|

If you caught the move up in commodities over the last month you would be laughing. I can’t say I did.

I'm still stalking alas. Timing is a personal thing.

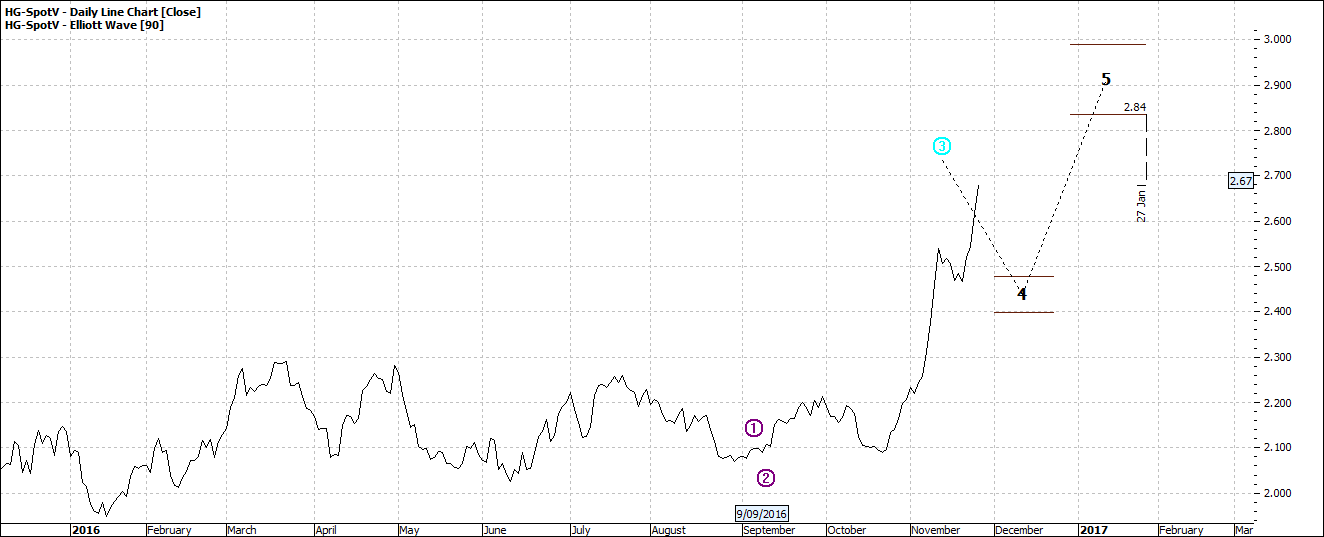

A nice upswing for copper:

Click to Enlarge

And likewise other metals and the major mining stocks and of course the Aussie dollar. So the world outlook is much better? New expectations?

