|

It amuses

me when at a party, someone says to me they buying gold. I smile inside.

It is a sort of status symbol. Firstly that you know when to buy gold. And secondly that you have the necessary dosh to do so.

But I know from first hand knowledge that Asians are buying gold right now. But they often buy gold. Especially when they get tired of buying land. You know – buying houses in Australia.

Click to Enlarge

Click to Enlarge

Click to Enlarge

So is this a good time to buy gold? For westerners maybe but Asians for example, do not worry whether it is the right or wrong time – they are long term players. Asians have a dynastic approach to assets – that is they buy for generations ahead. Thus those that have money just keep buying land – for children to build near them and for grandchildren. They do not buy and sell property as say Australian do – to upgrade lifestyle. It is not a past-time to them. Always buy never sell. And how much property a person owns can be rarely judged by the clothes they wear or the shed they live in. How much gold they own you never know. They work in the paddy field or factory 360 days as if they don’t have a dime to their name. The five days off is Chinese New Year.

The only compelling instances that I am familiar with for selling are two. Firstly the poor might sell to finance a funeral. A grand farewell is ‘face’ in Asia. The only other common reason is to pay a debt. That debt could be for any relative. This is to avoid going to jail. You can avoid jail for all sorts of other reason but not for failing to pay a debt. There is no chapter 11 in most Asian countries – or ‘Administration’ as it is known in Australia.

I meander.

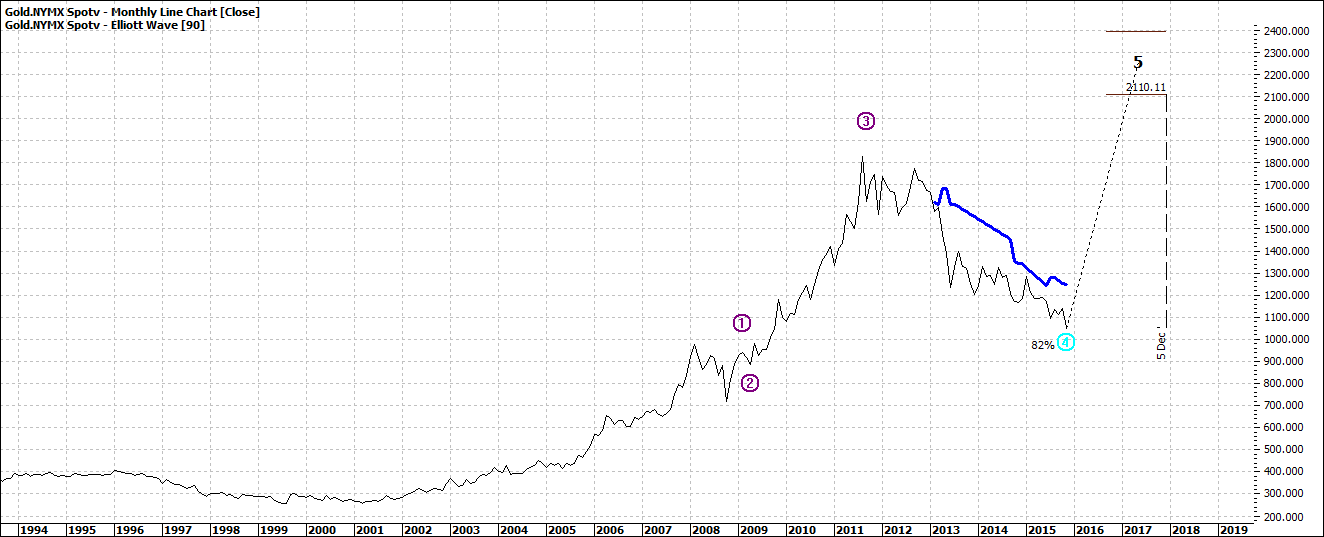

So I have given you above three rapid fire charts for gold – daily, weekly and monthly. All very interesting.

The daily says a near term low for gold. The weekly confirms this and also that it is a medium term low. Both might suggest this is a time to watch gold and maybe even start buying in the weeks and months ahead. But we are not yet at a long term low and I always think that we should wait for a low to be confirmed as the wave five could keep pushing lower.

The monthly chart may caution some who have the view this is not a big deal low. That is, ten years ago it was half the price. Thus it is not a major low. But we don’t know. And when you look at the change of wave five and the predicted wave five high then you can see a price 4-5 times higher than the low of five years ago. So never a clear answer.

We live in strange times. Sad in many ways. But I not digress again. Though there have been tragic incidents and scary politics – nothing has been big enough to cause a flight to safety – that is, to pile into gold.

Enjoy the ride

Tom Scollon

|