|

Already too much has

been said and written. I respect you too

much to insult you with more dribble.

But I will look at the current ecopolitical scene from a strictly technical

market perspective.

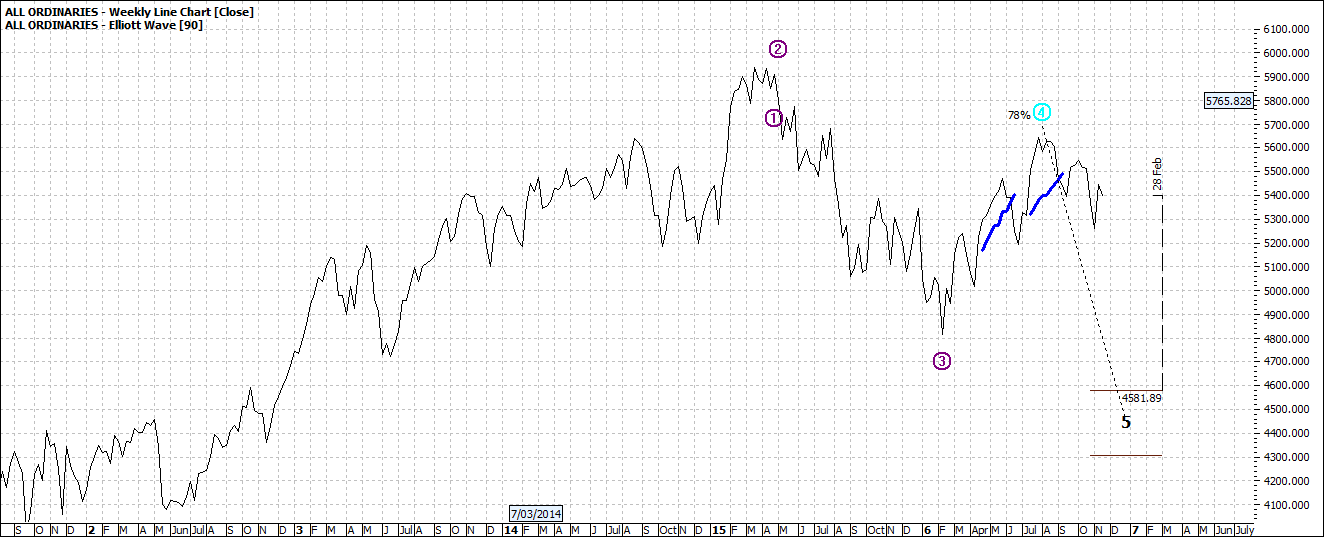

Markets – well at least the Australian market will continue to ease off:

Click to Enlarge

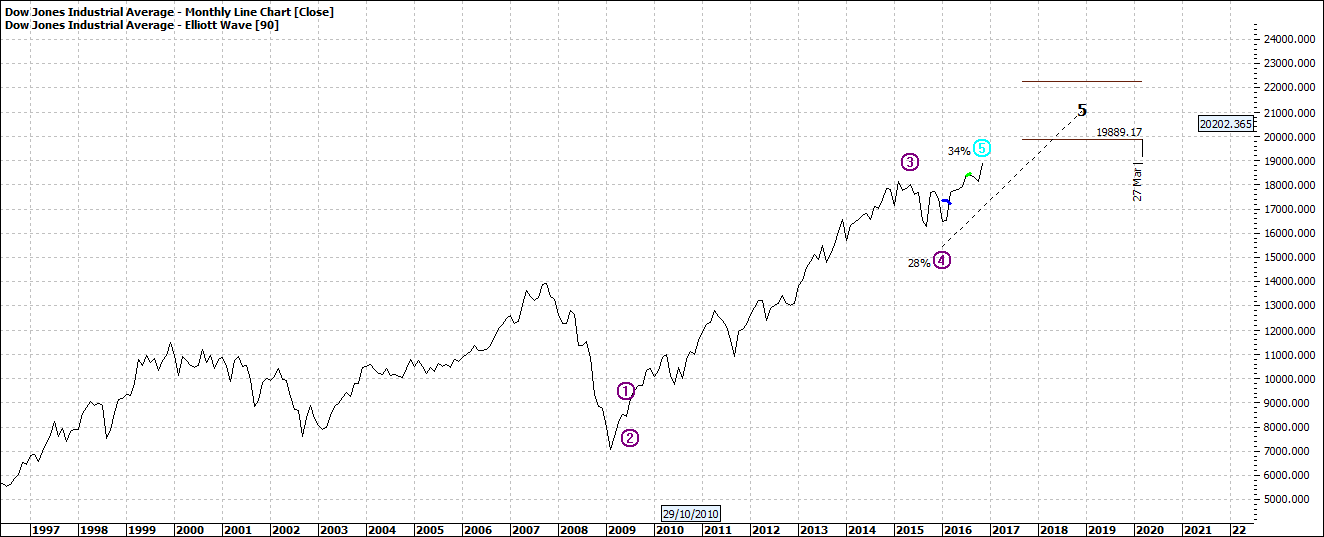

The US markets have more upside:

Click to Enlarge

Why? Well I could write about that but it matters little. It would be a long treatise and I just what to give you a short sharp overview.

But the USA markets will eventually become toppy but maybe not for some several months. But at the top it will ultimately get jittery. That’s the way it happens. The propensity is then to the downside.

