|

If you know

the limbo rock then you truly are date stamping yourself. And nothing wrong with that. But you are also maybe asking yourself if you

should be reading stuff about the financial markets. Maybe you should be kicking your heels up in

The Bahamas and letting someone else look after your money. Maybe more about that another time.

To

BHP. Well the mantra of the limbo rock

was ‘how low can you go’ as party revellers eased themselves under the horizontal

bar, with head and back low and trailing behind under the bar.

Worldwide investors

are wondering how low BHP can fall.

No-one knows. Anyone who says

they know are only guessing.

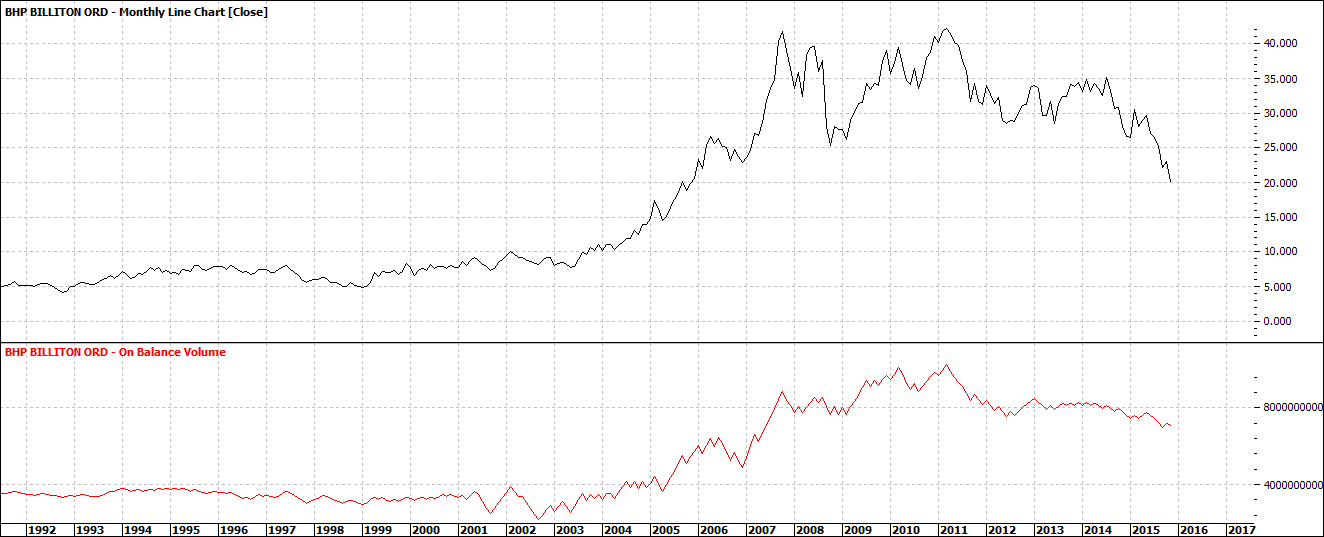

Let’s look

firstly at a Monthly chart:

Click to Enlarge

You can see

that BHP price is relatively high compared with the first ten years on the

chart.

With BHP we

also must remember that BHP has had many splits etc., over the years and it is hard

to know exactly that the original price equivalent is. Some analysts may know but for me, I am only interested

in the relativity. That is what the

price might do relative to today. Where

it may fall to and where it may recover to eventually. I think about finding the low for my own investment

portfolio. I hold no BHP though it has

been a long term favourite of mine. In

fact I have not held BHP for many years.

There are

two major factors at play for BHP one is the major and macro factor of global

demand for raw materials. And secondly

the micro factors – those that are BHP specific. It is the latter that has caused this latest

rout. Problems.

And we know

from experience that once there is a run on a stock or market rationality goes

out the window and price can be pushed well beyond what is reasonable. Whether BHP is well priced now I don’t

know. Does not matter to me. I just wait to see a low.

