|

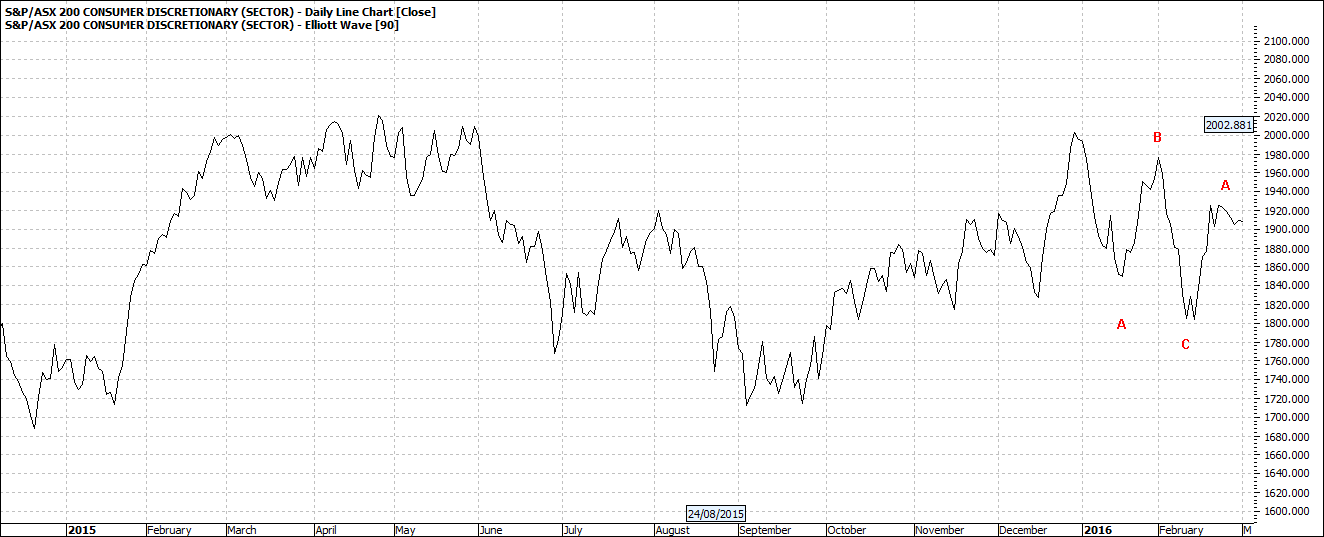

The Discretionary

index looks benign on both a daily and weekly basis:

