|

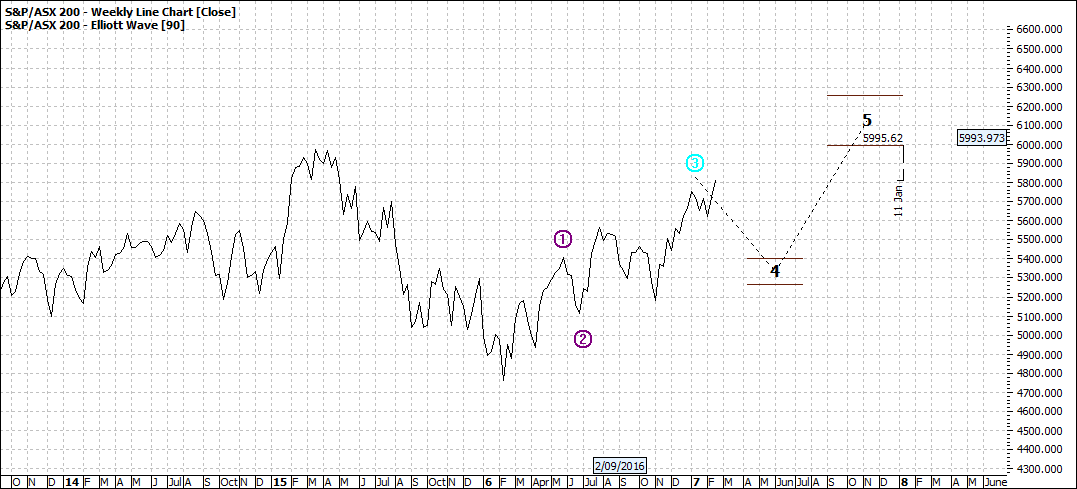

You could be wondering why there is upside in this market when what appears before our very eyes is global political mayhem and an economic new order that we don’t understand. But forget your feelings and just look at the charts. They are telling us there is upside.

Now not all stocks are equal in behaviour so not all stocks are rising. Some have completed their run and others are now readying for a run and some are even having a second crack.

Lets start with a chart - XJO this time - daily then weekly:

Click to Enlarge

Click to Enlarge

If you look at the daily you might think that is not such a big run. But indices charts are a sort of an average and therefore some stocks will move more and some less.

I expect that this run will last a few weeks and we may see a second wave five for the daily chart maybe an upside of 5% or more for the index - not bad for a few weeks. But after that, the weekly charts suggests we might see a decent pause and then finally a crack at an all Australian high. Other global markets have already taken out there old high so maybe the Australian market is attracting some attention.

This next chart says not a new time high:

Click to Enlarge

But when markets get going they sort of head for old territory and when a five wave impulse pattern is in play then we need to reassess as we go. Normal.

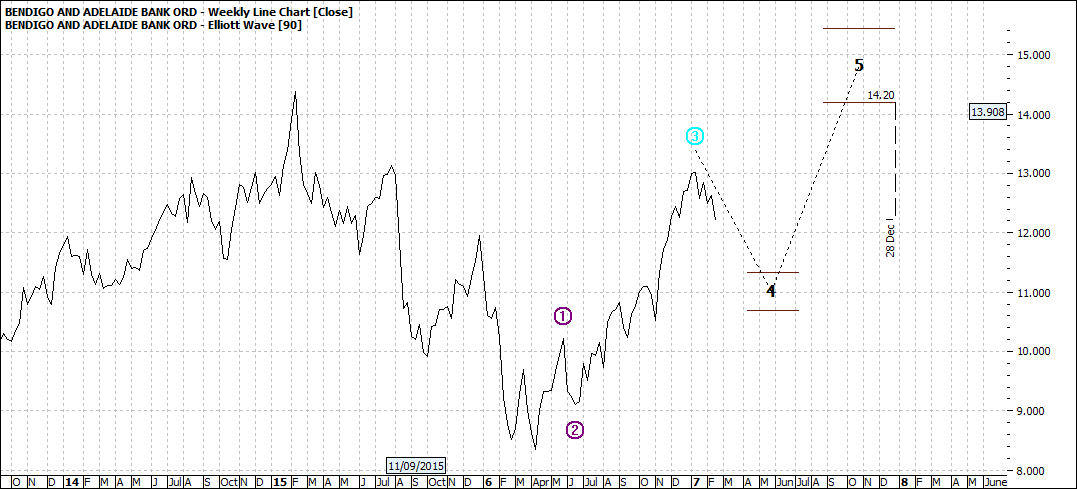

Here is a daily and weekly chart of BEN that illustrates my point how some stocks will move more:

Click to Enlarge

Click to Enlarge

I would think that we could see upside over the next year of the order of 20% - well and truly out performing the market.

Some stocks I am watching/buying as I see ‘light days’ - that is, when the market is not rushing ahead.

ANZ, API, BEN, DUE, ILU

As I am returning to the markets these are only short term buy and holds - to cut my teeth. But I expect there will be some good long term ‘buy and hold’ stocks when we see some market easing.

Enjoy the ride

Tom Scollon

|