|

The local

market is not giving very clear signals at the moment. So to get a confirming outlook we search

beyond our local minnow of a market and there is no better place to go to than

the big mamma of markets and that is the DOW.

So lets look a number of charts that might give us some clues.

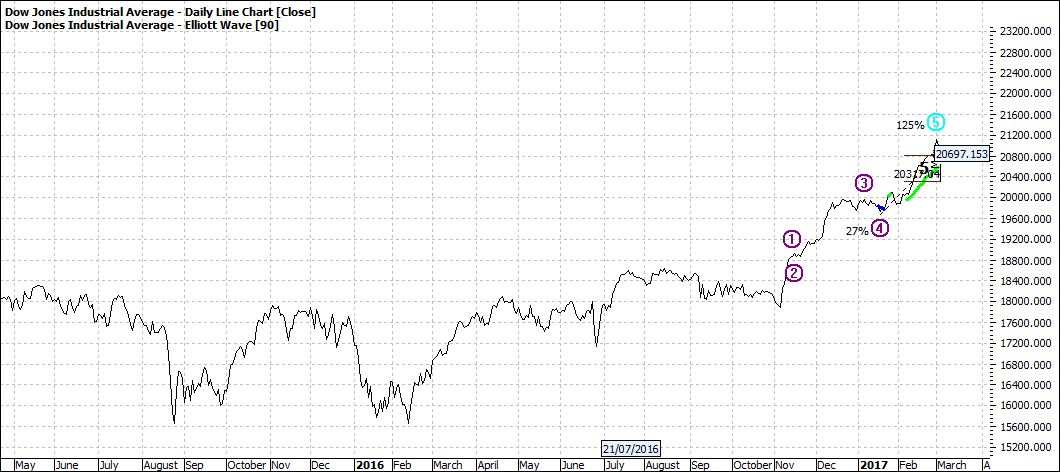

The DOW:

Click to Enlarge

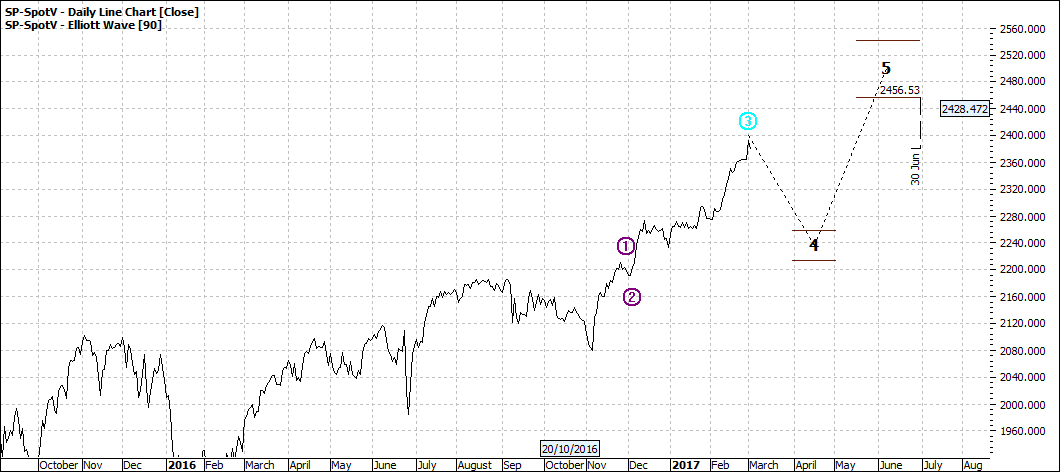

The S&P:

Click to Enlarge

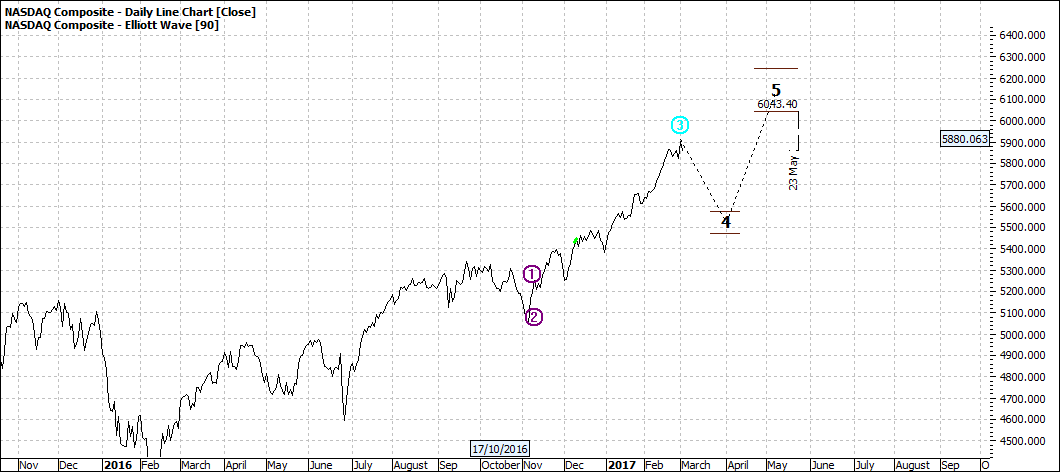

NASDAQ COMPOSITE:

