|

Maybe, but we need more time to have a clearer view. Markets are typically weak at this time of the year. There are many obscure reasons why markets soften at this time of the year. I pay little heed to the reasons why markets are soft at this time of the year but the fact history is embedded into this month is all that matters to me.

Lest look at some charts. We will focus on the XAO, XFJ and XMJ.

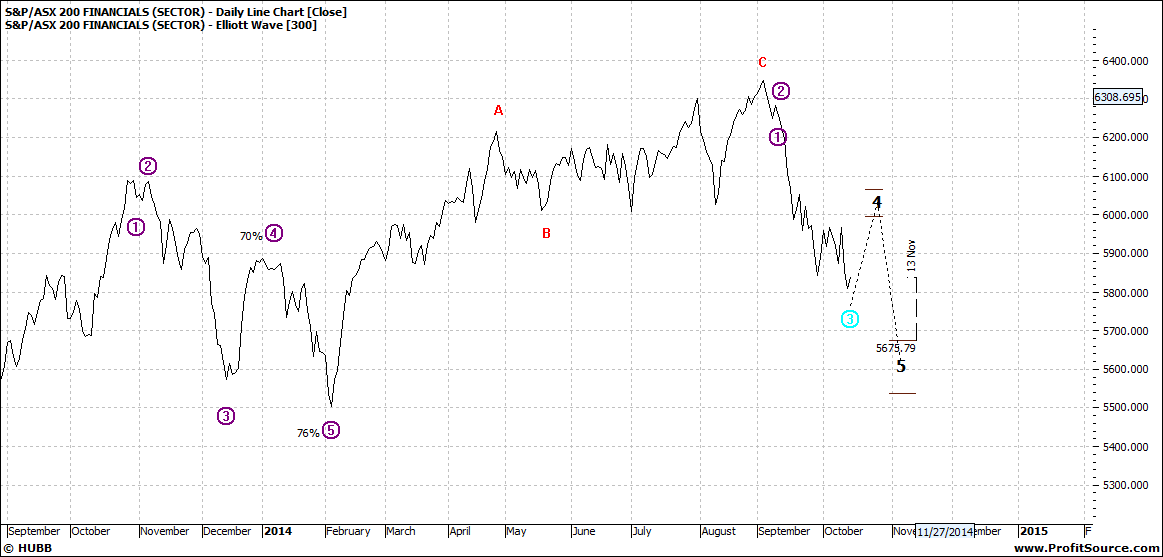

XAO:

Click to Enlarge

The XAO daily is into a small downward move.

To briefly summarize: ‘dips’ are micro moves within a trend. A ‘pullback’ happens when a market is moving within a trend but has a ‘major breather’ – of the order of around 10% - in the opposite direction to the major trend. A ‘reversal’ is a change of trend.

So we have seen the market move in an upward trend for the last few years. This trend has now been broken and we are now witnessing a move in the opposite direction to the major trend. At the moment it appears to be a minor reversal – but we cannot take for granted the possibility that wave 3 or 5 will play out as per the above chart. That is, as further days of data arrive, the predicted levels could change.