Click to Enlarge

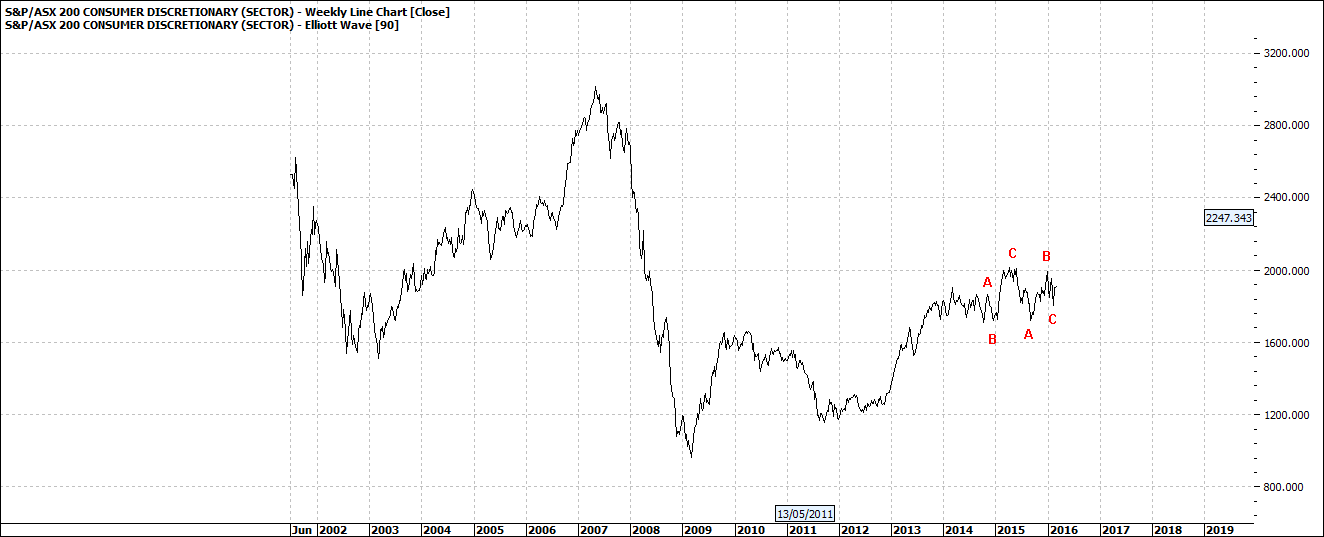

Click to Enlarge

According to the

weekly chart you have been spending generously over the last three years but

now you are a little more careful. You

are truly discretionary at the moment.

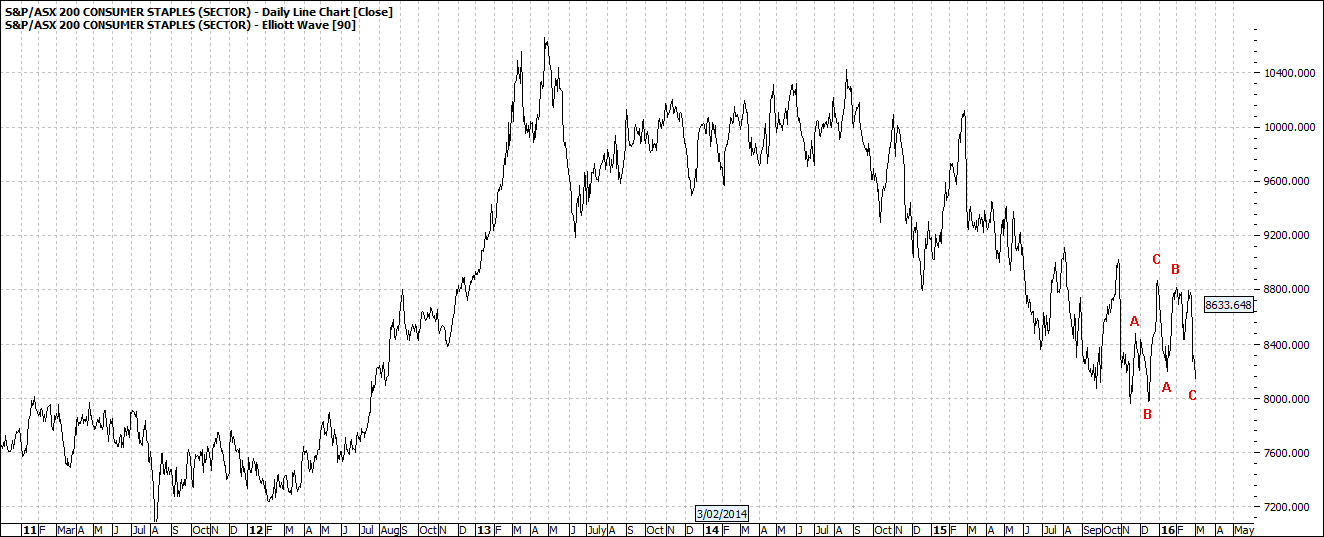

The Consumer Staples –

food and grog Index - is likewise benign:

Click to Enlarge

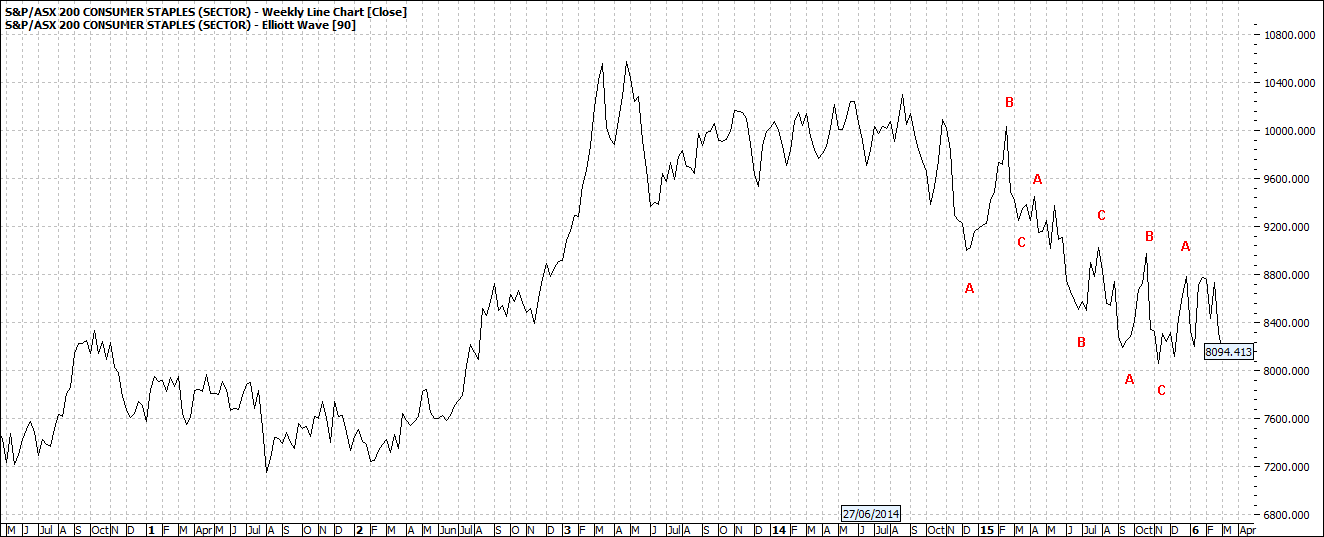

Click to Enlarge

You were living the

life or Riley but now you are objecting to prices and so you are hanging tight

to those hard earned dollars. Mind you

prices are ridiculously high for almost everything but the two dollar shop.

And looking at some

specific stocks:

WOW is doing it really

tough and it could get a whole lot worse:

Click to Enlarge

Hang on to your money

there could be better days ahead.

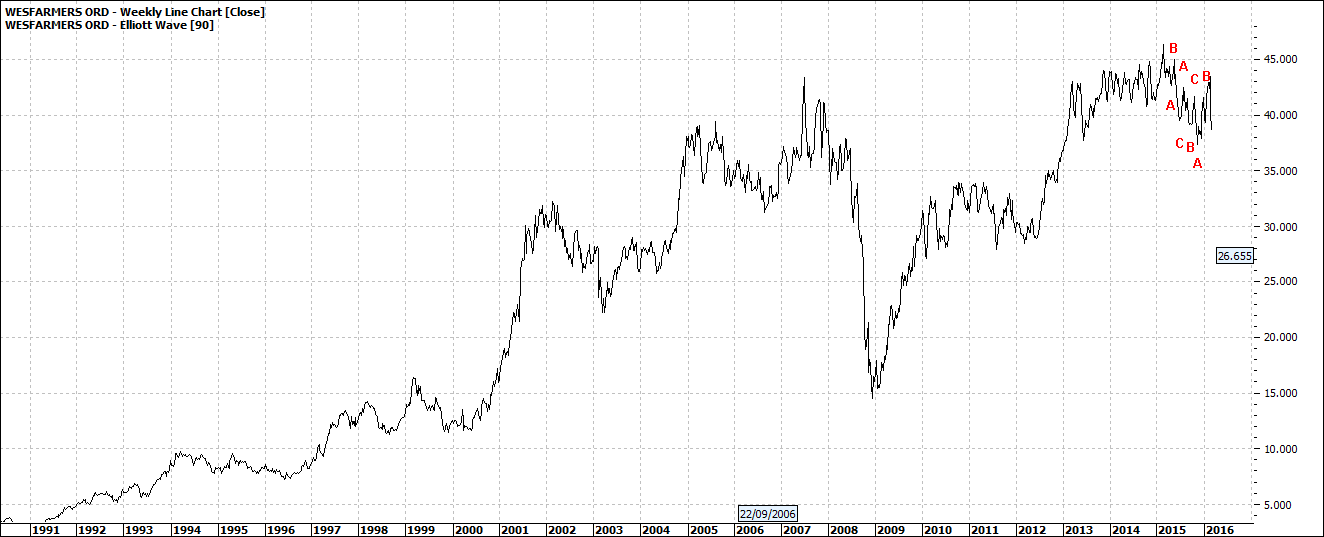

WES has had a big run

up and one of the better stories but now seems stuck at these current levels:

Click to Enlarge

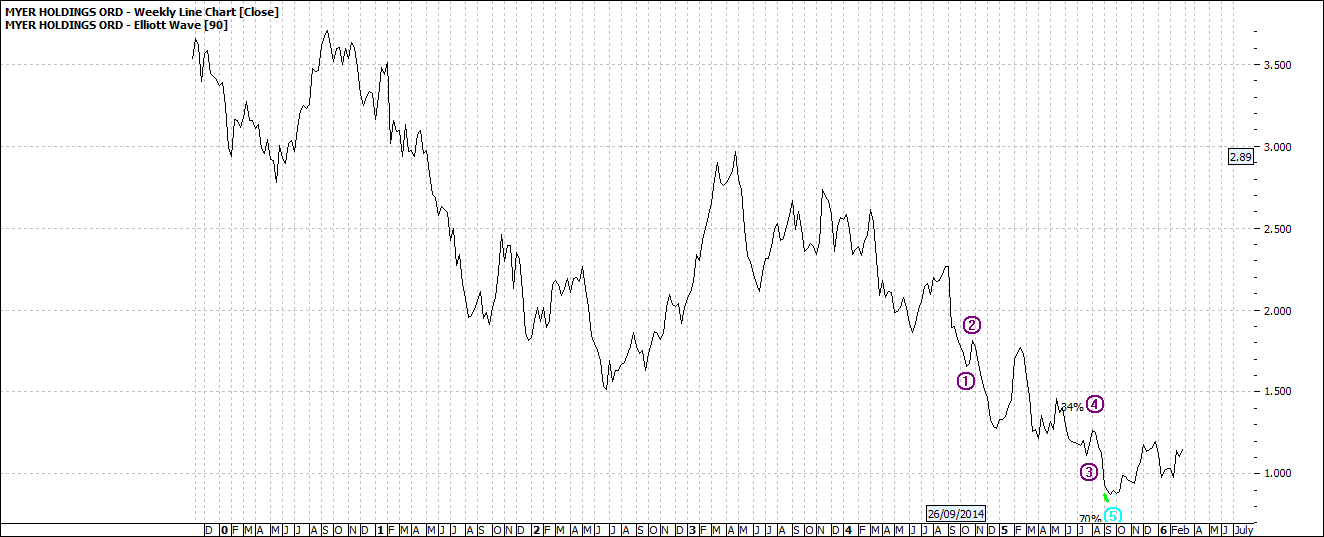

Myer has let you down

and so you only shop there when you really really want to:

Click to Enlarge

I know some of the

Board and can say no more other than I am not ….. But I feel sad for shareholders. A lousy

story.

