|

As I cycle through the charts I am reminded of the many companies that have ‘fallen from grace’ over the years. That is, once treasured icons fell over the cliffs.

Today I would like to look at some current examples of popular stocks that were well supported by Institutions but now well and truly over the cliff. And I will look at simple techniques to see the cliff ahead of time:

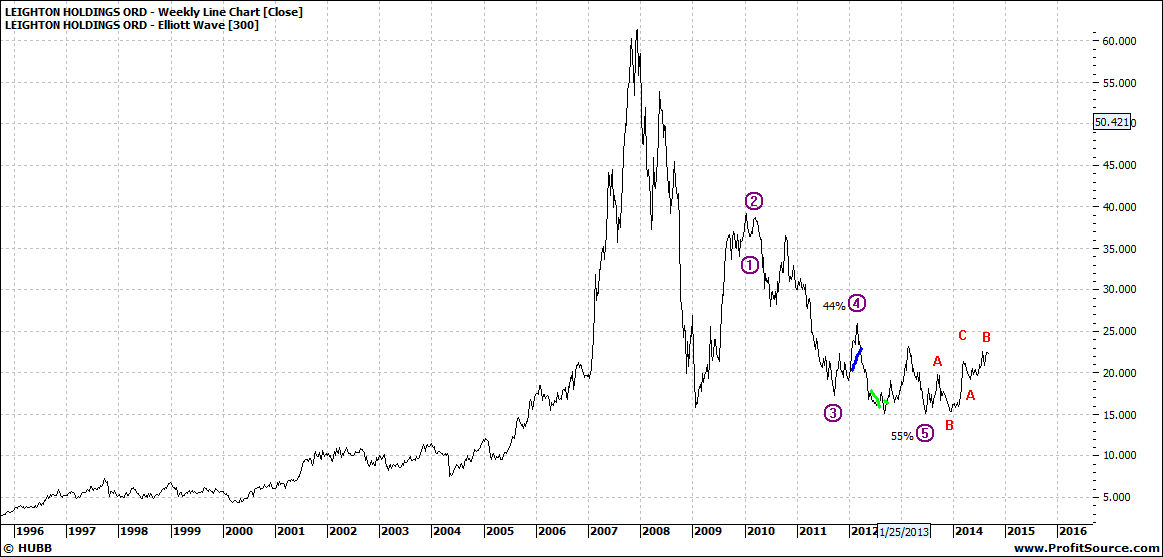

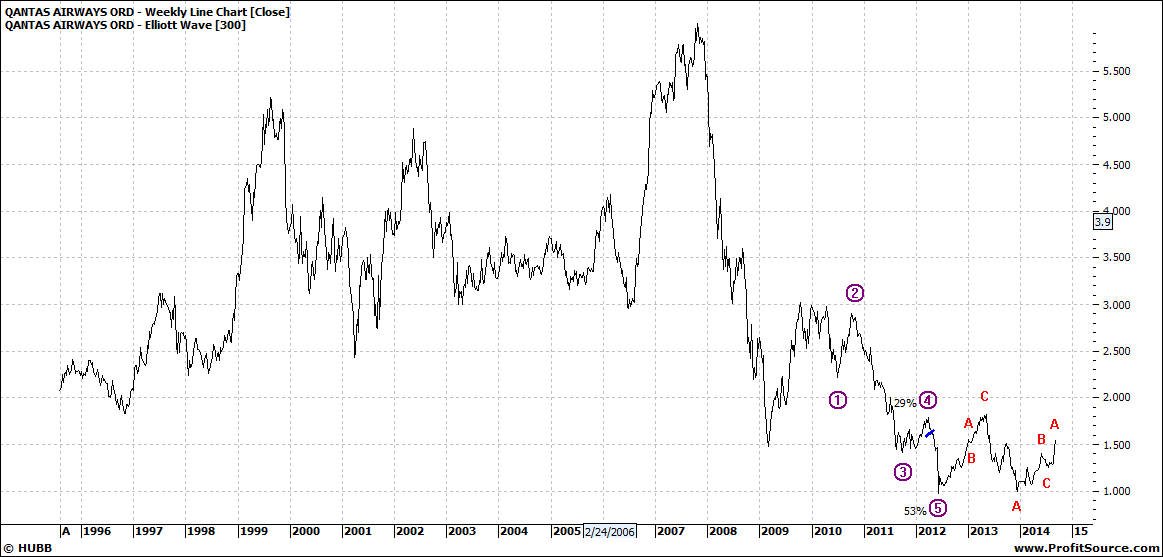

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Now the last one Telstra – has recovered somewhat and has received a lot of attention of late because of its turnaround. But as you can see it is well below the highs of 15 years ago. And it has taken 5 years for the stock to get off its haunches. 5 years is a long time to hang abut waiting for your money to get back to the black – at best. Overall, despite the headlines, Telstra has been a major disappointment for retail investors.

Qantas the second last chart, is a fifth of its high in 2008. Most shareholders – including institutions – have lost a lot of money in this stock.

I won’t go through each individual stock as I am sure you get my drift!

Let’s take Billabong as an example of how to set general rule of thumbs on how and when to exit:

Click to Enlarge

I use Elliott for my entry signals – using a daily chart. For exit I use the most simple of all tools – a trend line break on a weekly chart.

I use a weekly chart as whilst a daily chart will get you out earlier there will also be many occasions when it gets you out too early. Better early than late but it could get you out well before the top.

The criteria I use – the question I ask myself is: when is the absolute last point when I should no longer hold this stock. It is tempting to hold on in hope and I have leant from experience – many years ago – that hanging on to hope is not a useful strategy when it comes to share market trading. At some point you need to be decisive and cut and run.

So I have drawn a line break in the chart above and this indicates the last point you should leave the stock.

A general human trait is to be upbeat and optimistic when buying – why else would you buy if you were not optimistic? So that’s fine. But the greatest failing of most people is to be a reluctant seller. Those of you who have done buying and selling over the years will know that it is generally easy to buy but tough to sell – land, cars, businesses etc., My observation is that most people hang on too long to an asset in the hope of squeezing the last dollar out of the deal.

I have always loved the freedom that selling brings and I never look back to see did the stock go higher. Be happy and go.

Selling like all things in trading is very personal. If you don’t currently have a clear sell plan then this is a time when you should develop one.

I am not suggesting the market is going over a cliff but we just don’t know.

Enjoy the ride

Tom Scollon

|