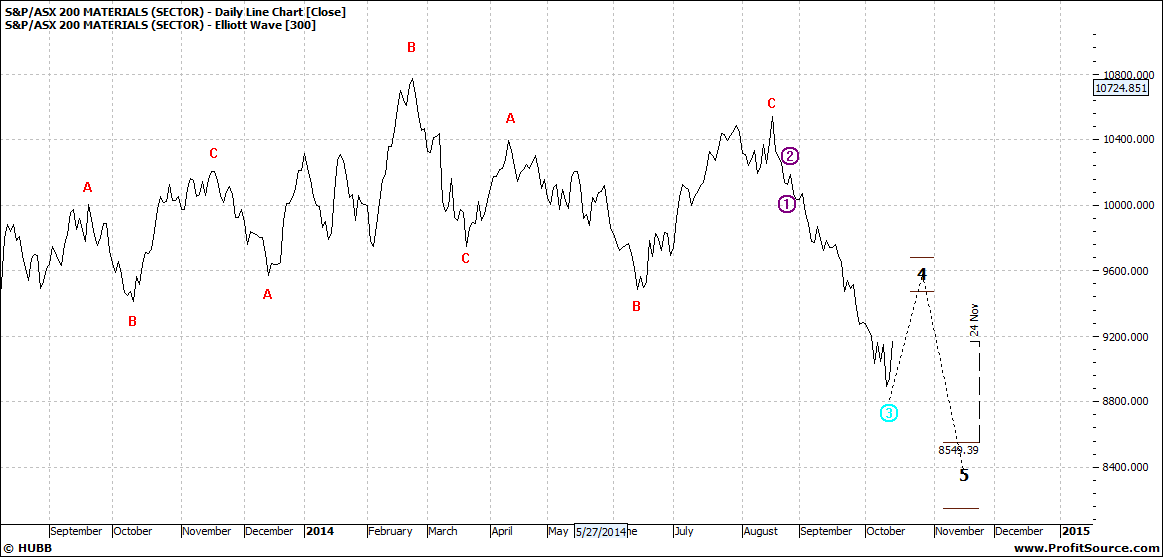

We can see a similar pattern for XFJ and XMJ:

Click to Enlarge

Click to Enlarge

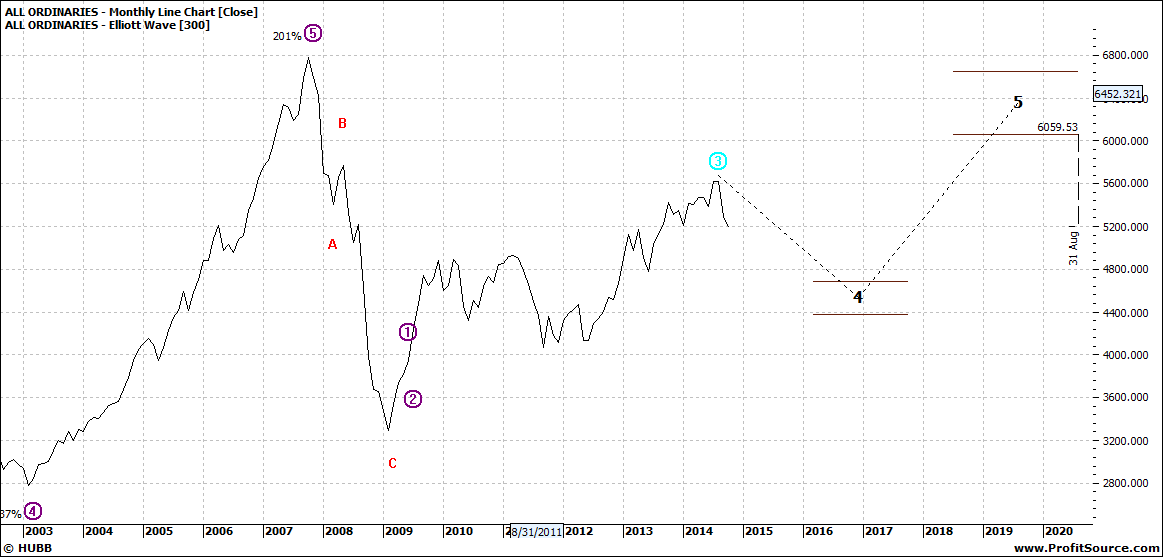

There is not a lot to see on the weekly chart so let’s jump to the monthly – for XAO firstly:

Click to Enlarge

This suggests in monthly terms that the this current move is possibly a sub set of a bigger move down – in the form of a wave four that could see the market fall to maybe ten year lows – over the next 2-3 years. Now this may not help you with immediate investing decisions but it is useful to get a sense of the bigger picture.

With monthly charts the moves are very slow and take time to evolve. And within major moves – and in this monthly the move is down – we can also see corrections upwards. So I am not suggesting that it is all going to be doom and gloom for the next 2-3 years. And of course what I am talking about here is the overall market as different sectors will move in varying ways and also stocks within sectors will move independently.

But I do suggest that at all times – but especially now keep your portfolio in a healthy condition. At such times the big money will sell into rallies – so you will need to be ahead of their money.

