|

|

Gold a safe bet?

24, August 2016

|

Well of course no such thing as a safe bet, but gold looks to have a steady future in the foreseeable future – and that is all we can expect when making an investment decision.

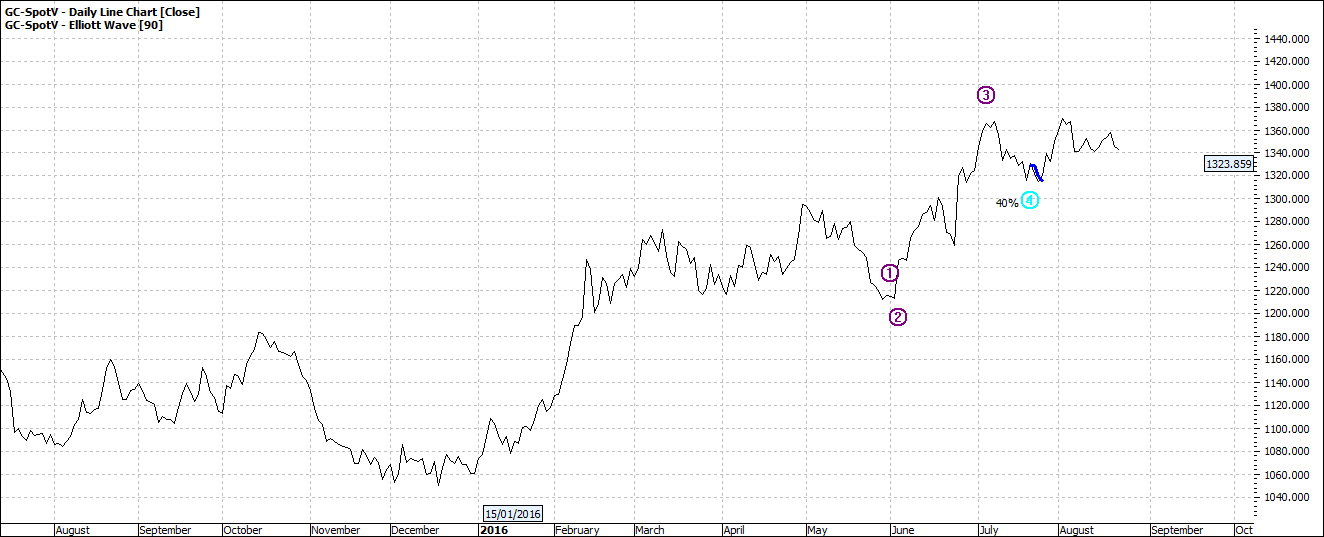

To the charts – daily, weekly and monthly:

Click to Enlarge

Click to Enlarge

Click to Enlarge

If you look at the daily chart you might think this horse has bolted. Useless to shut the gate and you got no chance of tracking that horse down. But when you see the weekly maybe you can feel a sense of a chance ahead. Gold at about USD1350 an ounce it is well of its 2011 high of USD1890. Better than a bet on any horse.

Buying shares is never a sure thing. We are always faced with balancing risk and our view of the future. But we try to minimize risk and one way of doing this is to buy in a pullback – especially after a stock has had a big run. And in this case gold.

If you look more closely at gold you can see there is a chance of a pullback. By no means certain but it is worth showing a little patience because when we look at the big picture – the monthly – we can see that there is a chance gold could find its way to USD2000 over the next couple of days.

Now that is a move of almost a 50% which is not bad return if it comes to pass. Somehow that notion is not out of the ballpark.

So even if you bought at current levels your risks are not that high. In these situations I would buy around these levels so if it goes below current prices that is a bonus and I buy more so that brings down my average ‘buy in’.

When I like a scenario I buy several times rather in one big bite. In the case of gold I am able to get a confirming perspective by looking at the ASX Index for gold the XGD:

Click to Enlarge

My next step is to stalk the various stocks that make up the index but that is your homework to do.

Enjoy the ride

Tom Scollon

|

|

|

|

|

|

|