Click to Enlarge

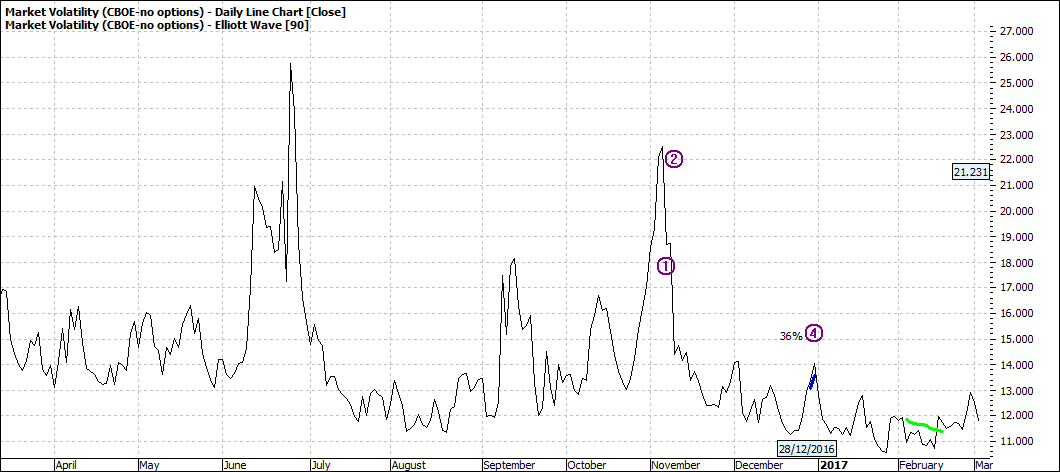

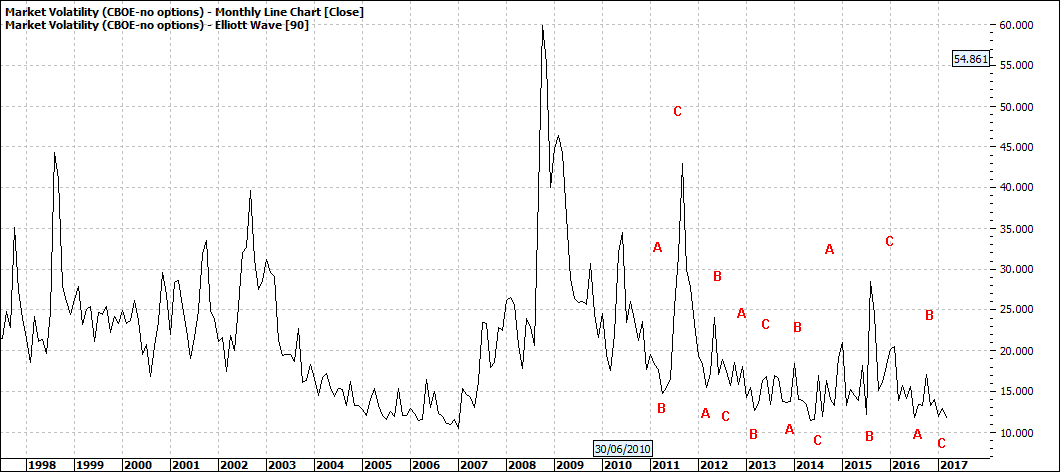

The VIX:

Click to Enlarge

I would like to talk briefly to each chart firstly and then focus on the DOW.

The DOW hit the 21000 mark during the week - with much fanfare. This is an all time high and well and truly much much higher than the 2007. What often happens when such milestones are reached, once the peak is reached the market turns back down again. A little like reaching the top of Everest. You get there and there is not a lot left to accomplish and so you set off back down.

The S&P and NASDAQ are looking a little tired - not exhausted - but just need a breather. And we could see an orderly retreat and rest before attempting a new high.

