|

Though the big picture may not help with short term trading

it is useful to look at it from time to time.

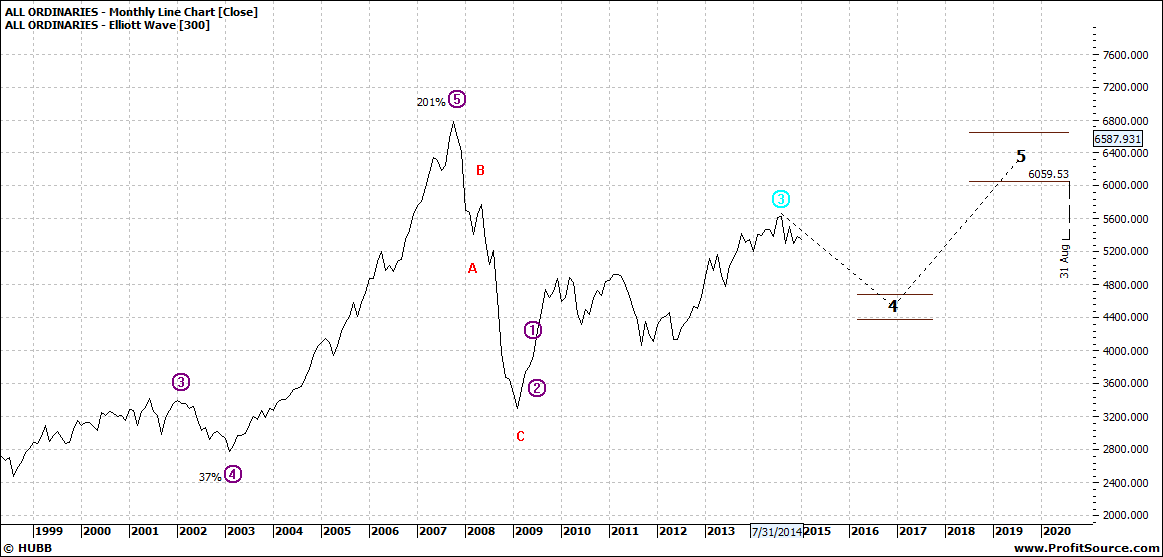

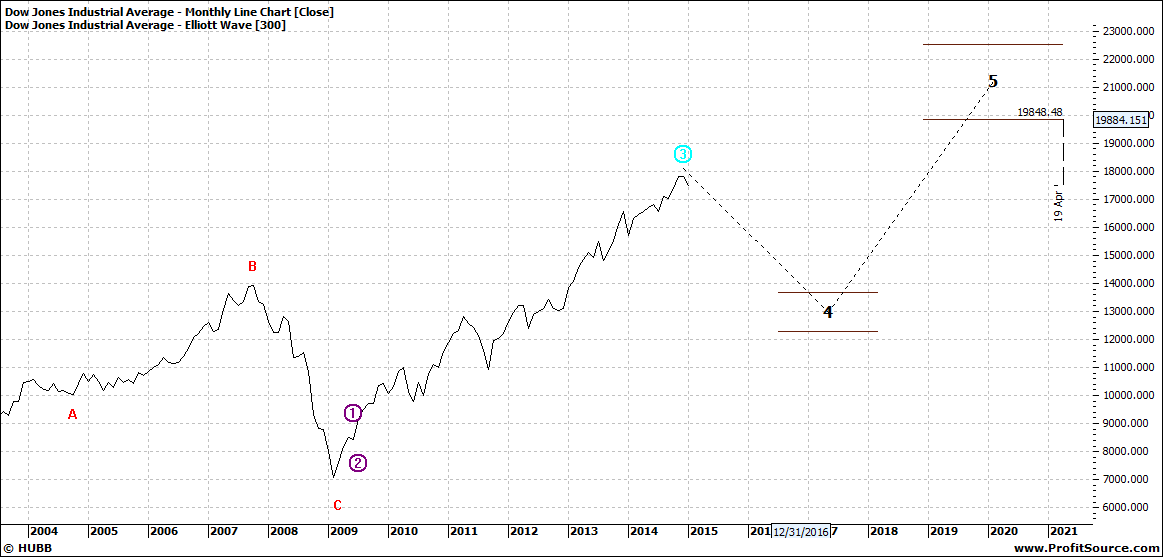

I am looking at the USA main index (the DOW) and the Australian

counterpart (the XAO), both monthly

charts:

Click to Enlarge

Click to Enlarge

You of course can make your own observations but I would

like to make a couple.

Firstly the Australian market is well off its 2007

highs. In contrast the DOW is well past

those levels and even if there was to be a major pullback it appears those 2007

levels may well hold.

Then looking further out – another 5 years beyond a looming pullback

- a new high some 50% higher than the 2007 levels appears a possibility.

Of course a lot can happen in the time perspective we are

looking at. So even though we see the

odd dramatic day on the DOW there is a lot of money chasing the USA market

higher. But this could also be setting

the market up for another bubble. One

key area of concern is the level of leverage.

Investors have never been as highly leveraged as they are now in

America.

But there are other bubbles in the making and even though it

may seem the DOW is stretched it could keep heading higher before we see any

major pullback.

The XAO on the other hand in another five years does not

appear likely to even reach the 2007 levels.

That is in the 13 years 2007 to 2020 – the net market change could be

nil!

So the outlook for 2015?

I expect a soft market with plenty of volatile and probably

a negative year. Of course you can make

money but as usual it will always be about choice.

Enjoy the ride

Tom Scollon |