As I look through the charts I see many companies still doing it tough and one in particular is Worley Parsons:

Click to Enlarge

It was a favorite of mine as I discovered the sweet taste of leveraged trading through CFDs many years ago. WOR gave me many happy days as I closed off my books at 4:15pm after a day’s trading in the halcyon days of 2006/7 in particular. The stock price always had plenty of movement for CFD traders.

I know the company quite well in other ways – albeit from a distance. With a Very good board I often wondered what such a company do when its world is changing and its share price into a chronic decline. It has been on the slippery slope for ten years. I am sure the Board has known they should re-think strategy but clearly the change had been too meek. Shareholders are obviously not confident much is changing so they just bail out of the stock.

WOR is a global company building gas and oil infrastructure, with 35,000 employees worldwide. If we look at light crude oil price we see a similar price pattern to that for WOR:

Click to Enlarge

The major difference being that oil recovered somewhat better from the post GFC fall out. – well for a few years.

As you can imagine with a global economy that is showing little strong trend there is little investment in oil and gas so WOR could be stuck with a stagnating business and share price for some time yet.

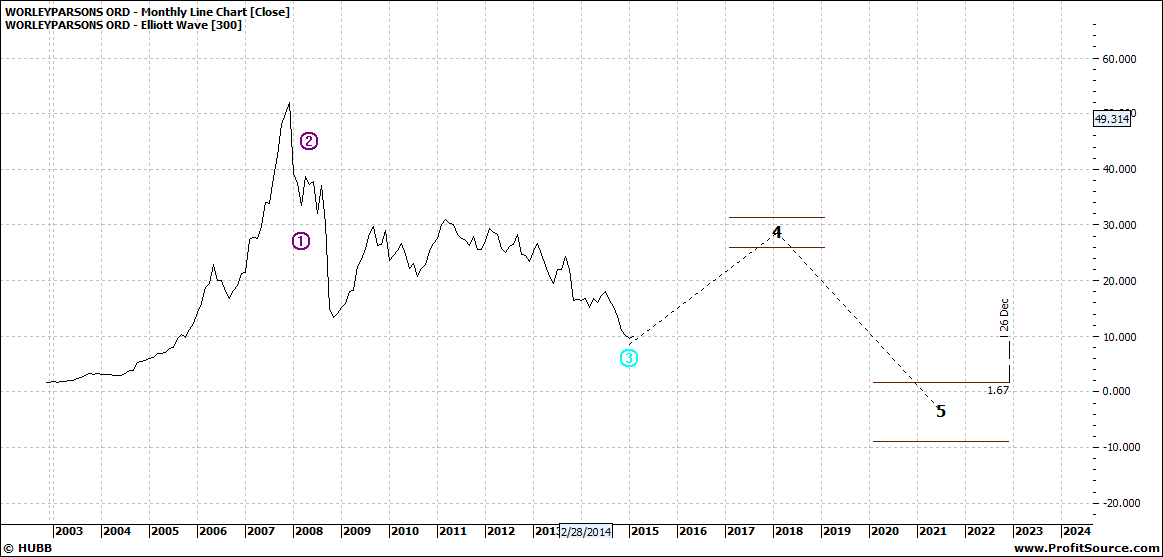

For how long? We could look at Elliott for some clues:

The weekly chart says the rout could be nearing an end:

Click to Enlarge

The monthly says otherwise:

Click to Enlarge

The share price could recover but another leg down could ultimately happen – albeit 7 or 8 years out.

This could mean net growth for almost 20 years for shareholders of this once megastar of the market.