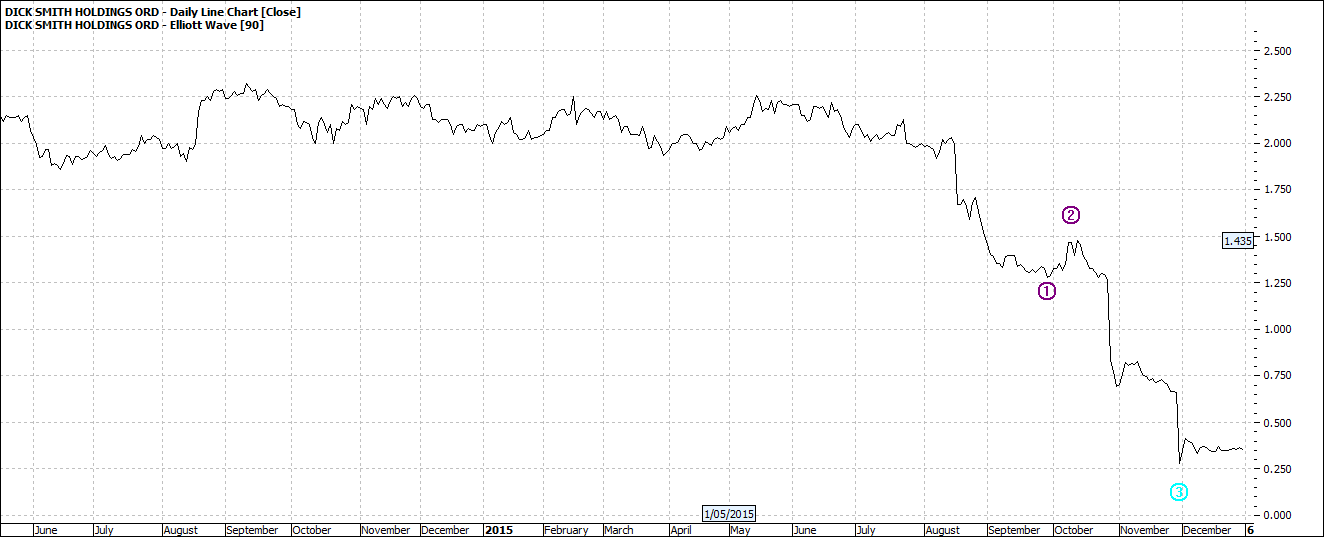

DSH we now know is a

basket case – well even casket case:

Click to Enlarge

Managed to let both shoppers

and shareholders down big time. What a

mess those stores were, though from the outside looked pretty – but when you

drilled down it was not too tough to see that they had no chance of survival.

BBG should have been a

roaring success and was for a while:

Click to Enlarge

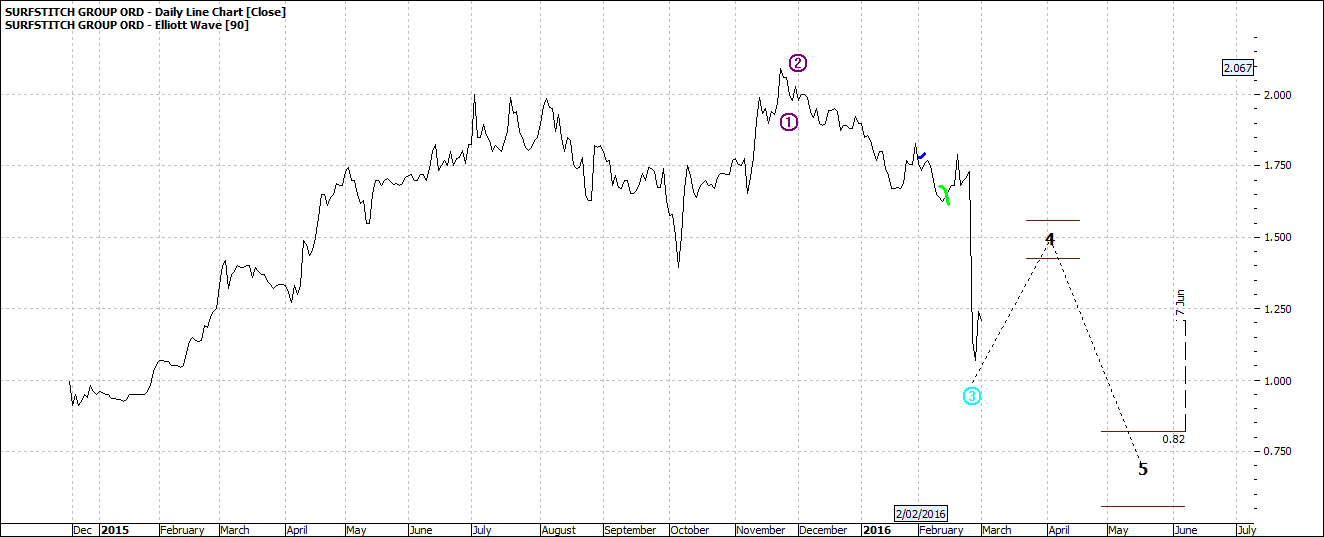

And you would have to

ask yourself if SRF has the same stench?

