|

The outlook for the Australian market is rather mixed. Short term upside, medium term downside and then long term upside. So there you are and I can hear you say what a fat lot of good that is. But let me elaborate.

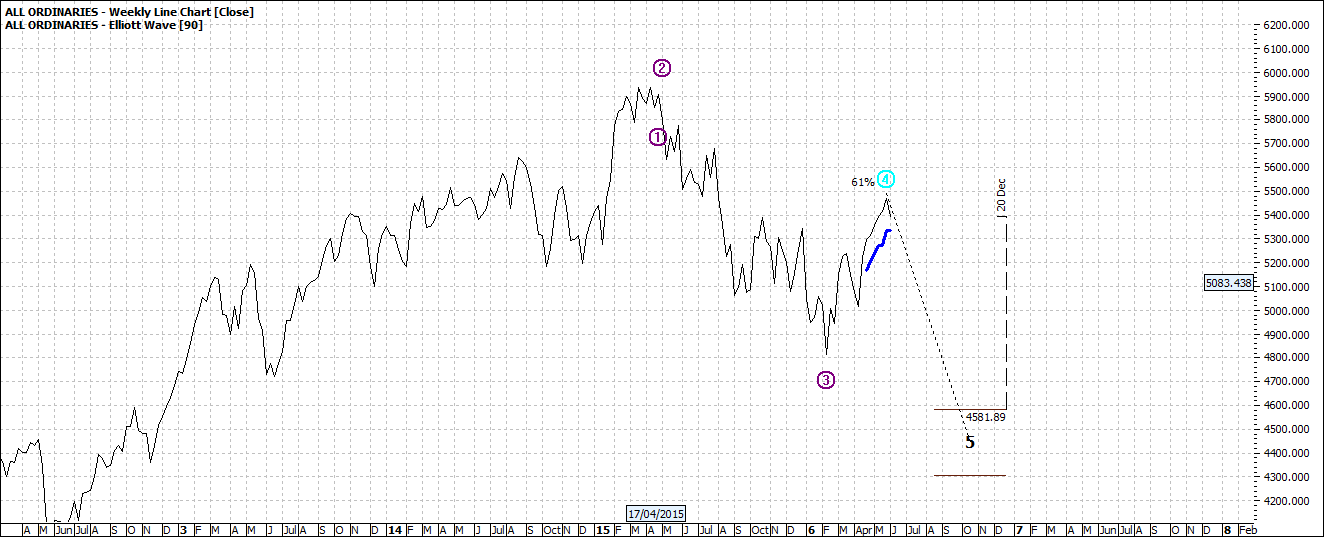

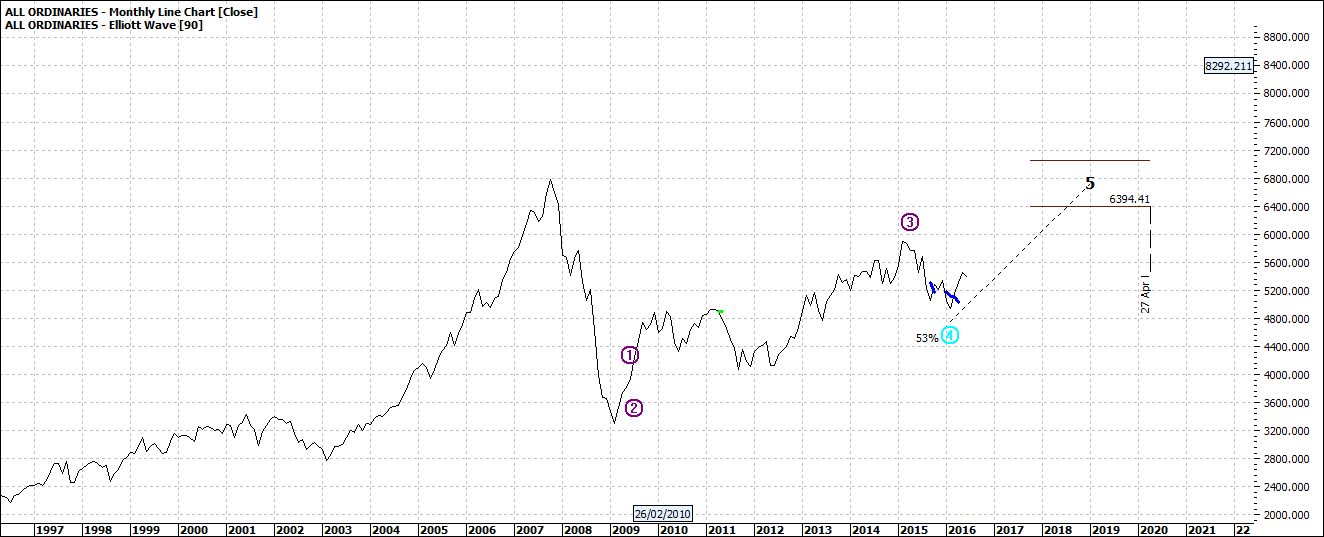

Here are – in succession – the daily, weekly and finally monthly:

Click to Enlarge

Click to Enlarge

Click to Enlarge

Now I am not locked in to all of this as I

know markets can change in literally the blink of an eye.

Firstly daily. Yes there is some upside but not a lot –

maybe 5%. Of course there will be some

stocks that can rise more than this in the next few weeks. Others will slide and others might go

nowhere.

And come September / October – seasonally a

time of jitters – downside seems a real possibility.

And then we turn to the monthly and we see blue

sky. The market heading up to the lofty

heights of 2007 – around 2018-2020. But

that is a long way away and anything can happen. But of course the market will get there but

we cannot say with any strong conviction when that might be.

For the long term investor that of course

is good news. For the trader that is

also good news as you can ride the peaks and the troughs.

What do you do short term? If your stocks are looking good you just ride

them higher. If they are in danger of

nose diving then you should spring clean.

This is something all investors should constantly do no matter what

state the market is in.

I guess the bigger question for many is,

what might that weekly slump look like.

I would say a very fair chance we will see a decent pullback. When I see a pullback on the horizon I am for

ever vigilant. Not nervous but I double

up my spring cleaning efforts. I work on

the premise that when a market falls we cannot make hard and fast assumptions

about where the low might be.

And when markets fall, equally one has to

be careful about what stocks might fall more and what stocks might hold up.

Having said all of that our strategy will

be influenced by our time horizon. If we

are there for the long term we might be happy to hold the bulk of our stocks

after cleaning out the possible duds.

We want to avoid selling our long term star

performers also – just because there is a dip ahead.

Enjoy the ride

Tom Scollon

|