|

Markets

have eased for the moment and in fact many have rebounded like there is not a

fear in the world.

As I look at

the chart for many markets I see a downward channel. I know I am not telling you anything new as

you have seen the rort on many markets over the last couple of weeks.

I would

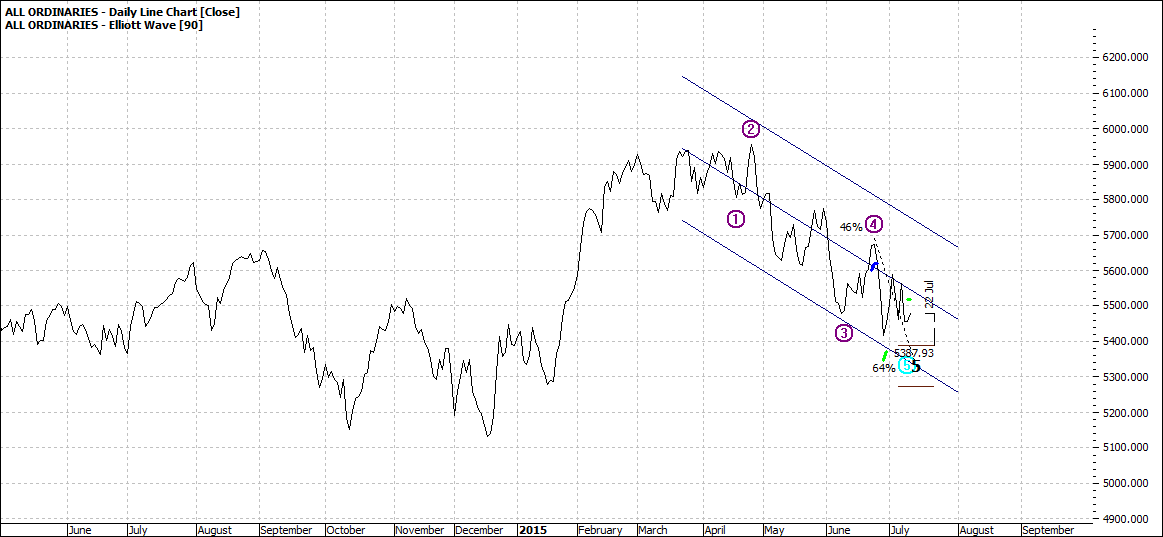

like to start with the Australian market:

Click to Enlarge

You can see

a downward trend channel. You will note

the downward five wave Elliott pattern.

And lastly you will see that at least from this chart that the wave five

low is technically not far away. That is

if there is only one wave five low. But

we cannot assume that the market will suddenly rebound and move higher. After all we are at the top of a long, large,

move higher:

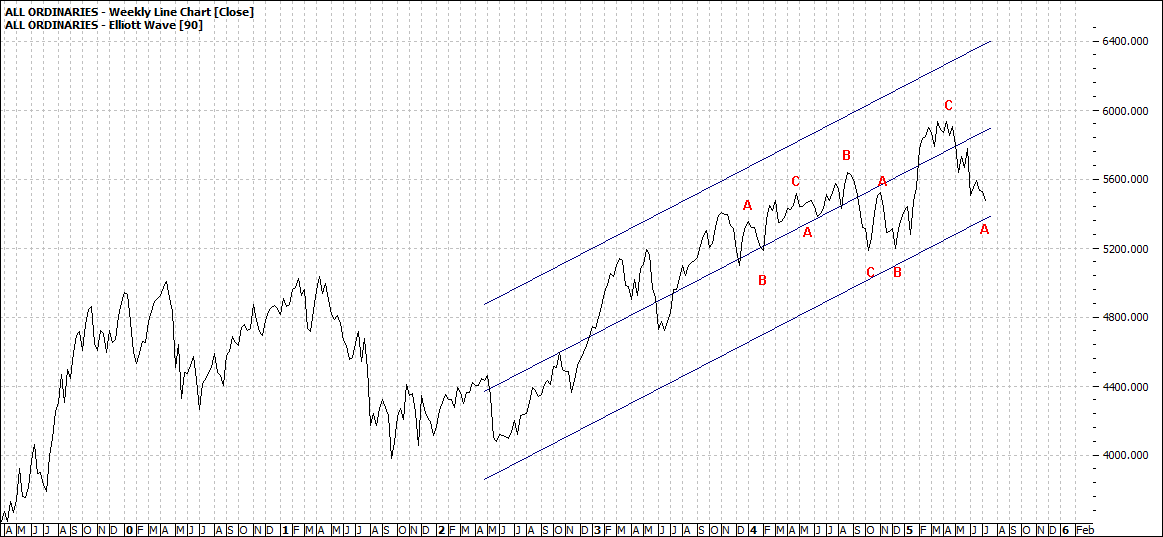

Click to Enlarge

So even if

markets are not going to fall over a cliff they are fairly unlikely to resume a

strong, sustained trend higher.

