|

So often the question but so often asked at the wrong time. It is usual human behavior to ponder this topic when the market has had a few days of falls.

Or is this a buying opportunity?

My view always is continually "spring clean". Always keep your Portfolio looking good. We all buy stocks that don't do as expected. We should quit when they fail our criteria and sell once our trigger criteria is met. We do not wait for the headline news of a market softness. Chances are at this time the soft stocks fall harder.

If you are sufficiently disciplined at these times and your portfolio is clean then you will have funds to buy in, at such dips.

Many experts and headlines will tout that this is a buying opportunity. But I am always cynical about those that espouse and have no "skin in the game".

The key test to apply now is the oscillator. We need to watch that it does not fall too far below zero. And to buy as it starts to rise again. There is a temptation to second guess and buy early. To apply more discipline we also look for rising volume.

I am travelling so I am sorry I cannot give you an oscillator. But we look more particularly at the oscillator of individual stocks in which we have a interest as well as the overall market and the sectors in which we have a interest.

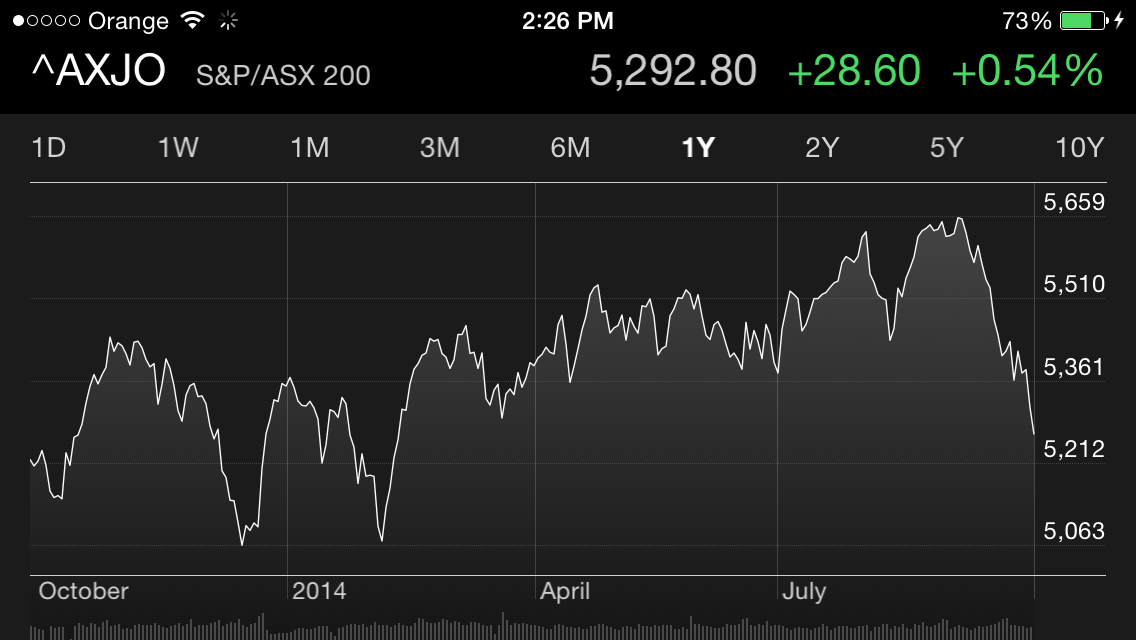

So all I can show you is a yahoo chart which shows we are at around almost one year levels. If you have bought at these points you may want to examine those purchases very closely.

Click to Enlarge

Enjoy the ride Tom Scollon

|