|

So what happens when markets trade sideways for an extended period?

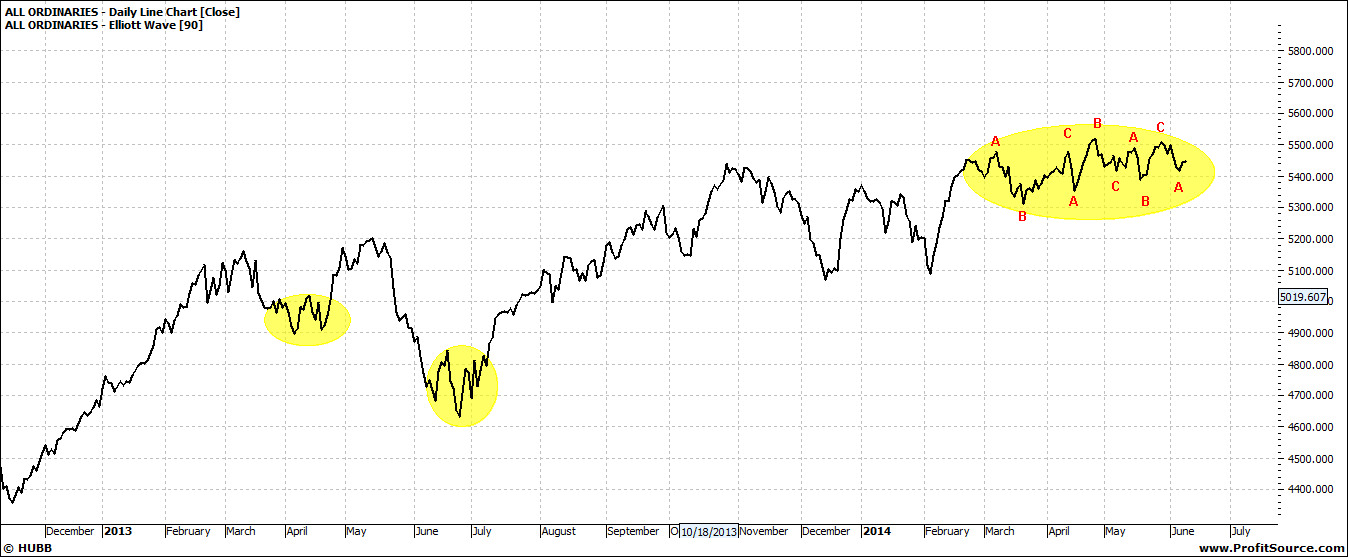

Firstly let’s look at the action in markets over the last year or so:

The All Ords:

Click to Enlarge

You can see that the All Ords has been range trading for the last four months and prior to this period of range trading, there were two short periods when markets lacked direction.

If we look at a weekly chart we see a different perspective:

Click to Enlarge

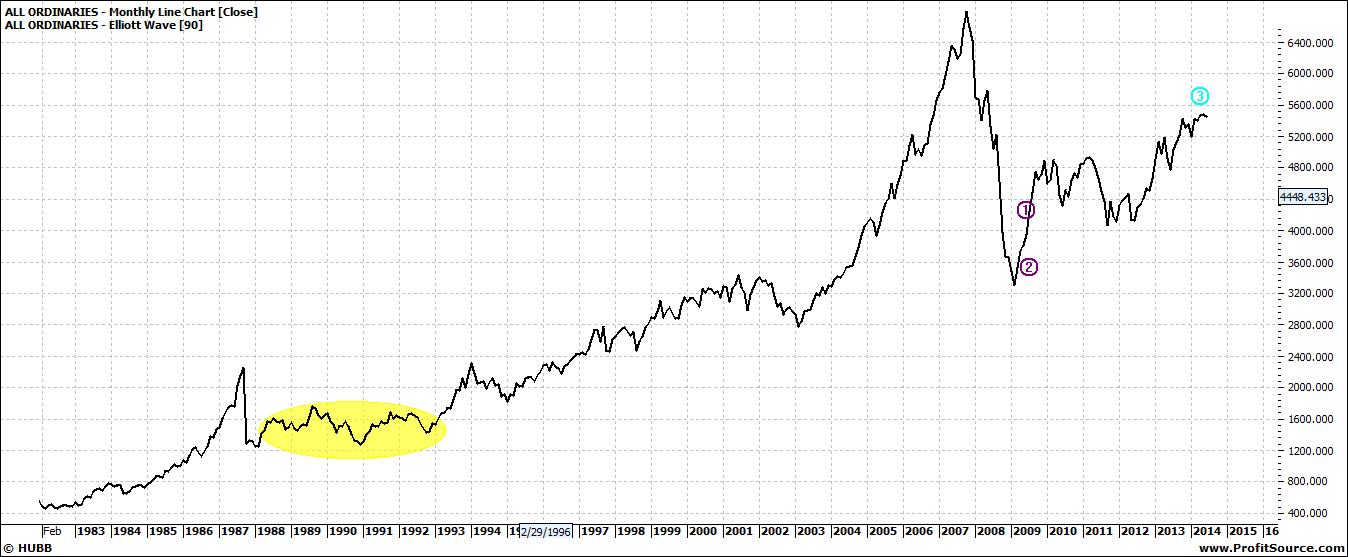

So in a relative sense this last few months is quite a short period for range trading – even though you may not feel so!

Markets that range trade can be likened to a steel or rubber spring – the more you wind them – the more tension that builds and ‘something has to give’. So markets then generally ‘breakout’ – one way or the other. And this can be with a lot of momentum.

So in 2010/11 the markets broke downwards whilst in 2012 the direction was up. Now I always point out that weekly markets are slow to unfold. We can see clearly patterns in hindsight but it does take time for them to unfold.

And this is even more amplified on a monthly chart:

Click to Enlarge

It took five years for the range trading pattern 1988/1993 to unfold. But of course if you were to zoom in to those five years you would still see much market movement on an intraday and intraweek timeframe - fine for the trader but if buying for the long term it can take time to be ‘in the money’

On a daily chart Elliott shows that we are simply range trading. On a weekly chart we get maybe some clues as to the direction:

Click to Enlarge

This becomes almost self-fulfilling in that most investors expect that market to have some level of pullback and it will take little to make the markets ease off from here. How far they may pullback will depend on the extent of the bad news trigger. If news is tepid then we will see an orderly wave four retreat – but over many months. If there is some fundamental macro shift – political or economic – then we could see a dramatic sell off.

And if all goes according to plan then we should see a recovery in classic Elliott style!

Enjoy the ride

Tom Scollon

|