And we do have to learn because there will be more unknowns in the future.

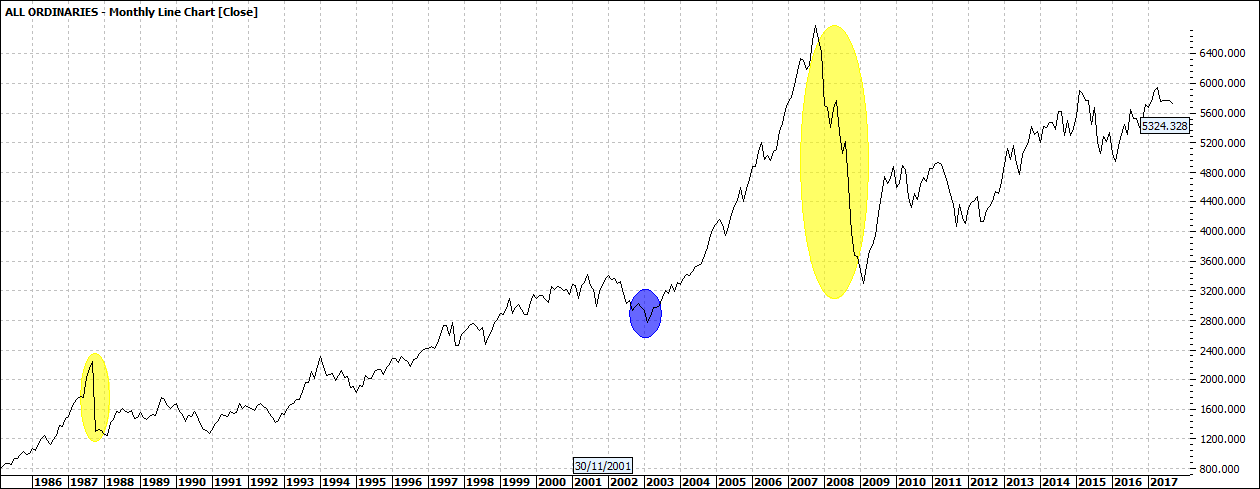

My first chart shows the two major share market crashes in a generation or more:

Click to Enlarge

They are shaded yellow – 1987 and twenty years later in 2007/08.

The blue shading in 2003 marks the beginning of one of an almost perfect bull run. March 2003 was when the US invaded Iraq. The markets celebrated and for the next four years you could almost buy anything and you made money but more about that later. But before I leave the subject of war and markets I did raise the question on my social media post mid-week more or less, ‘what if a war broke out with North Korea’. Could 2003 be repeated now with North Korea?

Probably not as most global markets are reaching full pricing. That does not mean the markets may not go higher as we know that markets are driven by ‘fear and greed’ Panic as a market collapses and ecstasy when they are running hot. Like there will never be a rainy day again. It’s possible the opposite could happen if a war broke out in the short to medium term.

The crashes in 1987 and 2008 were after long bull runs. And though the smart money was pulling out of markets before the crash, retail investors continued to buy like crazy – FOMO – fear of missing out.

In October 1987 most, global markets lost 30% in a week – almost 25% in one day. You can maybe imagine the panic. Everyone heads for the exits which are choked so panic sets in. The panicking investors are often those that have joined the bull run in its latter phase. They had their capital wiped out in almost a week. A cold sweat experience. It is these investors who think the markets are dangerous. The markets are not dangerous. What is dangerous is investors not practising due caution and following some basic rules. Buying at the end of a bull run is insane.

You might ask how to do we know when the bull run is about to finish. Well we don’t really need to know the answer to that question. Basic common sense tells us that markets do not climb forever. We know from experience markets over stretch themselves on the way up to the top. They over push to the downside in a major crash. So those panicking are selling well below market value. Their decision is not rational but rather driven by extreme emotion.

You can see in my chart that the two yellow marked crashes took place after a long run up.

So, there are a few simple obvious rules to guide us.

Firstly, be patient to buy in. Stalk the markets for an appropriate time to buy. I will talk much more about how to buy in to markets, with lower risk, in the coming weeks and months.

Secondly. Don’t overreach. Don’t do stuff that keeps you awake at night. Don’t take a punt. There are many sure-footed ways to choose the right stock. Again, I will talk more about this in the coming weeks.

Thirdly don’t turn your back on the markets. You don’t have to be looking at your stocks every day. You don’t need to be a ‘chartist’. But you do need to have a few basic rules to follow. A game plan. To embark on any venture without a game plan is asking for trouble.

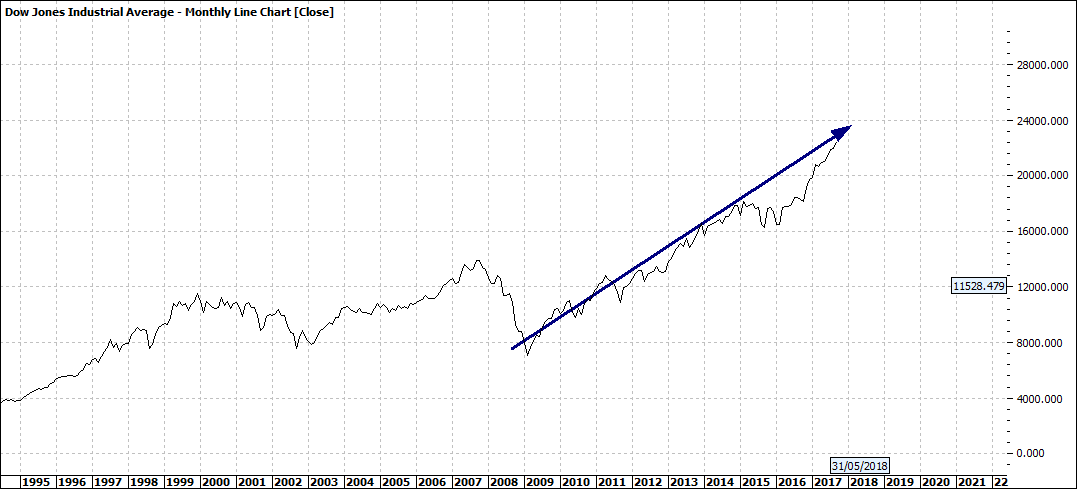

Let’s look at a couple of markets and see where they are against the 2007/08 crash – the German DAX and the USA INDU:

Click to Enlarge

Click to Enlarge

You can see they have both had a long run over the last eight years. I am definitely not saying they are ready for a crash but they are pricey. I would be very careful about what I bought and my time horizon. Markets generally could head higher in the coming weeks and even months – but we are moving well up the risk curve. And I remind myself at such times preservation of capital is paramount.

You see this is not rocket science and is well within the grasp of everyone.

Next week I will examine both 1987 and 2008 market collapses and talk about strategy options that will set you apart from the rest of the field. It is buying in a crash. I know because I have done it.

Enjoy the ride

Tom Scollon

|

|