Well for now.

Lets look at a couple of charts:

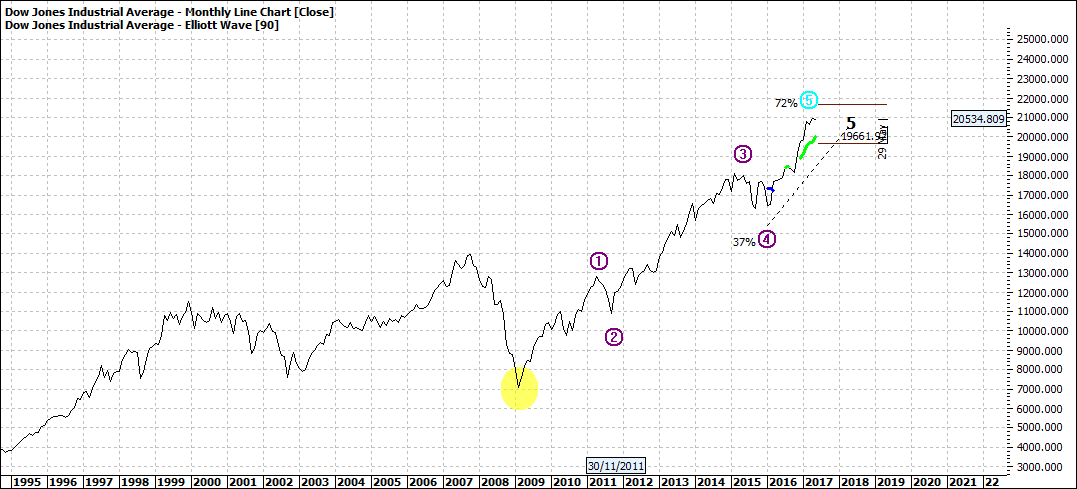

Firstly the DOW:

Click to Enlarge

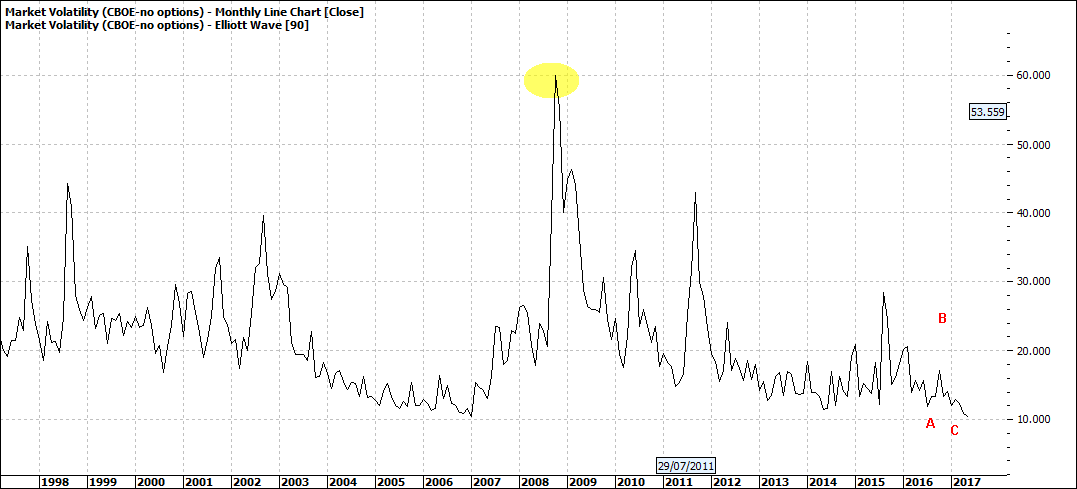

The VIX:

Click to Enlarge

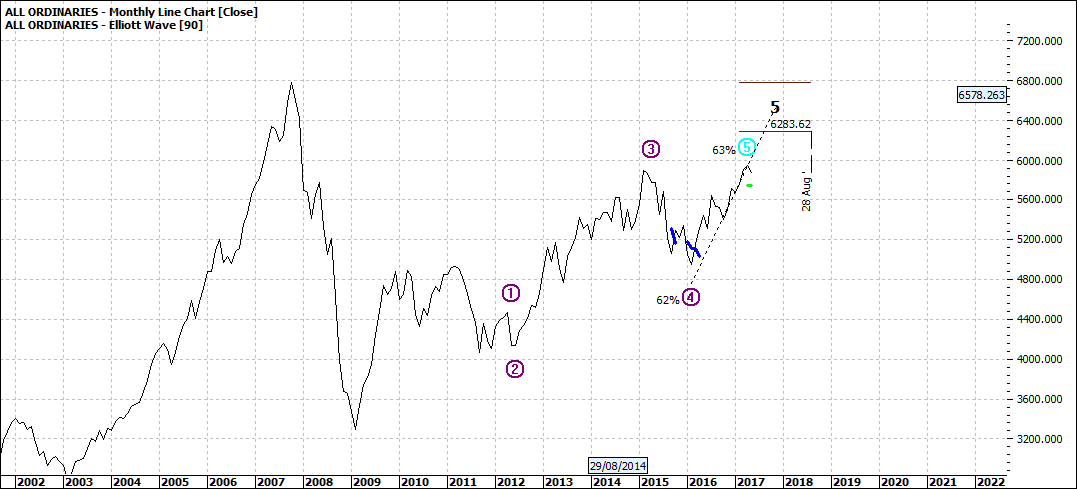

The XAO:

Click to Enlarge

Some thoughts.

World markets are currently looking very firm, in the main. Despite some pundits claims about over valuations.

The local Australian market could attempt a new high over the coming year or so. Or even a double top. I am not a student of such matters as double/triple tops/bottoms but one thing I do subscribe to is that when double tops do occur, the time between them is significant. If the time is a few days/weeks then the drop off also tends to be minor but if several years then the cliff can be major and fatal for some.

Either way before we see a another attempt at 6800 we will see pullbacks along the way. And opportunities to get on board for a last hoorah.

If the market was to sail through the 6800 level then we could be on a long long joy ride. But I not inclined to that view at this point.

The DOW also looks strong despite weakness over the last few days. Take a look at the current VIX - the fear index - and we can see that every one is really happy. Very very happy. Just like they were in 2007.

I would like you to take a look at the small but very significant yellow highlight on the DOW and the VIX. Take note how the VIX peaks well after the low in the DOW. That is whilst fear does kick in once markets start to fall the real selling happens when its all over red rover. The horse has bolted.

It is typical at market highs for many soothsayers to appear from the fog. And we have them now with some calling the XAO to 20,000 others predicting the mother of all depressions.

Take your pick.

Just make sure your portfolios are in really good nick.