|

Markets

generally look tame. Benign. Sort of “Goldilocks” phase. Not too hot.

Not too cold.

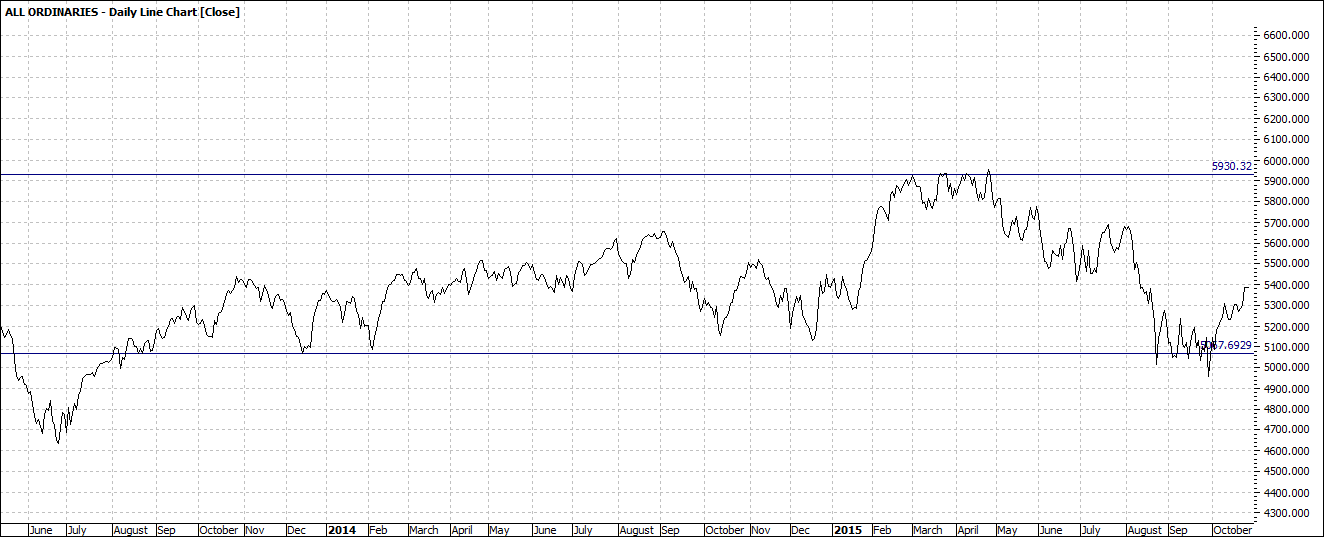

You can see

from the XAO weekly chart below that the markets are in a trading range mode:

Click to Enlarge

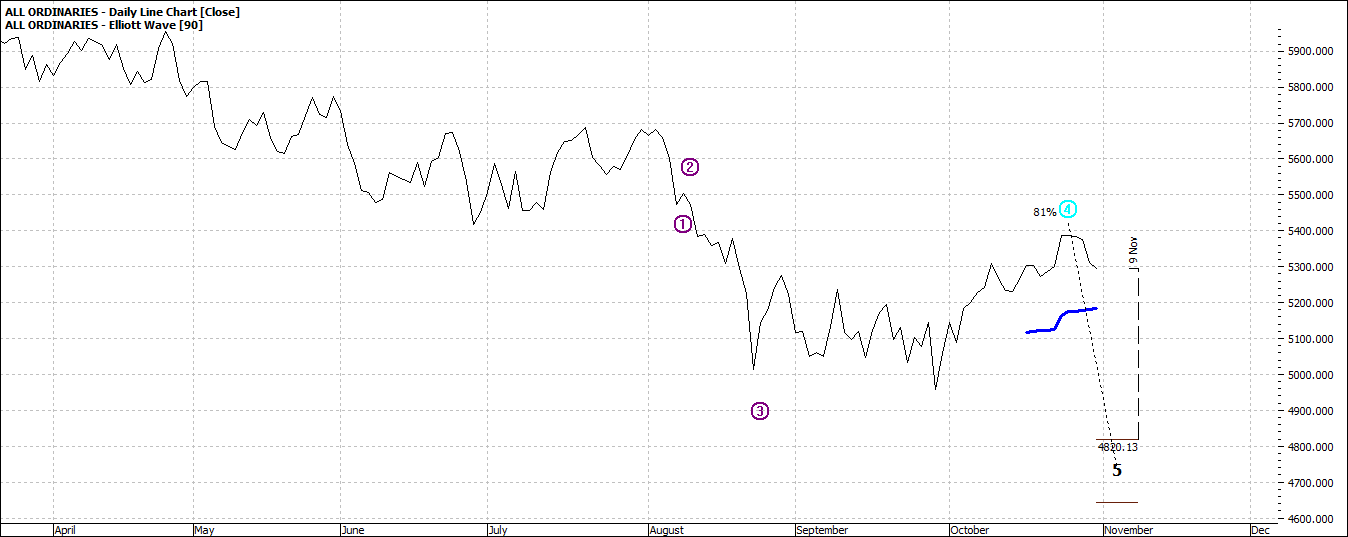

The

following is a daily version:

Click to Enlarge

You can see

that the market has not moved much in the last 12 months. Those who bought may or may not be happy –

depending on what they bought. Some may

also have had some anxious times as there have been times when it looked like

markets could tank. But they held as

there is still support for equities. In

fact support for investments in general.

Property included – putting aside even the China factor.