Click to Enlarge

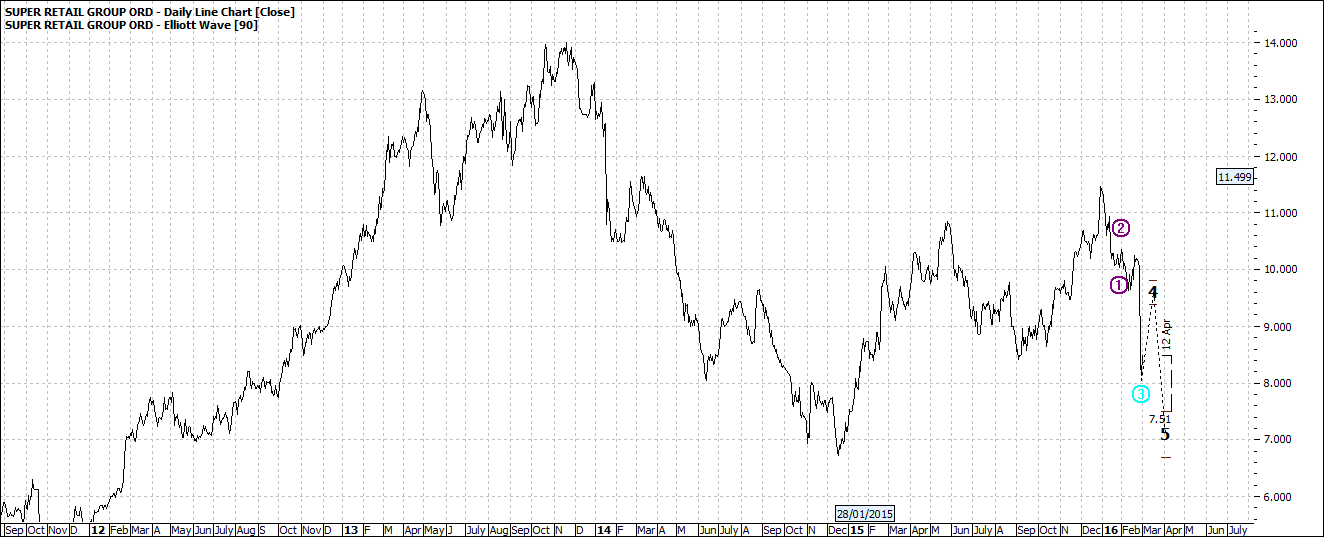

Super Cheap is looking

Super Cheap:

Click to Enlarge

And you are now in

love again with this cheap end of town:

Click to Enlarge

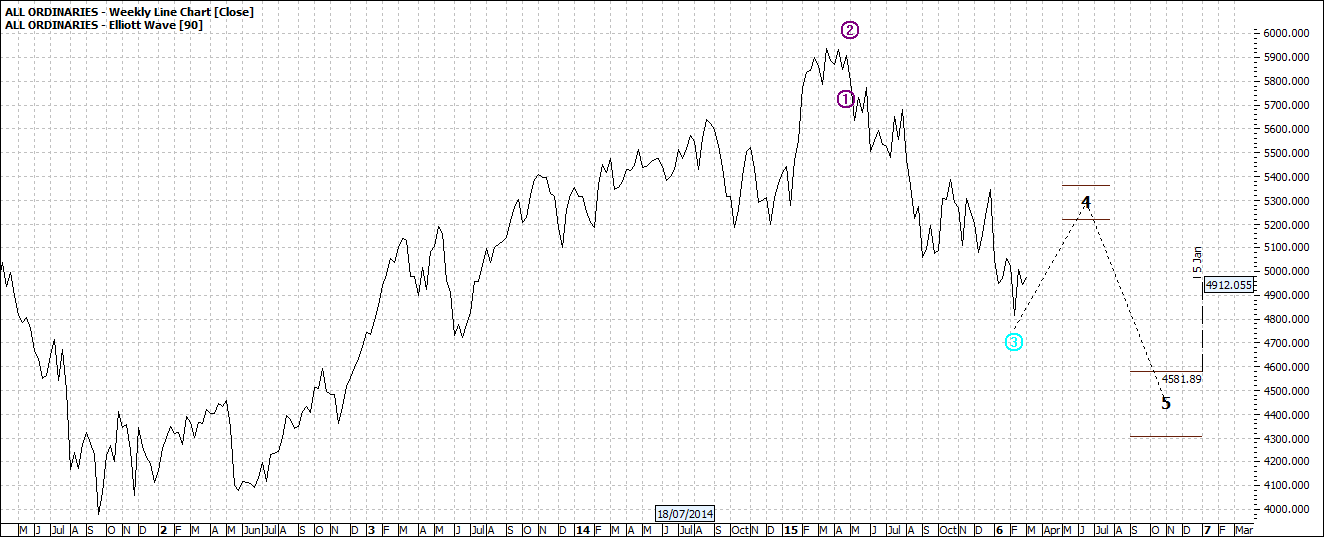

And lastly for good

measure a quick look at the overall indicator – XAO:

Click to Enlarge

Maybe steadying for a

time. But you will get bargains ahead:

Click to Enlarge

Enjoy the ride

Tom Scollon

|