|

There is not much joy to be found in the new lunar

year. Markets look grim. There is no joy to be seen. A quick run around the markets tells me that

many markets look set to find four year lows.

Back to 2012 lows. That is not so

dramatic. But that is how it looks at

the moment. When we get to these lows we

need to reassess whether there is more pain ahead.

So in this review I look at the macro outlook and then

finish with the Australian market in particular.

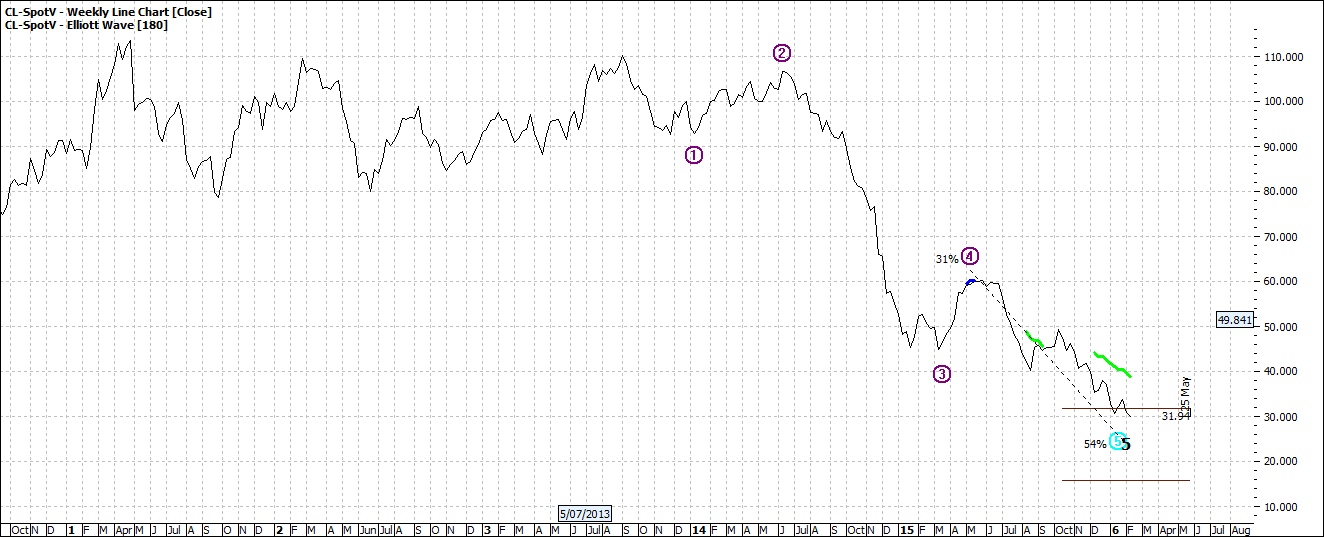

Oil is maybe finding a low:

Click to Enlarge

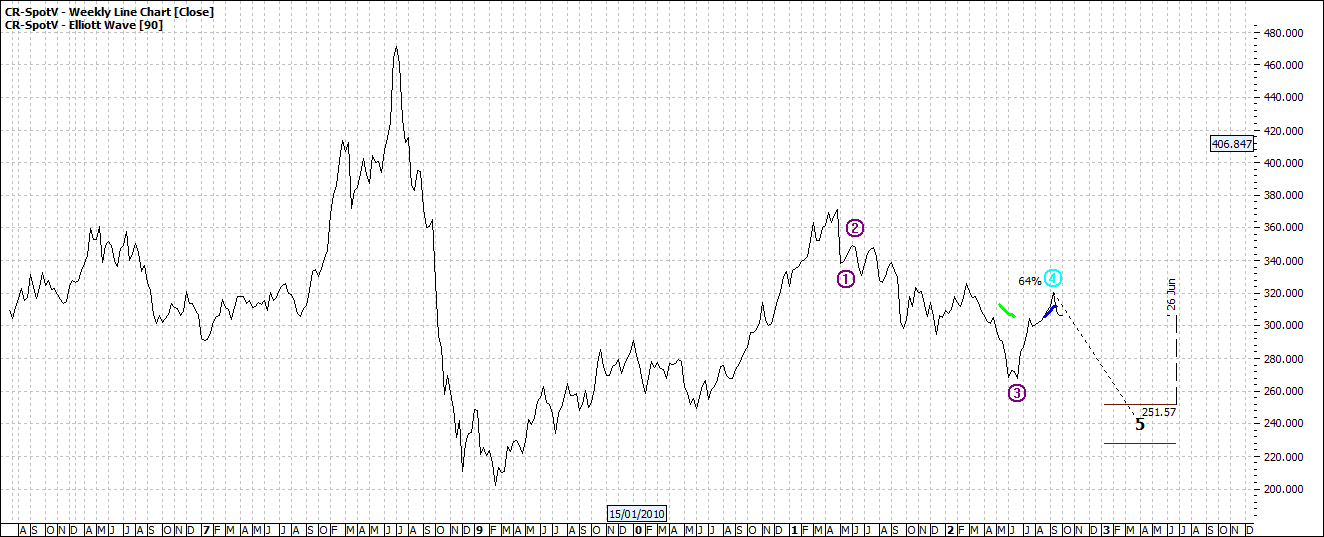

We might see a small recovery in copper but a deeper low may

also be more likely:

Click to Enlarge

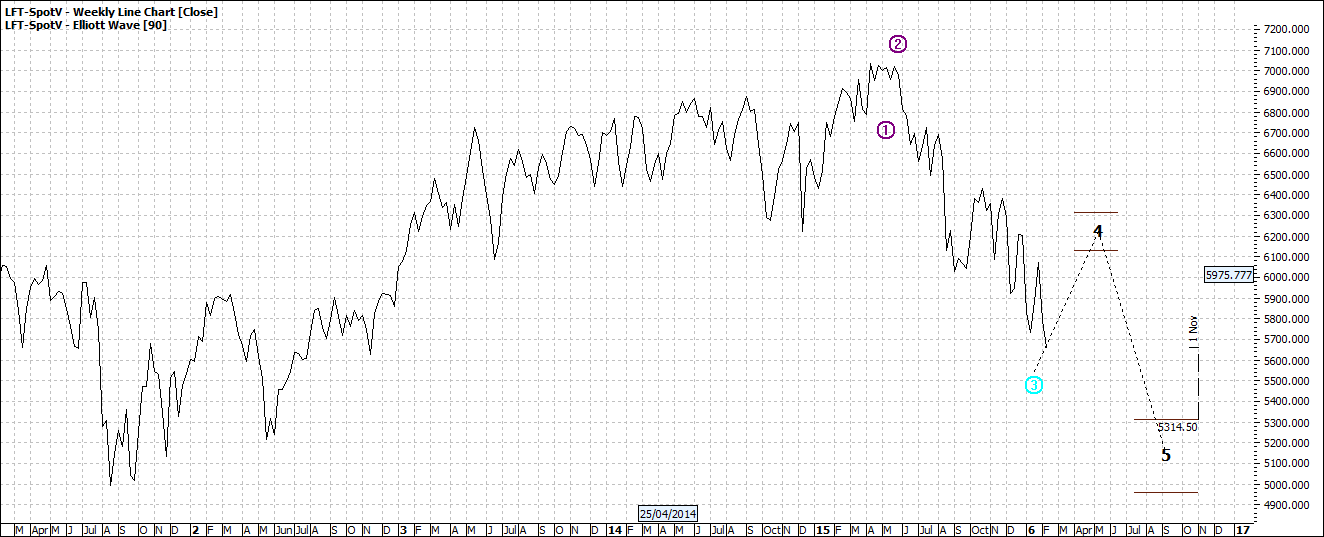

And likewise the FTSE:

Click to Enlarge

The USA S&P looks set to have a less dramatic year:

Click to Enlarge

In that the pullback is more likely to be back to be back to

2014 levels. Of course the USA has one

of the brighter economies but that also makes that market vulnerable to a major

pullback as the US equity markets have experienced an intense run up since the

lows of 2009. Higher you ride harder you

fall.

The Hang Seng, litmus for the Chinese market - looks the

most vulnerable of all – maybe back to 2009 levels:

Click to Enlarge

The China factor is also reflected in the Materials index:

Click to Enlarge

This is a broader index which covers agricultural as well as

mining materials. It covers basically

all that goes into manfucaturing.

Everything.

The Australian dollar preempted these lows and is already

down to 2009 levels:

Click to Enlarge

But may be reaching a low.

The XAO projection is less severe:

Click to Enlarge

But the Australian market could easily see 2012 levels in

just a few weeks.

What we rarely see on a chart is the capitulation

factor. For example in the above chart

we see a wave five low at about 4400.

This does not look too scary. But

if we were to see a sudden fall then this could cause panic and we might see a

more frightening low as investors just throw it all in and head for what will

be once again more crowded exits. ‘Get

me out at any price’ becomes the catch cry.

And yes cry as the greed now becomes fear.

So all in all this is not a great start to the year. It is early in the year to predict what sort

of finish to 2016 we could see. And

there is probably not much point in attempting such a forecast. We need to find a low first.

There are no good reasons to buy equities –

except maybe factious money. But there

appears to be more reason to sell.

Enjoy the ride

Tom Scollon

|