For Telstra shareholders it has generally been a very disappointing experience since the IPO. And expensive.

The government sold the first tranche of shares to Australian householders in 1997 for $3.30. Those who bailed out two years later at $9 did very well. But the reality is that the average Australian still holds Telstra stock. They have put them in the bottom draw to try to bury the memories of a miserable experience.

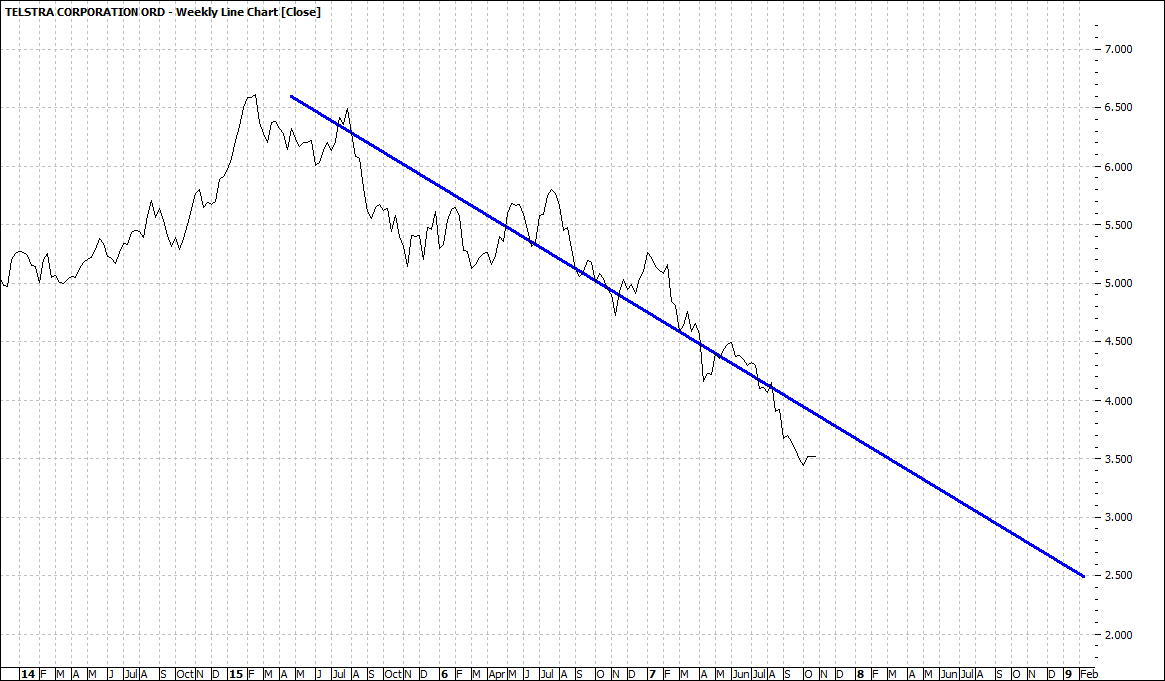

The weekly chart tells the sorry story:

Click to Enlarge

But if I was to tell you that it will get worse you will maybe not believe me. And would you do anything anyway if you half accepted my prognosis?