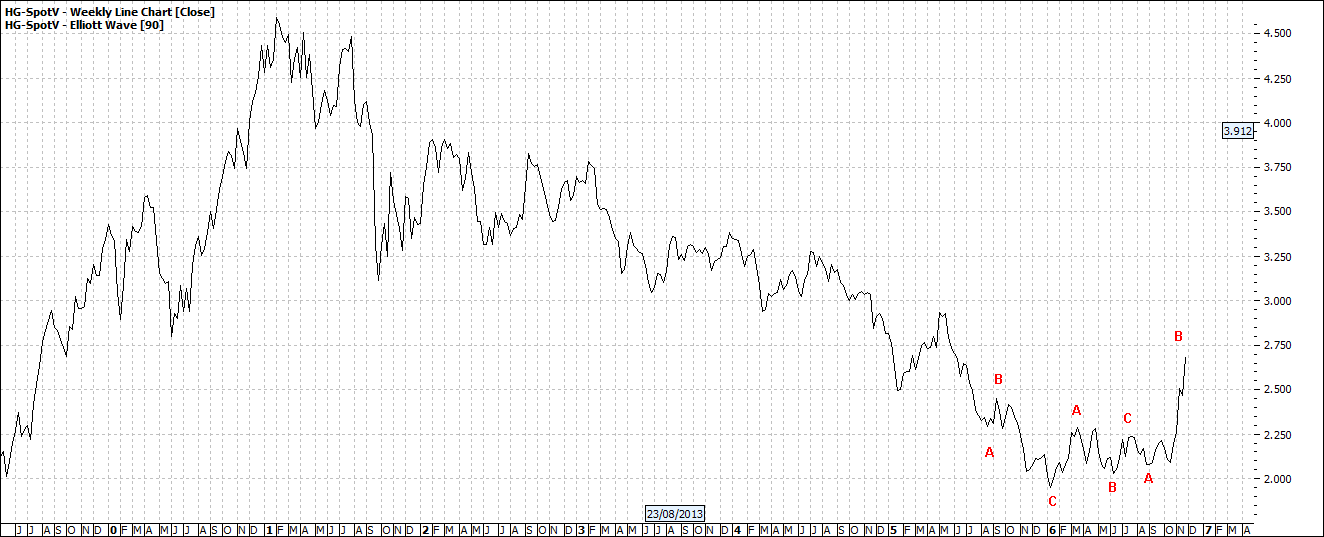

Let’s look at other time periods:

Click to Enlarge

Click to Enlarge

You can see that copper is coming off a major low. So perhaps the opportunists think that it can’t go any lower and must go higher? Maybe but we can see in the monthly chart a newer low could still be ahead. But as per the chart it could be in five years’ time.

Certainly politically and economically, we are into uncharted waters. There is not much point in my elaborating further on this and adding to the volumes that are written every week on the topic. I will stick with the technical.

