Well you both know that you have both been eating off the fattened calf for a long time and both of you know this cannot be the new norm.

Individually you have little power over your bank but collectively you vote with your feet. But you have no where to go. There is no wriggle room for many recent home buyers. You have a big loan.

It is not quite like the USA prime loans scenario all over again. But Oz will have its own mini version.

The banks need to be nice to you and to somehow encourage you to hang in there even if your home drops in value and your loan is under water - in other words your house is worth less than your mortgage.

Of course there are numerous personal reasons why we want to own our own home.

I don’t have a strong opinion about the future movement of home values but as an economist I do have a view that interest rates will not rise much any time soon.

Banks and their lobbyists make the point that customers are also shareholder. I don’t buy that. Whilst it is true the argument lacks weight. The average Australian home loan is $370,000 and more like half a million in the cities and higher than $1,000,000 for the well healed. Few shareholders own anything like that value of shares. So your relationship as borrower is paramount for most of you.

In any case I prefer the hard stuff - the charts - they are weighty:

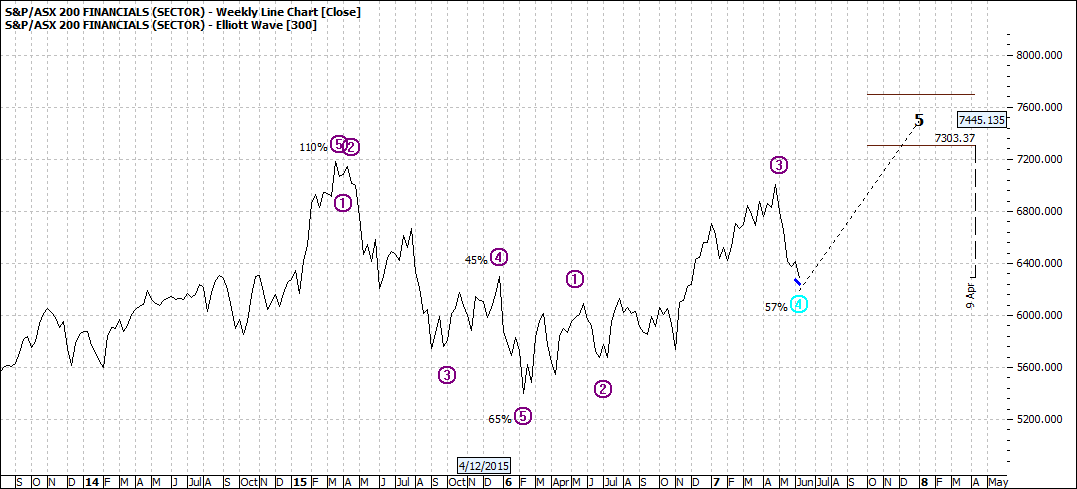

XFJ

Click to Enlarge

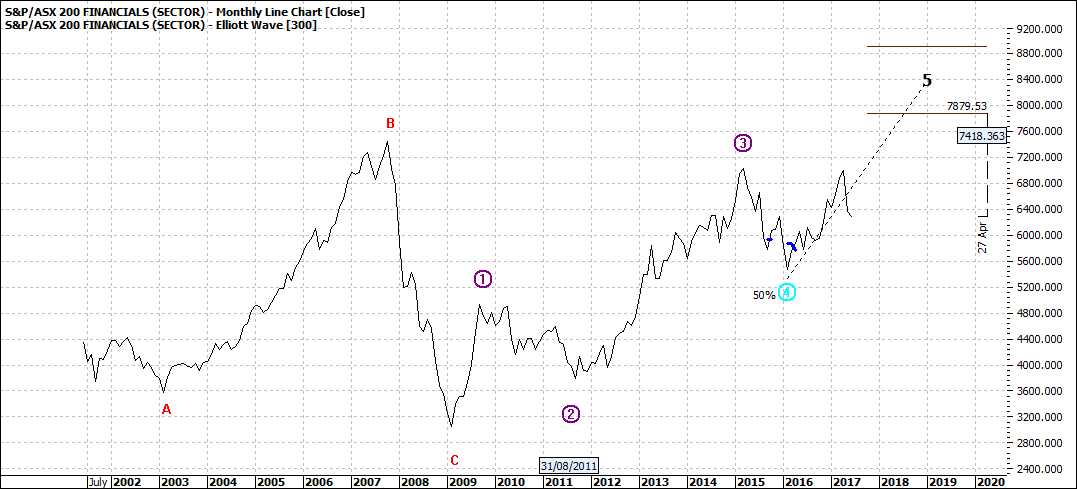

Click to Enlarge

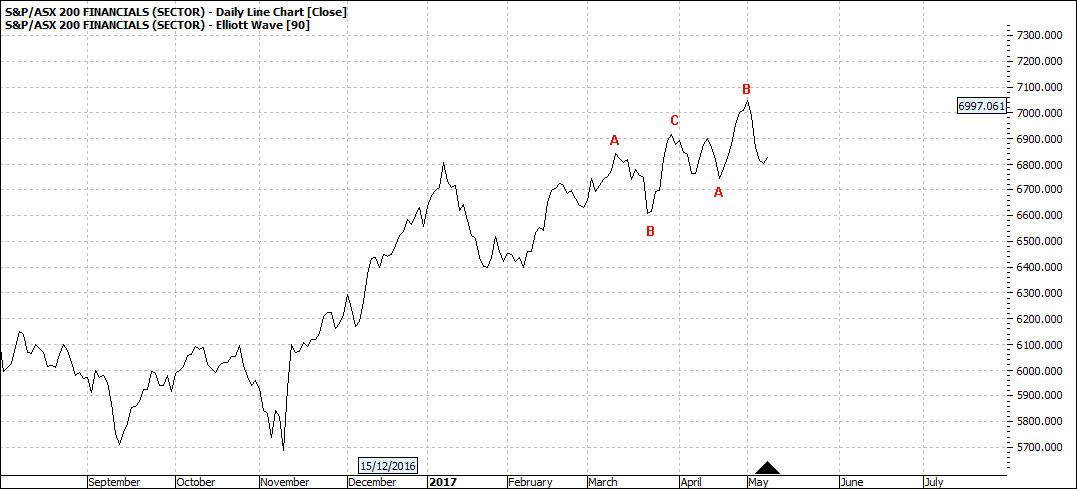

Click to Enlarge

So we have seen some softening in the last several weeks - as if you didn’t know.

The apparent good news is that all this bad bank talk will be over and we will see a recovery. Well that always happens. If you look at the monthly chart we can see that all will be forgiven and the 2007 high will be taken out - albeit 3-4 years away. I am thinking at least that time frame and even more.

That is the way markets are - especially major sectors like banking and mining - lots of cycles.

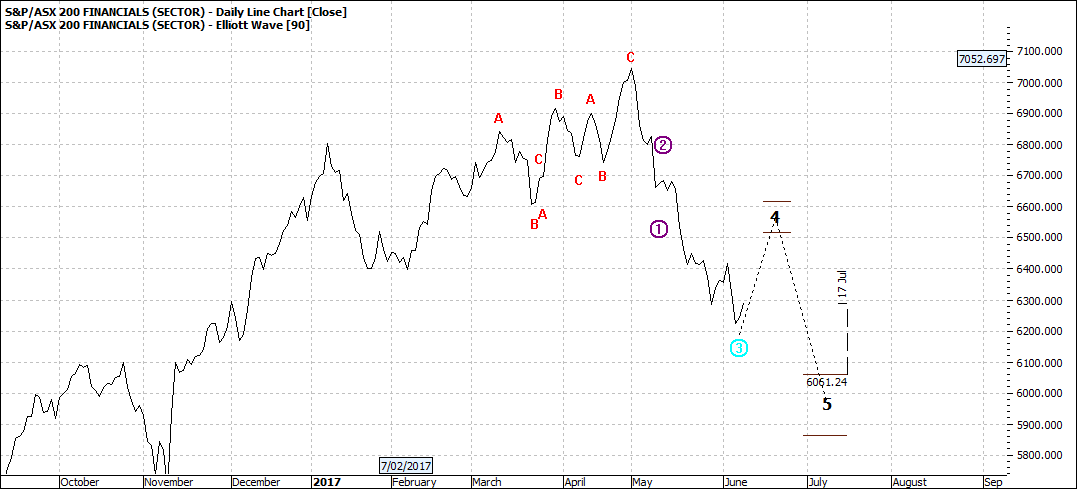

One word of caution is that when you focus on the daily - and any market that is in decline for that matter - we cannot say with strong conviction where the bottom might be. Charts keep adjusting daily with the addition of new daily data.

Back in May the charts predicated a smooth ABC correction

Click to Enlarge

Eyes wide open with the markets!

Enjoy the ride

Tom Scollon

|