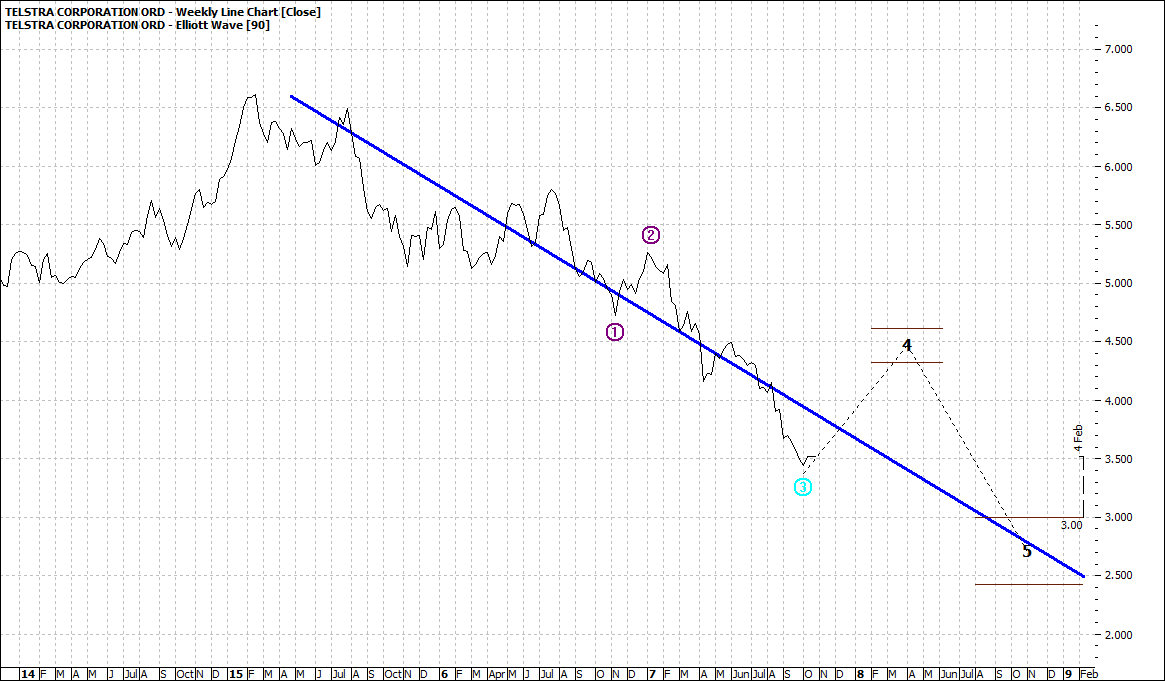

This is my projection:

Click to Enlarge

There are more sorry times ahead. It will be a long continuing slow painful experience. Yes, death by a thousand cuts.

I am not saying Telstra will fall to zero but a projection to $2.50 is bad enough.

I will explain my rational.

I would like you to focus for a moment on this chart below – again a weekly – and I will briefly explain:

Click to Enlarge

I think most investors would accept that shares or markets in general do not rise or decline in a straight line. They move forward then back then forward etc etc., Zig Zag in a way.

Ralph Elliott, in the 1920’s developed a theory about how markets move in waves. He used the simple number series of Leonardo Fibonacci, an Italian mathematics of around the 12th Century to posture that we can understand and predict to some extent moves ahead. Fibonacci’s mathematic theory has been universally accepted over by other mathematicians, scientists and philosophers in understanding many natural phenomena. Its wonderment is in its simplicity.

So, in the last few decades the theory around Elliott and Fibonacci has become commonly known as Elliott Theory. A theory I have studied and used successfully now for over twenty years. I use it because it gives me a high confidence when I invest in the market and it is a fast way of identifying how shares will perform. My interest in it, is that it is simply an efficient method of making successful buy and sell decisions – and more importantly it gives me a good handle on risk. I don’t like risky stuff.

If you look at my last chart, I will explain as follows. When markets have had a long-sustained fall, some hope comes back to the market for various reasons. Management make the right sounds of hope and /or opportunists think that the price is now cheap to buy. A few buy in – even institutions – and others follow thinking they must take advantage of this low price. This pushes price up – to what we call wave 4 – to about the level of ‘’4’’on the chart. But then price reaches a certain level where some holders of the stock believe this is actually a good time to dump their shareholding and over the cliff the stock goes. This can be the final capitulation down to the zone marked as ‘’5’’– but there are no guarantees the end is over. This scenario can play out all over again. In the last 20 years I have written frequently about this in relation to Telstra – you can check these articles out at http://www.hubb.com/TradingTutors/Authors/Tom-Scollon

My forecast is that over then next few months or so, we will see forgiveness for the stock but then another phase of disillusionment and realisation will become apparent. And sellers will trounce the stock.

That is my technical overview.

My fundamental perspective is that this is not about Profit or Dividend or fundamental value – but rather there has been a systemic change in who Telstra is and its inability to be ahead of the technology game at a time of lightning change. The reality is that it was always going to be a struggle. How could you believe that a very archaic Government monolithic organisation – steeped in a burdening cost structure with sunset management – could suddenly transform this business into a ‘’fleet a foot’’ dynamic tehie?

Not an exciting story. And nothing tells me it can reinvent itself any time soon.

Enjoy the ride

Tom Scollon

|

|