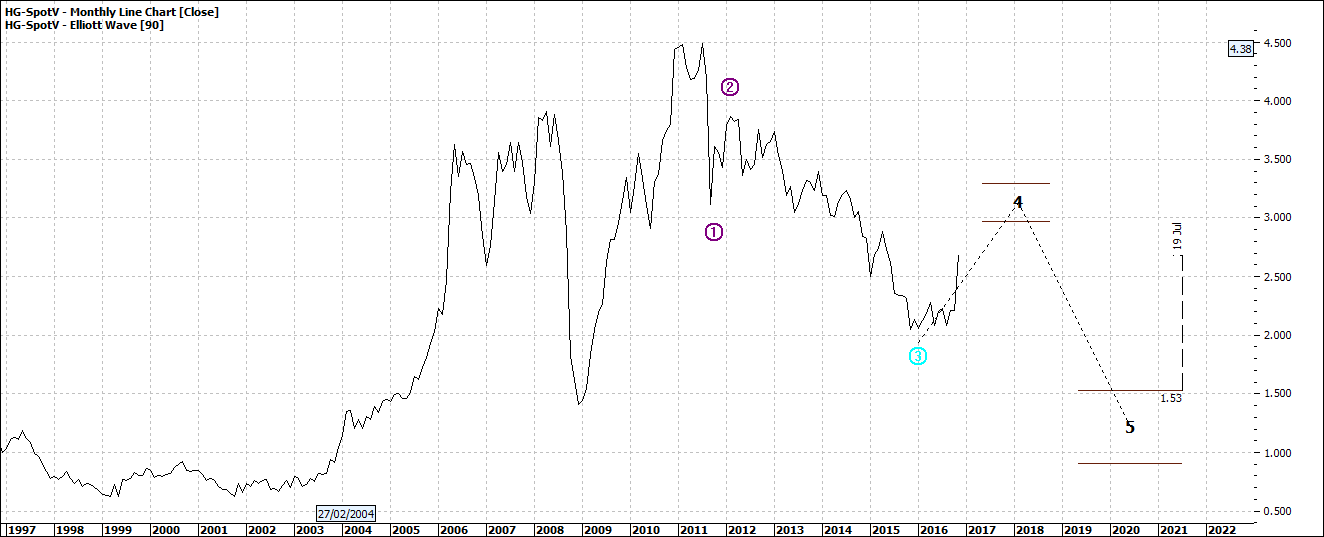

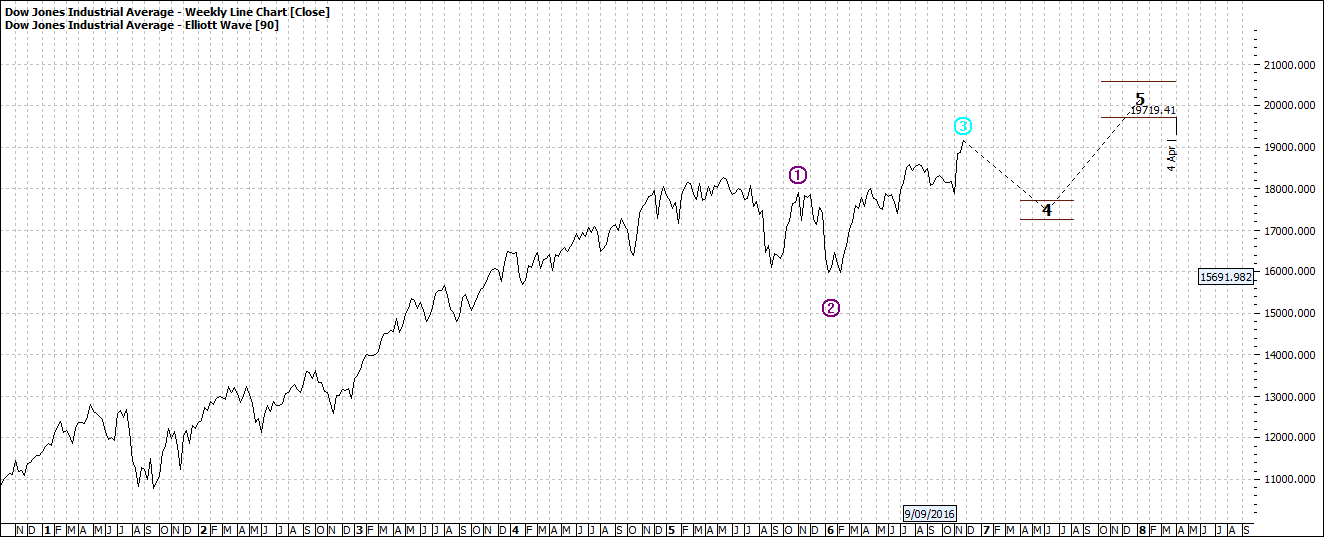

The DOW has higher to go:

Click to Enlarge

Possibly a rise as much as 15% which is still bullish – over the next 2-3 years. Despite the fact growth is slowing and Apple and maybe many other offshore manufacturers are highly unlikely to move manufacturing from China back to mainland USA. Weirdly they understand the order of China more than the vagaries of eco-political plans in the coming Trump era. Making America great again is great notion but the how has not yet been grasped. And if there are any hiccups we could see a market correction:

Click to Enlarge

Not because of Trump necessarily but because the market will be due for a correction.

