Greece? But

we have known for some time that this was going to be a problem requiring

reckoning at some point. It was only a

matter of time. But it is weird how the

market waits before panicking.

I remember

a couple of years ago in Morocco I met a Greek guy who said to me ‘ …you should

have known we would never pay the money back when you gave it to us’. I could write a book about this. But bottom-line Greek has not undergone any

real paradigm change. Nor have many

countries in Europe for that matter. Not

a lot has changed in the economic reality world since 2007/08.

What else

could act as a trigger?

Could a

cessation of interest rate easing also be the catalyst? What about an end to

the property boom in Australia – or even a bursting of the so called

bubble? Or could a disaster in property

result in a flight to equities?

What might

be the prompter to unsettle markets is a topic about which I can offer little

wisdom. As an equity analyst I don’t

spend much time thinking about this. As

a fundamental economist I do occasionally ponder such phenomena.

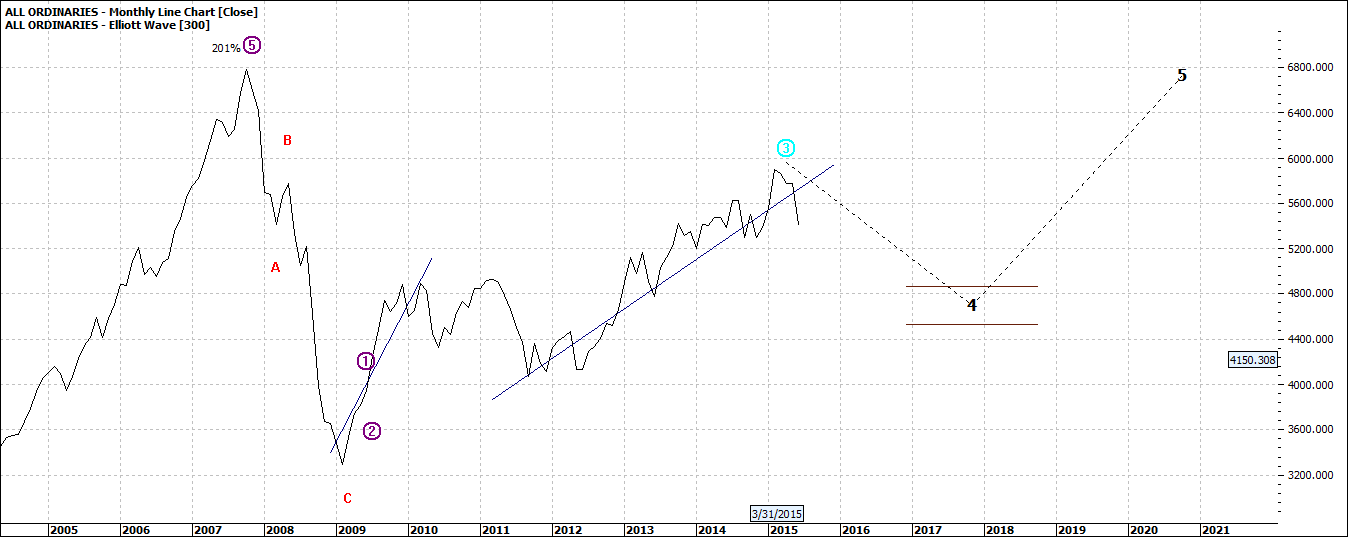

This is the

chart I most ponder:

Click to Enlarge

After the

2009 bottom the market bounced back with a sudden rush of blood to the head. There was no real consolidation. The market did consolidate a little around

2011/2013 and then took off again unabated for the next three years.

Markets

just don’t keep going up and the usual rule of thumb is that a pullback of

about 50% is healthy. And that is the

first wave four pullbacks projected in the chart above. So a level of about 4900 would do the

trick. A second projected wave four

would bring us back to 4500. Neither are

too disastrous except for those who have bought in recent months and more painful

for those who have negatively geared.

This second

wave four pullback could take us back to 2009 levels – even 2008:

Click to Enlarge

I cannot

say with any strong conviction that the market could come back to these

levels. I have no solid technical or fundamental

argument to say this. But I would not be

surprised.

I have seen

the ‘X’ factor come into play so often.

We have not had any X factor scenarios in the last several years. It is only a matter of time.

Is China an

‘X’ factor? In my view, no. A Chinese

trigger of any kind would have dramatic global ramifications. I would no like to project where markets may

settle under such a scenario.