The VIX - the fear Index remains sanguine. Despite the uncertainties on the US political scene - and consequentially economic scene - there is no weeping and gnashing of teeth. Maybe the consensus is that America is already great and the economy will power along regardless of who is the leader. That the American has a momentum of its own. I actually believe that and have been witness to the powerhouse of the economy when I have actually been there in other recessions. It is truly awesome to behold.

The VIX can be a very useful indicator of investor feelings but at times it can also be slow to read the signals - witness how it was slow off the mark in 2007:

Click to Enlarge

By the time everyone was hitting the panic button in October 2008 when the VIX hit sixty - meaning it was like the end of the earth was nigh - the rort was almost complete. That is the nature of markets - almost always optimistic even when the exits are jammed pack.

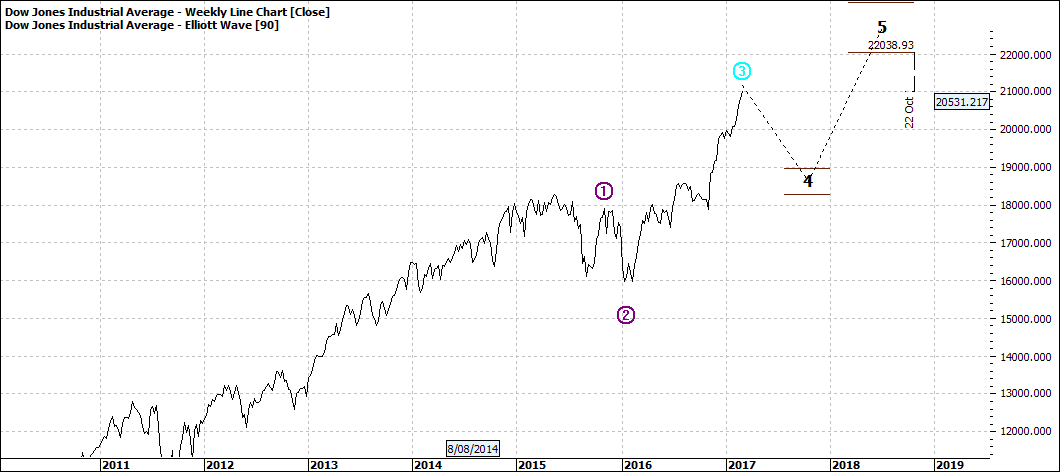

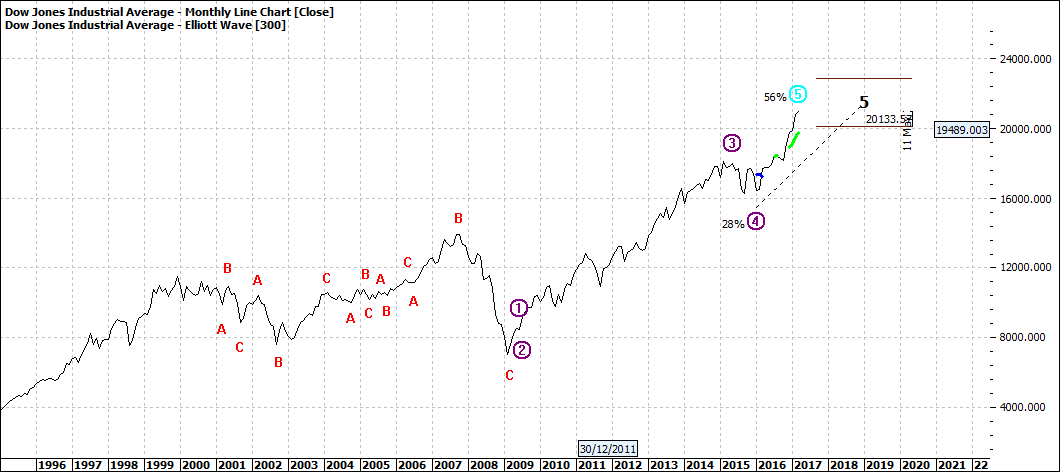

Lets look at the DOW weekly and monthly:

Click to Enlarge

Click to Enlarge

The weekly suggests a breather - over the coming year and it will not be dramatic - it will only take us back to 2016 which was already a huge gain over the 2007 highs - which feat few other markets have been able to achieve. So it is saying there is not a lot of drama ahead.

The monthly is a little ‘ho hum’ - indicating that there is not a lot more upside beyond the 21000 already achieved.

So the good news is already out and there is not a lot of dim dark news expected in the coming months nor even couple of years. Saving of course an ‘X’ factor out of the blue.

Enjoy the ride

Tom Scollon

|