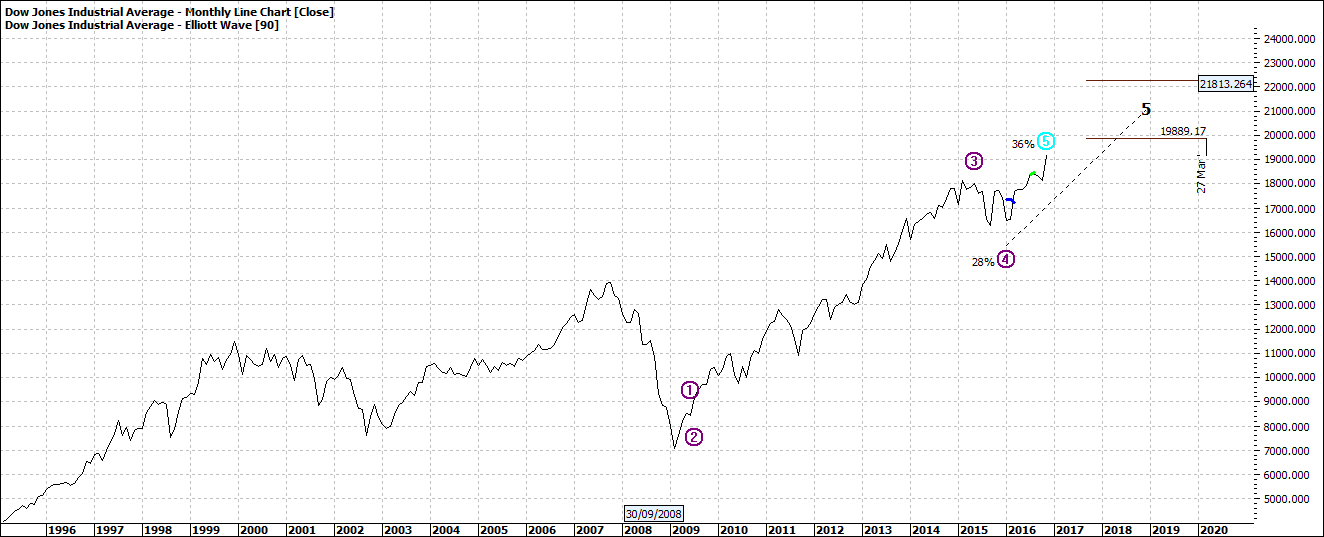

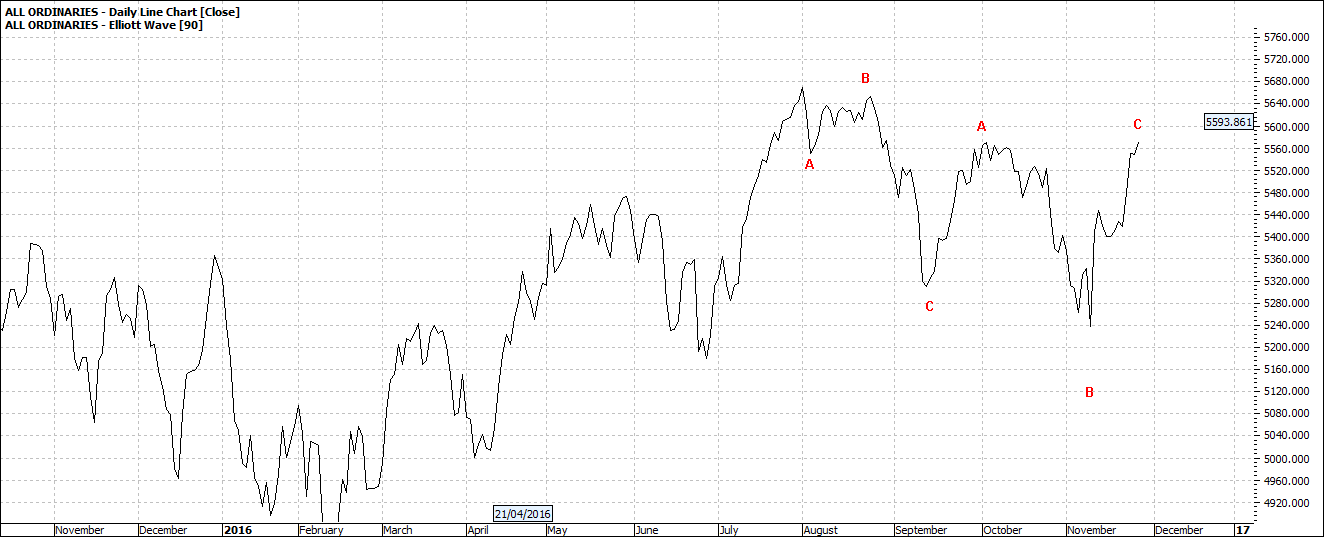

The Australian market has also ticked up:

Click to Enlarge

And could head higher

Actual stocks are a mixed bag. Some still looking sick and others that have been oversold could offer some short term relatively easy money.

I will keep an eye out. Stay tuned.

Enjoy the ride

Tom Scollon

|