|

Pundits had the Aussie at 40 cents to the Yankee dollar only a few months ago. Maybe a wild and hasty call.

Perhaps there is another side to this lil battler. Let’s look at the charts – daily weekly and monthly:

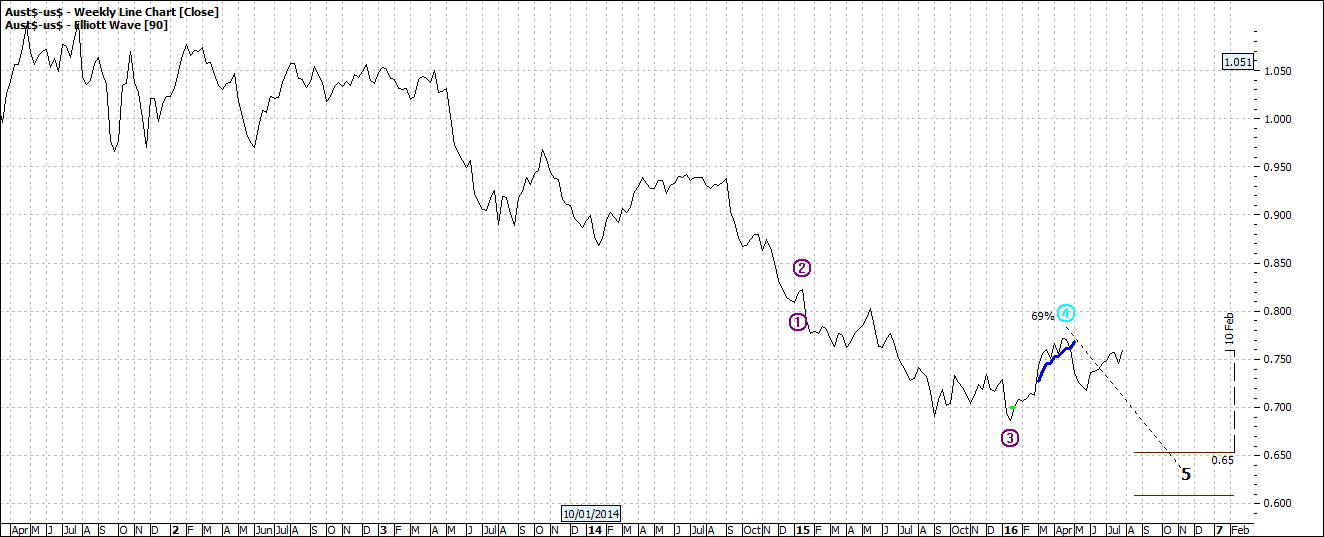

Click to Enlarge

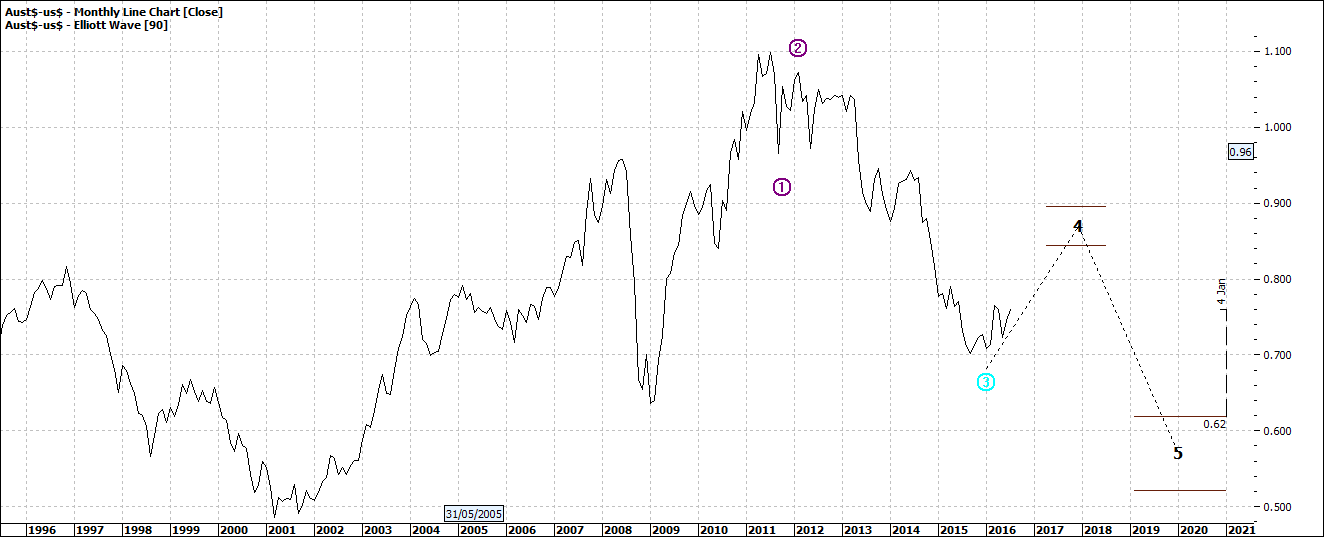

Click to Enlarge

Click to Enlarge

Of course the direction of the Aussie depends much on what size of the equation you are on. If you are an exporter a cheap dollar will make it easier but if you are an importer it could be tougher. It also has a different set of impacts on the economy generally.

I hazard a guess that most people will see the strength or weakness of the dollar through the eyes of a consumer. That is, if you are travelling overseas you want more than 40 cents for your dollar. If you are wanting to buy a new MacBook or high end TV or load up on your favorite French wines and cheese you will prefer a higher dollar.

So to the charts.

The daily suggest we could see weakness in the coming weeks. I think this is not a high probability. In any case your horizon is more likely to be months, if for no other reason you don’t like to be rushed into making major purchasing decisions. But soon you will be thinking of Christmas and summer holidays.

The weekly chart offers little hope of a better dollar. So that begs the question should you start to convert some of your cash to US dollar or Euro now? Before deciding that lets look further out and thus a different time perspective.

The monthly chart suggests maybe a higher Aussie before a lower low. That is there is a fair chance we could see 80 cents or more. But I doubt 90 cents as my charts proposes as a high point.

If we look at copper as a proxy for world growth the global we can see a very similar pattern to our dollar. That is our dollar is generally in demand when global growth is strong and the copper chart reflects a not so optimistic global economy over the next few years.

That is also a reason why many global powers want to keep their currency low – they want to be competitive in a tougher global trade environment in possibly difficult times. That will support the Aussie to some extent.

So not a cut and dry outlook for our dollar. But what it does mean is you should not turn your back on the dollar chart.

And finally perhaps you think about converting your dollars to Euro or Dollars progressively – averaging. Possibly anything over 75 cents might be a reasonable level. Even if it was not money to take overseas for a holiday you might just want to squirrel away some foreign currency into an account for future purchases of overseas dollars – or for just a fun foreign currency play. It is easy to open a foreign currency account at your local bank.

Enjoy the ride

Tom Scollon

|