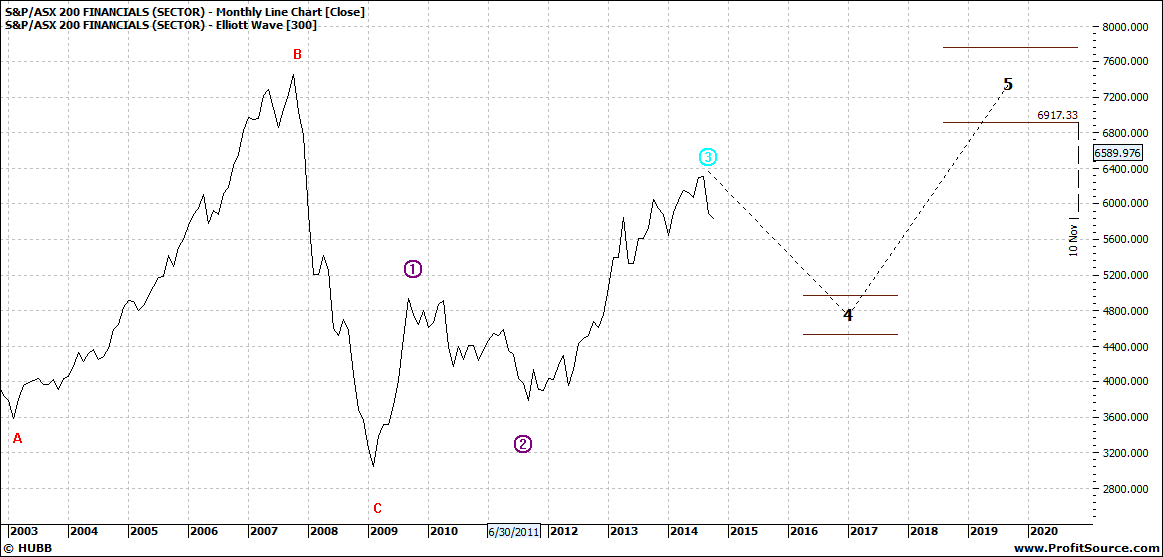

The XFJ shows a similar pattern:

Click to Enlarge

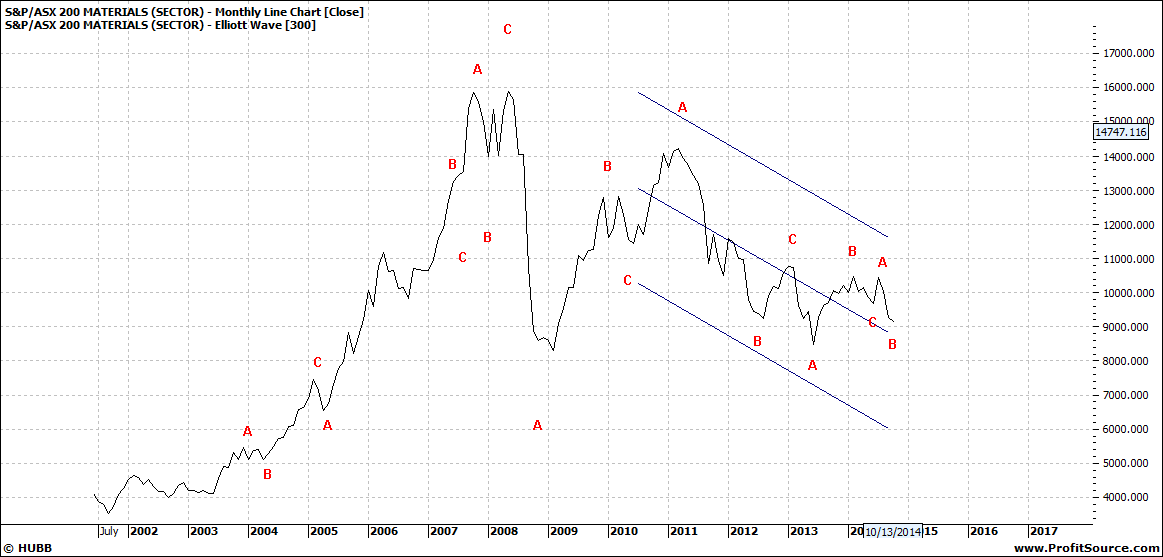

The XMJ is already in a long term downward move:

Click to Enlarge

Note also that the XAO and XFJ suggested pullback is about 50% retracement of the move up over the last few years.

This sort of scenario makes sense to me. But I accept there are other points of view.

Tom Scollon

Enjoy the ride

|