|

When the markets started to ease a few days ago many analysts touted that this could be the beginning of a much bigger slide. But at least for now , the All Ords is merely in a pullback before the next move higher that we are now seeing.

To the chart:

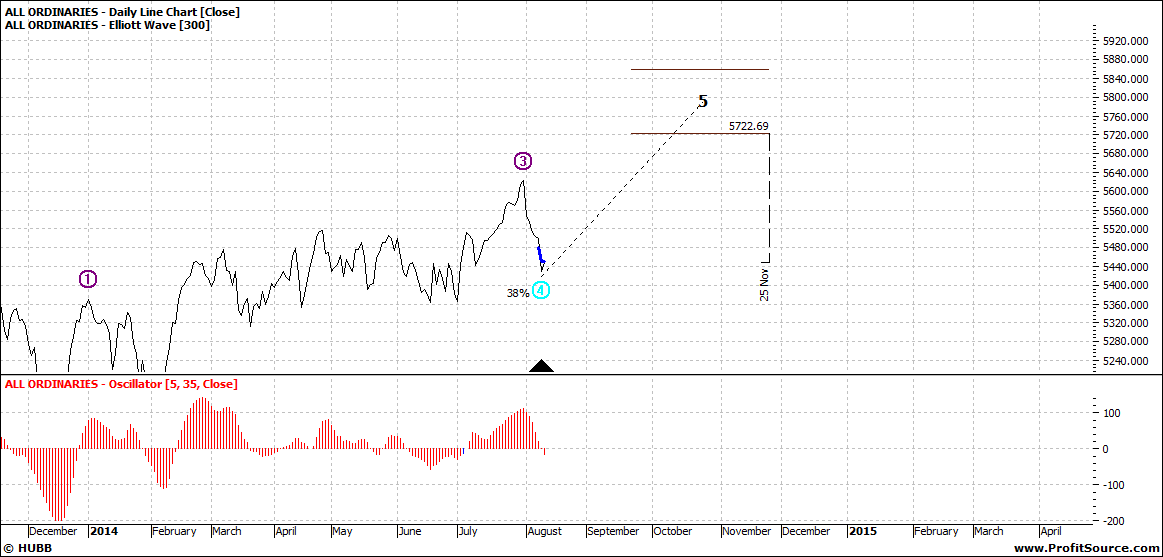

Click to Enlarge

This above chart is at August 8 – using the ProfitSource tool to jump back in time – a marvelous feature.

At that time the oscillator was just below zero. But then a few days later the oscillator went a little further south but recovered:

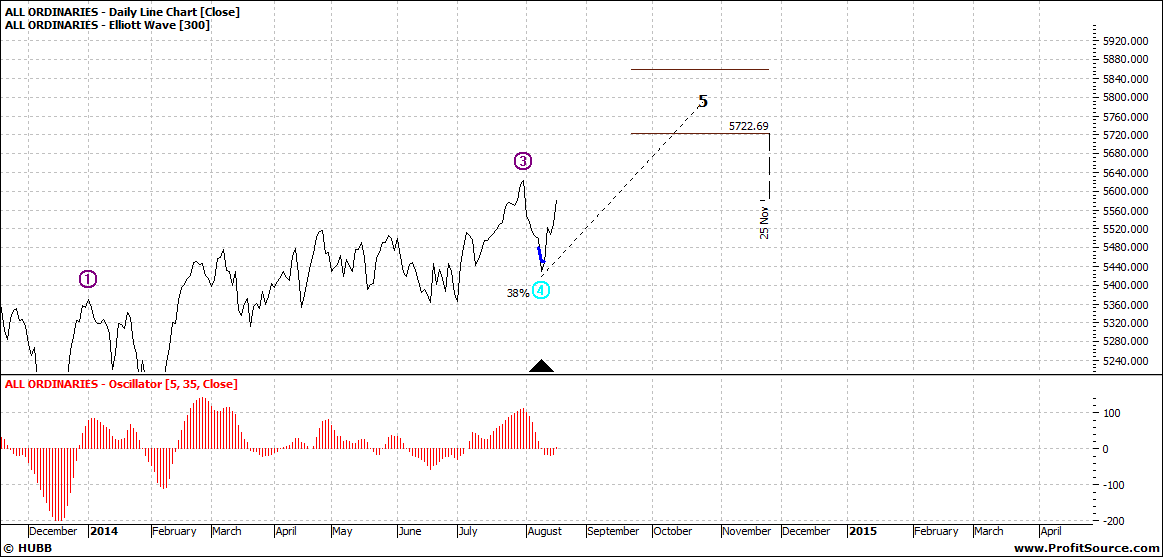

Click to Enlarge

And the market resumed its upward move.