So back to

the chart. If you look at the first BHP

above and in particular the OBV indicator below price, we can see that OBV – On

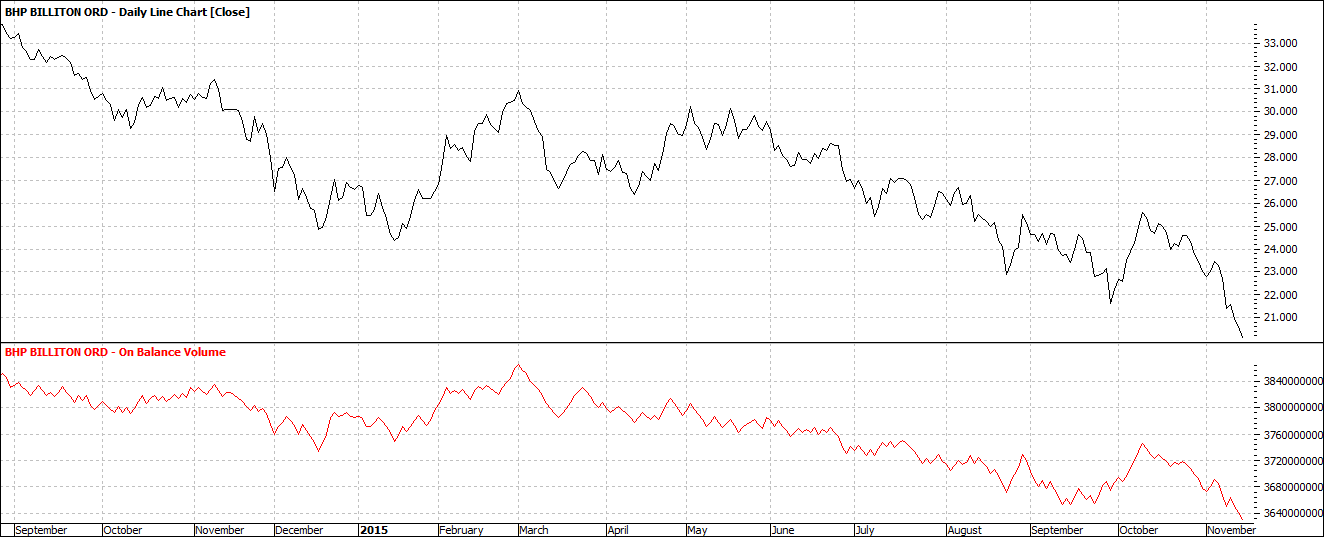

Balance Volume has held up well – relative to the last couple decades. If we look at a short term chart it looks

motherless:

Click to Enlarge

No-body’s

child.

My main

point of interest – probably like yours is when to buy. What price might that be at? And when.

I never expect

to buy at the lowest point. And I expect

that I will buy progressively over time.

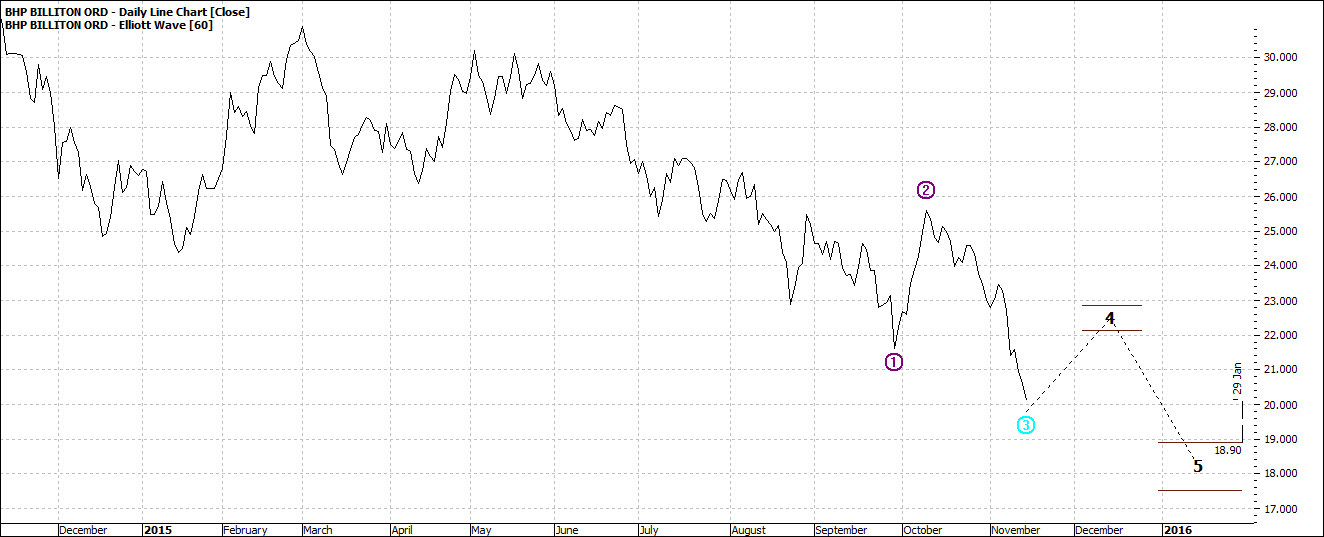

So I played

with some charts to think about what might lie ahead:

Click to Enlarge

Click to Enlarge

The first

chart is daily and suggests a low of $18/19 in January. That seems feasible to me. Maybe even before. Although the chart says, maybe a dead cat

bounce first. Maybe. Or maybe it goes straight to $18.

It nudged

below $20 this morning as I wrote. Down

over 11% for the week. Who predicted

that for this week? Anyone? Not I. So we

just don’t know. At the moment we can

only observe and speculate.

The weekly chart suggests maybe a low of $15

late 2017. Now $15 is a nice round

figure and markets also like them. 2017

is a long way away but somehow I muse. I

don’t think you will have to wait two years.

Enjoy the ride

Tom Scollon

|