Yes.

Not because anyone in particular is misbehaving but rather the markets have had an extraordinary run.

Take a look at the three key indices:

DOW:

Click to Enlarge

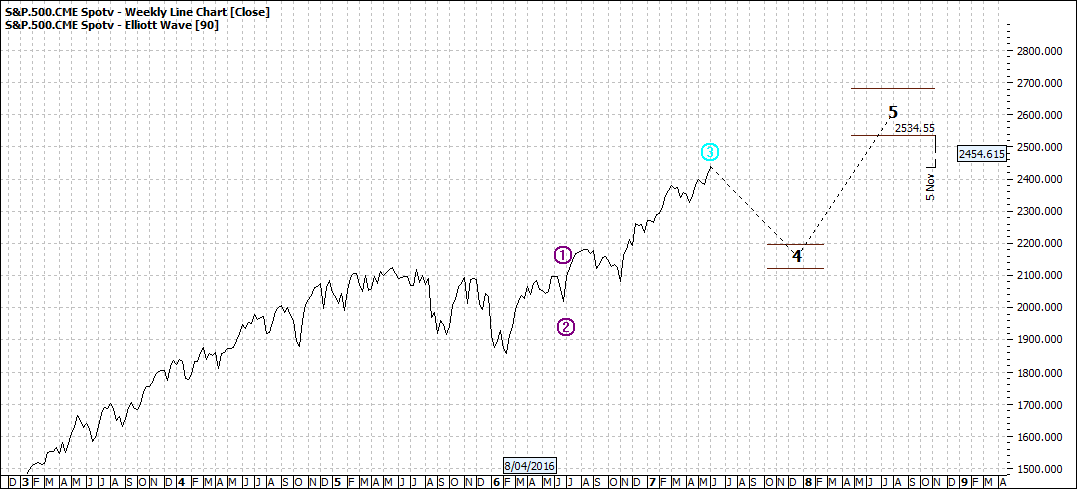

S&P:

Click to Enlarge

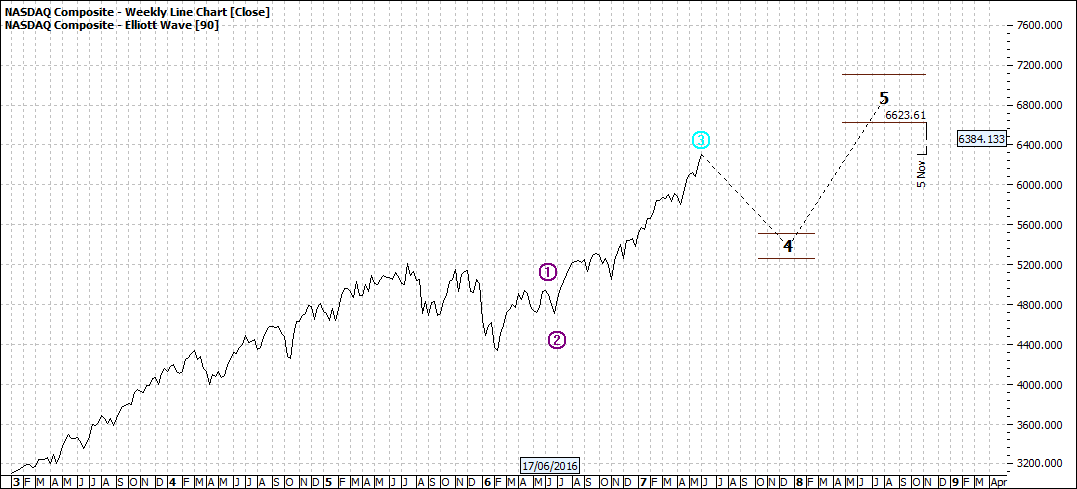

Nasdaq:

Click to Enlarge

You can see that all three indices have had an exceptional run.

As I see it there have been two major strong trends:

Click to Enlarge

From 2009 to now and a secondary subset one from the beginning of 2016. This latter one is a part of the bigger run since 2009.

The correction that I show in the first chart is a small one - but can take prices back a year. Of course we know that this is a prognosis of ‘best fit’ and as the retreat develops we could see the projection change.

But I always remind myself that when markets fall - especially after a long run - we should not be too strong minded about where they might settle. The reason I caution this is that the USA markets are due for a much bigger retreat than the minor one projected.

But no matter what chart I look at and no matter how I tweak such elements as the number of data points, I cannot see a major pullback to even 30% of the move since 2009.

This always makes me a little uneasy as when it does happen it can be with vengeance. I do not second guess the markets as I am strictly essentially driven. But I just apply a little sense of caution

Enjoy the ride

Tom Scollon

|