Turning

back to the XAO we look at Elliott:

Click to Enlarge

This suggests

a possible fall to 4800/4700 – but this is not a big deal. It is small and may in fact be a healthy

consolidation and attract new buying interest as there is not a lot of buyer

excitement at the moment.

But I am

not necessary overwhelmed by the projection in that it seems hardly plausible

that it will fall that much in the next two weeks.

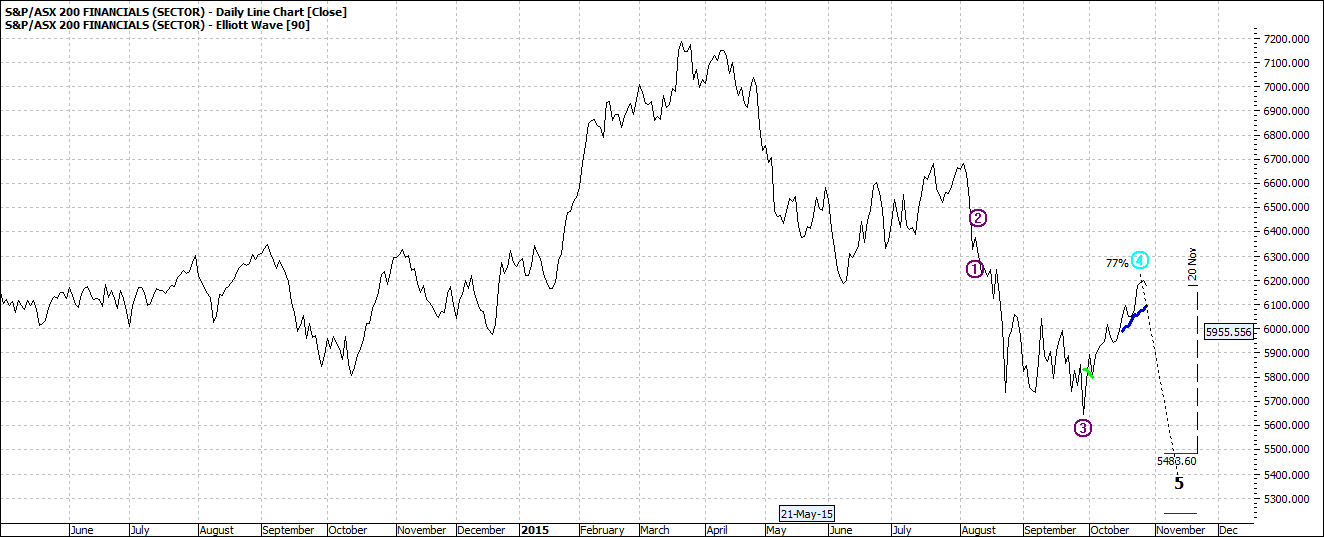

The Finance

and Materials sector also project easing in the short term – on daily charts:

Click to Enlarge

Click to Enlarge

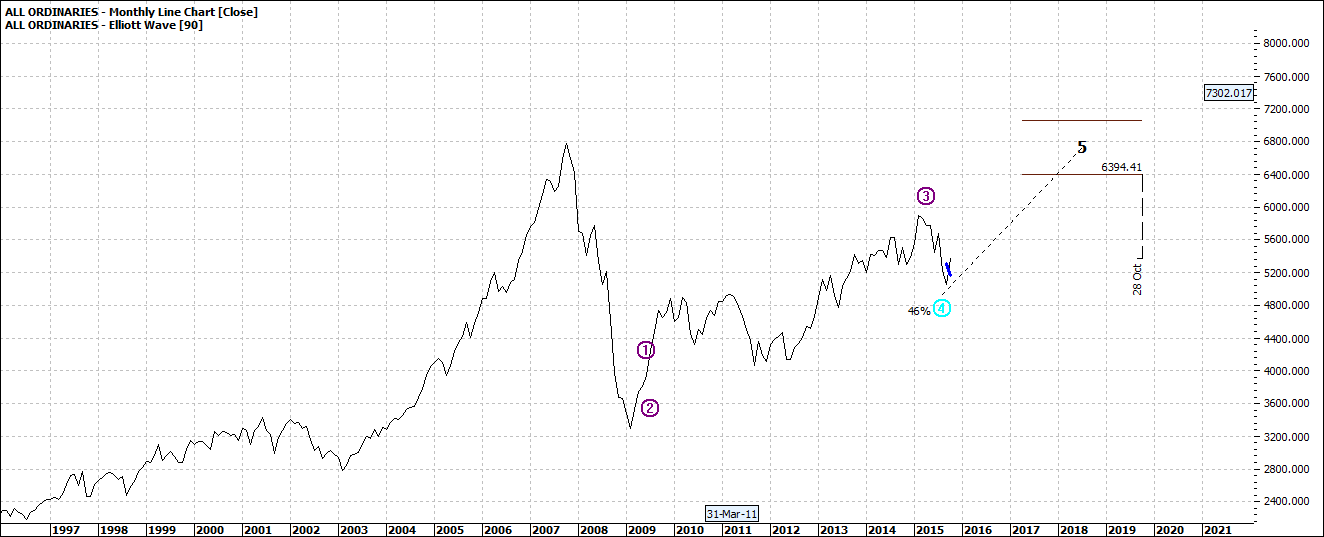

The monthly

outlook suggests the dreamy times will one day return:

Click to Enlarge

Of course they will. It is only a matter of time. But what happens in between also counts.

Enjoy the ride

Tom Scollon

|