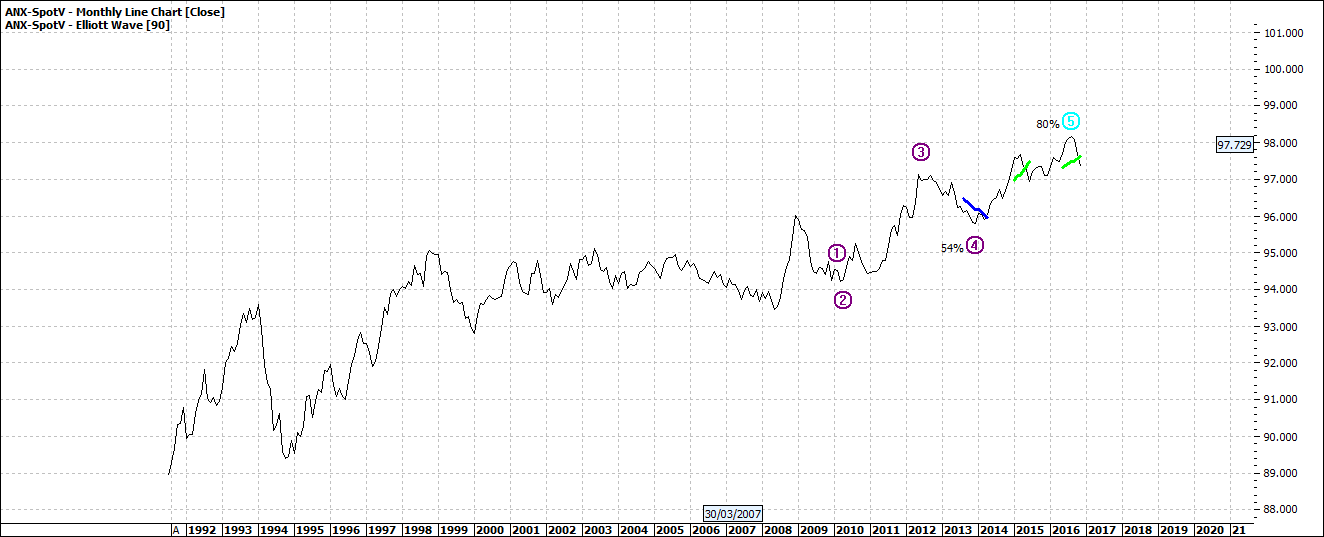

The more interesting point to focus on now is the bond outlook. Bonds demonstrate the very simple point I make. We have seen a long haul up in bond prices:

Click to Enlarge

Over a couple of decades. But now we see the first signs the party is over and as we know what goes up almost always comes down:

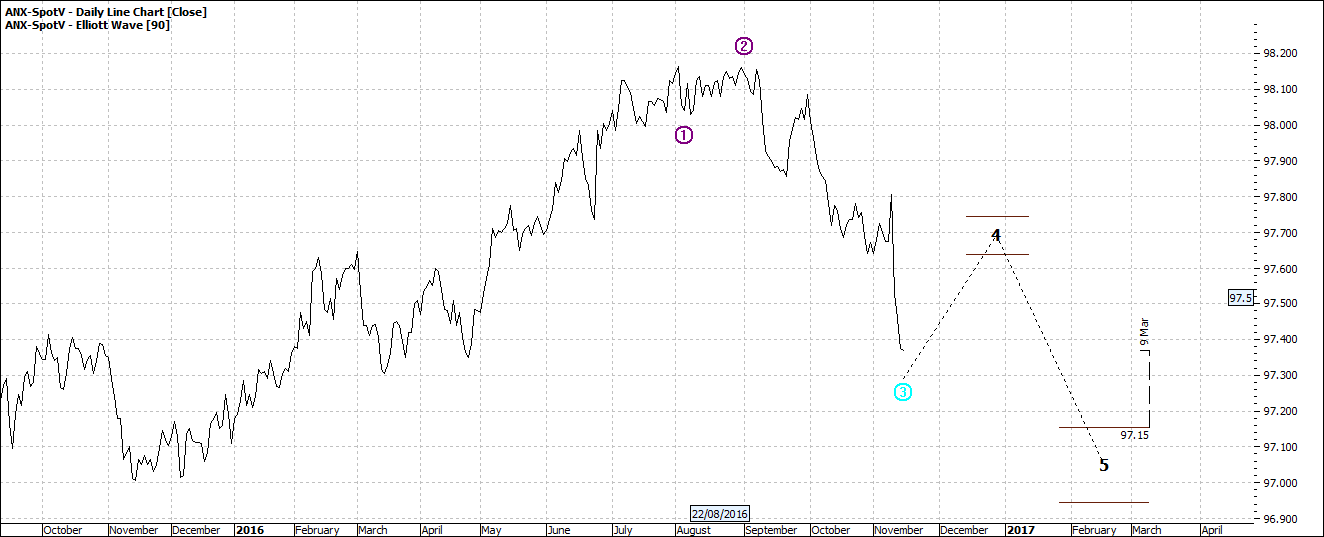

Click to Enlarge

They will not fall over a cliff - they are just at the beginning of a long trend down. Now we know that high bond prices mean low interest rates and the reverse – lower bond prices mean higher interest rates. So banks and especially the reserve are a little nervous about all that money that you have borrowed for that overpriced house. Anyway they will lend more and you will keep buying till things get really really silly.

In Australia the ultimate impact of falling bonds will be seen in the housing market but also equities. So that is why we are seeing softness in our local share market compared with a still buoyant US outlook.

There are other macro-economic factors at play worldwide and I will review these perhaps next week.

Enjoy the ride

Tom Scollon

|