As we look

at other markets/instruments we can see similar patterns:

The Hang Seng as a reflector of the

uncertainties in Chinese markets:

Click to Enlarge

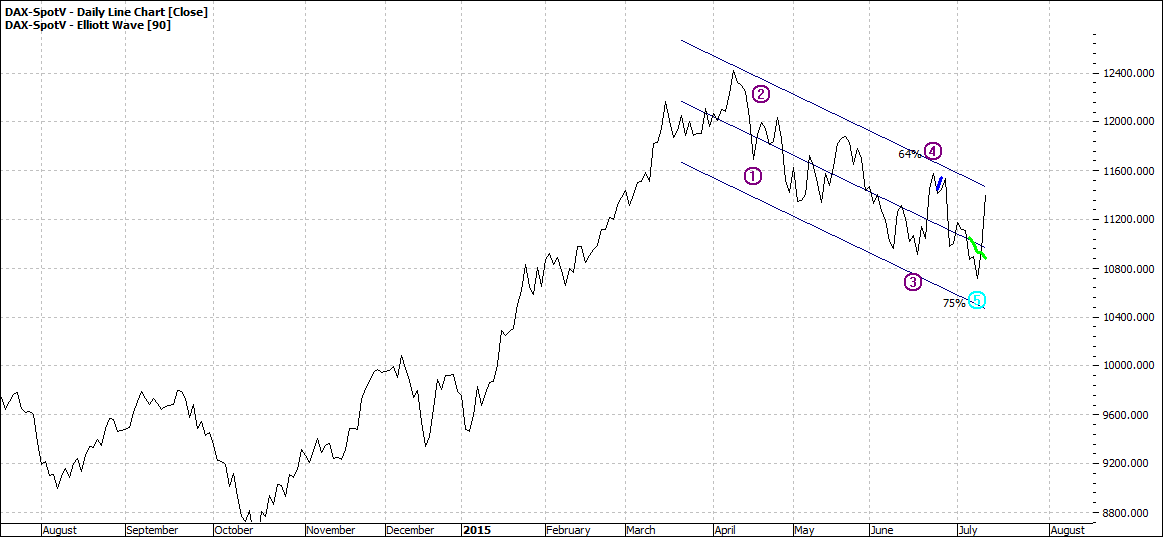

The DAX as it best reflects Grexit concerns as Germany has

the greatest exposure to a default by Greece – and Angela Merkel is a realist

and not one to pussy foot around:

Click to Enlarge

Copper as a proxy to the health of the global authority

continues a downward spiral:

Click to Enlarge

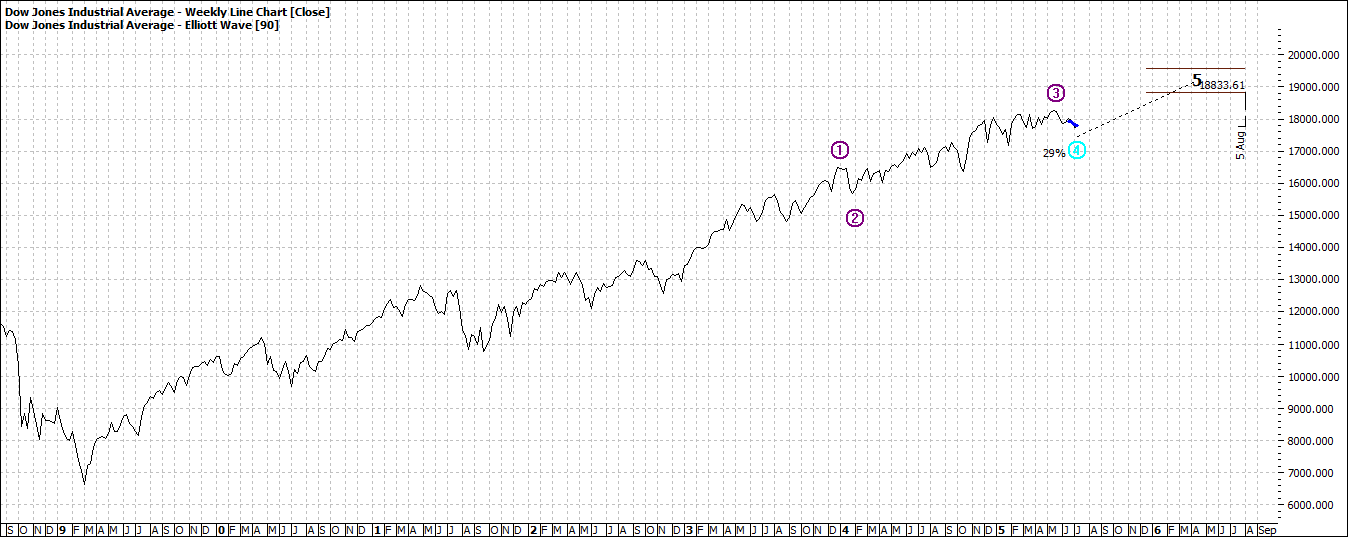

And the DOW forges higher and is non plussed about

happenings outside the USA.

Click to Enlarge

So we have quite a mixed picture.

My summary is that whilst markets may head higher we are

close to the top of a bull run – if we have not already arrived there.

Enjoy the ride

Tom Scollon

|