|

We have seen markets soften a little over the last four weeks after a strong rally over the previous month of February.

Click to Enlarge

Now I don’t want to go anywhere near USA politics and definitely do not want to mention the ‘T’ word.

Markets will go there own way. Markets assess the full range of macros - of politics and economics in particular. Markets are consensus driven as each day the players are voting with their money - a powerful force - whether from fear or greed. The players buy and sell based on both conscious and subconscious forces - emotional, good and bad - quantitative factors - some on the money some way off the mark.

Yes, there has been some political factors affecting markets in the last month but to me it is more like a lovers tiff. I don’t thing Armageddon has quite arrived yet. We not know when it might come - but generally it will in the dead of the night. When we least expect it.

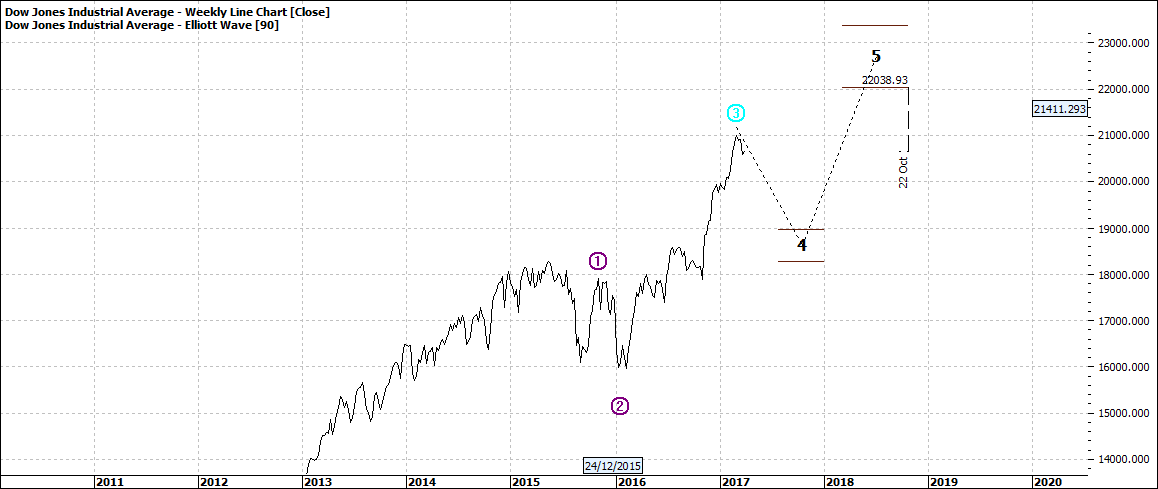

So my reading - from the single chart above - is that though we might see some more softness - I believe a recovery to wave five will happen.

But the second half 2017 could see some major softness - even a pullback - after a very long run by US markets:

Click to Enlarge

Great for traders and shorters - but also for the long term ‘buy and hold’ conservative investor - who look for the big pullbacks.

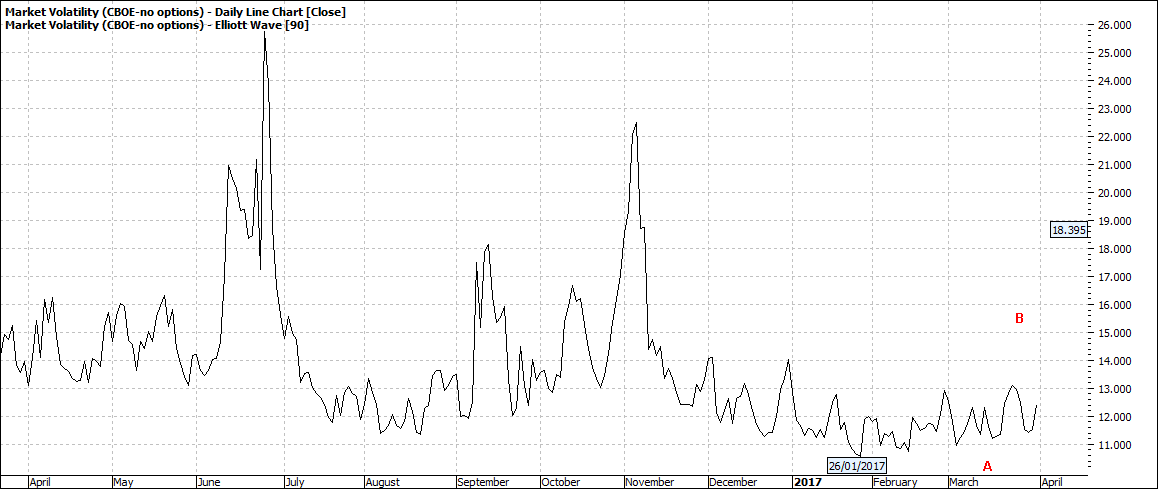

Oh and one last point the fear index is benign - take a look at the VIX:

Click to Enlarge

Not many investors are losing sleep at night.

Enjoy the ride

Tom Scollon

|