|

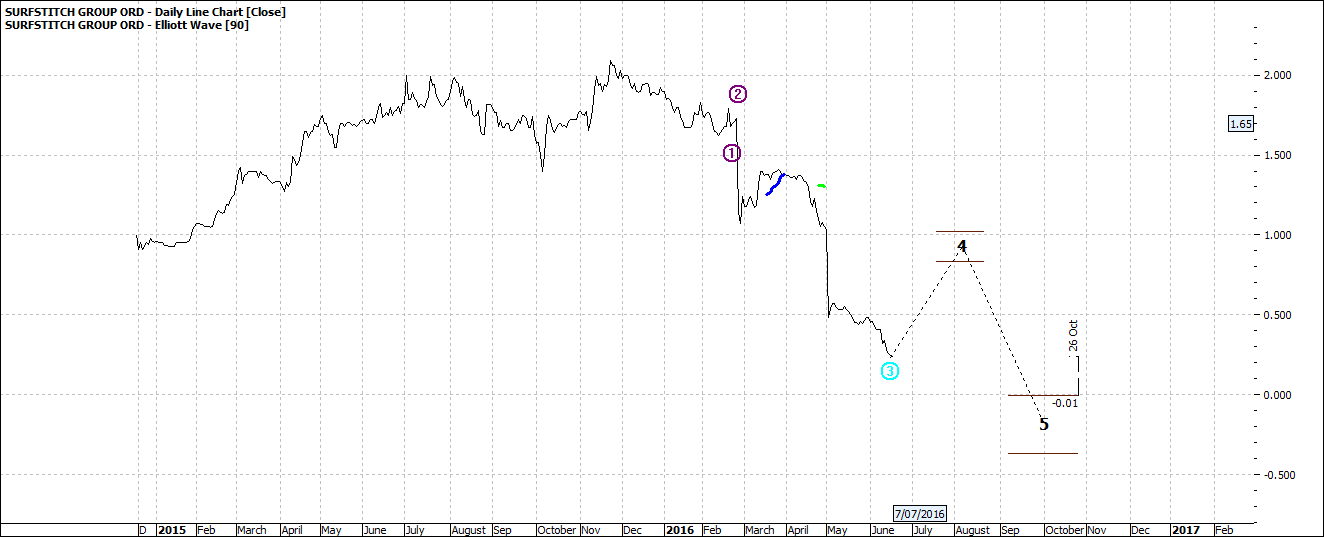

If you bought Surfstitch in 2014 you might be feeling a little stitched up right now.

This is not a pretty picture:

Click to Enlarge

I have seen it all before. A good pitch up to listing. Champagne corks popping on listing. And then ‘the life of Riley’. Now words, words, words.

I don’t actually know much about SRF but to me it was on the nose a few months ago. Some writing was on the wall back in February – I touched on SRF in my article March 1:

Click to Enlarge

I rather sense early investors liked the story – Sun Sea and surf and cool people. A potent mix of furry feelings. It reminds me of the prefect summer at your favourite beach resort. The family is having a perfect holiday and you buy the dream beach house. Only to try to sell it when you are stuck for cash a few winters later.

So what do you do with SRF? Don’t worry I’ve been there done that. Many times. And I always remind myself what doesn’t kill me makes me stronger. My thinking is clear. Unemotional. Take a hit.

The toughest bit about taking a hit is thinking about it before hand. Agonizing. Do yourself a favour. Cut the agony and sell. You will be amazed how even euphoric the post sell feeling will be.

As I say, I don’t know these guys. But I do not trust whoever is involved. They may be good guys. But I only want to back winners. They may double triple the buy in price eventually. But I don’t want to hang about.

I first got involved with the sharemarket a long, long time ago. I was a busy Managing Director buying and selling business. Turning them into gold. I thought I could walk on water. A rather toffy broker rang me one day on what was one of the first mobile bricks. He had a deal for me. It was a mining boom. The penny dreadfuls he sold me turned to dust. I vowed then I would find a better way.

I studied everything I could get my hands onto about technical analysis. I lost more money. All part of a steep learning curve. I was not scared to give anything a try. Eventually I had learnt much and thereafter stayed out of trouble.

The biggest lesson I learnt was: be quick to cut your losses.

Enjoy the ride

Tom Scollon

|