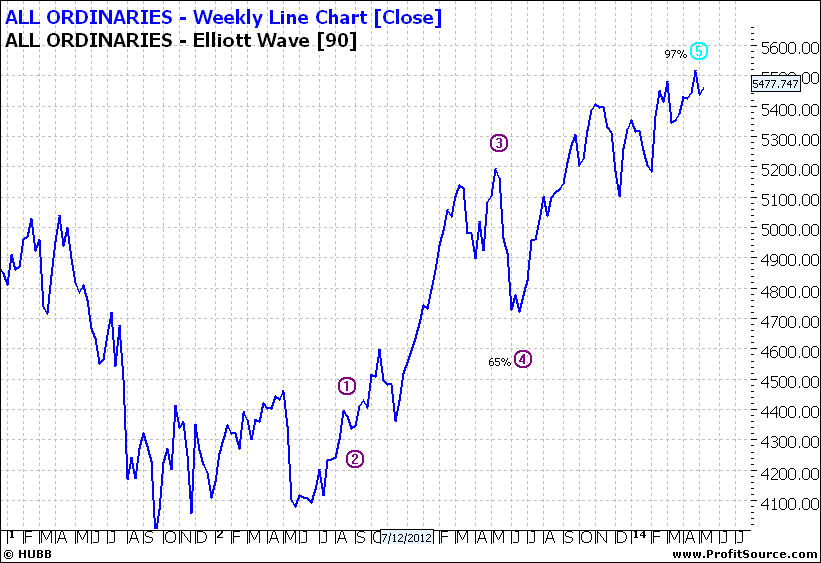

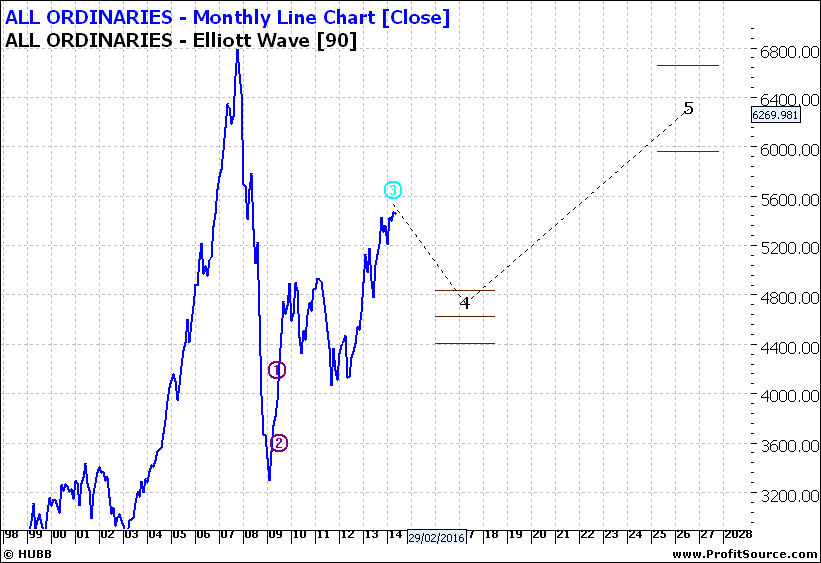

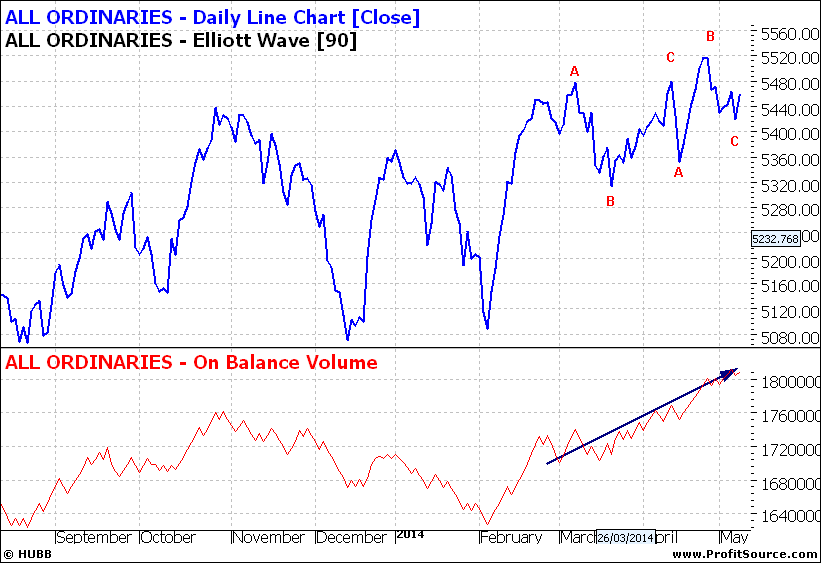

The Australian market shows a similar picture.

Click to Enlarge

Click to Enlarge

Click to Enlarge

The only difference is that the All Ords has retreated from its high – given up for the moment.

The All Ords seems to still have strong support as per OBV:

Click to Enlarge

But interest is waning in the DOW:

Click to Enlarge

It is tough to be a bull at the moment as stocks are fully valued, so there is little temptation to pile into the market. And for the moment current stock holders don’t feel yet an inclination to off load.

So everyone ‘waits and sees’ and this causes markets to side track.

Enjoy the ride

Tom Scollon

|