|

Wednesday

October 26 was the biggest fall day in a long time. I can recall of course 2007/08 when such a

day was a regular occurrence.

Analysts claim to understand investor sentiment and a summary view seems to be that there was growing pessimism on Wednesday, of a likely interest rate move higher. You don’t have to be a rocket scientist to work out that the probably of interest rate moves is to the upside. Rates have almost no wriggle room other than upwards. Why get sad?

Maybe when you have a sudden 80 point fall day investors also ask themselves is the party over. Maybe.

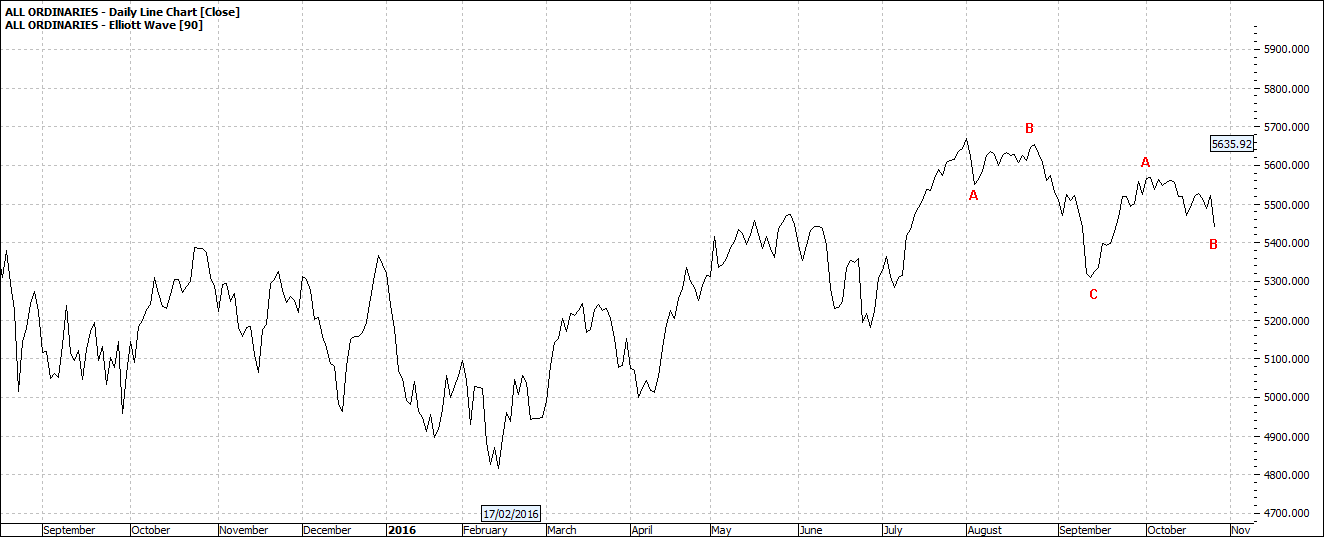

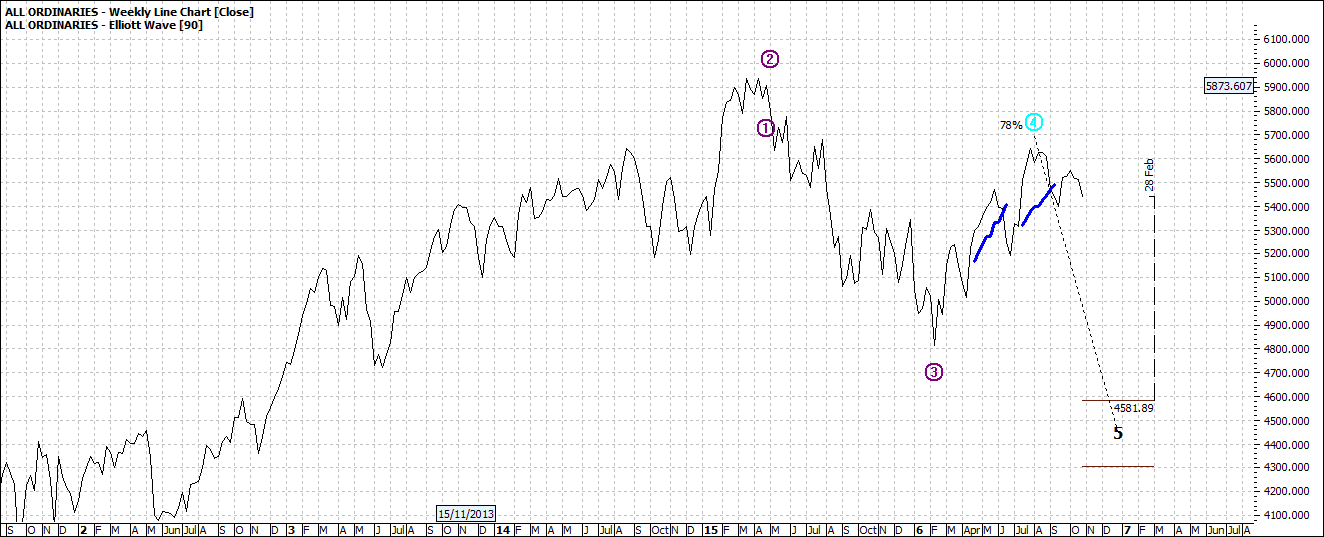

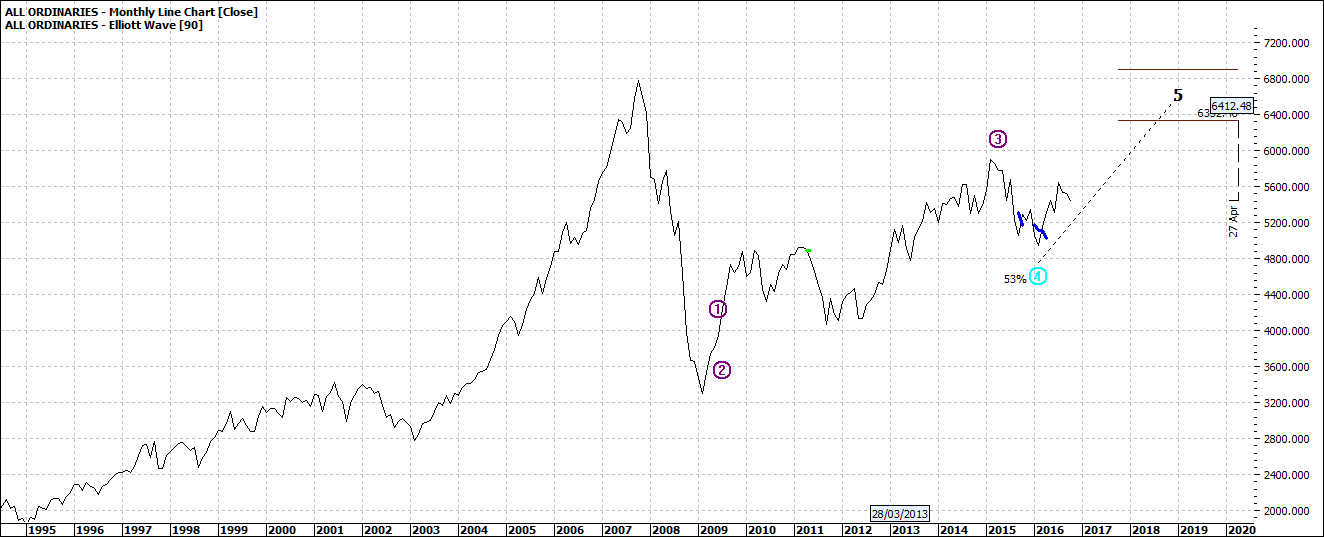

To the chart – my standard menu – a daily, weekly and monthly XAO:

Click to Enlarge

Click to Enlarge

Click to Enlarge

The daily says no need for panic. The weekly says hang on to your britches over the coming few weeks. And the monthly says sit back and enjoy the ride.