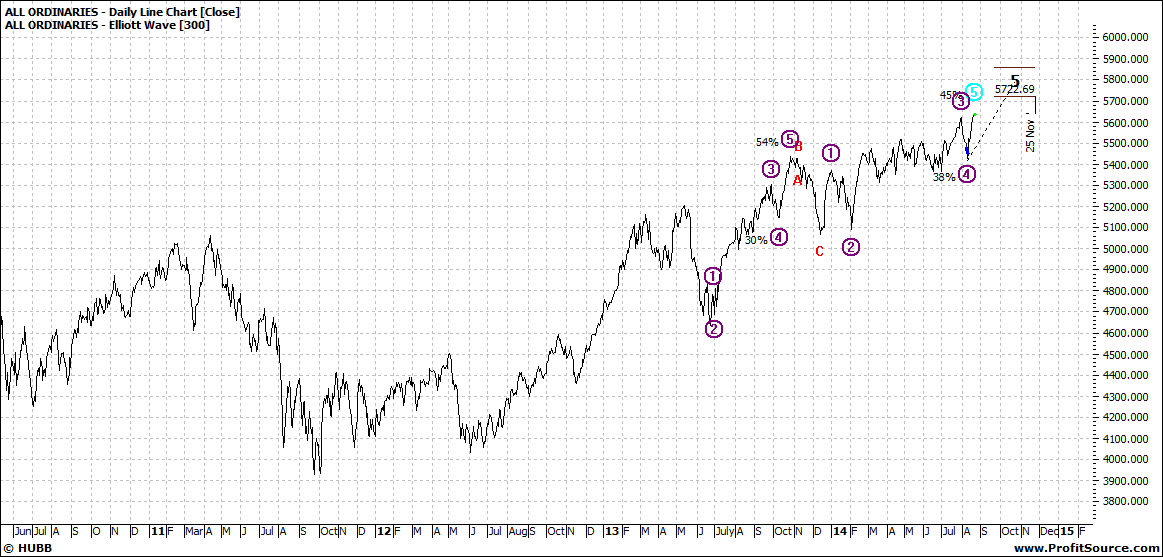

In the bigger picture this was a mere blip:

Click to Enlarge

And merely nerves at the top – some of course say it was because of political and economic uncertainties. Well they were not enough to topple the market at this time.

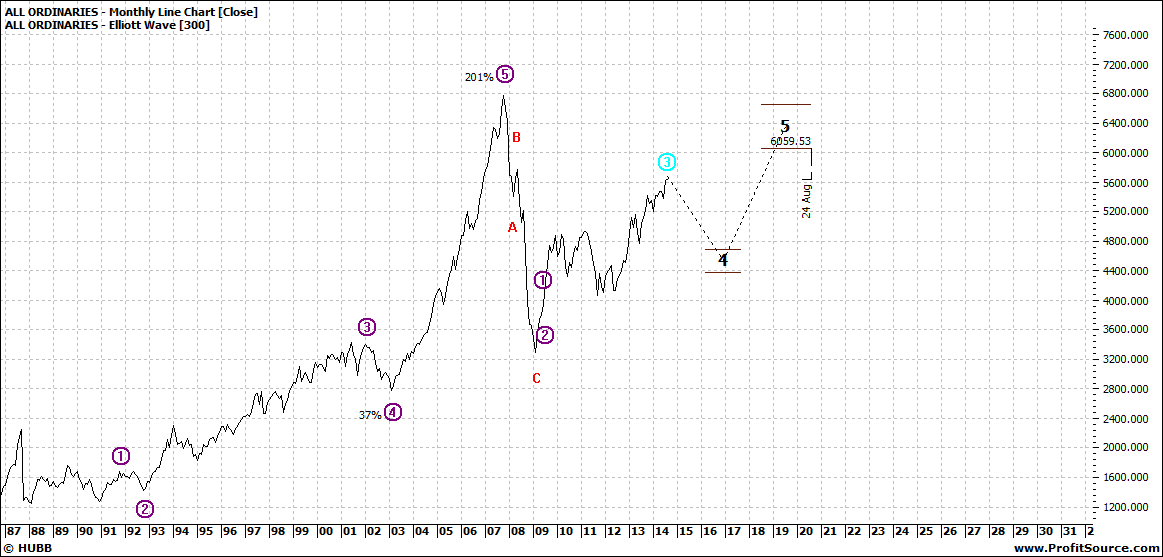

I can see no technical reason to convince me that there is a major pullback on the horizon – rather, one in some years out that could bring the market back five years:

Click to Enlarge

The daily chart is still the one to watch in my view as that is the more immediate term. And that says no blip – but we are at a major high. The risks are to the downside – even if not a major fall out. With the markets at a high even the naïve are cautious about buying in right now.

Though Instos and Super Funds will still be buying as part of their charter but there will be other Instos who will have much more flexibility and some of these may take this time to start lightening up on holdings.

At the moment the balance is between buyers and sellers. We just watch closely for any change to this balance.

If I was in the market now – which I am not – my decisions would be on a case by case basis and would depend on my ‘buy in’ timing.

So a day by day proposition.

Enjoy the ride

Tom Scollon

|