Oil can be a little like gold in that they are both topics of debate all over the world – with many experts and soothsayers giving freely their learned or maybe not so learned views. I imagine groups of men sitting on squat chairs at a tea house in the back lanes of Beirut fiercely debating, even arguing heatedly, about where to next.

We have seen oil jump in the last six months which caused much excitement for oil producing nations - after struggling for the last couple of years. The spurt maybe gave hope to these nations as many now ponder a life after oil.

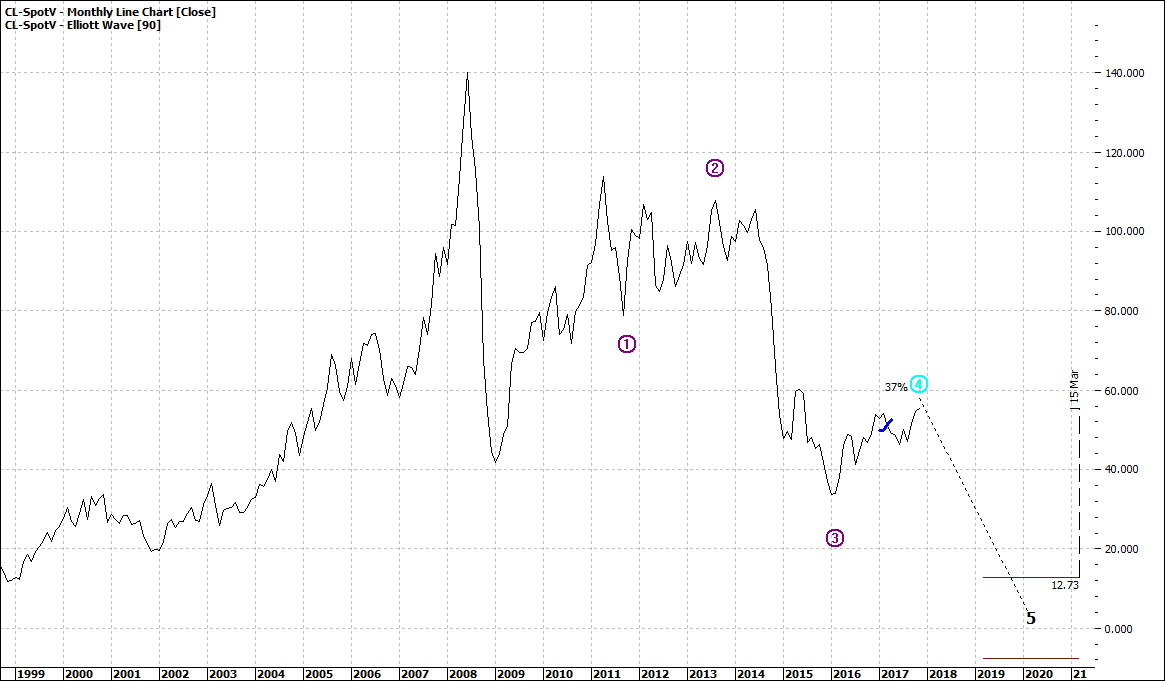

I would like to now take you to the monthly chart for light crude oil:

Click to Enlarge

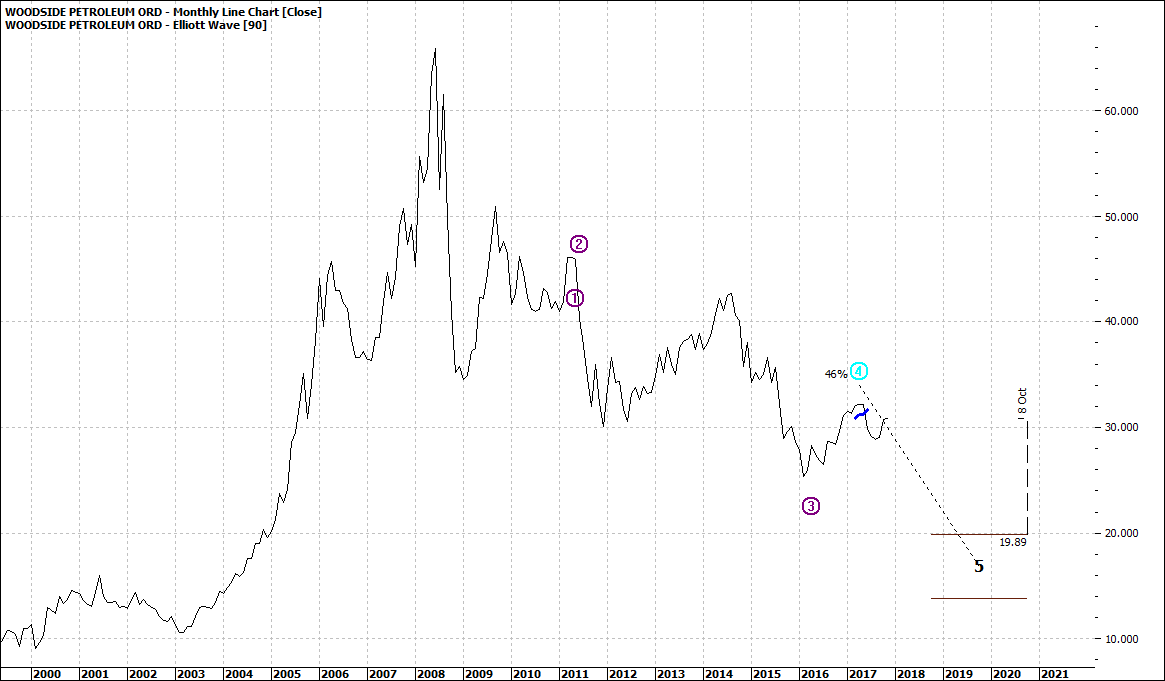

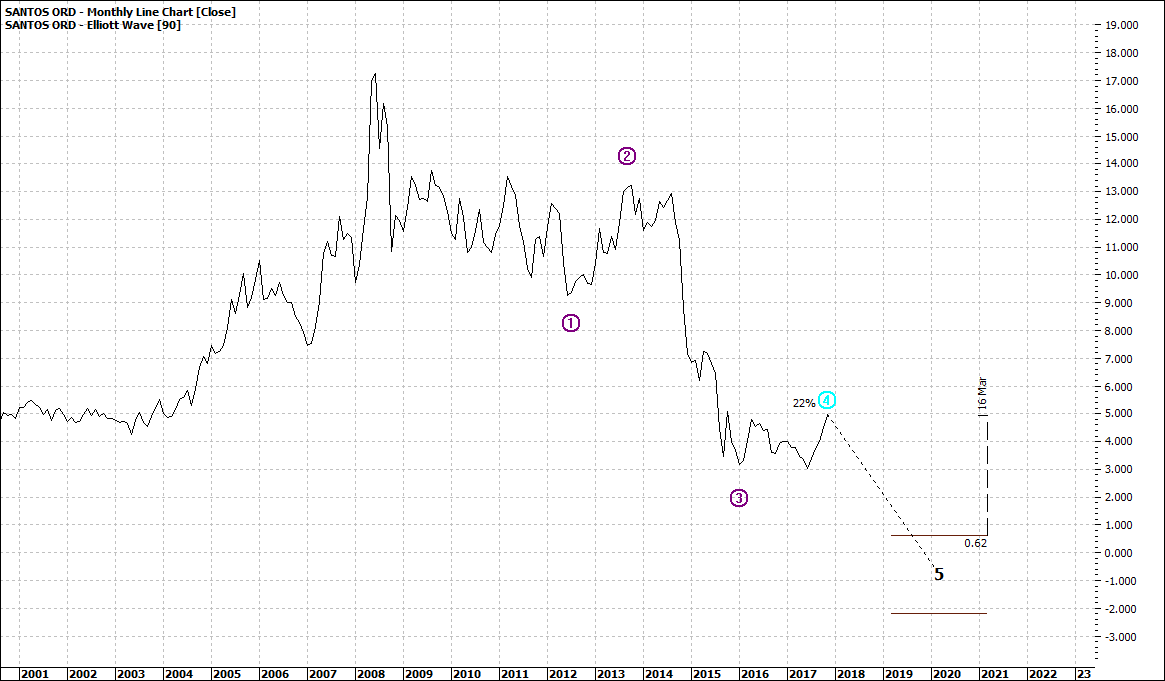

I would also like to show you a monthly chart for Woodside and Santos, two leading oil stocks:

Click to Enlarge

Click to Enlarge

Both stocks are examples of stocks that make up the Energy/Oil ASX index – the XEJ

What we can conclude is that they are all in sync. I like a contrarian view – and in fact I am cautious when I see too much congruency. But for now, I accept what the charts are telling me – that is that we will see anything to do with black gold drift lower over the 3-4 years or so.

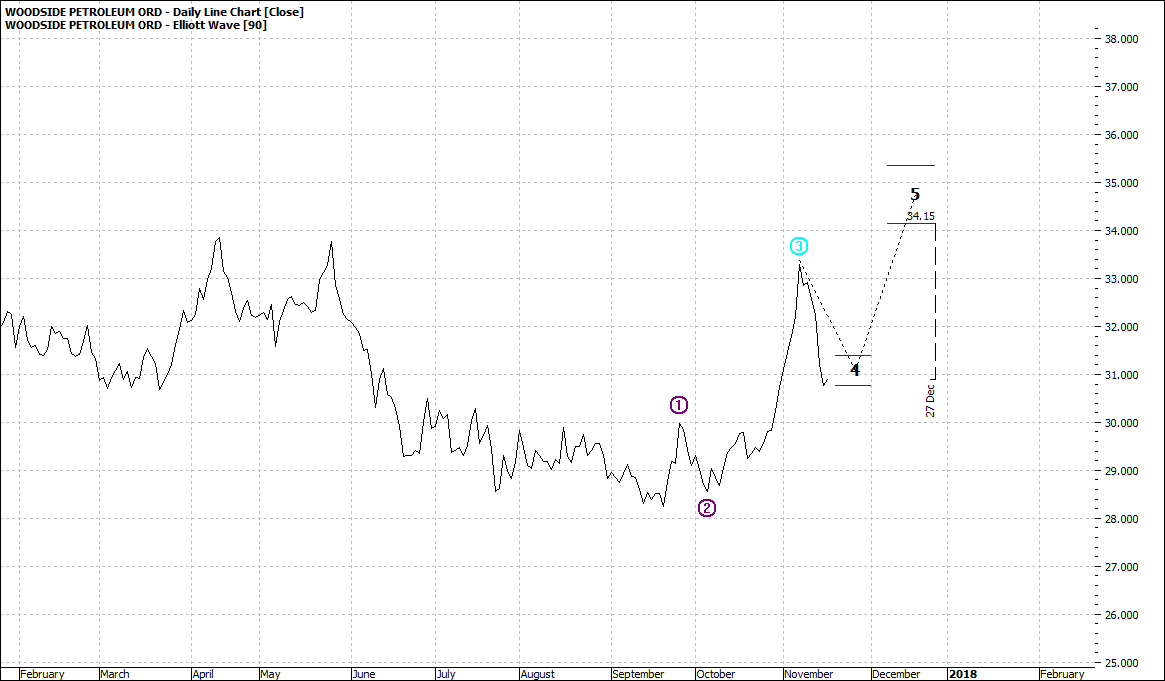

As I was cycling through the charts for the top 100 ASX stocks the WPL daily chart as below, caught my eye:

Click to Enlarge

Apart from noticing the obvious volatility I caught the signs of a new wave five upward movement.

These always catch my eye. But my next move is to look at a weekly and monthly chart to look for another perspective. I then look at the index the stocks are a member of, and then the fundamental driver behind these – that is light crude. And what I see in all is weakness. So, I quickly pass on Woodside.

I don’t allow myself to have hunches about stocks or any financial instrument – I need to have confidence in the chart outlook. So for some time I take oil stocks of my radar.

Next week I will look at some stocks/indices which are on my radar.

It is easier to focus on what’s looking good after eliminating the weak stocks and indices.

Enjoy the ride

Tom Scollon

|

|