Well I never take tips. Nor give them. But happy to talk about stocks I like. I have a couple of stocks I like but I would like to share analysis with you for FLT in particular.

As I have previously said we are heading up the risk curve BUT – there is still energy in this market. And there is money to be made.

FLT is an ASX top 100 stocks - a safe place – some might say boring. But boring can be good when investing. I do venture out of the top 100 to the top 300. But I do sort stocks within the top 300 – by daily volume as I don’t like to be caught with low volume stocks if I want to sell at the top of a market run.

So, let’s look at charts for FLT – a daily, weekly and monthly.

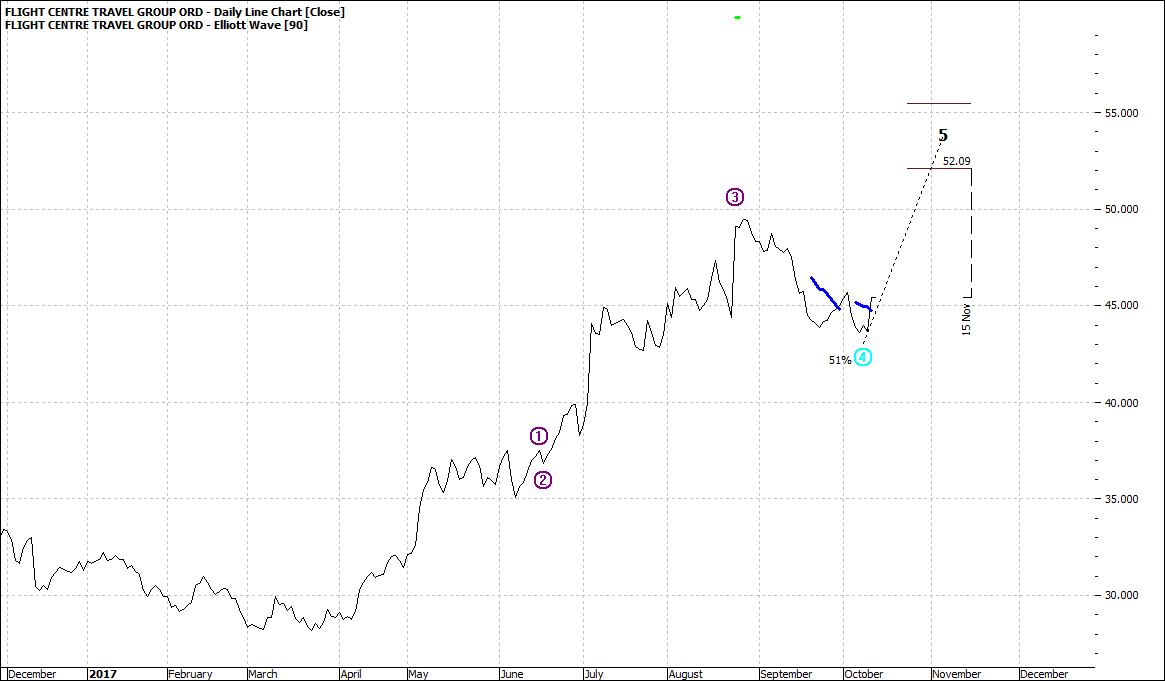

Daily:

Click to Enlarge

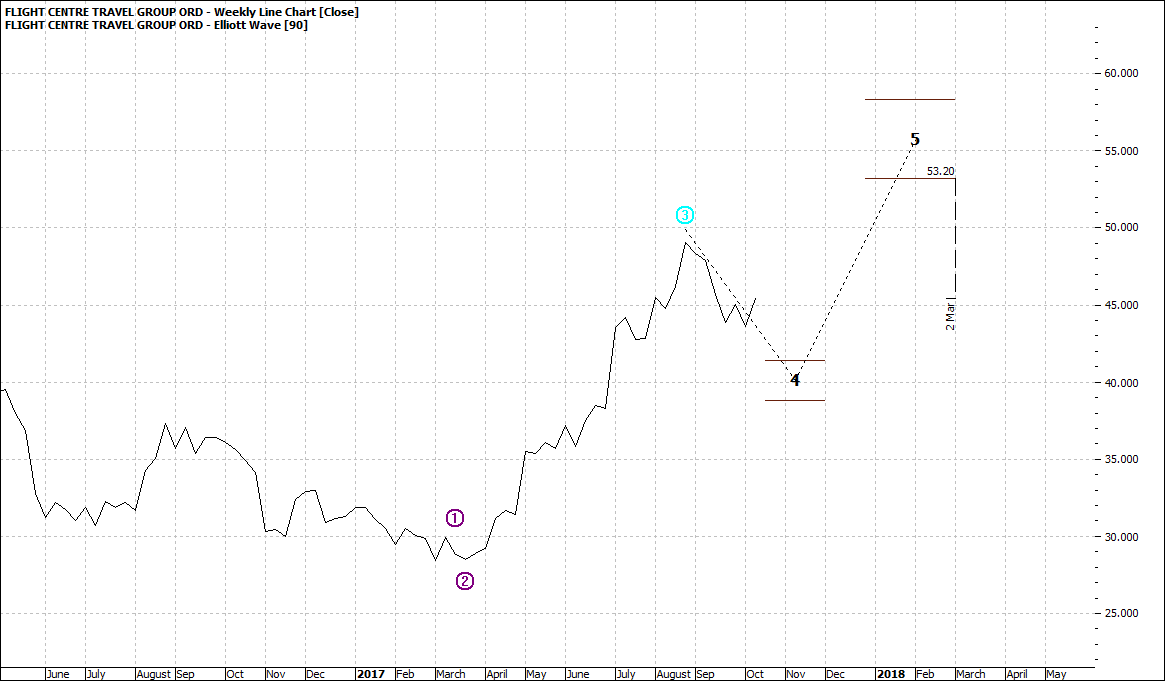

Weekly:

Click to Enlarge

Monthly:

Click to Enlarge

I look at these three time frames as I want to be able to stay with a stock for ideally several years, FLT has had a retreat over the last 2-3 weeks. I also like this. Retreats are healthy. And as I am a contrarian buyer I like to buy in retreats.

The three time frames show an upward trend. To some extent reassuring.

The third characteristics I like is that the stock has consolidated over the three weeks – range trading which indicates buyers and sellers have been in reasonable equilibrium. I would expect however that buying will outnumber sellers for FLT in the coming weeks and this will push the stock higher.

My target is $52 for the next few weeks – a move of about 10%. It could go higher but I am happy with a 10% move. Not too shabby.

Stay tuned and we compare notes in November

Enjoy the ride

Tom Scollon

|