|

I use the term "playing" very loosely as falling markets can be very very dangerous.

Even for China.

I think investors get a little tired about the constant China headlines but I followed with mirth over the last few weeks the Chinese government's desperate attempts to prop up their equity market with all sorts of mechanisms and regulations. Even one of the most regulated economies failed abysmally. I have seen smarter governments fail so I was never convinced China could succeed.

My simple adage has been when markets are in free fall do not stand in the way. I recall not that many years ago sitting alongside the Niagara Falls. The noise was deafening but the power of water was even more overwhelming. An experience I cannot forget. I liken falling markets to this extraordinary phenomenon.

Years ago I was guilty of thinking I understood falling markets well enough to trade. I had some lucrative short selling plays but overall free falling markets are not for the faint hearted on a sustained basis.

The Bulls and Bears have very different psyches. The bull's energy is long and sustained. The Bears anger is irascible and unpredictable in all ways. Can be short and sharp but can also be long and unrelenting.

I guess I am a mere chicken and when markets reach their top I take my money and go. I like to completely protect my profits and sleep well at night.

Maybe I am wrong and this is a pause before the next leg up. It could also be a mere shelf before the next fall.

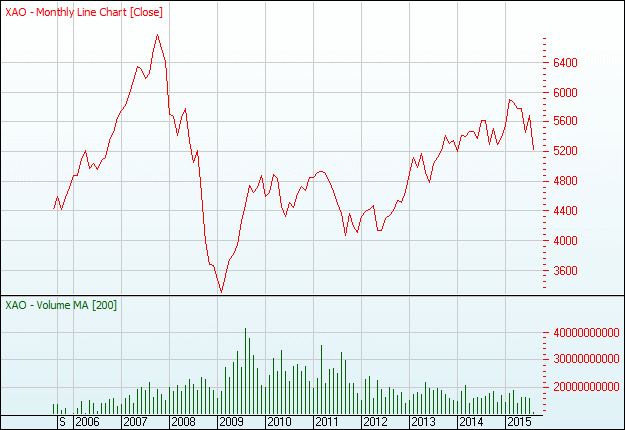

If we look at the simple monthly line chart below we can see that 5200 has been a point of resistance/support - in 2006, 2008 and 2013/14. The market knows this juncture well as it has been here many times before.

Click to Enlarge

I write on Saturday August 22 and the DOW has fallen over 3% on Friday. Australian markets might find some good news story by Monday's close but either way 5200 looks a perilous level.

The simple volume indicator shows buyers are well and truly outnumbered. That means there is little underlying support for the market. And thus is unlikely to come in till the market again become cheap. Such cheapness only comes about after real capitulation. And that happens after those who bought in the last couple of years are feeling much pain. That point has not been reached yet. But it will come and equities will be thrown back into the market at any price.

There is one more element to the Australian mix.

There is a basic link between home prices and equities. Many naive investors who have only experienced the party and not the hangover have seriously extended themselves by gearing their inflated home value to borrow to gear into equities. This is a highly toxic mix.

If we see a reversal in housing buyer sentiment we could see panic selling causing double jeopardy.

This is a time for a steady hand on the tiller.

Enjoy the ride

Tom Scollon

|