When

markets fall back we never quite know where they may finish – where their

retreat may end. We don’t know whether

this is a major retreat or merely a minor pullback or a dip. Over the years in Trading Tutors I have

written many times about what is the difference between a retreat and a dip or

pullback or a reversal. You may care to

revisit for a ‘refresher’

We do not

have ‘20/20’ vision so we don’t know what is ahead. Sometimes we can sense this is only a harmless

dip or small retreat and other times we might fear the worst but the worst does

not happen as we anticipated.

So we don’t

know if it will be an orderly or even predictable retreat or whether it could

be at first benign but then something really nasty is looming. Just like in so many other aspects of life.

So is this

current ‘unease’ merely order playing out or is it something more sinister? Let’s look at the charts:

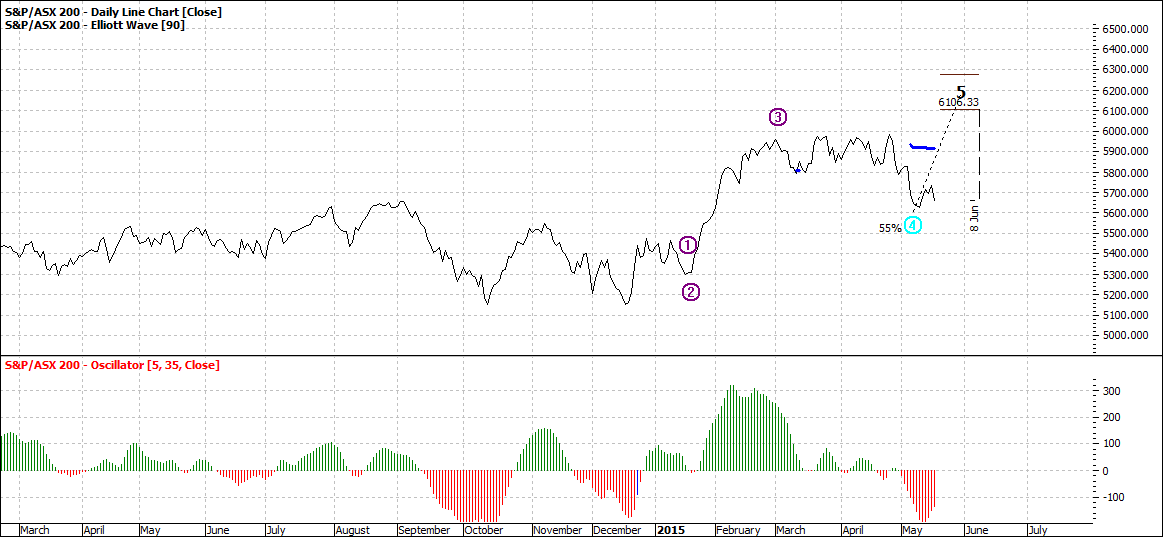

XAO Daily

Click to Enlarge

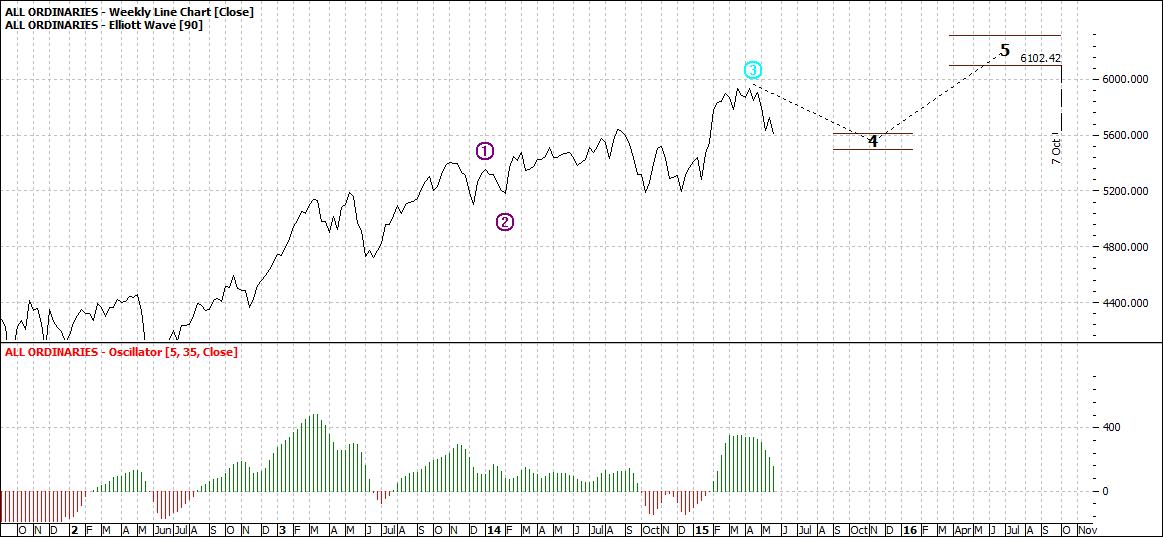

XAO Weekly:

Click to Enlarge

Note that

both charts have an oscillator which is a useful indicator to try and aid us in

assessing whether retreats are benign or not.

It aids us but as with many life issues such as medical diagnosis there

