Unfortunately

the chart does not show the 70’s but I can vouch for it as I was deep into

exchange rates as I was in international trading. That was the golden years for the dollar and

despite its strength the world also at that time could not get enough of our

raw materials – including agriculture.

You will

also notice that we had another purple patch in 2011-13 but for the bulk of the

last thirty years the dollar has been at the vagaries of foreign exchange

markets and the dollar has been shaken all over the place. Unfortunately that is likely to continue as

the dollar is free floating according to market forces as opposed to some

currencies which are ‘fixed’ by government.

So can the

dollar fall to 50 cents? Well back in

2000-2 it got a taste of the dunce’s corner.

It was a painful period. We felt

unloved. We could not travel. Nobody wanted our goods. We could import as much as we wanted really

cheaply but we were not in the mood.

Like most of the world we had a dose of the blues as that was the last biggish

recession before the GFC bust of 2008.

If we

continue to look at the big picture but zoom in and apply Elliott we see a

projection only as low as about 70 cents:

Click to Enlarge

And we were

there before in about 2008/09 – the more recent recession. So you can see our dollar is a litmus test

for the health of the global economy.

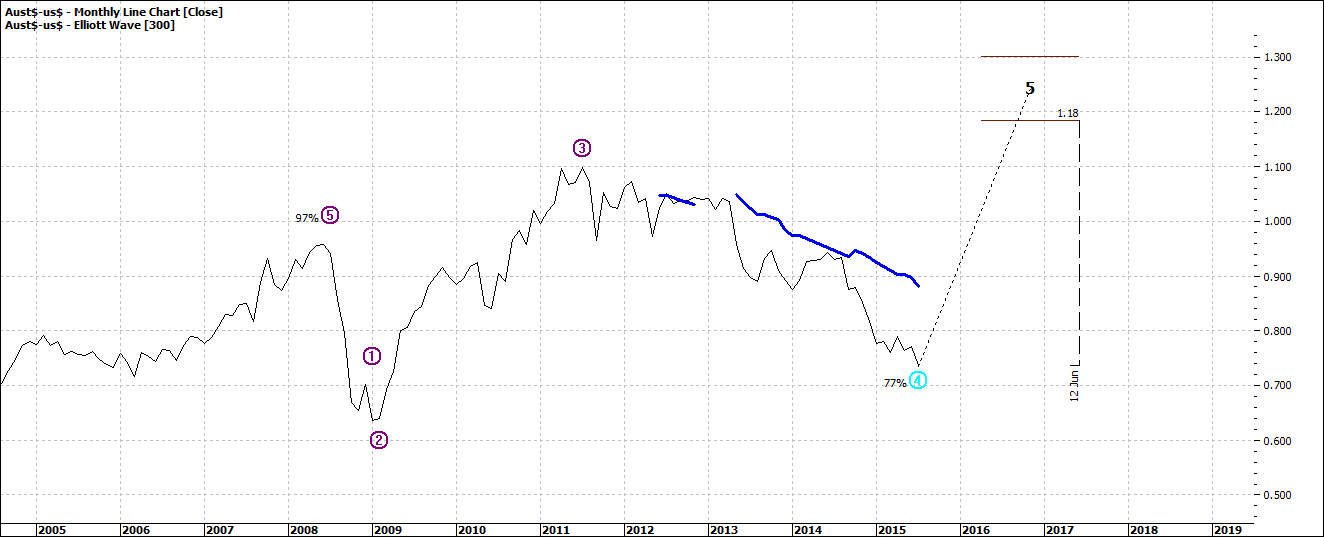

The above

chart is a 90 week. If we look at a 300

week we see a much lower dollar:

Click to Enlarge

To a low of

possibly around 60 cents – a popular level that many economists enjoy to

headline – people like to think in round numbers – easier for the front-page.

But you

will note that we could also see a rising dollar back up to 90 cents.

Some analysts

are paid to project exact levels. But I

also know that consensus forecasting rarely works. So I am inclined to hedge my

bets. And I know from coal face experience

that we will continue to see a volatile dollar.

If the wall paper is peeled off the China economy there is no saying

what might happen.

So my last

chart is the monthly:

Click to Enlarge

And it says

we could be all hopping on a plane in two years.

But beware

the ‘X’ factor.

Enjoy the ride

Tom Scollon