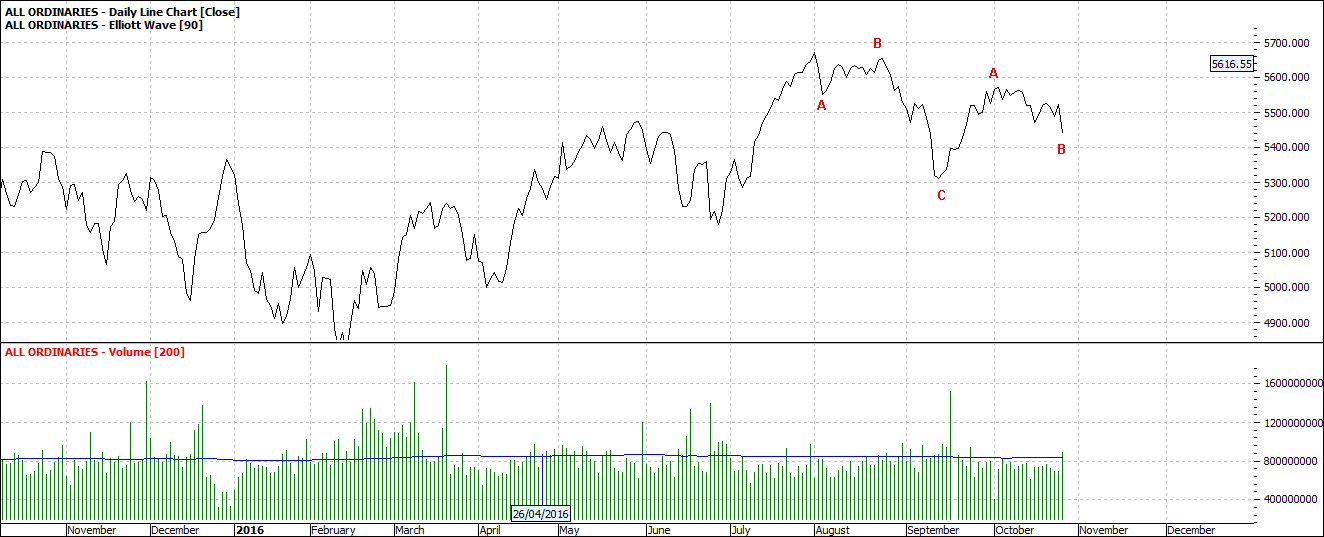

You can dig a little deeper into your ProfitSource for other perspectives. I will give you a start:

Click to Enlarge

Relatively decent ‘sell’ volume Wednesday – so quite a few investors are jumping ship – on a few stocks – many were hammered Wednesday.

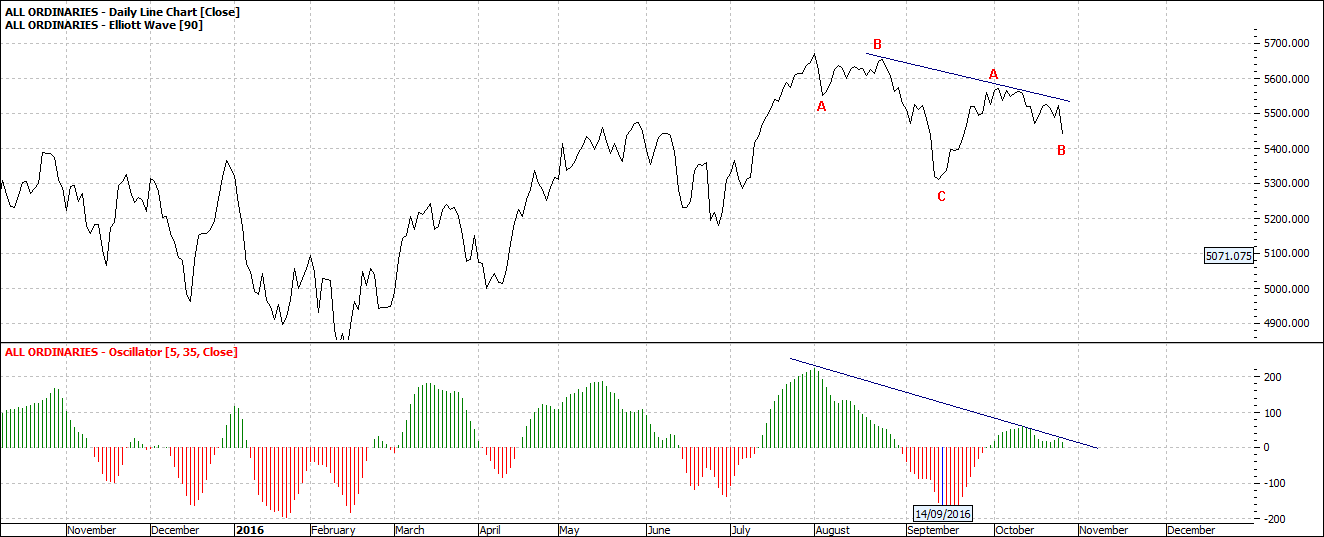

The oscillator in the chart below has not been able to regain ground in step with the market:

Click to Enlarge

A weakening oscillator confirms strength is disappearing and the propensity is likely to be to the downside.

As I cycle through the ASX top 300 I can see many stocks have been hit very hard and have been under pressure now for several days and in some cases weeks. There are some stocks tracking higher but these are in the minority. The balance it stands to reason, are going nowhere. But what surprises me more is the downside pressure on some market weight heavies.

No panic. Just keep your portfolio tidy. This good time to stalk for opportunities. I will be looking and I will be happy to pass on promising prospects in this column. Stocks I would put my own money – and will.

But I am more so keeping my mind’s eye out for the ‘X’ factor surprise. Enjoy the ride

Tom Scollon

|