are no guarantees. We are therefore more

concerned about probabilities.

The daily oscillator

indicates that the market is unlikely to recover from here. That is in the daily context. So we then focus on the weekly chart and

there seems at this point a reasonable probability of an orderly retreat taking

place. But as you know with weekly charts

it takes more time and it could be another 2-4 weeks before we get enough data

to give us a sense of confidence.

If the oscillator

goes significantly below zero as we have seen with the daily chart then we

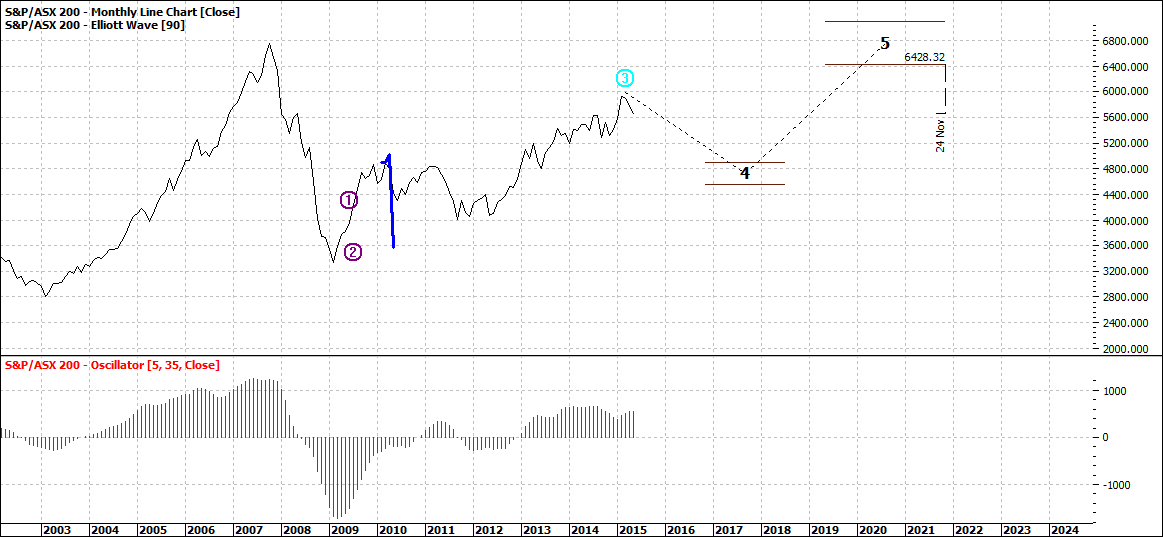

would need to turn to the Monthly chart:

Click to Enlarge

But that

could take a couple of years to unfold!

For many reasons

we have become used to markets trending strongly – up or down. There have been few extended periods in the

last couple of decades when markets have range traded for an extended period. That is still an option but does not seem

that likely for now.

But we

assume nothing. So it is always

advisable to do regular housekeeping – cleaning out stocks that do not meet our

criteria. That will not protect you if

there is an overnight disaster but it will help to minimise damage.