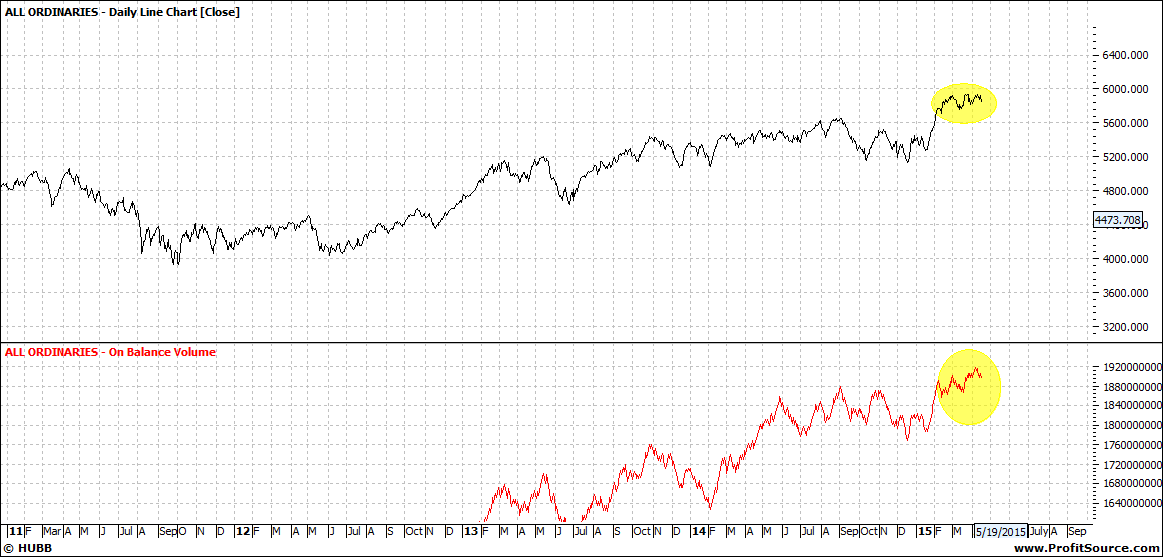

Divergence happens when price moves higher or lower and

volume moves in the opposite direction.

So at tops of markets we look for signs of a change of heart

by investors. After a long run like we

have seen in the last eight years we look to see if price heads higher but

volume stays about the same or heads lower.

We use OBV – on balance volume – which is an index - volume

is added or subtracted each day to/from the volume moving average.

Let’s look at OBV for the All Ords:

Click to Enlarge

Take note of the shaded areas - we can see no signs of

divergence at this point. It is more

likely to be seen on a day when there is a spike in price but volume is

low. Such a day might also show the

close of the day close to the opening after the market has reached a major

high.

It is useful to also look at OBV on a weekly chart – or even

monthly. But in such cases ‘the horse

has already bolted’

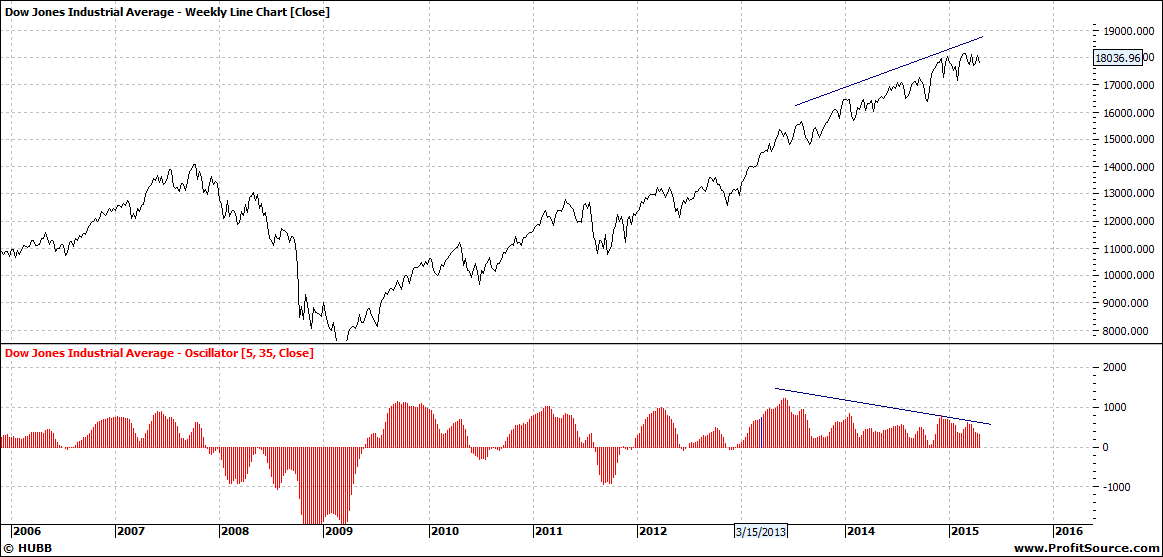

We could also look at the oscillator for divergence – in

fact many indicators. The oscillator is currently

diverging from price for the All Ords:

Click to Enlarge

But if you check out history you will see that the Oscillator

divergence gives false signals.

But overall right now we do not see any signs or any form of

divergence that should be a concern. But

that is not to say it could not suddenly appear.